No matter who you encounter, sincerity can reach others' hearts; no matter what happens, kindness never goes out of style. A beautiful appearance may impress others, but a sincere heart can move them even more. A strong tone may convince people, but kind actions will win their hearts. Being genuine means not being pretentious, not being perfunctory, and not being worldly; understanding tolerance, respect, and compromise reflects a person's kindness. By not losing one's roots and not forgetting one's original intention, a person can walk with ease, stand firm, and go far!

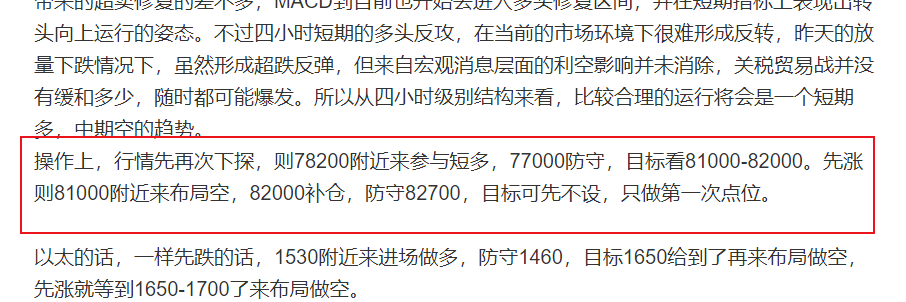

Yesterday's market gave several illusions. First, there was a rebound after an oversold condition. In fact, it stood above 80,000 multiple times yesterday, creating a false impression of a rebound. However, starting from the evening, the market fell again, testing the support around 74,500 once more. As of now, after hitting the bottom, it is in a rebound phase, with the coin price running around 77,000. Based on our analysis yesterday, we adopted a strategy of short-term long and medium-term short positions, but the rebound did not provide a position near 81,000 for layout. In the afternoon, there was a slight pullback, first dropping to around 78,200 for a long position, but it only reached around 78,800 without getting filled. Later, during the US trading hours, it quickly fell again due to the impact of tariff policy news, which also led to the failure of our strategy of shorting after a rebound. After the drop, trying to go long at 78,200 resulted in a direct stop loss, which was very frustrating.

The latest minutes from the Federal Reserve's meeting will be released at 2 AM Beijing time on Thursday, reviewing the meeting from March 19-20. At that time, the Fed maintained interest rates in the range of 4.25%-4.50% and signaled the possibility of three rate cuts within the year. However, since Trump proposed a global tariff plan, US stocks have plummeted, and economists have warned of recession risks. Powell turned hawkish in early April, indicating uncertainty in the outlook, with both inflation and unemployment rising, leading to an increase in rate cut expectations to four times. Additionally, CPI data will be released tonight, which will impact market trends.

On the chart, the daily line has once again formed a doji star within a bearish cycle. However, a small bullish doji star does not significantly change the market structure, and all moving averages are showing a downward trend. The MA7 daily line has formed the first short-term resistance around 80,600. Currently, we need to observe when the market can rebound and stand above this level or form a short-term bullish rebound. The market has tested the lower support again today, and as of now, it has rebounded. The key point to watch is the impact of the CPI data and the Fed's meeting minutes on rate cut expectations. From a technical indicator perspective, if the daily line continues to show bearishness, the RSI may indicate oversold conditions, with an approximate level around 70,000, and the time cycle is still early.

On the four-hour level, due to market news and emotional influences, the four-hour technical indicators are showing disorder. Yesterday's rebound expectations were insufficient, leading to inadequate indicator recovery. Currently, the market shows 78,800 as a resistance area. If the evening news can provide positive support, there is a chance for the market to test resistance upwards. Looking at the hourly and lower levels, there is a dense local bearish structure, with dual pressure from the moving average system and candlestick structure above. The current position is close to short-term resistance, making it difficult for the initial surge to sustain. After a series of upward movements, if it surges again, it could easily trigger a sharp drop, so avoid chasing the rise.

In terms of operations, there will also be data influences today. However, regarding tariffs, the East has not immediately taken countermeasures against the US's increased 50% tariffs but seeks dialogue to ease tensions. It is highly likely that both sides will step back on tariffs. Under emotional influences, the market may see some short-term improvement. In the short term, one can consider participating in a short long position around 76,500, with a stop loss at 75,500 and a target of 79,000-80,000. For short positions, consider around 81,000.

For Ethereum, a short long position can be taken around 1,450, with a stop loss at 1,380 and a target of 1,600-1,650, and then plan for a short position.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be delayed, and strategies may not be timely. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。