"Do not go gentle into that good night." We can only wait quietly for dawn to arrive.

Written by: Bright, Foresight News

On the evening of April 8, White House officials announced that an additional 104% tariff on China took effect at noon Eastern Time, with the tariff set to be levied starting April 9. Consequently, the financial markets, which had been recovering, all experienced a sharp decline, with the Nasdaq index fluctuating by as much as 8%.

Dismal Market and Disappointed Players

By the morning of April 9, the cryptocurrency market was increasingly panicked, plunging again. Bitcoin fell from $78,500 to $74,627, a drop of over 4%. Ethereum dropped from $1,533 to $1,385.38, breaking below the lowest point of "Black Monday." SOL performed relatively better, dipping to a low of $101.26, down 5.63%. The total market capitalization of cryptocurrencies fell by over 4%, down to $2.42 trillion. Bitcoin's market share rose to 62.48%, while the altcoin season index dropped to 16.

In terms of liquidation data, according to Coinglass, over 134,500 people were liquidated in the last 24 hours, with a total liquidation amount of $390 million, including $296 million from long positions. The largest single liquidation on a centralized exchange occurred on Binance, valued at $3.171 million.

During the same period, global financial markets performed poorly, overshadowed by tariff concerns. Nvidia, which had risen over 8% in the early session, closed down over 1%, while Tesla, which had risen over 7%, closed down nearly 5%; Peabody, a coal stock, rose over 20% after hours. The yield on two-year U.S. Treasury bonds plunged nearly 20 basis points during the session. The Bloomberg Commodity Index plummeted during the day, and WTI crude oil prices fell back below $60. Oil prices have dropped for four consecutive days, hitting a four-year low, with a decline of over 4% at one point. Spot gold turned to decline during the session, failing to rebound; silver futures rose over 3% before turning to decline; copper futures rose over 4% before briefly turning to a decline of over 2%.

In such a dismal market, even the big players are not feeling well.

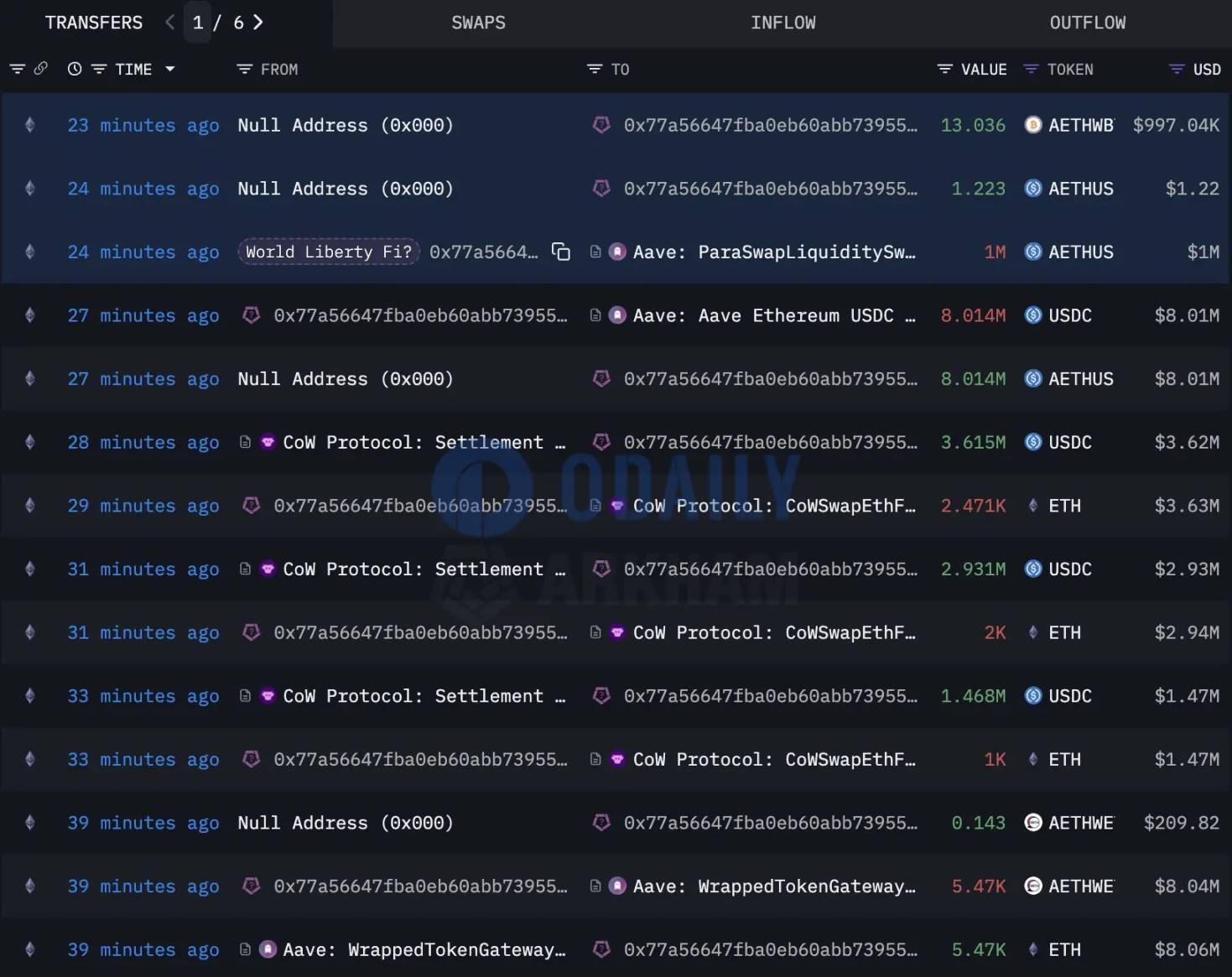

According to Lookonchain monitoring, a wallet suspected to be related to World Liberty (@worldlibertyfi) sold 5,471 ETH at an average price of $1,465 half an hour ago. In fact, this address previously spent about $210 million to buy 67,498 ETH at an average price of $3,259, resulting in a current unrealized loss of about $125 million.

Ryuta Otsuka, a strategist at Daiwa Securities, stated, "Regardless of the industry, the entire market may face sell-offs, especially as medium- to long-term investors are distancing themselves from the market." The cryptocurrency market is not immune to market sentiment; a whale that hoarded 254,900 ETH during the Ethereum ICO has recently frequently transferred to exchanges, having sold about 230,000 ETH, liquidating 90.2% of its position.

Meanwhile, Strategy's 8-K form submitted to the SEC on April 7 disclosed its regular risks, indicating that if Bitcoin prices continue to fall, Strategy may break Michael Saylor's promise of "never selling Bitcoin." Since Trump's election victory, Strategy has purchased 275,965 Bitcoins at an average price of $93,229, incurring an unrealized loss of $4.6 billion.

Tariff Clouds and Interest Rate Cuts

Regarding the additional 104% tariff on China, Trump's tariff stick shows no signs of being put down. Previously, billionaire Bill Ackman, founder of Pershing Square, warned world leaders: "Don't wait until war to negotiate; call the president now." However, when Vietnam sought peace with the Trump administration—stating it would accept zero tariffs—it was met with disdain from Trump's advisors. Before April 9, the market speculated that the Trump administration would use the window before the tariff took effect to negotiate with countries for a mutually beneficial exchange. However, repeated statements from the White House forced the market to confront the possibility of an economic crisis that could be worse than the Great Depression of 1929, leading to a wave of risk-off selling, with the S&P 500 index losing nearly $6 trillion in value, marking the largest four-day decline in history.

U.S. Treasury Secretary Scott Bessen emphasized that tariffs are essentially a "maximized leverage" negotiation tool, rather than a long-term economic barrier. However, the market can tolerate uncertainty but cannot accept "policy speculation" based on power.

Even as Trump repeatedly urged the Federal Reserve to cut interest rates, even claiming that "artificial market sell-offs are beneficial for rate cuts," the Federal Reserve, represented by Powell, has not budged on the timing of rate cuts. In the past, the market has always hoped the Federal Reserve would be the savior. This shows that capital is unwilling to pay the price for political gambles.

Deep Reforms and Reshaping Hopes

Ray Dalio, founder of Bridgewater Associates, recently stated that the current market is overly focused on the superficiality of tariffs while ignoring deeper systemic changes. Dalio believes we are witnessing the simultaneous restructuring of five major forces, including the collapse of monetary and economic orders; the disintegration of domestic political order in the U.S.; the reorganization of international geopolitical order; the destructive impact of natural disasters; and the significant effects of technological change.

According to historical experience, after the collapse of monetary, political, and geopolitical orders, dramatic changes often occur in the form of depressions, civil wars, and world wars, leading to the emergence of a new order.

Bitwise Chief Investment Officer Matt Hougan is optimistic about Bitcoin serving as a core asset in the new order, believing that Bitcoin could still reach $200,000 by the end of the year. He stated that in the short term, a weaker dollar is beneficial for Bitcoin. Over the past five years, the correlation between Bitcoin and the dollar index has ranged from -0.4 to -0.8. When the dollar falls, Bitcoin rises. This trend is expected to continue.

In the long term, the impact is even more positive. The turmoil in the global macro system creates opportunities for the emergence of new reserve assets. This makes sense: countries and businesses choose the dollar in international trade precisely because of its stability. When that stability is called into question, organizations must seek alternatives.

In this context, the reasons for choosing Bitcoin are simple: when international tensions rise and the global monetary system is in turmoil, where else can investors look for a scarce, global, digital store of value that is not controlled by any government or entity? Transitioning from a single reserve currency (the dollar) system to a more fragmented reserve system, Bitcoin will become the most sought-after hard currency. Chaos will ultimately lead to progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。