Trump's "reciprocal tariff" policy has caused a global uproar in the financial markets. As a measure aimed at protecting the U.S. economy and reversing trade imbalances, this initiative has not only sparked concerns about a trade war but also had a profound impact on the future trajectory of cryptocurrencies like Bitcoin. Since the policy was announced, Bitcoin's price has dropped from a high of $88,000 to $74,000 within a week, a decline of over 10%. However, whether this policy will ultimately benefit Bitcoin in the long run has become a heated topic of debate among authoritative media, crypto influencers, and KOLs.

Policy Background: Global Shockwaves from Tariffs

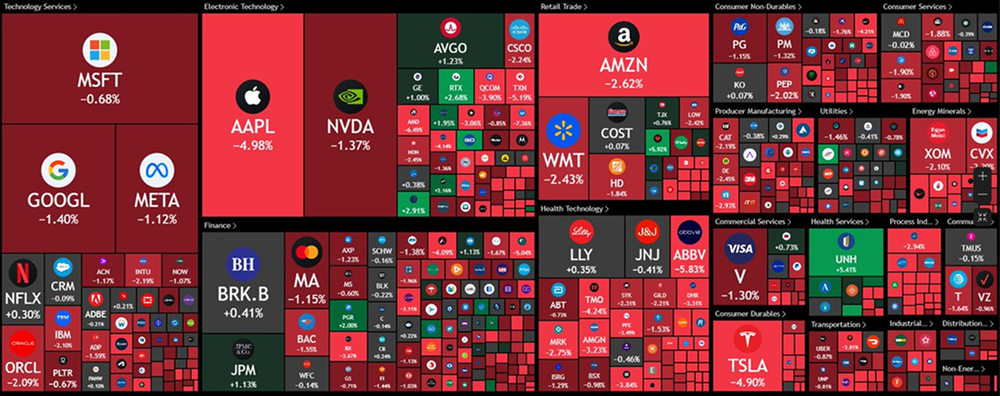

Trump's reciprocal tariff policy is characterized by an "America First" tone, implementing differentiated tariffs against major trading partners. The aim is to reduce trade deficits and stimulate domestic manufacturing, but the market response has been fraught with uncertainty. On the first trading day after the policy announcement, the S&P 500 index fell by 3.2%, the dollar index briefly strengthened before retreating, and risk assets like Bitcoin were not spared.

Short-term Pressure: Market Panic and Sell-off

The direct impact of the tariff policy has been an increase in global economic uncertainty, and Bitcoin has not been immune. The New York Times analysis pointed out that although Bitcoin has long been viewed as a "store of value," its price fell to around $74,500 after the policy announcement, indicating its correlation with traditional markets.

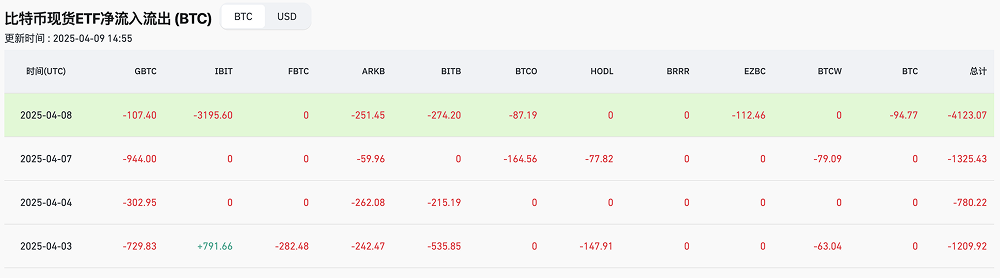

X user @thebtcdad posted on April 8 that companies like MicroStrategy lost up to $5.91 billion due to the drop in Bitcoin prices, highlighting the market pressure in the short term. Meanwhile, Bitcoin exchange-traded funds (ETFs) also experienced significant capital outflows. According to Investing.com, since the announcement of the tariff policy, Bitcoin ETFs have seen a net outflow of over $8.7 billion, reflecting investors' aversion to risk assets. This sell-off is closely related to concerns about a global trade war, as tariffs could drive up inflation, weaken corporate profitability, and drag down various assets, including Bitcoin.

However, short-term volatility is not the whole story. Some analysts believe that Bitcoin's decline is more of an immediate reaction to macroeconomic uncertainty rather than a denial of its long-term value. FX168 noted in a comment on April 7 that while Bitcoin may struggle to shed its label as a risk asset in the short term, its decentralized nature may gradually become more prominent amid global economic turmoil.

Long-term Benefits: Rising Safe-Haven Demand and Potential Challenges to Dollar Dominance

Despite the lackluster short-term performance, some authoritative figures and crypto influencers remain optimistic about Bitcoin's long-term prospects, believing that the tariff policy may indirectly benefit the cryptocurrency. Here are several key viewpoints:

The Rise of Safe-Haven Demand: Venture capitalist Tim Draper explicitly supported Trump's tariff plan in an X post on April 9, predicting that Bitcoin will emerge as the "ultimate winner." He believes that the tariff policy will weaken the dollar's global dominance, prompting investors to turn to non-sovereign assets. Draper pointed out that the long-term impact of countries like China on the U.S. economy may be diminished by tariffs, and Bitcoin's decentralized characteristics make it an ideal choice against trade protectionism. This view was echoed by some KOLs, with @DiosWeb3 predicting that Bitcoin could reach $113,000 by the end of 2025.

Potential Benefits of Monetary Easing: Former BitMEX CEO Arthur Hayes stated in an interview on April 9 that the tariff policy may force the Federal Reserve to adopt interest rate cuts or quantitative easing measures in the future to counter economic downturn pressures. Such a liquidity easing environment has historically favored assets like gold and Bitcoin. Hayes predicted that if global central banks engage in competitive easing due to the trade war, Bitcoin could see a new round of price increases. X user @ryan24eth expressed a similar view: "The printing press won't stop, and neither will the rise in BTC prices."

MicroStrategy's Long-term Bet: Despite facing a $5.91 billion paper loss after the tariff policy, MicroStrategy founder Michael Saylor increased his holdings by 6,911 Bitcoins on April 9, bringing the company's total holdings to over 500,000. Saylor emphasized in an interview that Bitcoin is unaffected by tariffs, and its global liquidity makes it the "ultimate asset" against economic uncertainty. X user @MarchandCorne reported that if Trump relaxes some tariff policies, Bitcoin could quickly rebound to $90,000.

Controversy and Uncertainty: The Nature of Risk Assets Remains Unchanged

Not all analyses are optimistic about Bitcoin's long-term prospects. Some experts point out that Bitcoin's correlation with traditional markets may weaken its safe-haven attributes. A report from Southern Finance News on April 8 mentioned that Bitcoin's gains since Trump's victory in November 2024 have been nearly erased by the tariff policy, and the short-term drop below $75,000 indicates its difficulty in completely decoupling from macroeconomic fluctuations. Cointelegraph analyzed on April 7 that the market initially expected Trump to advance a strategic Bitcoin reserve plan, but the policy has yet to materialize, leading to a loss of investor confidence.

Additionally, the lack of depth in the Bitcoin market has become a concern. AiCoin warned in an analysis on April 9 that if the key support level of $75,000 is breached, Bitcoin could further test the $60,000-$70,000 range. This technical vulnerability, combined with the external pressures from the tariff policy, could prolong its adjustment period.

Neutral Perspective: Between bullish and bearish viewpoints, some analysts have taken a more neutral stance. FX168 commented that while Bitcoin may struggle to stand alone in the short term, its safe-haven attributes may gradually emerge if the global economy falls into recession due to the trade war. AiCoin suggested that investors pay attention to the Federal Reserve's March decisions and global trade policy trends, believing that Bitcoin is at a crossroads of short-term risks and long-term potential.

Data Insights: Market Trends and Predictions

To present the viewpoints more clearly, here is a summary of key data:

- Short-term performance: Bitcoin's price fell from $88,000 to $74,000, a decline of over 15% (as of April 9).

- ETF outflows: Net outflow of $8.7 billion, indicating rising market aversion.

- Long-term prediction: Changelly forecasts a price of $113,000 by the end of 2025, an increase of about 53% from the current price.

- Corporate holdings: MicroStrategy lost $5.91 billion but continues to increase holdings to over 500,000.

Conclusion: Investment Insights Amid Complex Impacts

Trump's tariff policy presents a dual impact on Bitcoin. In the short term, global economic uncertainty has led to market panic, and Bitcoin, as a risk asset, has not been spared, with price declines and capital outflows dominating the narrative. However, in the long run, the policy may indirectly benefit Bitcoin by weakening the dollar's position, increasing safe-haven demand, or triggering monetary easing. Bullish figures like Tim Draper and Michael Saylor firmly believe in its "digital gold" attributes, while bearish perspectives emphasize its correlation with traditional markets.

For investors, the complexity brought by this policy necessitates greater caution. In the short term, monitoring the $75,000 support level and global economic data is crucial; in the long term, Bitcoin's trajectory may depend on the depth of the trade war, the stability of the dollar, and central bank policy responses. As the New York Times stated, Bitcoin may still be a "source of long-term value," but its path is bound to be fraught with challenges.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute investment advice for anyone.

AiCoin official website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。