The impact of reciprocal tariffs is more severe than expected.

On Monday, the global financial market faced a massive shock. The three major U.S. stock indices continued their downward trend, and stock markets in Europe and Asia plummeted as well. The commodity market was not spared, with crude oil and gold prices falling simultaneously, and cryptocurrencies also struggled to show resilience. Bitcoin's decline exceeded 10% over two days, while Ethereum dropped a staggering 20%, resulting in a sea of red across the global financial markets.

In response, the main culprit, Trump, remained calm, likening the current market reaction to "taking medicine for an illness." But is this remedy effective, or is it merely a poison? When will the market's impact be repaired? A looming storm hangs over the global market.

On April 2, U.S. President Trump signed two executive orders regarding the so-called "reciprocal tariffs" at the White House, announcing a 10% "minimum benchmark tariff" on trade partners and imposing higher tariffs on certain partners, officially kicking off the era of reciprocal tariffs.

If at that time the global community viewed reciprocal tariffs merely as a negotiation tactic by Trump, it has now become apparent that there is a glimpse of the iceberg of greed and ambition behind him, as the cost of this move is indeed significant.

Following the reciprocal tariffs, our country took the lead in retaliatory measures. The State Council Tariff Commission, the Ministry of Commerce, and the General Administration of Customs successively announced several countermeasures against the U.S., declaring that starting from April 10 at 12:01 PM, the State Council Tariff Commission would impose an additional 34% tariff on imported goods originating from the U.S., marking the initial signs of a global trade war.

On April 7, the storm surrounding reciprocal tariffs intensified, leading to an epic drop in the global financial market. U.S. stock futures continued the previous week's plunge, with Nasdaq futures down over 5% and S&P 500 futures down over 4%. The market capitalization lost by U.S. stocks over two trading days was roughly equivalent to the combined GDP of Germany and South Korea for 2024. European stock index futures also saw significant declines, with the European STOXX 50 index futures down over 4% and DAX index futures down nearly 5%. The Asian markets were not spared either, with the Japanese and South Korean stock markets crashing again; the Korean Composite Index opened down over 4%, and the Nikkei 225 index fell nearly 2%. The Hang Seng Index closed at 19,828 points, down 3,021 points for a drop of 13.2%, marking the largest single-day drop since October 28, 1997.

The crypto market also faced turmoil, with Bitcoin's decline exceeding 10% over two days, briefly falling below $75,000. Altcoins collapsed across the board, with Ethereum dropping below $1,500 and SOL hitting a low of $100. According to Coinglass data, there were 487,700 liquidations globally yesterday, with a liquidation amount exceeding $1.632 billion, including $1.25 billion in long positions and $380 million in short positions.

It is evident that global confidence has plummeted, and panic has surged, with U.S. recession fears once again becoming the center of public discourse. Canadian Prime Minister Carney stated that the U.S. is falling into recession due to President Trump's aggressive tariff actions. Larry Fink, CEO of asset management giant BlackRock, also agreed, emphasizing that many business leaders believe the U.S. economy may already be in serious recession. The consensus among businesses is surprisingly uniform; according to a survey by U.S. media, 69% of business leaders expect a recession in the U.S., with more than half indicating that it will occur this year.

In reality, global discontent is widespread, with some jokingly suggesting that Trump is shorting America. If this were merely a negotiation tactic, it has already had excessive effects. U.S. government officials revealed that over 50 economies are currently in contact with the U.S. regarding tariff policies, with Vietnam even proposing a zero-tariff strategy to show weakness, and the EU has also softened its hardline stance by proposing mutual tariff exemptions. However, Trump is not satisfied with this and has reiterated that he "will not pause tariffs."

The reciprocal tariffs undoubtedly have three main objectives: first, to reverse the trade imbalance and trade deficit that the U.S. emphasizes; second, to increase U.S. fiscal revenue, as personal income tax and corporate income tax are core components of the current federal tax revenue structure, with tariffs accounting for a very low proportion. Trump aims to raise the tariff proportion to around 5%, expecting to add approximately $700 billion to U.S. fiscal revenue; third, to serve as a diplomatic and negotiation tool.

However, it seems that a devastating blow has already been dealt. Under the guise of fairness in the U.S., global trade wars are intensifying, and how this will evolve remains a topic of global concern. Negotiations are expected to continue; in addition to our country's strong countermeasures, differing voices have emerged within the EU, and other Asian countries generally do not adopt a hardline stance. Overall, tariff rates are unlikely to increase further and may decrease when negotiations reach a consensus, achieving a balanced state.

On the other hand, the issue of reciprocal tariffs is not just about the tariffs themselves; the market is more concerned about the impact on the U.S. recession. First is inflation; according to research from the New York Fed, imported goods account for 28% of U.S. consumption, and every 10% increase in import tariff rates raises short-term inflation by 0.4 percentage points. Based on this theory, in the short term, due to the significant increase in import tariffs, a rise in short-term inflation is inevitable. Research institutions generally estimate that the new tariff policy will raise U.S. price levels by between 1% and 2.5%. However, since tariffs exhibit the characteristic of "the weaker party bears the cost," consumer demand is also on a downward trend, especially for non-essential consumer goods. From this perspective, inflation is expected to rise initially and then fall.

Beyond inflation, there is the economic impact. The Budget Lab estimates that the new tariff policy will drag down U.S. real GDP by -0.7% by 2025, while the Tax Foundation estimates that Trump's tariff policy will reduce U.S. GDP growth by about -0.87% by 2025. JPMorgan has raised its expectation of a U.S. recession from 40% to 60%.

Unlike the initial proposal of reciprocal tariffs last week, recession expectations are becoming a global consensus. Recession + inflation puts immense pressure on the Federal Reserve. Overnight interest rate swaps indicate that the market currently expects a 125 basis point rate cut by the end of the year, equivalent to five cuts of 25 basis points. Last week, traders generally expected only three cuts. According to CME FedWatch, the probability of a rate cut in May has risen to 57%. Trump has also added fuel to the fire for the Federal Reserve, stating on the social platform Truth Social yesterday, "Oil prices are falling, interest rates are falling, food prices are falling, there is no inflation," and reiterated that the "slow-moving" Federal Reserve should cut rates.

If this trajectory continues, it is highly likely that the Federal Reserve will restart rate cuts in May to alleviate market panic, further becoming the last safety net for the market. Overall analysis suggests that despite the suspicion of inflicting self-harm while harming the enemy, with the support of a healthy and strong private sector balance sheet, reciprocal tariffs may cause short-term volatility, but as negotiations progress and the rate-cutting cycle opens, the long-term probability of triggering a U.S. recession is not as high as imagined.

Looking at the global stock markets, many countries have already begun taking action to stabilize the market. Our national team, Central Huijin, entered the market, increasing its holdings in ETFs by 50.5 billion yuan in a single day, providing comprehensive support from individual stocks to indices. Japan and South Korea have also been active, with both markets opening higher today. This indicates that yesterday's epic drop was more driven by emotional panic rather than a genuine recession.

A false report also supports this conclusion. Last night, CNBC reported that Trump was considering pausing tariffs for 90 days. Following this news, all stock indices quickly rebounded within seven minutes, and Bitcoin rose back to $80,000. However, even after White House Press Secretary Caroline Levitt called it "fake news," the upward trend receded, but the market did not experience further significant declines, initially showing some bottoming characteristics. Therefore, the global financial market may see a rebound today.

The crypto market has shown a similar trend; although it has fully rebounded, with Bitcoin returning to $80,000, the altcoin market remains grim, but Ethereum has risen above $1,500 again, and SOL has rebounded to $110. From yesterday's trading data, most holders maintained a wait-and-see attitude, and trading volume was not high, suggesting that risk aversion seems to outweigh selling pressure. In this context, if tariffs can be mediated, a rise in asset prices is likely, as evidenced by the seven-minute rebound indicating interest in the "golden pit" targets. However, whether a true reversal can be achieved still hinges on the focus on recession and rate cuts, with the Federal Reserve's market support being central.

However, opinions among traders on how the market will move forward vary widely. @AnnaEconomist believes that this round of selling still has downward space, citing a lack of potential for "Federal Reserve support" or "Trump support." She argues that the Federal Reserve is more focused on hard data, and Powell is concerned about his historical positioning, so the Federal Reserve will not easily intervene and must wait for clearer inflation signals. @Cato_CryptoM believes that the final version of Trump's reciprocal tariffs will be on the 9th, so before that date, it is more of a negotiation period, and it is too early to define the overall magnitude of these tariffs and their impact on the economy, and it is premature to hastily define whether Trump will be impeached. The Kobeissi Letter analyzes that if April 9 approaches without a trade agreement between China and the U.S., market sentiment may collapse again. Market sentiment is polarized, with panic levels reaching those of March 2020, indicating that more volatility is likely in the future.

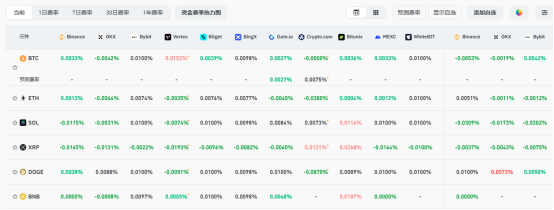

Technical traders seem more pessimistic; @marketbeggar states that the larger trend is downward, and @YSIcrypto agrees that a slow rebound in a downtrend will only lead to more severe declines, suggesting that Bitcoin prices may reach $66,000 to $72,000. Currently, according to Coinglass data, funding rates on mainstream CEX and DEX show that the market is fully bearish.

As for the current situation, April 9 is just around the corner, and reaching a complex agreement in a short time is clearly unlikely. U.S. Treasury Secretary Scott Bessent also stated that a trade agreement is unlikely to be reached before April 9. However, the U.S. is not entirely united. In addition to Elon Musk, a close ally of Trump, advising against reciprocal tariffs, Republican members are also being urged by donors to advise the president. Of course, Trump still shows a very resolute attitude.

In this context, the Federal Reserve is facing significant internal and external pressures. Fed Governor Goolsbee remains calm, while Fed policymakers are feeling anxious. This Thursday, the Federal Reserve will release the minutes from the March monetary policy meeting, which may provide more clues. Whether the market will face another rollercoaster ride remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。