Source: Financial Associated Press

Author: Xiaoxiang

Following our morning article mentioning the "trillion-dollar U.S. Treasury landmine" (basis trade liquidation) being completely detonated, the sell-off of U.S. Treasuries intensified further during the Asian session on Wednesday…

Market data shows that the yield on the 30-year U.S. Treasury bond has surged straight past "5," dramatically spiking by 25 basis points to 5.010% at one point during the day, reaching the highest level since the end of 2023.

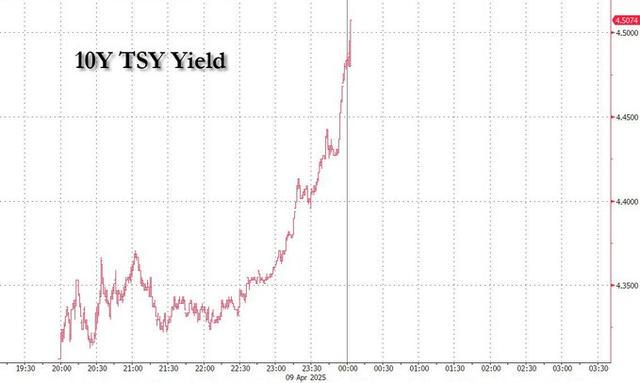

The 10-year U.S. Treasury yield, known as the "anchor of global asset pricing," rose by 21 basis points to 4.503%.

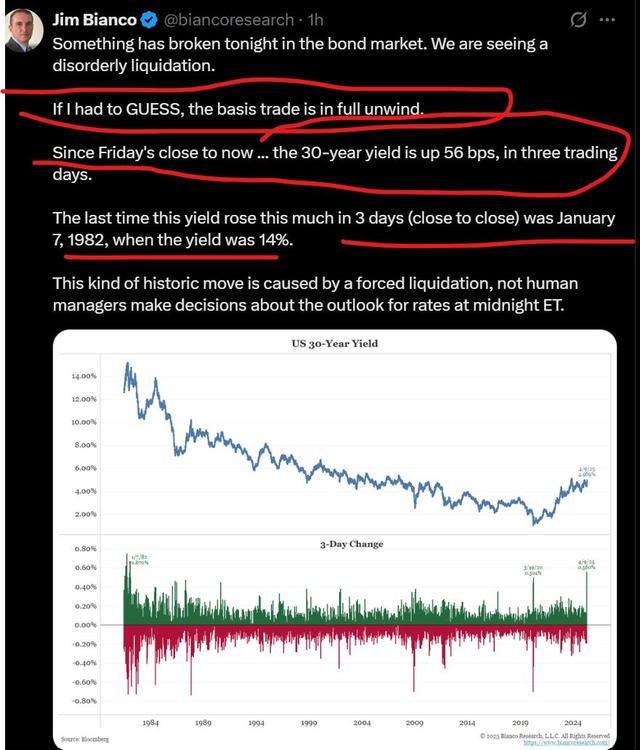

According to statistics from Jim Bianco, founder of the renowned research firm Bianco Research, the yield on the 30-year U.S. Treasury bond has increased by 56 basis points in less than three trading days since last Friday. The last time yields rose this much in three days was on January 7, 1982. However, it's important to note that at that time, U.S. Treasury yields were as high as 14% (56 basis points was not significant back then). Bianco stated that this historic market movement is clearly caused by forced liquidations.

It can be said that this round of U.S. Treasury bond collapse has completely deviated from normal market volatility. Industry insiders are currently focused on two main speculations: ① How significant is the impact of the U.S. Treasury basis trade explosion? ② Are there really overseas "creditors" selling U.S. Treasuries?

Regarding the topic of the U.S. Treasury basis trade explosion, we have fully explained it in our morning article, and investors can refer back to it.

The well-known financial blog site Zerohedge has also summarized the potential developments that need to be watched closely:

① The trillion-dollar U.S. Treasury basis trade is exploding, and countless funds and banks may be liquidating positions;

② The liquidity in the system is far from sufficient;

③ The shockwave from insufficient liquidity could sweep across all markets, leading to a stock market crash (liquidation panic), a bond collapse (yield guarantees continue), and foreign exchange hedging (yen soaring… and at some point, a turning point will come, leading to a severe shortage of dollars);

④ Investors may encounter a critical liquidity exhaustion event in the next couple of days (Wednesday's 10-year Treasury auction, followed by Thursday's 30-year Treasury auction). If there is not enough liquidity in the system, we may see informal auction failures—yes, while a failure is unlikely—primary dealers, who have the obligation to purchase all unsold government bonds to prevent auction failures, will step in, but if the allocation ratio for primary dealers reaches 40% or 50%, it would be almost equivalent to an auction failure.

Zerohedge believes that the results of the two upcoming U.S. Treasury auctions in the next 48 hours, as well as whether the Federal Reserve will intervene urgently, could be the most critical moment for the fate of the U.S. financial system in modern history.

Nomura interest rate trader Ryan Plantz also warned in an internal memo that "in the Treasury market, swap spreads and basis trades are melting away. The U.S. Treasury market is experiencing a massive liquidation not seen in careers, and a liquidity vacuum has formed."

According to Plantz, the Federal Reserve must intervene now, even though Powell may be reluctant to show that he is providing relief for Trump's trade war, he may have no choice. Plantz pointed out:

The so-called "silent mode" of the Trump administration is taking effect—they are allowing market pain to spread. Due to the U.S. government's tough stance against trade partners, a real buyer strike has occurred, leading to panic and creating a demand vacuum in the U.S. Treasury market. The spectacular collapse of U.S. Treasuries at Tuesday's close has left many practitioners (including myself) continuously questioning the rationality of the market—the yield curve has steepened sharply into a bear market, and various spreads and basis indicators have collapsed across the board.

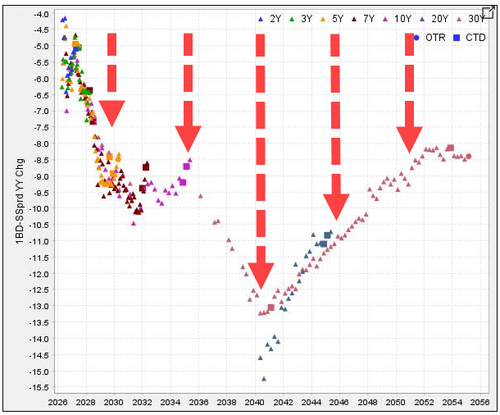

The daily volatility of asset swap spreads is astonishing (note that this is a change within 24 hours), and it is at least one of the most extreme fluctuations I have witnessed in my career. The current market has completely fallen into a liquidity vacuum:

Market discussions have quickly shifted to the intense debate of "when will the Federal Reserve step in to save the market." We emphasized on Tuesday that unless the following signals appear: a surge in financing pressure in the repo market, banks massively financing through agencies like Fannie Mae (similar to the situation during the banking crisis a few years ago), the current turmoil remains a matter of market sentiment and confidence—only upon reaching these thresholds could "emergency rate cuts" by the Federal Reserve be put on the agenda.

However, we are now acutely feeling that the next shoe may drop soon. Looking back, the core goal of quantitative easing in 2020 was to maintain market liquidity and functionality. If we see a gap-like volatility similar to Tuesday's on Wednesday, measures such as activating the Standing Repo Facility (SRF) and ending quantitative tightening (QT) may quickly come to the table. I even mentioned "twist operations" (OT) today… this is the situation we are currently in. But it is important to clarify that the financing market has not yet reached a critical point.

It is worth mentioning that according to a report last month by four scholars, including Anil Kashyap from the University of Chicago and former Federal Reserve Governor Jeremy Stein, the Federal Reserve should adopt "hedged purchasing" as a relatively better intervention method to address the U.S. Treasury basis trade explosion, which involves selling an equivalent amount of Treasury futures contracts to hedge while purchasing Treasury bonds.

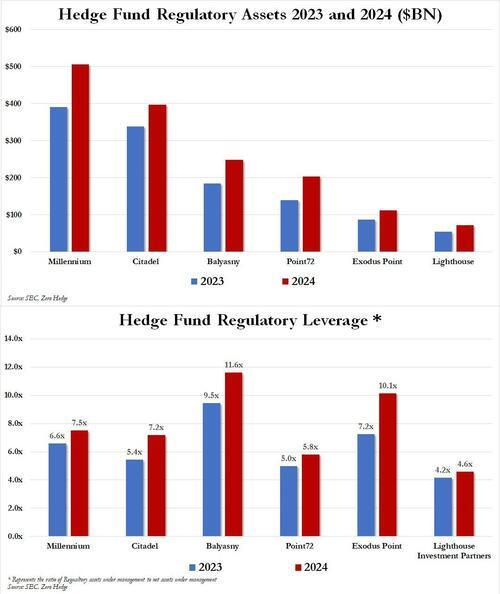

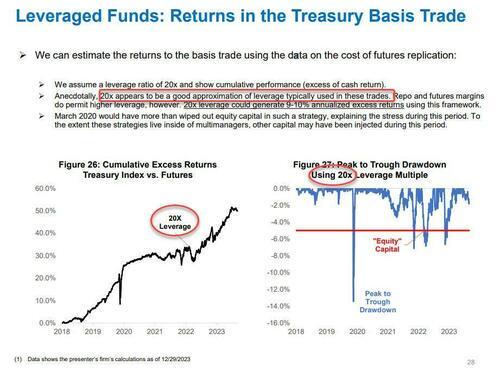

Currently, although the scale reaches trillions of dollars, the main positions in U.S. Treasury basis trades are actually concentrated in fewer than 10 hedge funds, represented by Millennium, Citadel, Balyasny, Point72, ExodusPoint, and Lighthouse. Industry estimates suggest their average leverage ratio is 20 times. This also means that as long as the related basis trade losses reach 5%, they could face total collapse and be forced to add margin.

Note: The above image compares the asset sizes of the six major hedge funds from the previous year and the year before, while the lower image compares leverage ratios.

In the past few years, the most severe losses related to these trades occurred during the initial phase of the pandemic in March 2020. At that time, foreign central banks and bond funds facing redemption waves sparked a "cash grab," being forced to sell the most liquid assets—U.S. Treasuries. This, in turn, severely impacted hedge funds that had established large leveraged basis trades, nearly turning the chaotic Treasury sell-off into a catastrophic financial crisis. Ultimately, the Federal Reserve's "massive injection" of $1.6 trillion in a single month was what calmed this disaster.

Note: The right-side image shows the drawdown rate during the Treasury market sell-off in March 2020.

Of course, one point currently troubling the market is whether there are other forces selling besides the basis trade explosion. An increasing number of investment banks are beginning to suspect that Trump's regressive policies on tariffs may trigger more overseas creditors of the U.S. to sell Treasuries.

Steve Sosnick, chief strategist at Interactive Brokers, stated on Tuesday, "Due to tariff frictions with China, they may stop buying and resist U.S. bonds. Japan holds the largest reserve of U.S. Treasuries, but China is also the second-largest overseas creditor of the U.S. What will happen if this source of foreign demand shrinks or completely dries up?"

Sosnick indicated that in such a scenario, the U.S. Treasury would have to issue bonds at higher interest rates to make up for the losses: "The supply won't decrease quickly, right? But you have to take measures regarding demand."

Currently, Japan, the largest "overseas creditor" of the U.S., has stated that the recent sell-off of U.S. Treasuries is not its doing—Japanese Finance Minister Katsunobu Kato ruled out the possibility of using Japan's holdings of U.S. Treasuries as a bargaining chip against Trump's tariffs on Japanese imports on Wednesday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。