Author: Nancy, PANews

Currently, an increasing number of publicly listed companies are actively implementing cryptocurrency asset reserve plans, especially after Trump won the U.S. election and took office in the White House. This strategy has rapidly gained traction globally, becoming a new trend in corporate asset allocation. However, with the fluctuations in the global economic environment, panic caused by policy uncertainties, and the concentration of profit-taking, the cryptocurrency market has experienced severe volatility, leading many listed companies to face significant unrealized losses.

This article by PANews reviews five publicly listed companies that have launched cryptocurrency reserve plans. These companies generally increased their investment efforts after Trump won the election. However, with the noticeable pullback in the cryptocurrency market, the losses from high-level purchases have generally intensified. Among them, Strategy's unrealized losses on Bitcoin holdings have exceeded $4 billion, while companies like Metaplanet, Semler Scientific, and SOL Strategies have also reported losses exceeding tens of millions of dollars, with their stock prices experiencing rollercoaster-like fluctuations.

Strategy: Bitcoin unrealized losses exceed $4 billion, stock price down over 40% from highs

Since Trump won the U.S. election on November 6, 2024, Strategy has purchased nearly 276,000 BTC at an average price of $94,506 each, with a total investment cost of $25.679 billion. Based on the current Bitcoin price of $79,581 (as of April 8), this portion of Strategy's Bitcoin holdings currently has unrealized losses of approximately $4.12 billion.

From Strategy's purchasing strategy during this period, a clear shift from aggressive expansion to cautious observation can be observed. Specifically, in November 2024, when Bitcoin prices were at a high, Strategy significantly increased its holdings by over 134,000 BTC, accounting for about 48.7% of the total increase during that period, demonstrating its aggressive market expansion attitude and strong confidence in the long-term bullish outlook. Entering 2025, as Bitcoin prices pulled back, Strategy adopted a more cautious strategy, significantly reducing its purchase volume and entering a wait-and-see period. However, recently, Strategy has shown signs of re-entering the market, investing nearly $1.92 billion in the latest investment on March 31. It is worth noting that Strategy did not further increase its Bitcoin holdings last week, maintaining a certain wait-and-see attitude amid unclear market conditions.

Additionally, since November 6, Strategy's stock price briefly soared to $473.8, an increase of 83.77%, but then continued to decline. As of April 8, its stock price has dropped about 43.4% from this peak.

Metaplanet: Accelerating Bitcoin reserves still facing unrealized losses, stock price once hit multi-year high

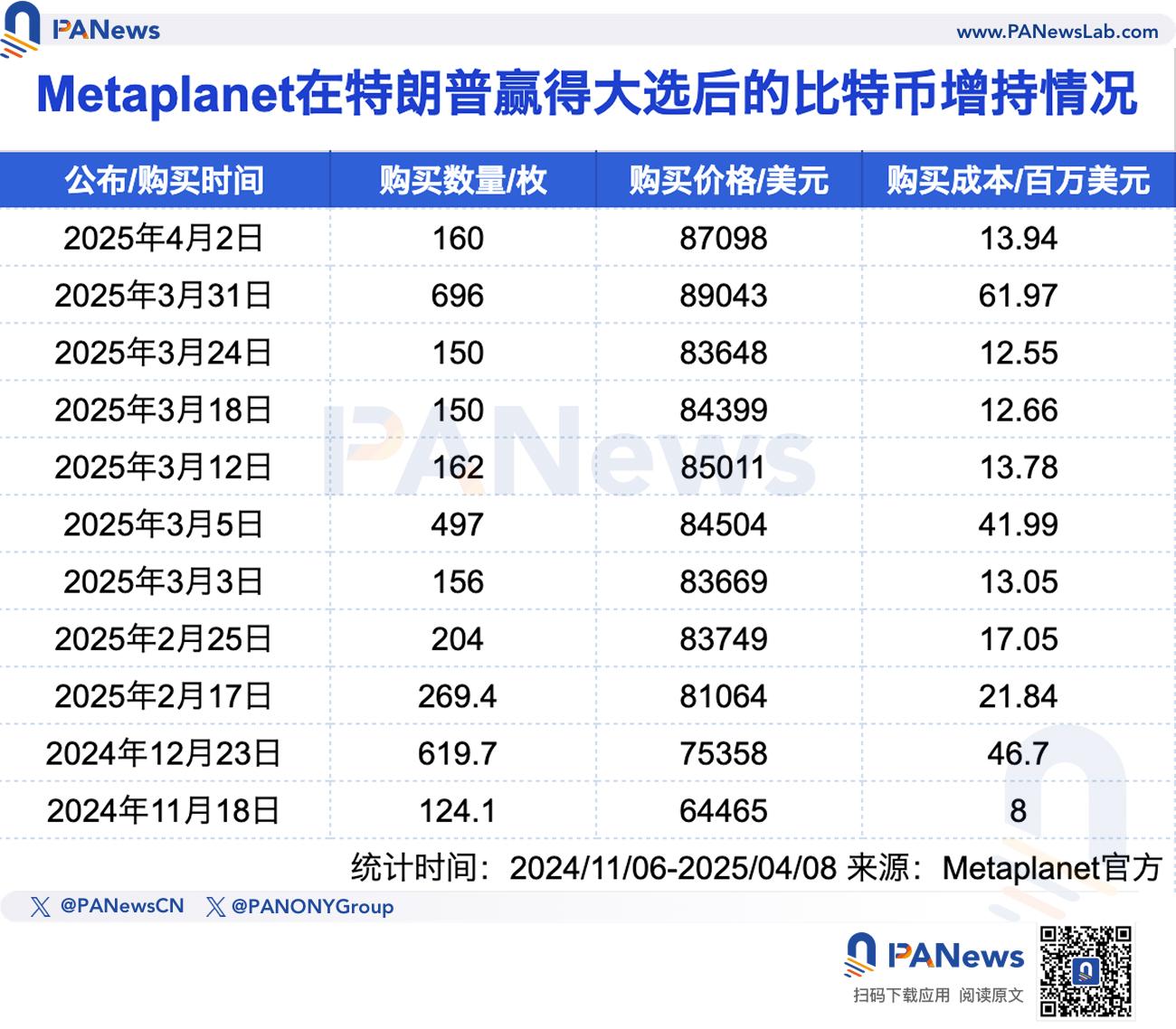

Since November 6, 2024, Metaplanet has purchased 3,188 BTC through 11 increases, with an average purchase price of $82,001, totaling over $260 million in expenditure. Based on the current Bitcoin price of $79,581 (as of April 8), this means Metaplanet currently has unrealized losses of approximately $23.63 million on its Bitcoin holdings during this period. Since starting to reserve Bitcoin in April 2024, Metaplanet has spent over $360 million to purchase 4,206 BTC, indicating a significant increase in Bitcoin reserves after Trump's election. However, based on the overall average purchase price of $86,500 for Bitcoin, Metaplanet currently still has unrealized losses of about $29.09 million.

From a timeline perspective, after Bitcoin began to decline from its historical high in January, Metaplanet noticeably accelerated its purchasing pace, conducting nine increases in less than two months, buying approximately 2,444 BTC, which accounted for 58.1% of its total holdings, reflecting its strategy of buying on dips.

It is worth mentioning that this Japanese hotel development and operation company plans to increase its Bitcoin holdings to over 10,000 BTC by 2025, aiming to rank among the top ten Bitcoin-holding companies globally. Meanwhile, during the fluctuations in Bitcoin prices, to strengthen its financial position, Metaplanet has recently fully repaid bonds worth 2 billion yen ($13.5 million) ahead of schedule.

In terms of stock performance, Metaplanet's stock price once surged to 665 yen after Trump's election, an increase of 216.7%, reaching a new high since October 2013. However, as Bitcoin prices fell, its stock price also dropped nearly 49.2% from the peak.

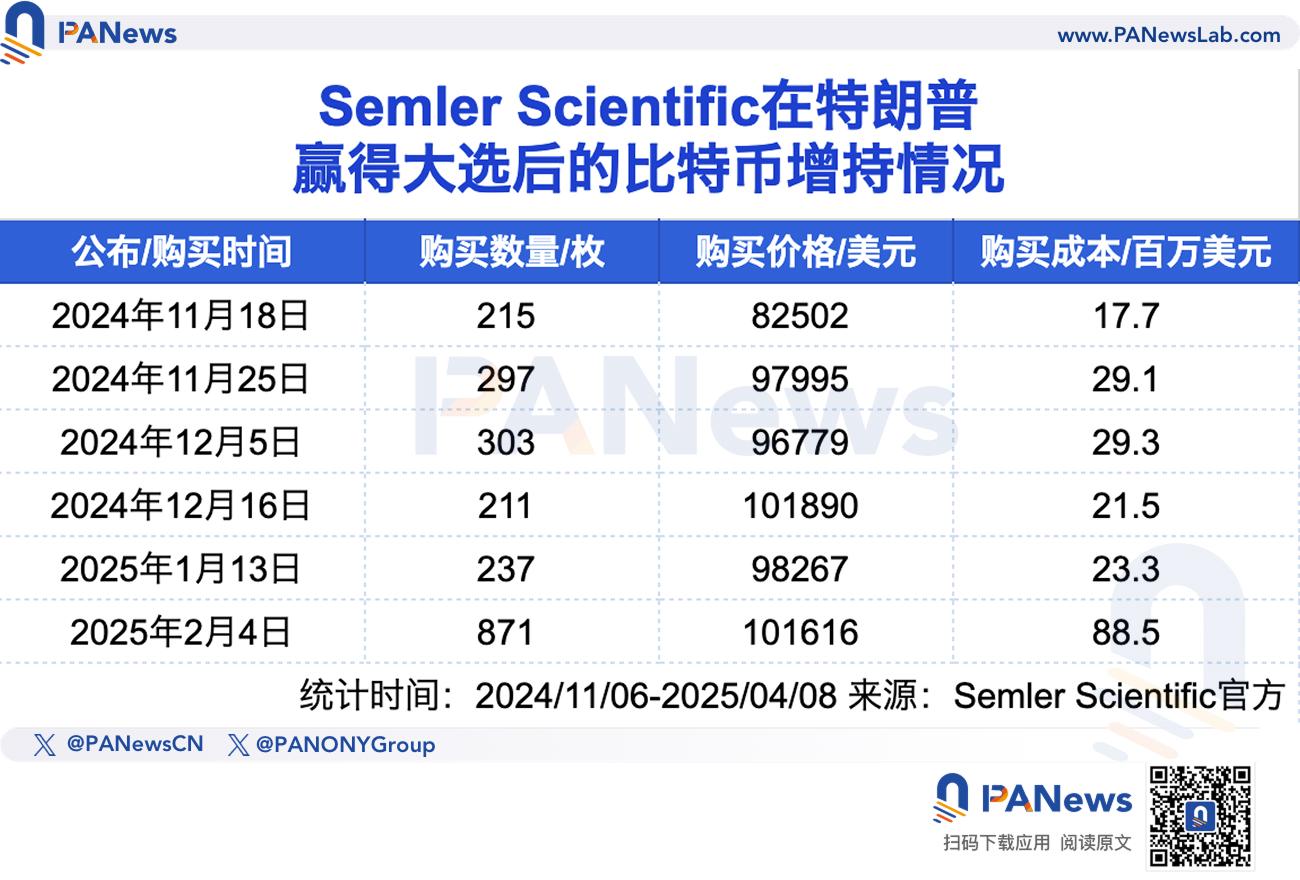

Semler Scientific: Aggressively increasing Bitcoin holdings at high levels, stock price gains retraced

Since Trump's election, Semler Scientific has significantly increased its Bitcoin holdings, accumulating 2,134 BTC, which accounts for 66.8% of its current publicly disclosed holdings (3,192 BTC), with a total investment cost approaching $210 million. However, its Bitcoin purchasing strategy shows a clear "high-level buy" characteristic: compared to the previous average price of $69,682, the average purchase price during this period reached $96,508. Based on the current Bitcoin price of $79,581, the company's unrealized losses have exceeded $36.12 million.

In terms of stock performance, Semler Scientific's stock price experienced a brief surge during this period, peaking at $74.7, with an increase of up to 86.3%. However, the stock price subsequently fell back, erasing all gains and failing to maintain its previous strong performance.

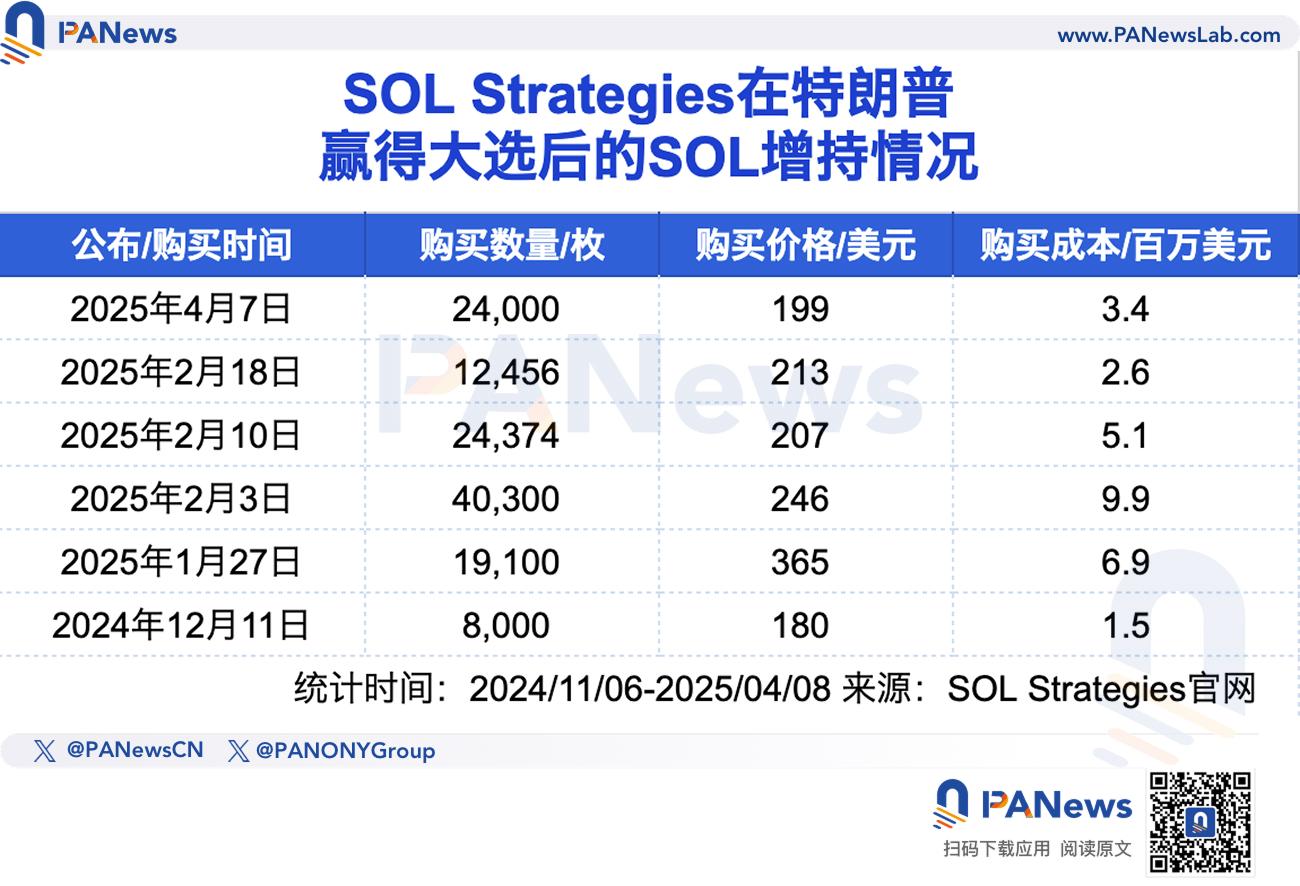

SOL Strategies: High-level heavy positions with unrealized losses in the millions, stock price dropped over 60% after hitting new highs

SOL Strategies has invested a total of $29.4 million since Trump's election, purchasing over 128,000 SOL, which accounts for 47.9% of its total holdings (267,000 SOL). However, its purchase timing was mostly concentrated at high prices. For example, on February 3, 2025, SOL Strategies announced the purchase of 40,300 BTC at a cost of $246; while on January 27, 2025, it purchased 19,100 BTC at a cost of $365. This high-level buying strategy has led to an average purchase price of approximately $235. Based on the current market price of $108, its unrealized losses have exceeded $16.28 million. Nevertheless, SOL Strategies has used its holdings of over 265,000 SOL for staking, effectively alleviating some losses through staking rewards.

Meanwhile, SOL Strategies' stock price exhibited significant volatility during this period, soaring by 258.8% to $6.1, reaching a historical high. However, the stock price subsequently fell sharply, down 65.74% from the peak.

Remixpoint: High-frequency small purchases of Bitcoin, average price as high as $96,000

The Japanese listed company Remixpoint has included cryptocurrency assets in its strategic reserves since 2024, covering BTC, ETH, SOL, and XRP, with BTC being its main purchase asset. Since November 6 of last year, Remixpoint has significantly accelerated its BTC accumulation pace, investing over $46 million to purchase 483 BTC, which accounts for 78.4% of its total holdings (616 BTC). In terms of investment strategy, Remixpoint adopts a high-frequency, small-amount purchasing method, controlling the number of BTC purchased each time to dozens, with a maximum of no more than 56.3 BTC per transaction.

However, Remixpoint's average purchase price for BTC is relatively high, reaching $96,807. Based on the current Bitcoin price of $79,581, its 483 BTC purchases have unrealized losses exceeding $832,000. If estimated based on the overall holding average price of about $86,000, Remixpoint's unrealized losses would narrow to about $395,000.

Despite this, Remixpoint's stock price performance during this period has been quite impressive, soaring approximately 444% to $806, reaching a new high since October 2018. However, as of April 8, 2025, the stock price has retraced about 55.5% from its peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。