Recently, influenced by U.S. policies, the total market capitalization of cryptocurrencies has fallen below $2.7 trillion, with a single-day drop of up to 7% on April 7. Gold, recognized globally as a safe-haven asset, has historically played an important role during times of increased market uncertainty. The closing price of gold was $3,037 per ounce, and crypto assets backed by gold have also shown resilience. Crypto gold assets like XAUT (Tether Gold) and PAXG (Paxos Gold) are becoming new choices for investors seeking safety and asset allocation due to their "digital gold" properties.

The Logic of Gold in a Changing Macro Environment: The Federal Reserve's Policy and Gold's "Counter-Cyclical" Nature

Recently, U.S. President Trump announced a 10% "minimum baseline tariff" on the vast majority of imported goods and implemented higher retaliatory tariffs on dozens of countries and regions. The Nasdaq index in the U.S. stock market evaporated 12% of its market value in two days, and the global market is experiencing the most severe crash since March 2020. Cryptocurrencies are also undergoing a massive plunge, with Bitcoin and Ethereum leading the way down.

In this context, the price of gold has shown strong resilience against such macroeconomic backdrops, while crypto gold assets like XAUT have limited declines, demonstrating their value as "ultimate safe-haven tools." Compared to the futures market, XAUT achieves instant delivery and global circulation of gold through blockchain technology, eliminating the need for complex derivative contracts and lowering the participation threshold for ordinary investors.

Due to a surge in strategic reserve demand, the safe-haven sentiment for gold has intensified, with global central bank gold reserves increasing by over a thousand tons for three consecutive years. Meanwhile, the trend of institutional investors using tokenized gold to hedge against dollar credit risk is accelerating. With its 1:1 backing of physical gold and on-chain transparency and traceability, XAUT has become a tool for sovereign funds and multinational corporations to optimize their reserve structures.

XAUT's Resilience: Highlighting the Safe-Haven Value of Digital Gold

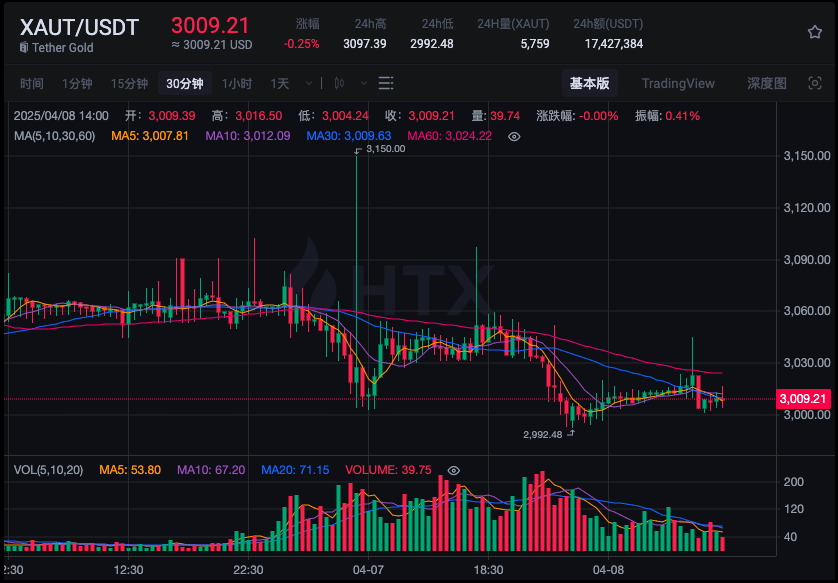

As a gold-backed token issued by Tether, each XAUT token corresponds to 1 ounce of physical gold certified by the London Bullion Market Association (LBMA) and is guaranteed by Tether's gold reserves. While the traditional gold market is rising, crypto gold assets like XAUT and PAXG are also strengthening. According to data from the Huobi HTX platform, when the crypto market as a whole plunged on April 7, XAUT's decline was only 0.08%.

Image source: Huobi HTX data from April 8

Compared to traditional gold investments, crypto gold assets offer greater liquidity and convenience, allowing investors to trade 24/7 without being restricted by traditional market hours. Additionally, crypto gold can be used for lending, collateral, and other operations within the DeFi ecosystem, expanding the financialization scenarios for gold assets. Crypto gold assets like XAUT have achieved the fragmentation of gold ownership, instant trading, and frictionless cross-border transfers, addressing the pain points of high storage costs and poor liquidity in traditional gold.

As a leading global digital asset trading platform, Huobi HTX has launched the XAUT/USDT trading pair and is the primary exchange for trading XAUT, providing investors with an efficient and secure trading environment. Users can freely buy and sell XAUT on the Huobi HTX platform, enabling flexible allocation of gold assets. Furthermore, Huobi HTX is actively promoting the development of the Real-World Assets (RWA) sector by offering various financial tools to allow more investors to participate in crypto gold investments.

The RWA Era: The Trend of Tokenization of Real-World Assets

The resilience of XAUT not only reflects the safe-haven value of gold but also mirrors the trend of real-world assets (RWA) moving towards tokenization. The RWA sector has rapidly developed in recent years, from stablecoins and government bond tokenization to the on-chain representation of traditional assets like gold and real estate. More and more institutions and investors are exploring how to enhance the liquidity and accessibility of assets through blockchain technology.

In the future, as global economic uncertainty continues, the development of the RWA sector may accelerate, and the tokenization of traditional financial assets such as gold, real estate, and bonds will encounter more opportunities. For investors, crypto gold assets like XAUT may become an important choice for asset allocation, providing more robust value support amid market fluctuations. Huobi HTX, with its secure, liquid, and innovative ecosystem, is becoming a core driver of this transformation. Whether individual investors seeking value preservation or institutions planning for the future, they can trade gold options on Huobi HTX to smoothly embark on a new chapter in their gold asset allocation!

(Note: The data in this article is as of April 8, 2025. The market carries risks; investment should be approached with caution.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。