Source: Cointelegraph Original: "{title}"

Cathie Wood's ARK Investment Company has shown a contradictory attitude towards the latest U.S. tariff policy: on one hand, it has reduced its holdings in its own spot Bitcoin ETF (ARKB), while on the other hand, it has increased its position in Coinbase stock.

According to trading data obtained by Cointelegraph, ARK has accumulated $26.6 million in Coinbase (COIN) stock since U.S. President Trump announced the new tariff policy on April 2.

This includes two large purchases of $13.2 million on Monday (April 7) and $13.3 million on April 4.

Despite taking a bullish stance on Coinbase, ARK simultaneously sold $12 million of the ARK 21Shares Bitcoin ETF (ARKB) on April 7. This ETF is one of the first spot Bitcoin ETFs approved in the U.S. in January 2024.

ARKW still provides $14.2 billion in indirect exposure to Bitcoin.

It is worth noting that this sale came from ARK's Next Generation Internet ETF (ARKW), setting a record for the largest single-day reduction of ARKB by the institution.

Previously, ARK had reduced its holdings by $8 million on March 3, $8.6 million in February, and two small reductions totaling $3.5 million in January.

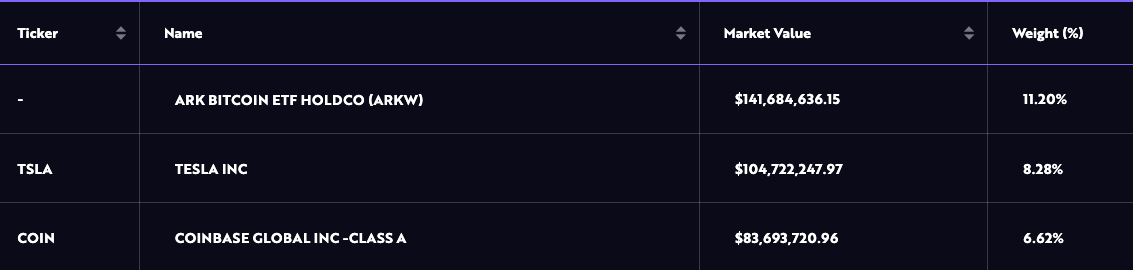

Top three holdings of ARK's Next Generation Internet ETF Source: ARK

After the reduction, ARKW still maintains indirect exposure to Bitcoin through its largest holding, ARK Bitcoin ETF Holdco. As of April 8, the fund held $142 million in ARKB shares, accounting for 11% of the fund's weight.

Bitcoin ETFs suffer losses due to expanded tariffs.

This adjustment comes during a period of significant market volatility. According to CoinGecko, Bitcoin briefly plummeted 11% to a low of $74,700 following the announcement of the tariff policy.

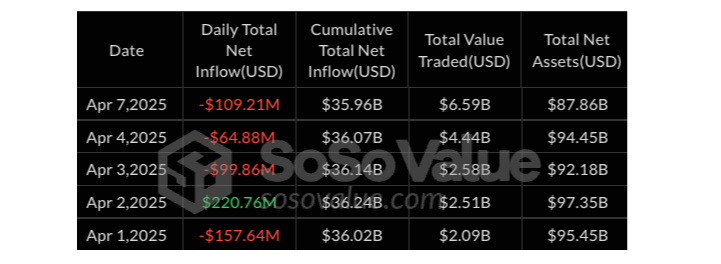

According to SoSoValue monitoring, after a net outflow of $207 million from global Bitcoin ETP products last week, there was a further net outflow of $109 million on the first day of the week of April 7.

Over the past three trading days, Bitcoin ETFs have lost a total of $273 million.

Bitcoin ETF fund flow chart Source: SoSoValue

Despite facing selling pressure, ARK remains one of the few spot Bitcoin ETF issuers with positive net inflows this year. CoinShares data shows that as of April 4, ARK recorded a net inflow of $146 million in 2025.

Other issuers with positive inflows include BlackRock iShares ($3.2 billion) and ProShares ($398 million).

Related articles: First Trust launches Bitcoin strategy ETF

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。