1. Market Observation

Keywords: Tariffs, ETH, BTC

U.S. President Trump's reciprocal tariff measures officially took effect today, and the impact of this trade war has quickly spread to global financial markets. Ironically, Trump himself has not been spared. Since the comprehensive tariff plan was introduced on April 3, his personal net worth has dropped from $4.7 billion to about $4.2 billion, primarily due to the decline in the public and private stocks he holds. On the market side, since Trump announced the comprehensive tariffs, global stock markets have evaporated about $1 trillion. The Dow Jones Industrial Average plummeted over 2,000 points from its high, and tech giants like Apple and Microsoft have seen their market values evaporate by more than $5 trillion from their peaks. In response, Ken Fisher, founder of Fisher Investments, harshly criticized Trump's tariff policy on social media, calling it "foolish, wrong, and extreme." Notably, Boujnah, CEO of the Euronext exchange, stated that some European investors have begun transferring physical assets like gold from the U.S. to Europe in search of safer havens.

In this round of market turmoil, the cryptocurrency market has shown a unique trend. Bitcoin, which fell to $74,501 on "Black Monday," has touched $74,627 again today, but seems to have formed a potential support level around $74,000. Crypto analyst Eugene and BitMEX co-founder Arthur Hayes both built positions around $75,000, with Hayes predicting that Bitcoin's market cap share will rise to 70%. Bernstein analysts pointed out that the current 26% decline, compared to historical deep corrections of 50% to 70%, indicates that Bitcoin is gaining more resilient capital support. Additionally, Matrixport analysis noted that the USD/CNY exchange rate is approaching a key technical resistance level, which may signal a new round of rapid increases for Bitcoin. Standard Chartered even predicts that before Trump leaves office, the price of Ripple's XRP token could rise to $12.50.

In terms of regulation, the situation is becoming increasingly complex. To comply with Trump's executive order on digital assets, the U.S. Department of Justice announced the dissolution of the department responsible for cryptocurrency-related investigations. According to Fortune magazine, the U.S. Chamber of Commerce is considering suing the Trump administration to block the new tariffs set to take effect on Wednesday, with other groups potentially joining the lawsuit. U.S. Treasury Secretary Mnuchin stated that discussions are ongoing about which regions to prioritize for tariff agreements, but White House officials have confirmed that there will be no tariff exemptions implemented in the near future, with reports indicating that over 50 countries (regions) have stepped forward seeking negotiations.

On the macroeconomic front, the situation is becoming increasingly severe. Former U.S. Treasury Secretary Summers warned that Trump's tariff policy could lead to a recession in the U.S., with an estimated 2 million Americans losing their jobs and each household facing at least $5,000 in income loss. Goldman Sachs' strategy team issued a warning that the current stock market sell-off could evolve into a longer-lasting cyclical bear market. The U.S. bond market has experienced severe sell-offs, with the 10-year Treasury yield soaring to 4.503% and the 30-year yield breaking 5.010%. Wall Street titans, including Bill Ackman, Daniel Loeb, and Jim Chanos, collectively voiced concerns, warning that Trump's latest tariff policy contains serious miscalculations, amplifying the tariff levels of other countries by four times. However, Fisher provided a relatively optimistic view, suggesting that the market may be overreacting, citing that the stock market also experienced similar adjustments in 1998, ultimately achieving a 26% return that year.

2. Key Data (As of April 9, 13:30 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $76,492.96 (Year-to-date -18.12%), Daily Spot Trading Volume $52.41 billion

Ethereum: $1,454.83 (Year-to-date -56.28%), Daily Spot Trading Volume $27.709 billion

Fear and Greed Index: 18 (Extreme Fear)

Average GAS: BTC 0.51 sat/vB, ETH 0.38 Gwei

Market Share: BTC 62.5%, ETH 7.2%

Upbit 24-hour Trading Volume Ranking: XRP, AERGO, BTC, ETH, AQT

24-hour BTC Long/Short Ratio: 1.0004

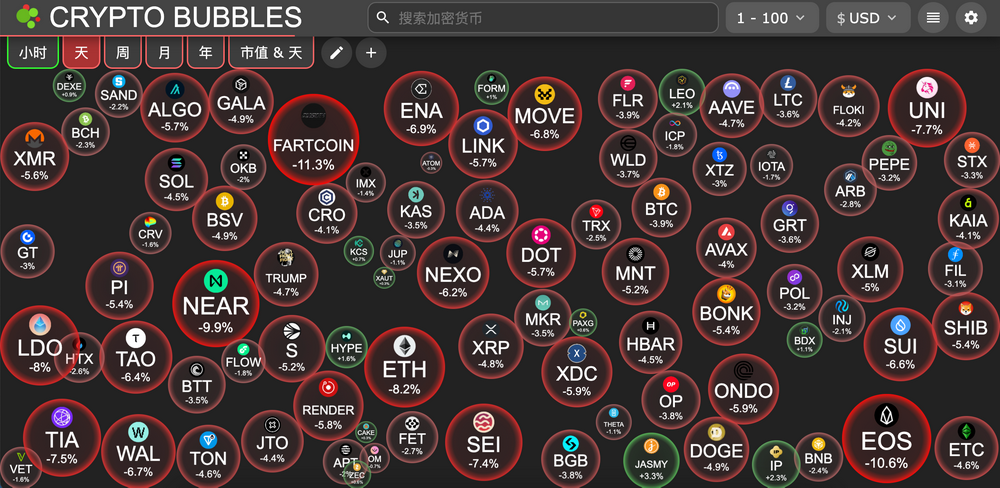

Sector Performance: The crypto market saw a general decline, with the Meme sector down 5.58% and the AI sector down 5.55%

24-hour Liquidation Data: A total of 137,588 people were liquidated globally, with a total liquidation amount of $412 million, including $141 million in BTC and $112 million in ETH

BTC Medium to Long-term Trend Channel: Upper Line ($82,688.70), Lower Line ($81,051.30)

ETH Medium to Long-term Trend Channel: Upper Line ($1,774.39), Lower Line ($1,739.26)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (As of April 4 EST)

Bitcoin ETF: -$326 million

Ethereum ETF: -$3.29 million

4. Today's Outlook

Movement (MOVE) Unlocks 50 million Tokens, Worth Approximately $20.9 million

U.S. SEC to Decide Whether to Approve BlackRock's Ethereum ETF Options Trading

U.S. Senate to Hold Procedural "Termination of Debate" Vote on SEC Chairman Nominee Paul Atkins

Federal Reserve to Release Minutes from March Monetary Policy Meeting

U.S. March Unadjusted CPI Year-on-Year (April 10, 20:30)

- Actual: To be announced / Previous: 2.8% / Expected: 2.6%

U.S. Initial Jobless Claims for the Week Ending April 5 (Thousands) (April 10, 20:30)

- Actual: To be announced / Previous: 219 / Expected: 223

Top 500 Market Cap Gains Today: ARDR up 73.38%, FORTH up 36.70%, GAS up 31.30%, RFC up 29.01%, SOS up 18.83%.

5. Hot News

The Probability of the Federal Reserve Cutting Rates by 25 Basis Points in May is 45.2%

CBOE Submits 19b-4 Application to the SEC for Canary SUI ETF

Standard Chartered: XRP Could Reach $12.50 Before President Trump's Term Ends

Bubblemaps: 50 Million MELANIA Tokens Transferred and Partially Sold from Community Fund

Affected by Binance's Delisting, PROS, FIRO, and Other 4 Tokens Drop Over 50%

Glassnode: Bitcoin Stabilizes Around $74,000, Downtrend May Slightly Slow Down Next

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。