Annual returns exceed 15% and airdrop expectations.

Written by: 0x Sketon, DeFi Researcher

Translated by: CryptoLeo

Editor's Note: After experiencing "Black Monday" and the "CNBC Incident," the market has turned cold again. BTC remains around the $80,000 level, and most altcoins have halved compared to a year ago, with the secondary market in despair; those who are good at trading may still encounter a few golden opportunities.

Overall, the development of tariffs and Trump's "big mouth" characteristic have led to a market that is completely driven by news, making it increasingly difficult to profit from trading cryptocurrencies. DeFi researcher 0x Sketon has compiled a list of 11 DeFi protocols on Solana worth participating in for earning yields, with a focus on lending and stablecoin deposits. The following is a translation by Odaily Planet Daily.

This article will introduce 11 major DeFi strategies for earning passive income on Solana, seeking annual returns of 15% to 50% through lending, vaults, and farming. Below is a curated list of protocols for earning stable returns:

1. Adrastea Finance

Lend USDC, offering an APY of 13.94%;

Provide SOL (Solayer) for liquidity re-staking, with an APY of 9.7%.

2. NX Finance

Deposit SOL into the GMS lending pool (APR 16.68%), earning "yield + double points" through collaboration with Fragmetric.

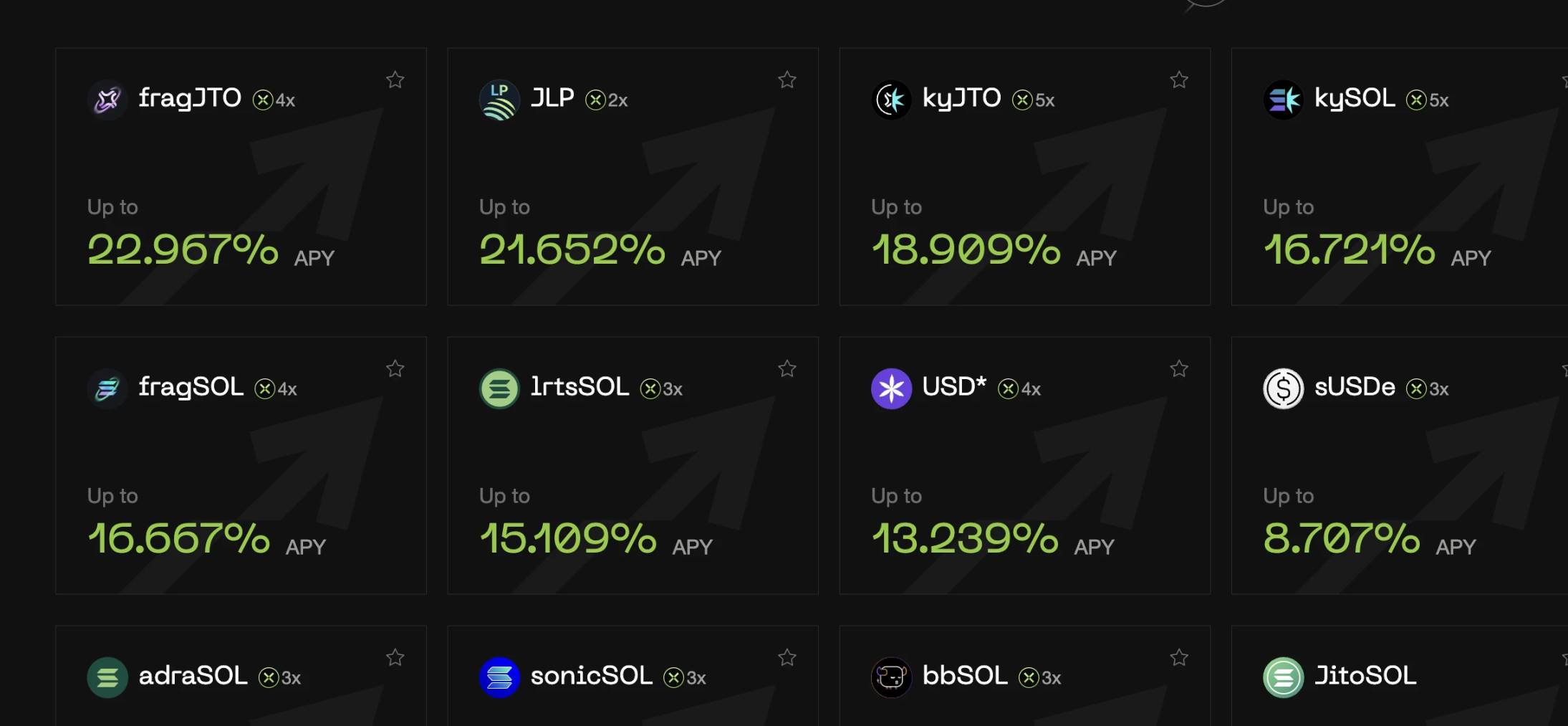

3. Vaultka

JLP mining (15% - 20%), V1 version lends SOL (APY 16.65%), USDC (10.27%), USDT (12.65%);

Additionally, you can borrow JLP and SOL for leveraged mining (maintaining lending health), with partners including: Jupiter, Solayer, Jito.

4. RateX (also known as Little Pendle)

Choose high APY pools to deposit staked tokens, earning Fragmetric + native points.

5. DeFituna

Borrow tokens into protocol pools, with currently high APY pools including SOL, Fartcoin, USDS.

6. Pluto

Deposit to borrow USDC, SOL, and PYUSD, and achieve higher APY through its JLP and INF compounding.

7. Exponent

A Pendle-style DeFi protocol on Solana, exchange corresponding tokens through Jupiter and deposit into matching pools. This protocol also features farming and liquidity treasury rewards (including points bonuses for staked token protocols: Fragmetric, Fyros).

8. Sandglass

A lending aggregator, choose JLP pool deposits, with an APY of 5 – 20%.

9. Vectis Finance

Delta neutral strategy, choose a vault to deposit USDC, earning 6 – 25% stablecoin APY.

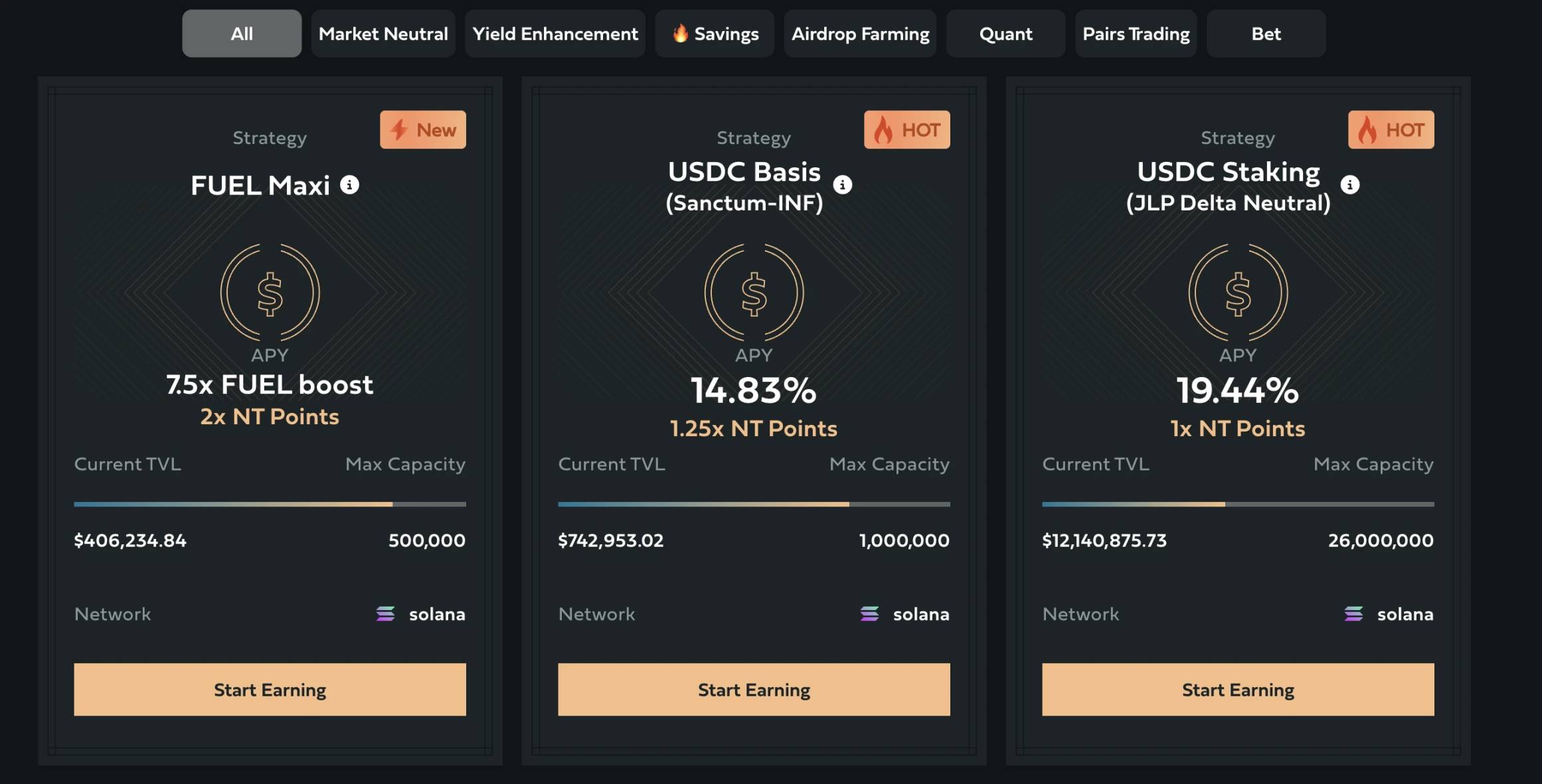

10. Neutral Trade

Led by a former Goldman Sachs team;

Choose a yield strategy and deposit funds to earn 1-2 times NT points (airdrop).

11. synatra

Synthetic re-staking protocol, converting SOL to ySOL, earning 31 – 38% APY.

The above are the lending and deposit protocols for earning APY shared today. I recommend focusing on the following projects:

Neutral Trade: Created by quantitative analysts, traders from Goldman Sachs, Barclays, and three major global hedge funds, as well as experienced Web3 developers; it is also one of the award-winning projects at the Solana Radar hackathon;

RateX: Seed round financing participated by GSR, Animoca Ventures, etc., funded by the Solana Foundation, and also an award-winning project at the Solana 2024 Renaissance hackathon MCM, with a clear mechanism;

Exponent: Announced completion of $2.1 million financing in 2024, led by RockawayX, with deposit staked tokens eligible for multiple project points bonuses;

DeFituna: Founder Dhirk previously stated that they are building a V2 version and also developing an independent product, with TGE token news to be announced later. However, DeFituna's token is primarily a revenue-sharing token, with governance features to be added in the future. Dhirk also revealed a $200 million market manipulation plan involving LIBRA, MELANIA, and other tokens (then named Moty);

NX Finance: Collaborated with multiple DeFi protocols on Solana; although its TVL is not high, its points system has airdrop expectations.

Finally, including the recommended projects, most are early-stage projects and carry certain risks. Please participate cautiously and do your own research (DYOR)!

If necessary, I will select a few key projects for detailed introduction in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。