Source: Cointelegraph Original: "{title}"

International trade tensions have intensified the volatility in the cryptocurrency market, but this may also accelerate institutional adoption of cryptocurrencies, several industry executives told Cointelegraph.

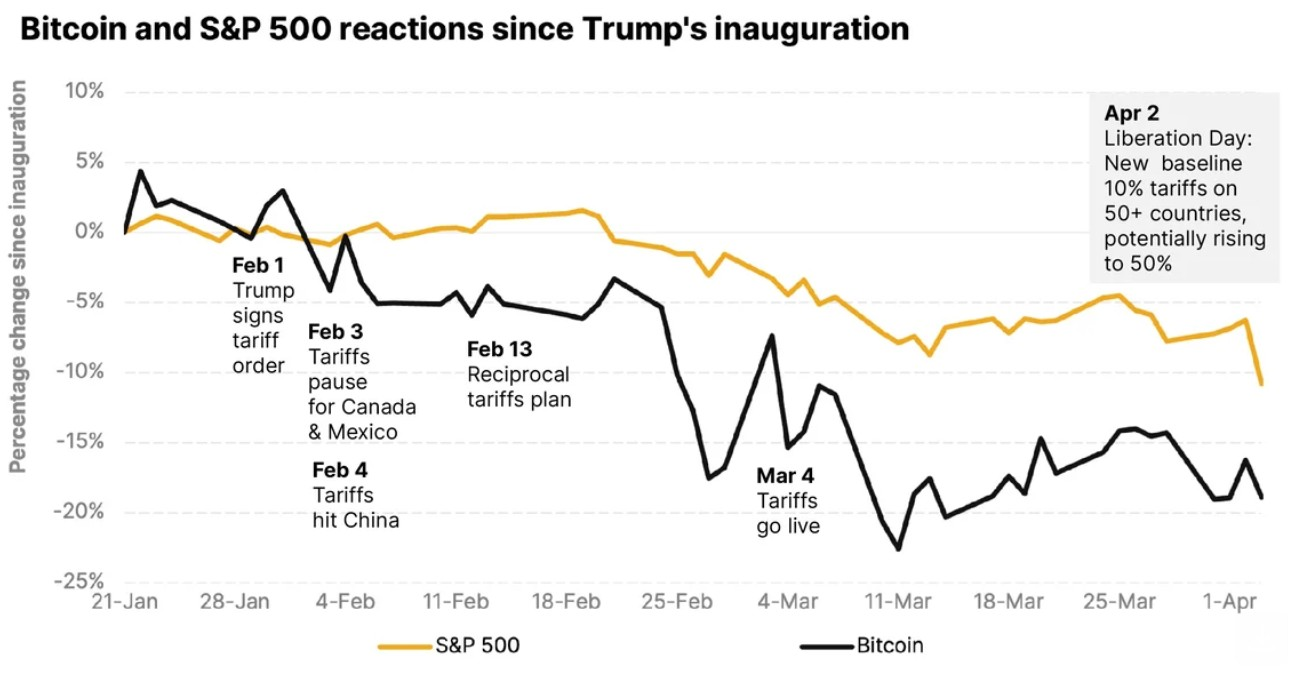

Since U.S. President Donald Trump announced comprehensive tariffs on U.S. imports on April 2, core cryptocurrencies have experienced double-digit price fluctuations, exacerbating the market crash that began earlier this year.

However, David Siemer, co-founder and CEO of Wave Digital Assets, told Cointelegraph, "Historically, economic uncertainty has accelerated institutional interest in digital assets as a diversification strategy."

Bitcoin (BTC) has shown "signs of resilience" amid market turmoil, according to a report from Binance on April 7, highlighting the potential of this cryptocurrency as a hedge against geopolitical turmoil.

Now, Siemer stated, "As traditional banking channels become complicated due to geopolitical tensions, we are seeing an increased demand for blockchain-based settlement solutions that operate outside of traditional correspondent banking networks."

Recent performance of Bitcoin and the S&P 500 Index Source: 21Shares

Tariff Turmoil

On Wednesday (April 9), Trump suspended the implementation of some comprehensive tariffs on U.S. imports announced on April 2, while vowing to raise tariffs on Chinese goods to 125%.

According to Google Finance data, the S&P 500 Index—the largest stock index in the U.S.—rose by more than 8% on this news, partially reversing losses associated with Trump's original tariff announcement.

CoinMarketCap data shows that as of Wednesday evening's trading, the spot price of Bitcoin (BTC) and the total cryptocurrency market capitalization also increased by about 8%.

Cryptocurrency market capitalization increased on April 9 Source: CoinMarketCap

Decentralized finance (DeFi) protocols are particularly well-positioned amid trade turmoil, highlighting the "strategic value" of the sector, said Nicholas Roberts-Huntley, co-founder and CEO of Concrete & Glow Finance.

Roberts-Huntley stated, "DeFi offers a neutral, borderless alternative for accessing credit, earning yields, and transferring capital. For builders, this is an opportunity to double down on achieving interoperability and censorship resistance."

Nevertheless, Aurelie Barthere, research analyst at Nansen, told Cointelegraph that cryptocurrency prices will continue to reflect the broader market for the foreseeable future. If sell-offs continue, cryptocurrencies are expected to behave as "higher beta risk assets currently associated with risk assets," Barthere said.

Related Articles: Finance Redefined: Despite tariff concerns, the cryptocurrency market may still bottom out in June.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。