As economic nationalism, trade fragmentation, and de-dollarization trends accelerate, Bitcoin's theoretical role as a "neutral currency" is transitioning from theory to reality.

Author: LSTMaximalist

Translated by: Deep Tide TechFlow

Summary

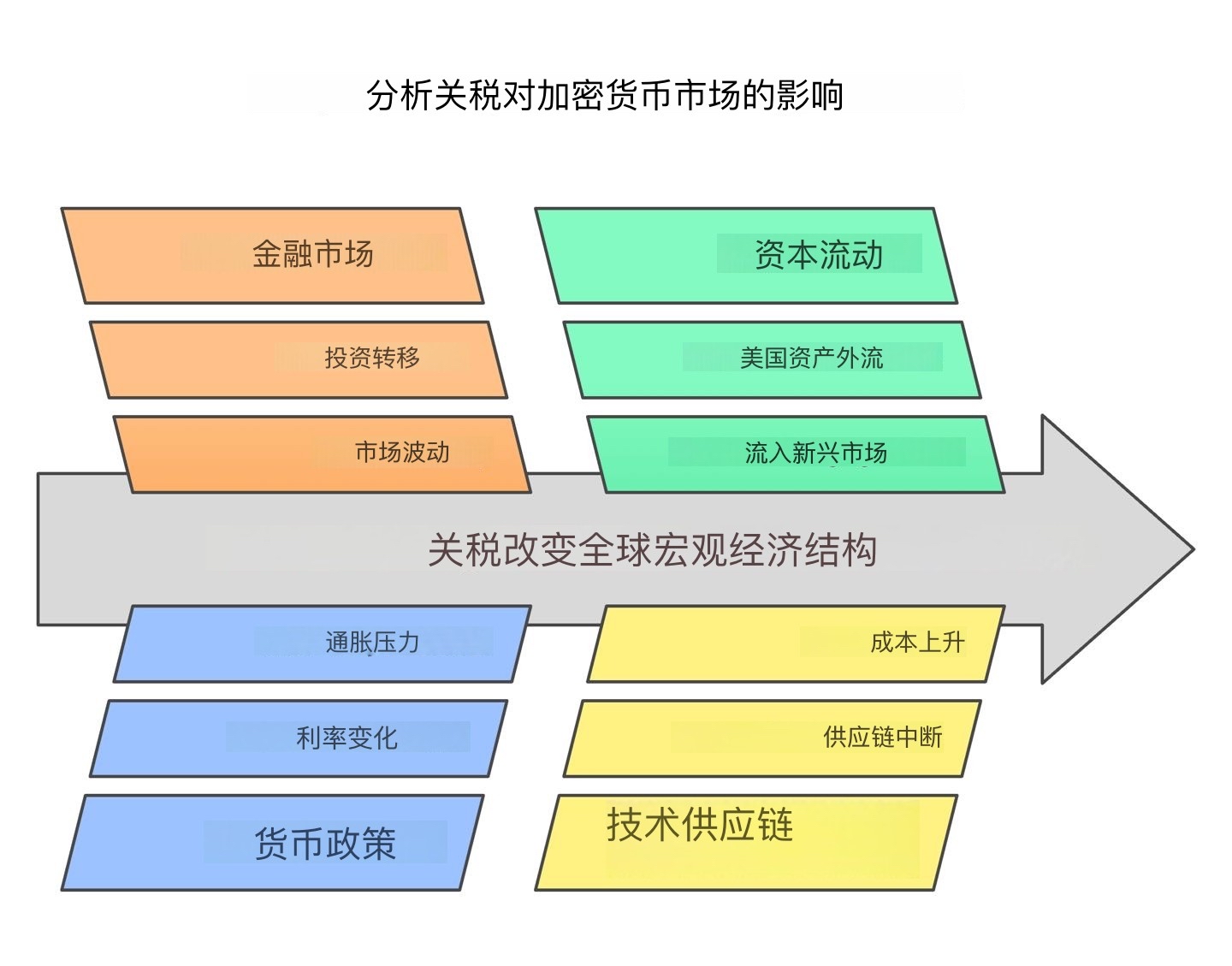

The Trump administration's reintroduction of tariff escalations in 2025 is changing the global macroeconomic structure, significantly impacting the digital asset market. The tariff policy was initially aimed at protecting domestic industries but has had profound secondary and tertiary ripple effects on financial markets, monetary policy, global capital flows, and technology supply chains, all of which are closely related to the crypto economy. This report analyzes how tariffs multifacetedly affect the cryptocurrency market, focusing on liquidity conditions, mining economics, capital flows, monetary system fragmentation, and Bitcoin's evolving role in the global financial order.

1. Background: "American Ponzi" and Global Capital Flows

After World War II, the United States built a self-reinforcing economic flywheel: foreign countries exported goods to the U.S. and repatriated their dollar surpluses into U.S. financial assets (government bonds, stocks, real estate), keeping yields low and asset valuations high. This cycle drove credit expansion, consumption growth, and asset inflation, establishing the dollar as the world's primary reserve currency.

However, excessive fiscal spending during the COVID-19 pandemic, aggressive monetary easing policies, and rising sovereign debt levels have shaken the structural integrity of this system. The Trump administration's reintroduction of tariffs represents an attempt to "force a reset" of this system—but this could undermine the core mechanisms sustaining this "Ponzi scheme."

Figure: The impact of tariffs on the cryptocurrency market, content translated by AI

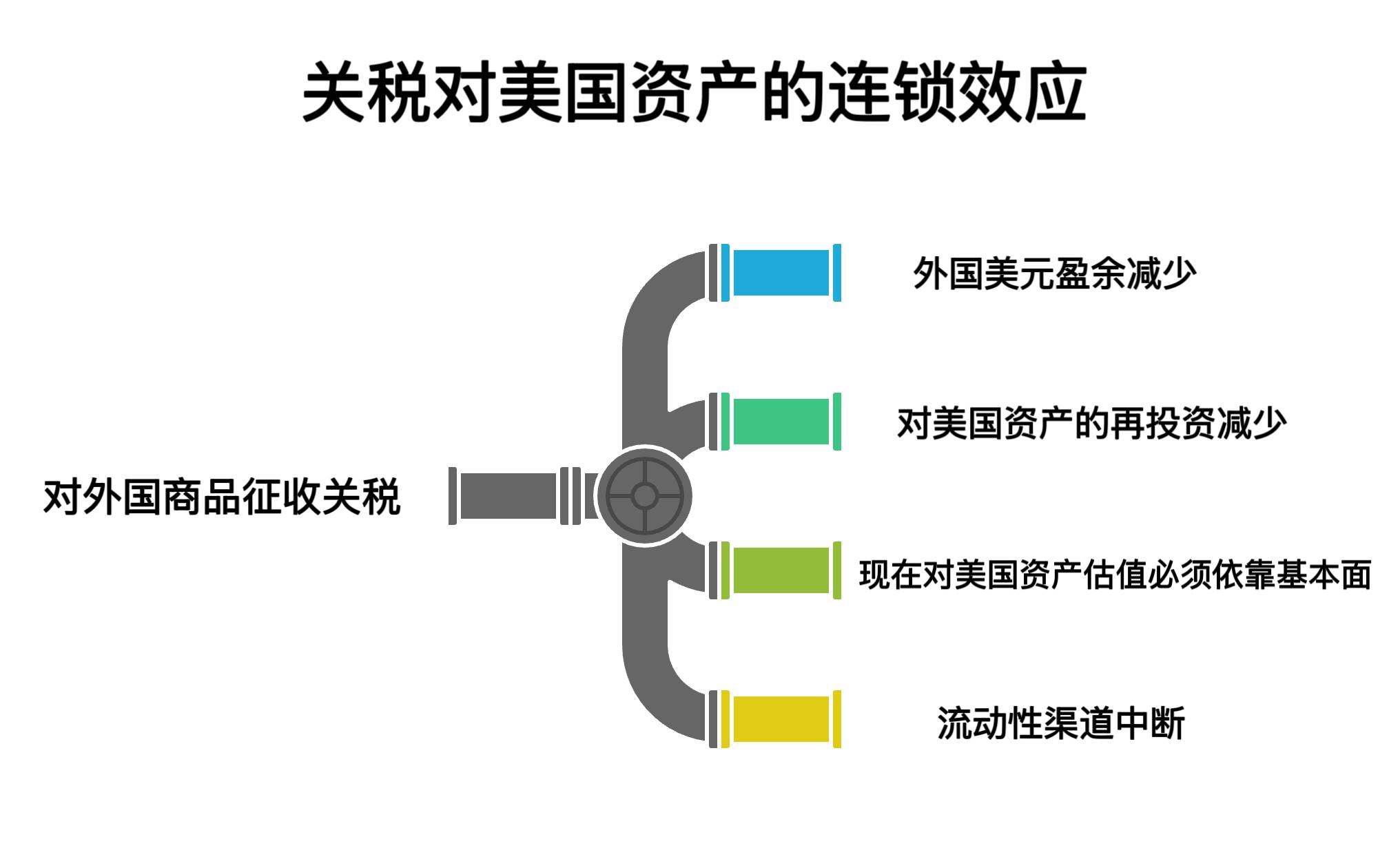

Mechanism of Operation:

Tariffs reduce dollar surpluses for foreign exporters

A decrease in surpluses means a decline in reinvestment in U.S. assets

U.S. asset valuations, previously supported by foreign capital inflows, must now rely on fundamental earnings and growth indicators to justify their value

Disruptions in liquidity channels affect all asset classes, including cryptocurrencies

Figure: The chain effects of tariffs on U.S. assets, translated by Deep Tide TechFlow

2. Short-term Impact: Liquidity Shock and Sentiment Shift

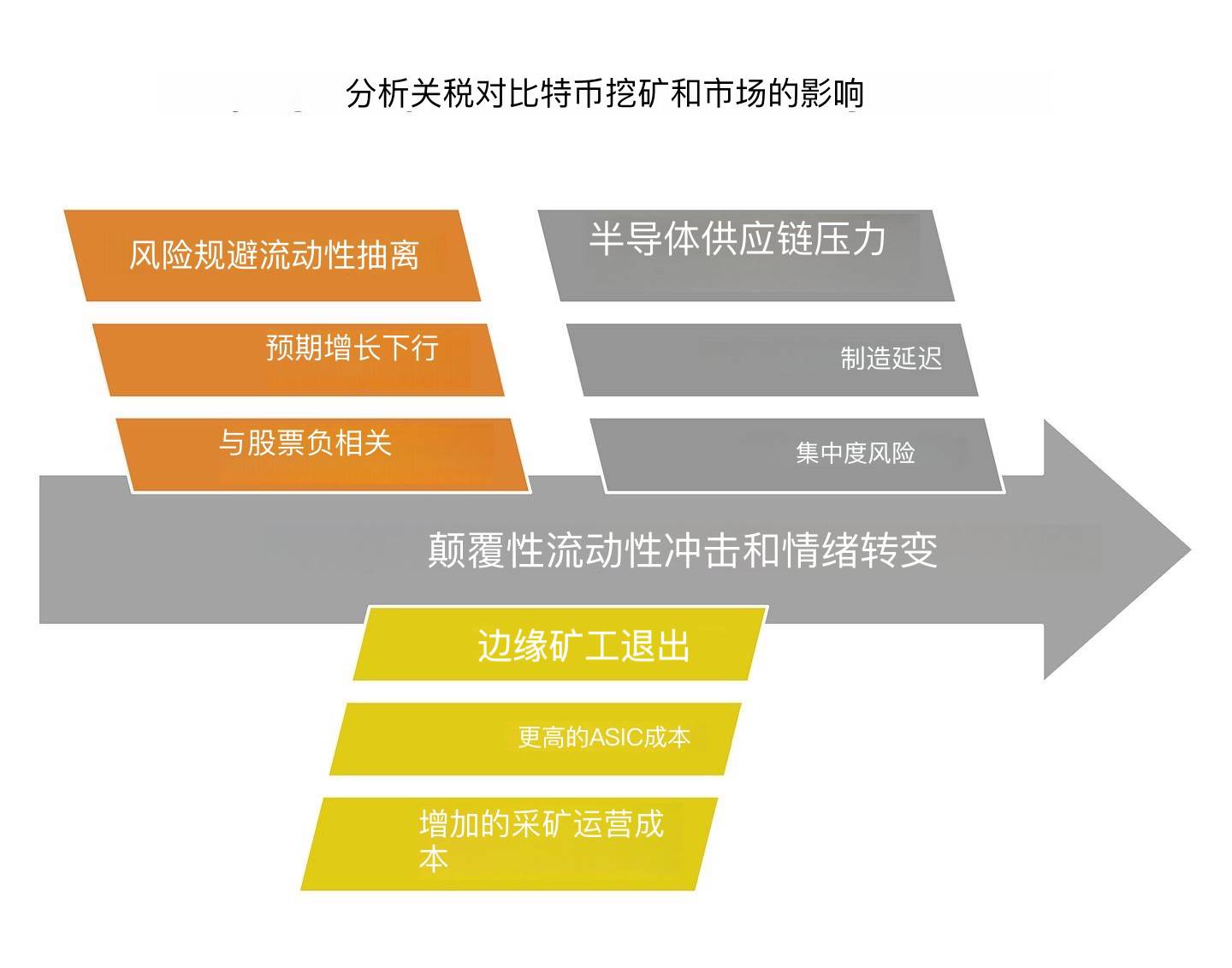

- ### Liquidity Drain Due to Risk Aversion

Tariffs trigger global risk aversion, leading markets to lower growth expectations. As a historically high-beta asset, Bitcoin (BTC) initially showed a negative correlation with the stock market during such liquidity shocks. After Trump announced the tariff plan in April 2025, BTC/USD fell about 8% intraday, briefly touching $81,000.

- ### Rising Mining Operating Costs

New tariffs on Chinese mining hardware (ASICs, GPUs, semiconductors) have increased capital expenditure requirements for mining operations.

Impact Model: Assuming energy costs and network difficulty remain unchanged, a 10% increase in ASIC costs could lead to a 6-8% decline in mining profit margins.

Elasticity: Higher costs may force marginal miners to exit, potentially slowing the growth rate of hash power and tightening mining economic conditions.

- ### Semiconductor Supply Chain Pressure

Tariffs on key chip components disrupt the production timelines of next-generation mining hardware, which may delay hash power expansion and exacerbate concentration risks in mining centers.

Figure: The impact of tariffs on Bitcoin mining and the market, content translated by AI

3. Mid-term Impact: Monetary System Restructuring and Cryptocurrency Monetization

- ### Federal Reserve Policy as a Catalyst for Bitcoin

If tariffs significantly slow GDP growth but do not reignite inflation (due to consumption contraction rather than supply shocks), the Federal Reserve may be forced to adopt a dovish stance.

Mechanism of Operation: Lowering interest rates expands liquidity and reduces real yields, which has historically been associated with rising Bitcoin prices (negative real rates favor non-yielding assets).

Observation: As of the end of March, net inflows into spot Bitcoin ETFs this year were about $600 million, indicating that despite the volatility triggered by tariffs, structural demand remains persistent.

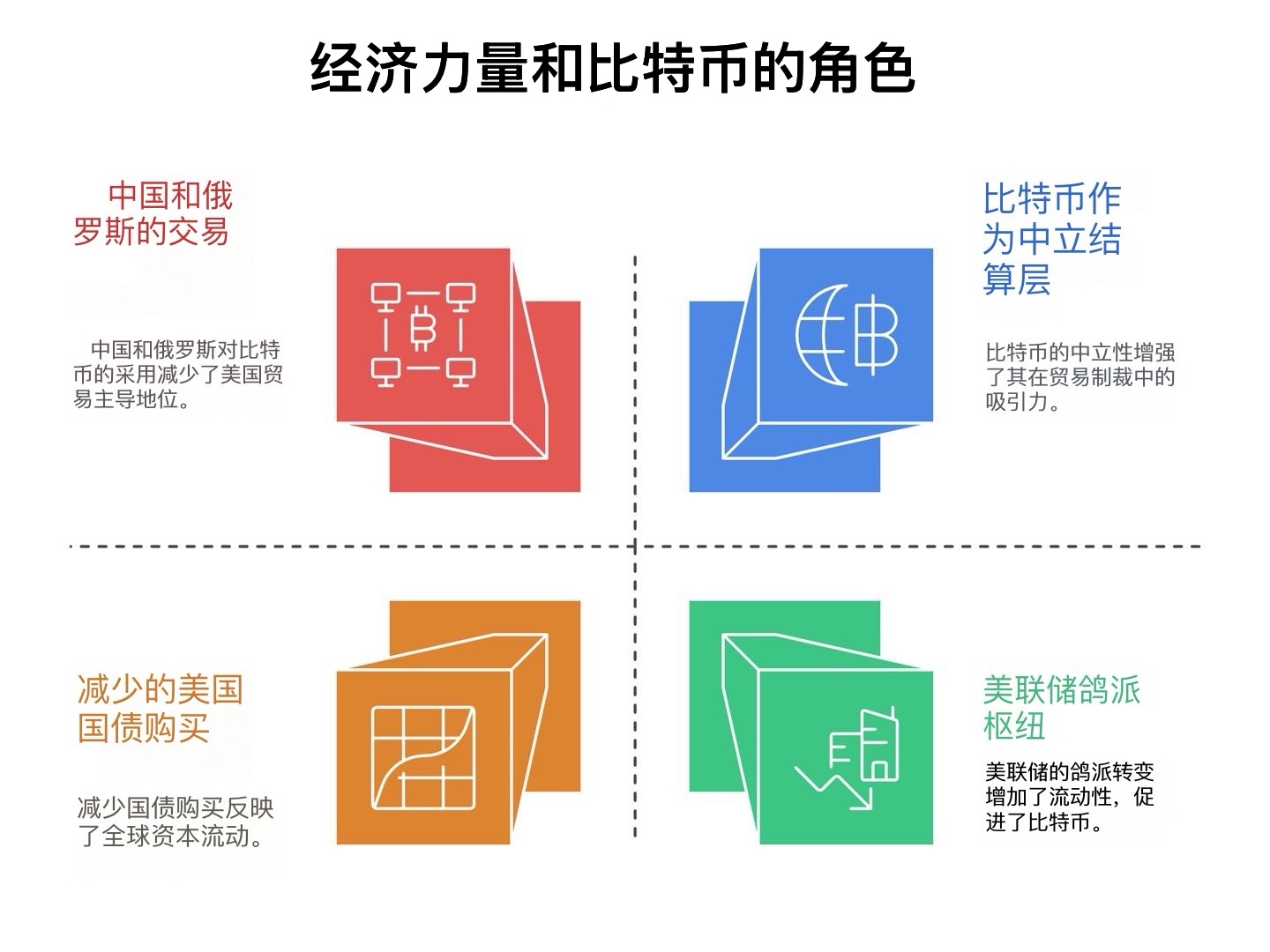

- ### Weaponization of Trade Infrastructure

Trade sanctions and tariffs accelerate the trend of de-dollarization.

Empirical Data:

China and Russia are using Bitcoin and other digital assets to settle energy transactions.

Bolivia is exploring cryptocurrency-based energy imports.

French utility company EDF is considering Bitcoin mining as an export monetization strategy.

These initiatives validate the theory of Bitcoin as a neutral settlement layer, resistant to sovereign intervention.

- ### Global Capital Reallocation

The reduction of foreign capital inflows into the U.S. alters global liquidity dynamics:

With foreign buyers reducing purchases of U.S. government bonds, long-term assets (stocks, bonds) face resistance.

In this environment, non-sovereign assets like Bitcoin may attract marginal liquidity seeking alternative reserves.

Figure: The role of economic power and Bitcoin, content translated by AI

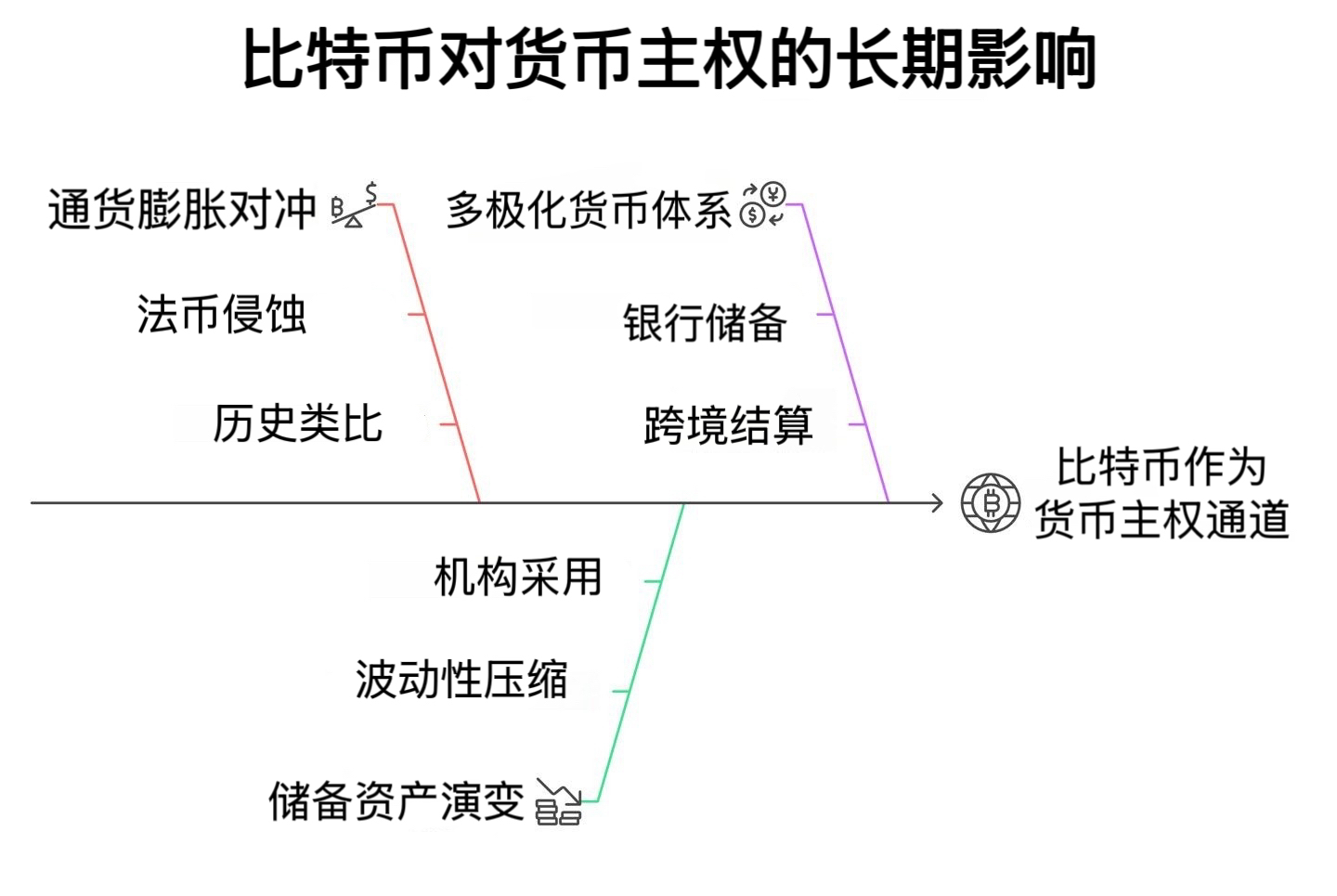

4. Long-term Impact: Bitcoin as a Channel for Monetary Sovereignty

- ### Inflation Hedge and Devaluation of Fiat Currency

If ongoing trade disputes structurally damage the purchasing power of fiat currencies, Bitcoin's utility as an inflation hedge may increase.

Historical Analogy:

Bitcoin adoption surged in Argentina and Turkey during currency collapses.

The performance of gold after the collapse of the Bretton Woods system.

- ### Evolution from Risk Asset to Reserve Asset: Bitcoin's Behavior is Path-Dependent

If instability in sovereign currencies becomes the norm, Bitcoin's volatility relative to fiat currencies may decrease, encouraging institutional allocators to adopt it.

Key Transformation Indicators to Monitor:

Convergence of volatility relative to the stock market.

Increased correlation with Treasury Inflation-Protected Securities (TIPS).

Pilot allocations by treasuries and sovereign wealth funds.

- ### Multipolar Monetary System and Bitcoin as a Settlement Layer

The disintegration of the U.S.-centered trade architecture creates opportunities for alternative cross-border settlement layers, where Bitcoin has a unique advantage due to its decentralized and censorship-resistant characteristics.

Potential Development Trends:

Central banks holding Bitcoin as a hedge for reserve diversification.

Energy-exporting countries inclined to adopt Bitcoin-based settlement methods to avoid dollar exposure.

Figure: The long-term impact of Bitcoin on monetary sovereignty, translated by Deep Tide TechFlow

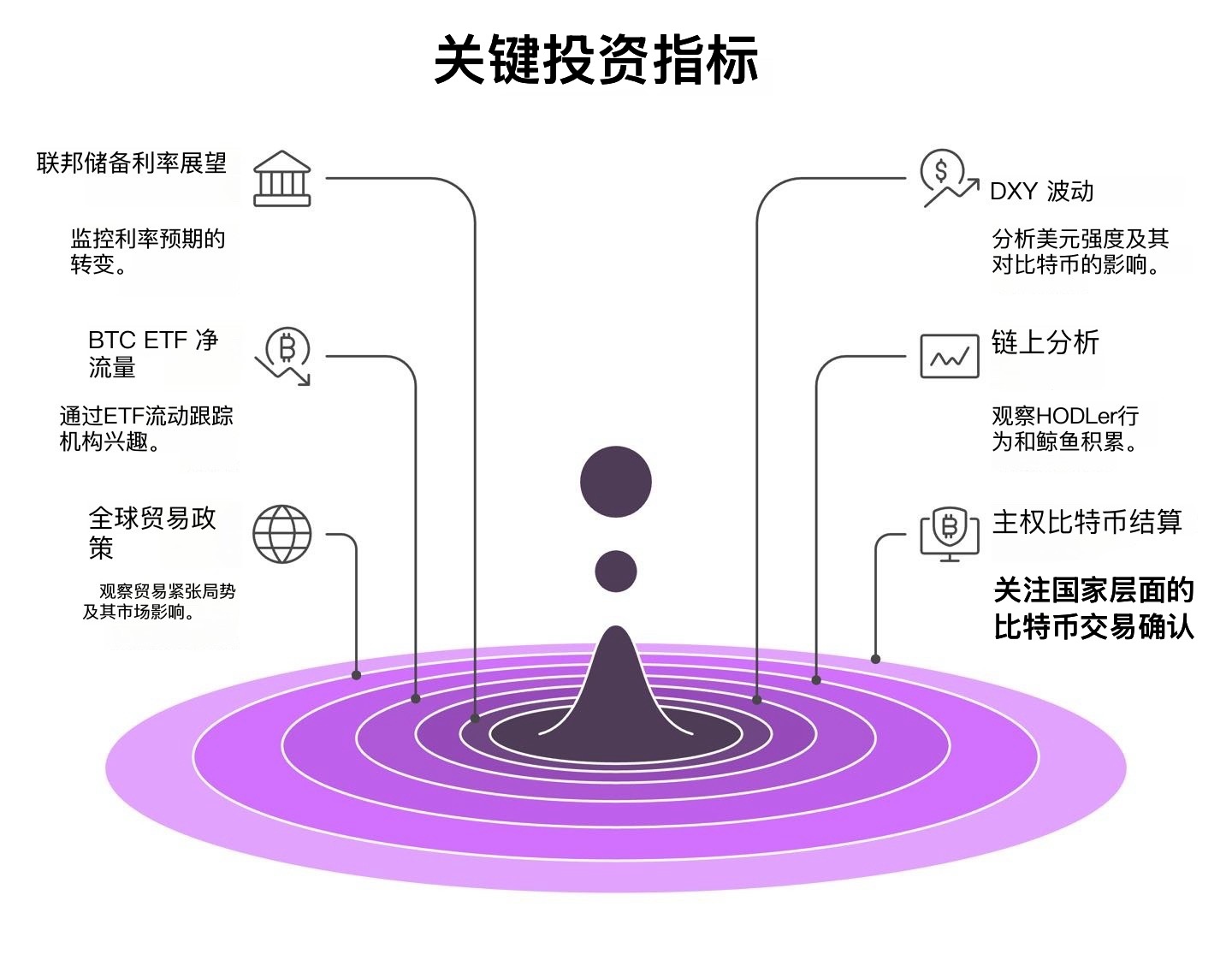

5. Key Indicators for Investors to Watch

Federal Reserve interest rate outlook: changes in the federal funds futures curve.

U.S. Dollar Index (DXY) trends: continued weakening is favorable for Bitcoin.

Net inflows into Bitcoin ETFs: an important indicator of institutional investment interest.

On-chain analysis: holder behavior, accumulation by large holders, changes in exchange reserves.

Global trade policy escalations: watch for retaliatory measures from the EU and China.

Sovereign Bitcoin settlements: monitor confirmed Bitcoin transaction events by national entities.

Figure: Key investment indicators, content translated by AI

6. Conclusion: The Beginning of a New Monetary Paradigm?

Although tariffs primarily target trade balance and domestic industry protection, their ripple effects touch all aspects of global capital markets. For the cryptocurrency market, tariffs are not just transient risk events but may catalyze a structural reorganization of the global financial trajectory.

As economic nationalism, trade fragmentation, and de-dollarization trends accelerate, Bitcoin's theoretical role as a "neutral currency" is transitioning from theory to reality. In a multipolar world characterized by financial fragmentation, Bitcoin's role as a sovereign neutral reserve asset and energy settlement layer may not only persist but also thrive.

Investors, miners, and protocol developers should adjust their strategies to adapt to this new era where liquidity flows, monetary credibility, and sovereign trust are fundamentally redefined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。