The homework on Tuesday is harder than on Monday. Although everyone anticipated that Trump would take a hard stance on China's tariffs, no one expected it to be so direct, with a 104% tariff set to be implemented. While a difference between 54% and 104% may not seem significant, it is detrimental to the economic environment. The U.S. will lose access to high-quality and inexpensive Chinese products, and it will also become more difficult for China to obtain American electronic and technological products. Moreover, China's manufacturing sector will face significant impacts, and the unemployment rate in China may rise under such tariffs.

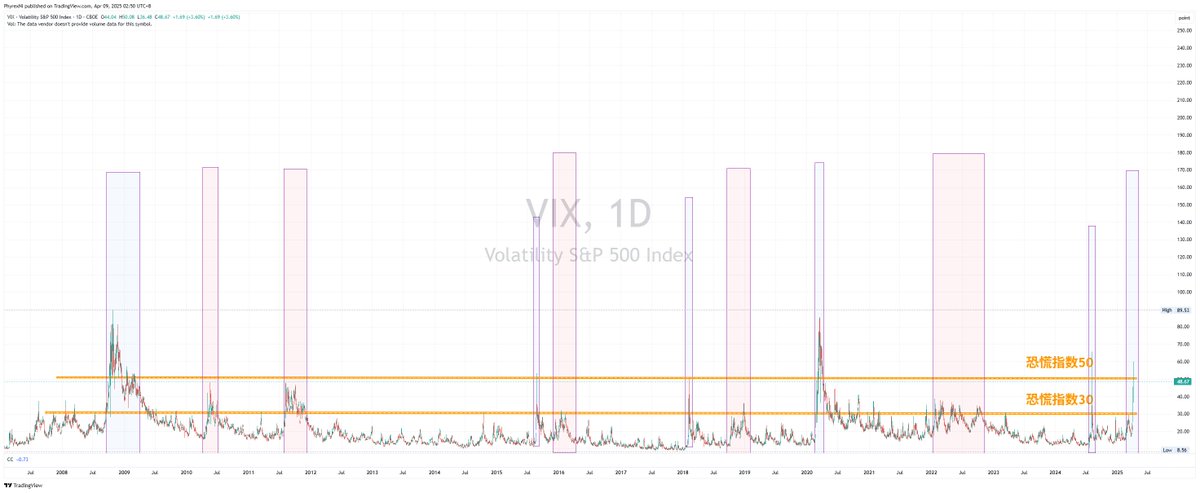

After the announcement of the 104% tariff, both cryptocurrencies and U.S. stocks experienced declines. The Nasdaq and S&P shifted from gains to losses, and the VIX returned to around 50, further dampening the sentiment in the risk market. With the White House's announcement, it is expected that officials from China's Ministry of Commerce and Ministry of Foreign Affairs will have headaches tonight, as a countermeasure from China may be imminent tomorrow.

In fact, the numbers regarding tariffs have become less meaningful at this point. Even if China raises tariffs on the U.S. to 110%, the ultimate result will still significantly impact trade between the two countries, with the common people bearing the brunt of the consequences.

From the perspective of the risk market, while tariffs may cause market gloom, the White House and Trump have indicated that they will not consider lowering tariffs unless it benefits U.S. employment and trade deficits. The implementation of tariffs is already a certainty, but there is still a significant chance that the final tariffs announced by the U.S. on April 9 will be lower than those on April 2. If this occurs, it could provide a breather for the risk market. After all, the tariffs have already been set; as long as Trump does not frequently alter them, the rest can be left to time.

Of course, the best-case scenario would be for Trump to announce a suspension of the tariff implementation on April 9, but the likelihood of that is quite low, especially since Trump himself stated yesterday that he has no plans to suspend them. In response to this situation, the market has increased expectations for the Federal Reserve to cut interest rates in 2025, raising the number of anticipated cuts from four to five.

Many may think this is a good thing, but it is not. The increase in the number of expected rate cuts is due to market expectations that tariffs will push the U.S. economy into recession. The Federal Reserve may choose to implement defensive rate cuts to prevent the economy from reaching that point. However, from my personal understanding of the Federal Reserve, this possibility remains low. Historically, the Fed has been more concerned with inflation than with economic recession. Unless a recession has already occurred, leading to a decline in inflation, the likelihood of rate cuts starting in May is very low.

I can also understand that market expectations are based on the GDP data to be released at the end of April, which may mark the beginning of economic maneuvering.

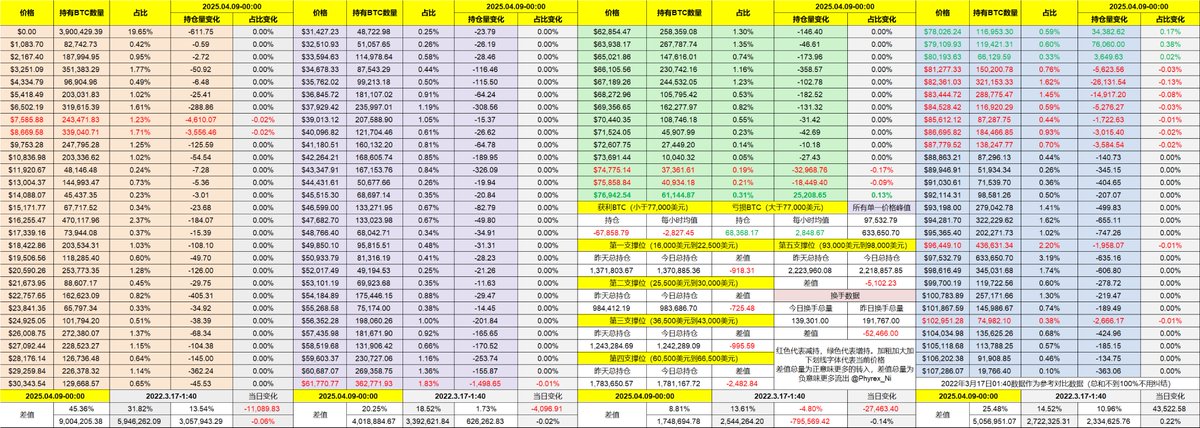

Looking at Bitcoin's data, today's turnover rate has decreased compared to yesterday, likely due to better sentiment today. However, unfortunately, after the White House announced the 104% tariff in the evening, the market fell again. This also highlights a viewpoint: aside from the tariff speech on April 2, the recent declines have been related to tariffs with China.

The market may be worried about the escalation of the trade war between the U.S. and China, which is relatively mild for $BTC but has a greater impact on U.S. stocks. China's response tomorrow may prompt a short-term decline in U.S. stocks again.

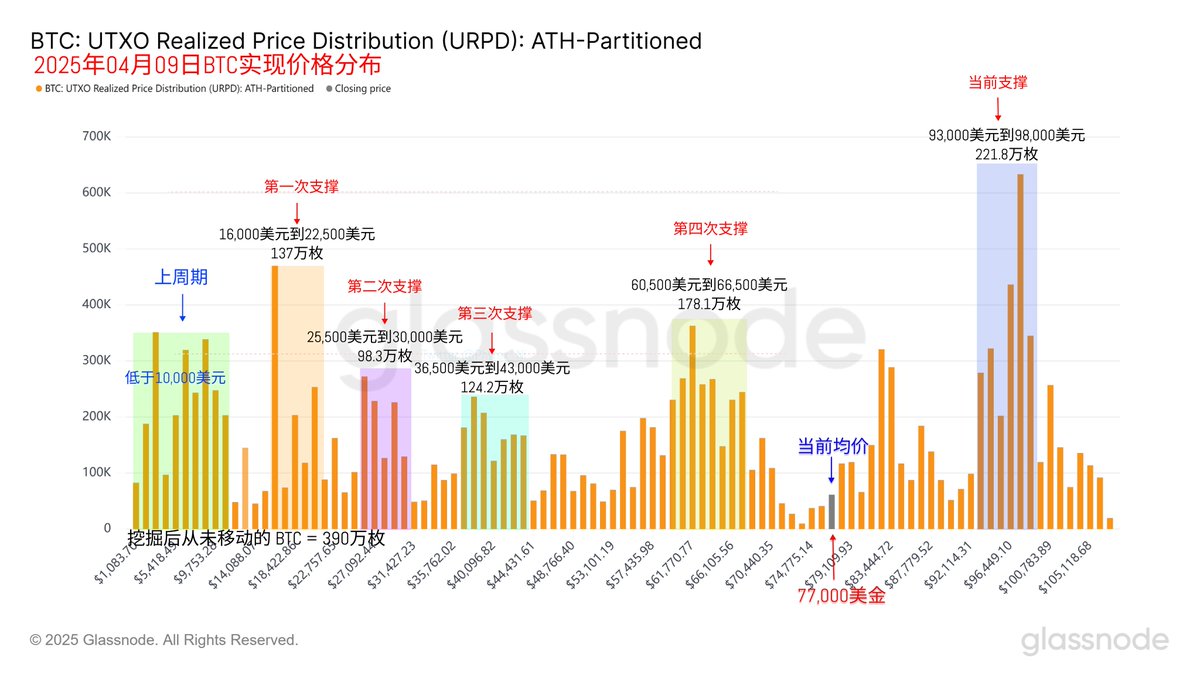

Another important data point is URPD. It is evident that although Bitcoin's price has fallen below $77,000 again, there has not been a significant reduction in investors at the $93,000 to $98,000 range, with only about 5,000 $BTC sold off. This indicates that the current selling pressure is not coming from this group of investors who are at a loss; rather, it appears that more losses are occurring among investors around the $83,000 mark, who are exiting the market.

This situation is quite different from the past, especially since the top loss-makers have not shown panic. Therefore, the pressure on prices to decline may not be very strong, but it remains uncertain whether they can withstand the pressure of an economic recession.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。