Original Author: Luke, Mars Finance

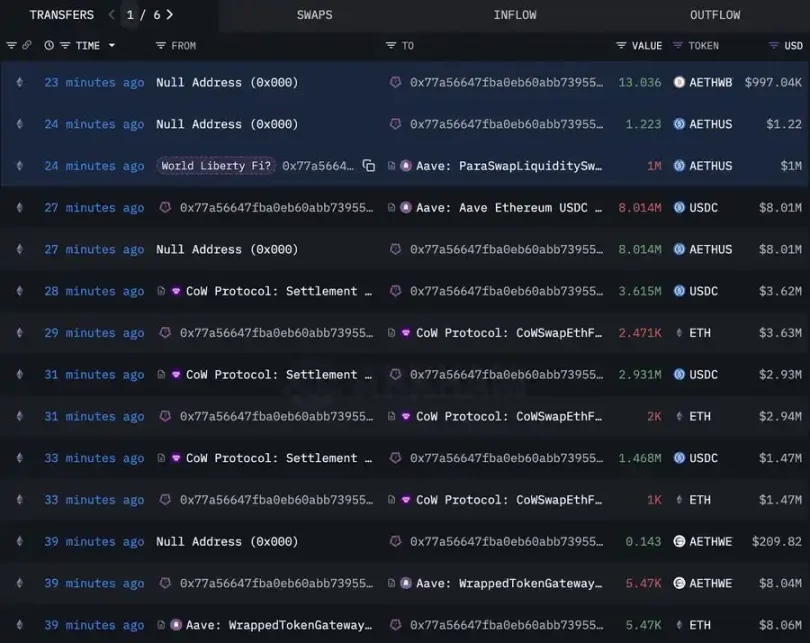

On April 9, 2025, a wallet suspected to be linked to World Liberty Financial (WLFI) sold 5,471 ETH at an average price of $1,465, cashing out approximately $8.01 million. This is not a small matter—this wallet had previously spent $210 million to accumulate 67,498 ETH at an average price of $3,259, now facing a paper loss of up to $125 million. As a DeFi star project backed by the Trump family, WLFI's actions are puzzling: why sell at this critical moment? How much more ETH can they sell? Will they continue to sell in the future?

Difficult Choices in a Cold Market

Currently, the crypto market is shrouded in cold air, with ETH prices trembling between $1,465 and $1,503, more than halving from WLFI's buying price. Looking back to early 2025, the optimism brought by Trump's inauguration had led WLFI to significantly increase its ETH holdings, seemingly ready to soar with favorable policies. Unfortunately, the good times did not last long, as ETH's continued slump turned that enthusiasm into a massive paper loss of $125 million. From $89 million in March to now $125 million, the loss snowball keeps growing.

The timing of the sale is intriguing. On the same day, a whale bought 4,677 ETH at $1,481, with the market in a fierce tug-of-war. WLFI's choice to act at this moment may indicate they sensed a short-term bottom or were worried about further price declines. Regardless, this $8.01 million cash-out feels like selling an old coat in winter—reluctant, but necessary.

Why Sell: Stop Loss or Other Plans?

Why did WLFI choose to cut losses at this juncture? The answer may not be singular.

First, the logic of stopping losses is evident. With ETH dropping $1,794 each, selling 5,471 ETH incurs a loss of nearly $10 million, but it's better than watching the remaining 62,027 ETH continue to devalue. It's like cutting a "bad stock" in the market—preserving cash first. After all, if they liquidated their entire position at the current price, the loss would approach $111 million; who could withstand that?

Second, the pressure on cash flow cannot be ignored. WLFI enjoyed a period of glory with $590 million in token sales, but expenses for operations, partnerships, and new projects won't stop. While $8.01 million isn't much, it can alleviate urgent needs during market lows. After all, a project backed by the Trump family can't afford to have an empty wallet, right?

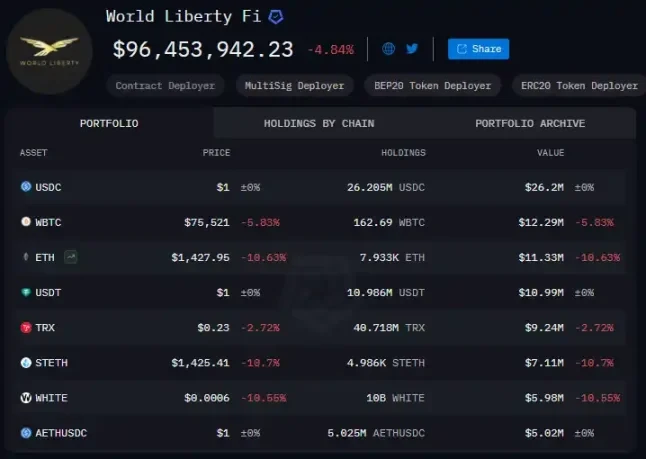

Moreover, this could be a trial for a strategic pivot. WLFI's asset pool includes not only ETH but also "veterans" like WBTC and TRX, as well as "newcomers" in the RWA field. Reducing ETH holdings could free up funds to invest in partners like Ondo Finance or bet on the potential of Layer 2, which is not without foresight. After all, the DeFi stage is large enough, and ETH is just one role.

Finally, don't forget the external scrutiny. As the "favorite child" of the Trump family, WLFI is under a spotlight but also carries controversy. With 75% of profits going to the family and risks shifted to token holders, this model has long raised suspicions. Could this sale be a response to investor pressure, proving they aren't just relying on "celebrity effect"? The likelihood is low, but not entirely unreasonable.

In summary, stopping losses and liquidity are the most direct drivers, while strategic adjustments are potential undercurrents. As for external pressure, it may just be background noise in this drama.

How Much More Can They Sell: Bottom Cards and Bottom Lines

After selling 5,471 ETH, WLFI still holds 62,027 ETH, worth about $90.9 million at current prices. How much more can this bottom card yield?

From a funding perspective, if each sale targets around $8 million in cash flow, selling about 5,000 more ETH would suffice, leaving a "safety line" of $56 million in holdings. However, if there are larger funding gaps, such as new project launches or debt maturities, selling 10,000 to 20,000 ETH isn't out of the question. But doing so would raise questions about ETH's core status.

Whether the market can absorb this is also key. This $8.01 million sale didn't stir much turbulence; the daily trading volume of ETH at $5 billion seems capable of digesting it. However, if WLFI were to dump tens of millions of dollars' worth of ETH at once, panic could exacerbate price declines. Cautiously, small-scale, phased sales seem more in line with their style.

More importantly, there's a strategic bottom line. WLFI views ETH as a "strategic reserve"; if their holdings drop below half (about 33.74 million ETH), their image as a DeFi leader could be shaken. Unless absolutely necessary, they likely won't easily deplete this card. In the short term, selling another 5,000 to 10,000 ETH (about $730,000 to $1.465 million) seems a reasonable guess—quenching thirst without causing significant harm.

Will They Continue to Sell?

In the future, will WLFI continue to reduce its holdings? The answer lies in three clues.

First, watch the market's reaction. If ETH falls below $1,400 and paper losses increase by another $10 million or so, the impulse to sell may be hard to resist. However, if prices rebound to $1,800 and paper losses shrink to $90 million, they might tighten their pockets or even buy back some confidence. Currently, the support level at $1,450 and resistance at $1,600 serve as indicators.

Second, internal calculations are also crucial. If WLFI still wants to play a leading role in the DeFi space, they can't afford to let ETH's status decline too severely; sales may gradually slow. However, if they target other trends, such as RWA or emerging tokens, ETH could become a "cash cow," accelerating the pace of reduction.

Third, external developments matter. The Trump administration's pro-crypto policies serve as WLFI's shield; if a major move occurs in the second quarter and the market warms up, they may sit comfortably. But if the family gets embroiled in political turmoil or investors demand transparency, the pressure to cash out will be unavoidable.

In the short term (one to two months), small-scale sales are quite likely, totaling between $10 million and $20 million. If the market remains sluggish, mid-term reductions could account for 30%-50% of remaining holdings, or $27 million to $45 million. In the long run, unless ETH makes a complete turnaround, WLFI may gradually fade from this territory, shifting their chips to new battlefields.

Changes in Ethereum's Fundamentals: Why Are Whales Turning Pessimistic?

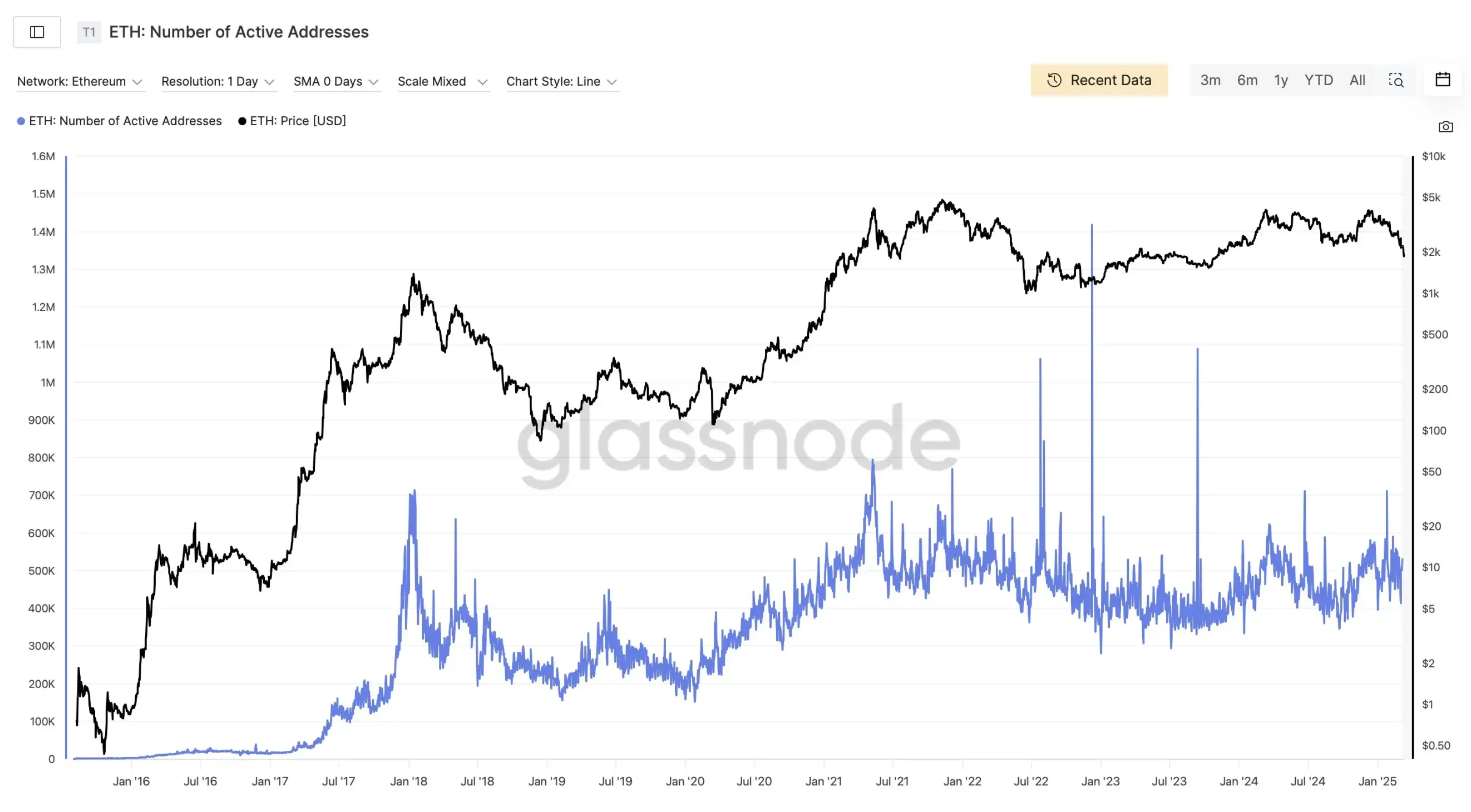

Ethereum's fundamentals seem to be undergoing a quiet transformation in recent years, which may be a significant reason why whales are turning pessimistic about ETH's prospects. Data from Glassnode shows that the number of active Ethereum addresses has stagnated over the past four years, hovering at the same level without significant growth alongside market booms. This is not a "efficiency range" of technical optimization but rather a sign of exhausted growth momentum, indicating Ethereum's fatigue in attracting new users and developers.

At the same time, the rise of Layer 2 (L2) solutions was supposed to bring new vitality to Ethereum but unexpectedly weakened its value capture ability. L2 significantly reduced mainnet gas fees by diverting transaction volume (with gas fees dropping over 70% in March 2025), which, while user-friendly, has led to the value that was supposed to be returned to ETH holders through the EIP-1559 burning mechanism being intercepted by L2, further compressing Ethereum's "profit space." Some analyses suggest that unless the mainnet can revitalize demand for block space through large-scale tokenization, Ethereum's long-term competitiveness may be at risk.

Institutional perspectives also reflect this concern. CoinShares noted in a report that frequent adjustments to Ethereum's protocol economy (such as the Dencun hard fork) have brought uncertainty, hindering institutional investors from building reliable valuation models, thereby weakening its appeal. In March 2025, Standard Chartered lowered its price target for Ethereum in 2025 to $4,000, citing structural decline.

Jon Charbonneau, co-founder of crypto investment firm DBA, also stated that Ethereum's issuance model under the proof-of-stake (PoS) mechanism has fundamental trade-off issues, and adjustments are unlikely to resolve core contradictions. On the X platform, some users even remarked that Ethereum "has hardly changed since 2016," with slow upgrades and missed opportunities for rapid transformation, seemingly becoming a "victim" of its own success.

Meanwhile, the EigenLayer staking airdrop (Stakedrop) event disappointed the market; the narrative that should have boosted ETH holding yields through restaking collapsed due to unfair distribution, further undermining whale confidence. These signals collectively point to a reality: Ethereum's fundamentals are being eroded by internal and external factors, and the once-thriving growth engine is showing signs of fatigue, with whale pessimism perhaps being a direct reaction to this trend.

Summary

This sell-off event not only reveals WLFI's struggles in a cold market but also reflects deeper dilemmas facing Ethereum. Stagnant growth in active addresses, value diversion from L2, and signals of institutional pessimism cast a shadow over Ethereum's fundamentals, shaking whale confidence. WLFI's next steps, whether continuing to sell or shifting strategies, will unfold in the dual game of market and policy.

For investors, chasing the spotlight is certainly tempting, but a calm judgment is needed: can Ethereum's future reignite vitality? Where will WLFI's gamble lead? Perhaps only time will tell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。