Today's Key Points Overview (April 8, 2025)

Market remains volatile but has not collapsed: Global stock markets have evaporated one trillion dollars, and the escalating trade war has left investors anxious. However, both traditional finance and the crypto market are seeking a brief technical rebound. Uncertainty still looms over the market.

Cryptocurrency temporarily warms up: Bitcoin and Ethereum rebounded after last week's sharp decline, but panic remains. The launch of new products like the XRP leveraged ETF indicates that some institutions are testing the waters.

Web3 is paving the way for the future: BlackRock CEO Larry Fink pointed out that asset tokenization is key to financial democratization, while ETHGlobal Taipei showcased a group of developers dedicated to solving real pain points.

The next phase of DeFi: Liquidity and trust: Facing issues like stagnant total locked value and dispersed incentives, the industry is rethinking liquidity guidance mechanisms and exploring scalable trust networks to propel Web3 towards a more mature direction.

The market never sleeps—this week has been a complete insomnia. Global stock markets plummeted, with market capitalization evaporating by trillions of dollars; the crypto market experienced a thrilling rebound, and trade frictions have once again become the focus. However, amidst the turmoil, there have been many highlights: crypto ETFs launched one after another, investment moguls released significant viewpoints, and the industry engaged in deep discussions about "liquidity" and "trust mechanisms." From Larry Fink's advocacy for asset tokenization to ETHGlobal Taipei gathering developer energy, the Web3 ecosystem continues to evolve. Whether you are a trader, builder, or an observer trying to keep up, this daily report will help you distill the most noteworthy points and see the real signals amidst the noise.

Table of Contents

Cryptocurrency Market Overview

This Week's Macroeconomic Hotspots

This Week's Major Events in the Crypto Circle

Recommended In-Depth Web3 Articles

Macroeconomic Overview

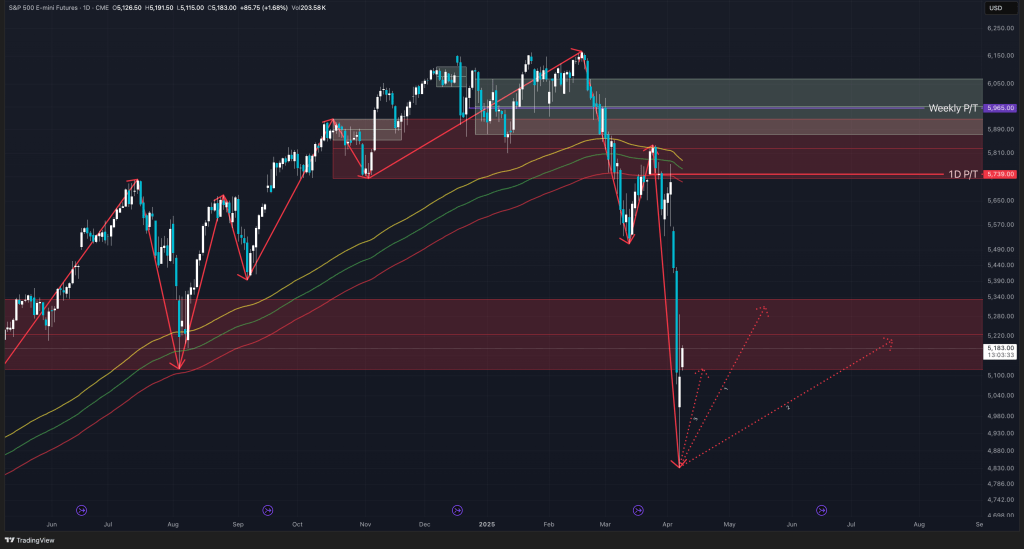

After last week's tragedy of over $10 trillion in global market capitalization evaporating, the market has finally seen a temporary rebound—but investors remain on edge. On Tuesday, signs of market warming appeared, with bottom-fishing funds entering the market as everyone awaits further clarification on Trump's trade policies. In Asia, Japan's Topix index surged over 6% due to Trump's appointment of two cabinet members and the initiation of bilateral talks with Japanese Prime Minister Shigeru Ishiba, suggesting Japan may receive priority in tariff negotiations. The Chinese stock market also rebounded, with state funds stepping in to stabilize the market, and the central bank promising more liquidity support.

The European Stoxx 600 index rose 1.1%, attempting to rebound from three consecutive days of sharp declines. In the U.S., S&P 500 and Nasdaq futures rose 1.4% and 1.2%, respectively. The U.S. bond market stabilized slightly, but volatility remains high due to upcoming auctions of 3-year, 10-year, and 30-year Treasury bonds.

S&P 500 Futures Image Credit: TradingView

The market has currently priced in three rate cuts by the Federal Reserve within 2025, with the first cut expected in June. However, uncertainty still hangs overhead—Trump has threatened to impose an additional 50% tariff on China and rejected the EU's proposal for "zero tariffs on industrial goods," leaving the policy direction unclear.

Meanwhile, oil and gold prices have risen slightly, and the dollar has pulled back, reflecting a slight recovery in investors' "risk appetite." The good news is that BYD and Samsung have released positive earnings forecasts, further boosting the sentiment in tech stocks.

In summary: This rebound comes at a crucial time, but the market remains precarious. Geopolitical frictions, policy uncertainties, and the direction of monetary policy will continue to influence market confidence.

Cryptocurrency Market Overview

The cryptocurrency market started off rocky this week but is finally seeing some glimmers of hope—though don't celebrate too early, as the storm is far from over.

Bitcoin (BTC): Pulled Back from the Brink of Collapse?

Bitcoin experienced a thrilling rebound, nearly dropping below $75,000, and is currently back around $79,524, up 6% for the day. The volatility between highs and lows reached $6,000, and market sentiment remains tense. Analysts warn that if the support at $73,745 is lost, it could retract all the way to the $55K–$57K range. For now, it can only be considered "barely stable," and caution is still advised.

BTC/USDTImage Credit: TradingView

Ethereum (ETH): Rebounding but Unstable

ETH also saw a rebound, rising 8% in the past 24 hours to $1,571, peaking at $1,608. Just recently, ETH hit a two-year low of $1,410, and the DeFi and NFT ecosystems were in a state of panic. Although there is a slight warming at this stage, macro pressures and whale sell-offs still overshadow the market.

ETH/USDTImage Credit: TradingView

Other Notable Cryptocurrencies

BNB rose nearly 5% to $557, with Binance Chain trading volume rebounding significantly;

XRP surged over 10% to $1.86, driven by optimistic expectations regarding the SEC case;

Cardano (ADA) increased by 11.7% to $0.58, supported by active staking;

Solana (SOL) rose 11% to $108, despite recent network issues, development enthusiasm remains high.

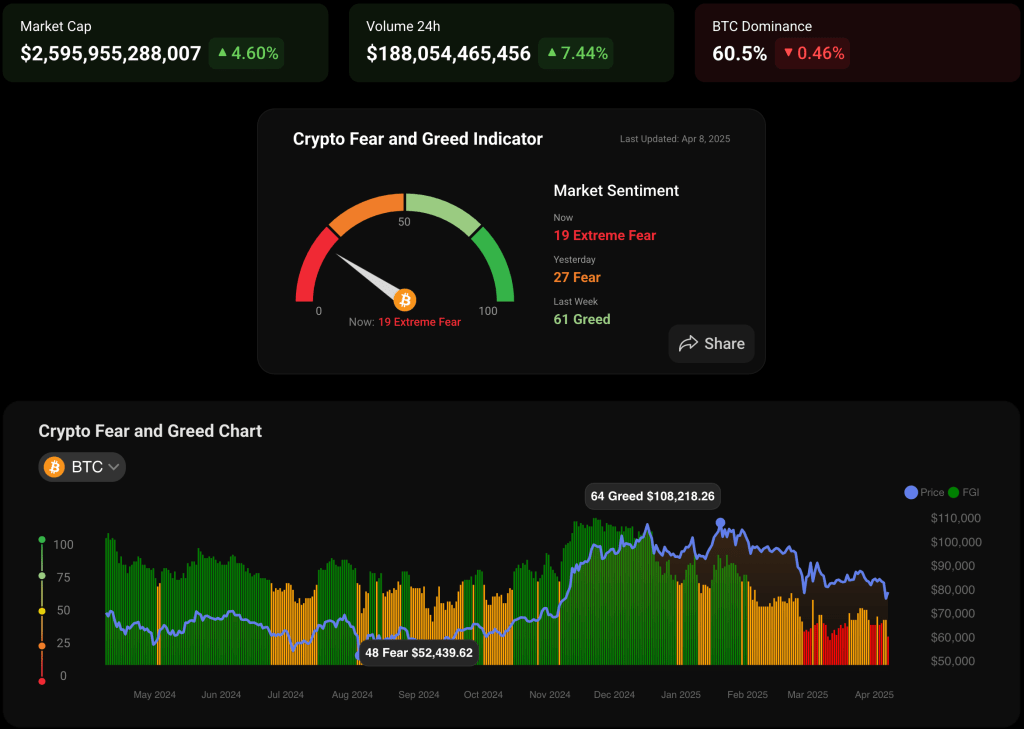

In terms of total market capitalization, the crypto market has risen to $2.54 trillion, with a daily increase of 4.3%. However, the "Fear and Greed Index" remains in the "Extreme Fear" zone—despite the rebound, market confidence is still fragile.

Image Credit: CoinStats

Macroeconomic News Highlights

U.S. Stocks Lose $5 Trillion in Two Days, Market in Panic

Wall Street has faced a storm of declines, losing over $5 trillion in market capitalization in just two days! The S&P 500 and Nasdaq 100 indices both fell sharply, with tech stocks plummeting into bear market territory. The trigger was the Trump administration's large-scale imposition of new tariffs on multiple countries, catching the market off guard. Despite the market's bloodbath, Trump remains defiant, stating this is a necessary cost for "restructuring global trade balance."

China Responds Strongly, Quickly Takes Action to Stabilize the Market

In response to U.S. provocations, Beijing swiftly launched market stabilization actions. State-owned funds entered the market to buy stocks, the central bank injected liquidity, and the yuan was allowed to depreciate past 7.20, hitting its lowest level since 2023. Several analysts predict that China may adopt a more flexible exchange rate mechanism to maintain export competitiveness.

Tesla Faces Double Blow: Trade War + Musk Controversy

Tesla's stock price plummeted 15% over two days, partly due to the impact of the U.S.-China trade conflict on sales in the Chinese market, and partly due to the backlash from Chinese consumers against Musk's frequent PR missteps. Wedbush significantly lowered its target price by 43%. Investor sentiment is highly tense.

In summary: The global market remains in a "nervous" mode.

Cryptocurrency Market Highlights

Teucrium Launches First Leveraged XRP ETF, Igniting Market Attention

Teucrium, the ETF issuer, has recently launched the world's first leveraged XRP exchange-traded fund— the "Teucrium 2x Long Daily XRP ETF," which is now listed on NYSE Arca. This product offers investors double the daily returns of XRP without the need to hold XRP directly. It is designed for short-term trading and high-yield seekers, naturally accompanied by higher risks. As XRP makes a comeback amid clearer regulations and the expansion of DeFi applications, this ETF arrives at a timely moment, attracting strong interest from institutional investors.

Galaxy Digital Poised for Nasdaq Listing

Crypto investment bank Galaxy Digital is preparing to list on Nasdaq (stock code: GLXY), with its restructuring plan approved by the SEC, and a shareholder vote is expected on May 9. If approved, the company will complete a dual listing, retaining its existing listing on the Toronto Stock Exchange, thereby enhancing liquidity and brand influence. This also marks a further deepening of its layout in the crypto asset management field.

Tether Plans to Launch New Stablecoin for the U.S. Market

According to sources, Tether is developing a new stablecoin specifically designed for the U.S. market. Tether CEO Paolo Ardoino stated that the project will align with current U.S. regulatory trends, reflecting the company's strategic thinking of "compliance first, global expansion." This move also demonstrates Tether's proactive attitude in responding to global policy changes.

Web3 Selected Reading

Larry Fink: Tokenization is the Future, Bitcoin May Challenge Dollar Dominance

Larry Fink, CEO of BlackRock, made a surprising statement in his annual letter to investors: if U.S. debt continues to deteriorate, Bitcoin could challenge the dollar's status as the global reserve currency. He praised DeFi for improving market efficiency and transparency, stating that "tokenization" is the true financial democratization—where everyone may own a part of an office building or private equity fund in the future. BlackRock is increasing its investments in infrastructure and private credit, aiming for the explosion of this new financial era.

👉 Original link: https://seekingalpha.com/article/4772236-larry-finks-2025-annual-chairmans-letter-to-investors

Circle Rushes for IPO, Valuation Drop Sparks Debate

Circle is preparing to restart its IPO plan, but market reactions are mixed. Its valuation has nearly halved, and its main revenue relies on U.S. Treasury investments—this model is under pressure amid potential interest rate cuts. Additionally, profit-sharing with Coinbase limits profitability, leading many investors to adopt a cautious stance. However, its global business expansion and the growth trend of stablecoins provide a glimmer of hope for the future.

👉 Original link: https://www.panewslab.com/zh/articledetails/w533b2xp.html

Don't Let Stablecoins Sit Idle, Try These Yield Strategies

Are you still letting USDT and USDC sit idle in your wallet? This guide will help you understand smart uses for stablecoins: from basic lending to advanced funding rate arbitrage, all covered. Emerging projects like Ethena, Ondo, and Pendle are redefining "low-risk, high-efficiency" DeFi yield strategies.

👉 Original link: https://mirror.xyz/zhaotaobo.eth/G_kbXo-qsNfYOcKiKscXc8f0XNP6Op2GDo7xJ1Cy-lg

Crypto Twitter Hot Topics

This week on Crypto Twitter, discussions have ignited on topics ranging from technical inspiration to foundational beliefs. Here are 5 hot posts that have sparked conversations:

🚀ETHGlobal Taipei Showcases Exciting Projects

ETHGlobal Taipei showcased 226 projects and selected the final top 8. Developers proposed many innovative ideas, from new DeFi tools to Layer 2 architectures, proving once again that Asia is a hotbed for Web3 innovation.

🔗 View the tweet: https://x.com/ETHGlobal/status/1908803397278654744

📉Bitcoin ≠ S&P 500

@tmel0211 reminds everyone: Bitcoin was not designed to follow traditional indices. It represents a completely different financial logic—decentralized, uncorrelated, and highly disruptive.

🔗 View the tweet: https://x.com/tmel0211/status/1908346012814762259

🛠️Weekend Inspiration Explosion, Go Build Something!

@dwr posted 50 mini app ideas, directly igniting developers' passion. His core point is: stop waiting for the best idea, just do it—execution > procrastination.

🔗 View the tweet: https://x.com/dwr/status/1908307344456581274

💧DeFi's Liquidity Dilemma

@paramonoww pointed out that the current TVL in DeFi is stagnant, and liquidity incentives are hard to sustain. He suggests that everyone start thinking about new sustainable solutions to attract real capital.

🔗 View the tweet: https://x.com/paramonoww/status/1907163920877678881

🧠Not Just Technology, But Trust Needs Scaling

@NTmoney shared insights on the "social scalability" of blockchain: the real power of blockchain lies not in TPS, but in amplifying trust mechanisms.

🔗 View the tweet: https://x.com/NTmoney/status/1907506604842561862

Conclusion and Outlook

Although the market has temporarily stopped its decline and rebounded, the overall macro landscape remains full of uncertainty. Geopolitical tensions, concerns about economic recession, and the actions of central banks continue to keep investors on edge. While the crypto market shows signs of price recovery, the "extreme fear" index indicates that sentiment remains bearish.

However, this is also a time for builders and long-term investors. From Galaxy Digital's push for a Nasdaq listing to Tether considering launching a U.S. version of a stablecoin, institutional actions are frequent. Larry Fink's vision of asset tokenization is no longer just a concept; it resembles a realistic path toward capital inclusivity.

In the coming days, it is advisable to pay attention to the results of U.S. Treasury auctions, the Federal Reserve's policy direction, and Bitcoin's movements around the $80,000 mark. Meanwhile, on-chain liquidity incentive mechanisms are brewing new changes, and the next phase of DeFi may be just around the corner.

In summary: the short term is volatile, but the long term relies on innovation. Stay flexible and keep learning.

Disclaimer: The content of this article represents the author's personal views and does not reflect the official position of XT.COM. The information in this article is for reference only and does not constitute any investment advice. Please make independent judgments and manage risks accordingly.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports spot trading, margin trading, futures trading, and a variety of other trading products. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。