Source: Cointelegraph Original: "{title}"

Blockchain oracle service provider RedStone has launched a push oracle solution on the MegaETH network, aiming to overcome the latency bottleneck that restricts on-chain transaction efficiency.

A company spokesperson stated that this new type of oracle can achieve on-chain price pushes every 2.4 milliseconds. The product debuted on the Ethereum Layer 2 network MegaETH and may expand to more public chains in the future.

In terms of technical architecture, RedStone's oracle system obtains price data from centralized exchanges and directly transmits it to applications or smart contracts through nodes natively running on the MegaETH chain.

This "server co-location" strategy achieves extremely low latency by eliminating delays caused by physical distance. In the future, the protocol will also integrate price data sources from decentralized exchanges.

As the Ethereum Virtual Machine (EVM) compatible ecosystem expands, the demand for oracles continues to rise. According to Alchemy data, there are currently 12 decentralized oracle networks running on Ethereum.

CoinMarketCap statistics show that the total market capitalization of oracle tokens has reached $10.2 billion, with business models including data usage fees, licensing, staking rewards, and node incentives.

The explosive growth of DeFi is accelerating competition in the oracle market

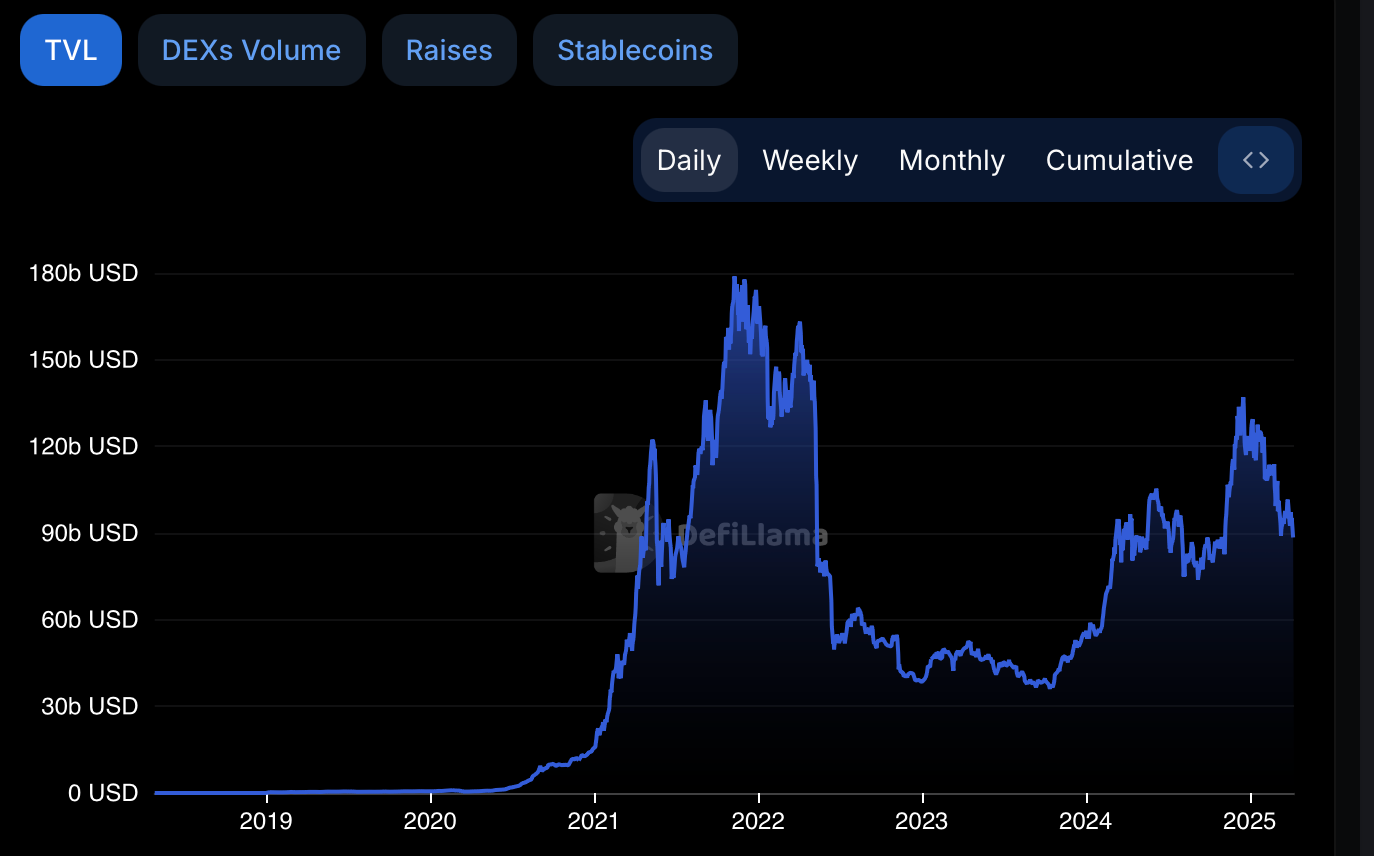

According to DefiLlama data, as of Tuesday (April 8), the total value locked (TVL) in on-chain DeFi approached $88 billion, with a 116% increase in 2024. Ethereum remains the leading DeFi public chain with a TVL of $47.8 billion, while Solana ranks second with $6.1 billion.

DeFi TVL Trend Chart Source: DefiLlama

The rise of DeFi has intensified competition in the oracle market—this field is a key support for the operation of decentralized applications. Price oracles serve as a bridge between blockchain and the real world, responsible for inputting real-time market data into smart contracts.

Current leading players in the oracle space include Chainlink and Pyth Network—the latter surpassed Chainlink in October 2024 with a 30-day trading volume of $36 billion, as its request-based pull model is more suited for high-frequency trading scenarios.

Related Articles: Solana's TVL reaches a new high in SOL terms, DEX trading volume performs strongly—Will SOL price respond?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。