In 2025, the crypto market resembles a quiet morning after a grand feast, with altcoins—those tokens that once ignited the wealth dreams of countless investors—quietly losing their former luster. The ICO boom of 2017, the DeFi and NFT frenzy of 2021, altcoins once wrote the legendary tale of the "altcoin season" with their hundredfold increases. However, the current market has changed beyond recognition, with exhausted narratives, collapsed values, and liquidity crises completely ending the altcoin bull market. Will the altcoin season return? The answer may be no. So how can one operate in the next cycle to capture potential local trends?

The Dream of Altcoin Season Shattered: From Frenzy to Cold Reality

Altcoins were once the brightest stars in the crypto market. In 2017, the ICO boom swept the globe, with countless projects raising funds through token issuance, and investors flocked like gold miners, eager to catch the "next Bitcoin." Tokens like Ethereum and EOS skyrocketed overnight, with market values multiplying by dozens. By 2021, DeFi and NFTs became the new hot spots, with DeFi tokens like Uniswap and Aave seeing astonishing increases, and the NFT project Axie Infinity's token AXS soaring from $1 to $160, with the total market cap of altcoins once exceeding $1 trillion. It was a frenzied era, with retail investors intoxicated by the dream of "hundredfold coins," and the altcoin season seemed endless.

However, the altcoin market in 2025 is a desolate landscape. The Altcoin Season Index has fallen to a new low of 16, indicating that the overall performance of altcoins has hit rock bottom. Market analysts point out that according to the logic of terminal acceleration, the next quarter may be a critical period for altcoins to find a bottom. The once fervent enthusiasm has turned to vapor, and investor confidence in altcoins has nearly collapsed, with even leading altcoins like Ethereum not spared. The dream of the altcoin season is shattering in the cold reality.

Why is the altcoin season difficult to sustain? The answer lies in the inherent dilemma of altcoins. Many tokens lack real value, contributing little to society compared to Web2 companies of similar market capitalization. For example, some meme coins have market values in the billions, but their technical value is almost zero; meanwhile, SaaS companies of equivalent market cap often have stable revenues and user bases, creating real value for society. More than a decade after the birth of blockchain technology, there are few practical applications for altcoins. Metaverse projects like Decentraland were once highly anticipated, but their virtual worlds have few users and struggle to convert into sustainable value. The collapse of value in altcoins has made them the first victims in a bear market, with investors gradually turning to Bitcoin and a few leading projects, leaving altcoins with increasingly narrow survival space.

Exhausted Narratives and Shrinking Increment: From Nationwide Frenzy to Cold Stock

The fuel for the altcoin season relies on new narratives and the influx of new funds. In 2017, the narrative of the "blockchain revolution" led to the global ICO boom; in 2021, the buzzwords of DeFi and NFTs ignited market enthusiasm, with retail investors rushing in, and funds flooding in to push token prices higher. However, the altcoin market in 2025 has lost the magic of narrative, and the flow of funds has dried up.

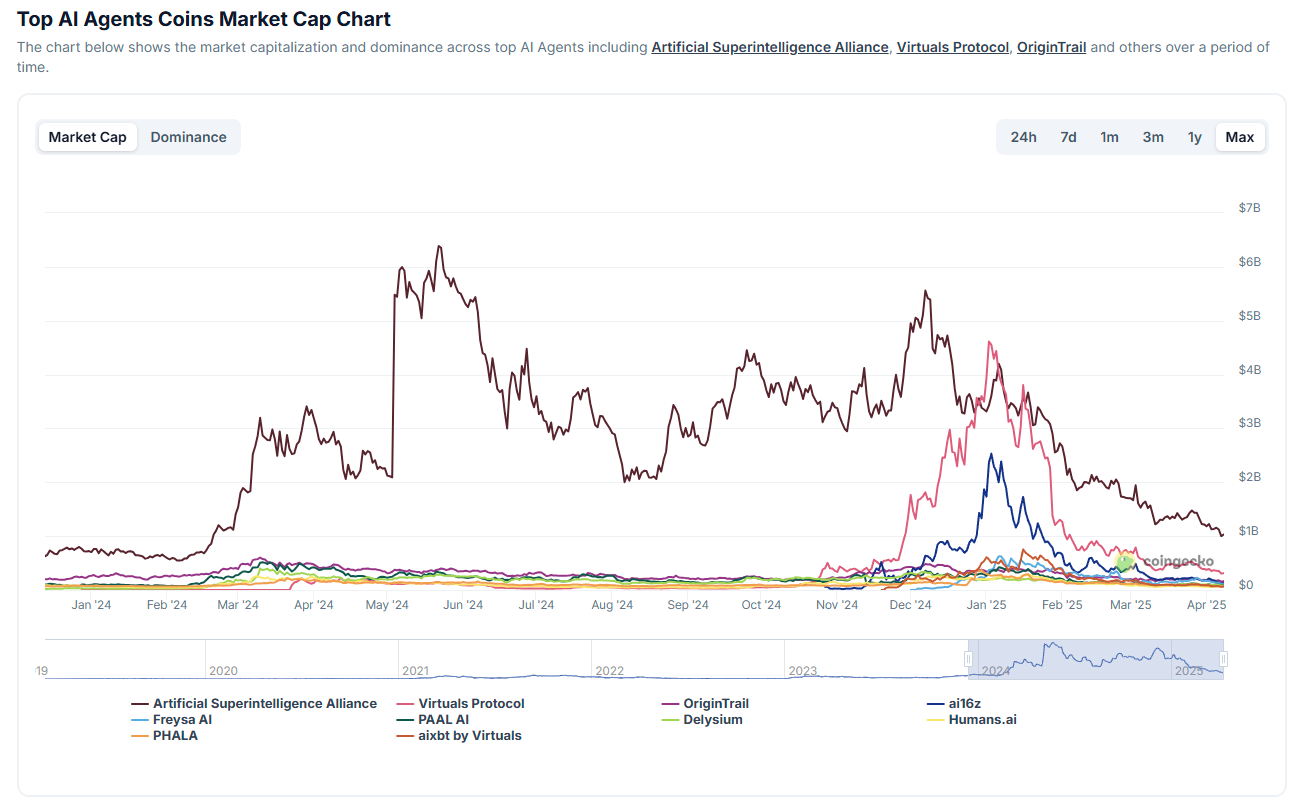

First, the exhaustion of narratives has rendered altcoins unattractive. The DeFi craze has long cooled, with many projects losing trust due to unsustainable high yields and frequent hacking incidents (such as cross-chain bridge vulnerabilities). The NFT market has also cooled, with trading volumes plummeting from tens of billions in 2021 to rock bottom, and once-glorious NFT tokens like AXS have now dropped below $5. New narratives like the metaverse and AI tokens have been attempted, but they struggle to form market consensus, far from igniting a comprehensive bull market. More critically, blockchain technology has yet to produce a killer application; without the halo of "disrupting tradition," altcoins find it increasingly difficult to attract new players.

Secondly, the market has shifted from "increment" to "stock." The early crypto market was like an uncultivated wasteland, with few projects and concentrated funds, making it easy for retail investors to push market caps higher. Now, the number of crypto projects has surged to tens of thousands, but the total market cap and retail investor attention have been severely diluted. The deteriorating global economic environment has further exacerbated the situation: high interest rate policies compress risk asset valuations, geopolitical risks have intensified, and investors are more inclined to hold cash or gold, leading to a significant shrinkage in speculative demand for altcoins. Without the influx of new funds, the engine of the altcoin season has stalled.

Departure from the Decentralized Original Intention: Bitcoin Dominates

The original intention of blockchain is decentralization, but many altcoin projects have strayed from this path. Some public chains sacrifice decentralization for performance, while centralized exchange tokens rely more on platform policies than community consensus. This deviation has made the consensus around altcoins fleeting, and investor confidence difficult to sustain. For example, the 2022 LUNA/UST collapse saw a centrally designed algorithmic stablecoin drop to zero overnight, resulting in hundreds of billions in losses for investors; similar incidents are common among small altcoins, severely damaging market trust.

In contrast, Bitcoin, as the origin of blockchain, has a high degree of decentralization (with no single control point and miners distributed globally), making it irreplaceable. By 2025, Bitcoin's market share is nearing 60% (based on historical trends). BitMEX founder Arthur Hayes candidly stated on social media: "Shitcoins are getting in our strike zone, but I think #bitcoin dominance keeps zooming towards 70%." Institutional investors also favor Bitcoin, viewing it as "digital gold" and the preferred safe-haven asset. If Bitcoin's market share surges to 70%, the survival space for altcoins will be further compressed, making the possibility of a return of the altcoin season extremely slim.

Liquidity Crisis and Decline of Public Chains: Survival Dilemmas in the Shadow of Ghost Towns

Another fatal flaw for altcoins is the fragmentation of liquidity. In 2025, crypto market liquidity is concentrated in a few public chains, such as Ethereum, Solana, and BNB Chain, while trading volumes and developer activity for small public chains have significantly declined. For instance, EOS had a TVL of several billion dollars in 2018, but now it is less than $100 million, nearly becoming a "ghost chain." The decline of public chains is due to a lack of ecological attractiveness, making it difficult to attract DApp developers; slow integration of cross-chain technologies; and Layer 2 draining transaction volumes from the main chain. In the future, over 90% of public chains may become "ghost towns," making the survival environment for altcoins increasingly harsh.

More dangerously, altcoins that have lost liquidity are not suitable for bottom fishing. A saying in the market goes: "A 90% drop can drop another 90%." Take LUNA as an example; it fell from a peak of $120 in 2022 to $0.0001, a drop of over 99.9%. Similar fates are common among small altcoins, and if investors blindly try to bottom fish, they may end up losing everything. The liquidity crisis acts like an invisible shackle, trapping altcoins firmly in the abyss.

A Glimmer of Hope in the Darkness

The comprehensive return of the altcoin season may have become history, but in the next cycle, altcoins are not without opportunities. Even in a generally sluggish market, certain sectors and projects may still stand out due to unique narratives, practical applications, or strong community support, becoming highlights of local breakthroughs. Here are three types of altcoins that may maintain high market values in the next cycle, worthy of investor attention.

1. Strong Narrative New Projects: The Explosive Points to Ignite Market Enthusiasm

The explosion of altcoins often hinges on a narrative that can "break out," one that can quickly attract new funds and users, igniting market enthusiasm. The NFT boom of 2021 and the concept of the metaverse are typical examples: the NFT project Axie Infinity attracted millions of players through its "play-to-earn" model, with its token AXS soaring from $1 to $160; the metaverse project Decentraland became a focal point due to the concept of "virtual real estate."

In this cycle, AI Agent tokens and meme coins have shown similar potential. AI Agent tokens (like AI16Z, Fetch.AI) benefit from the AI boom, attracting significant attention; meme coins spread through social media, aligning with the logic of "attention economy." However, they are also unlikely to escape the fate of most tokens going to zero. What we can learn is that if a similar strong narrative sector emerges, it could still become the explosive point of the next cycle, driving funds in, but remember to take profits at the top.

2. Projects with Practical Applications: The Solid Foundation of DeFi, RWA, and Stablecoins

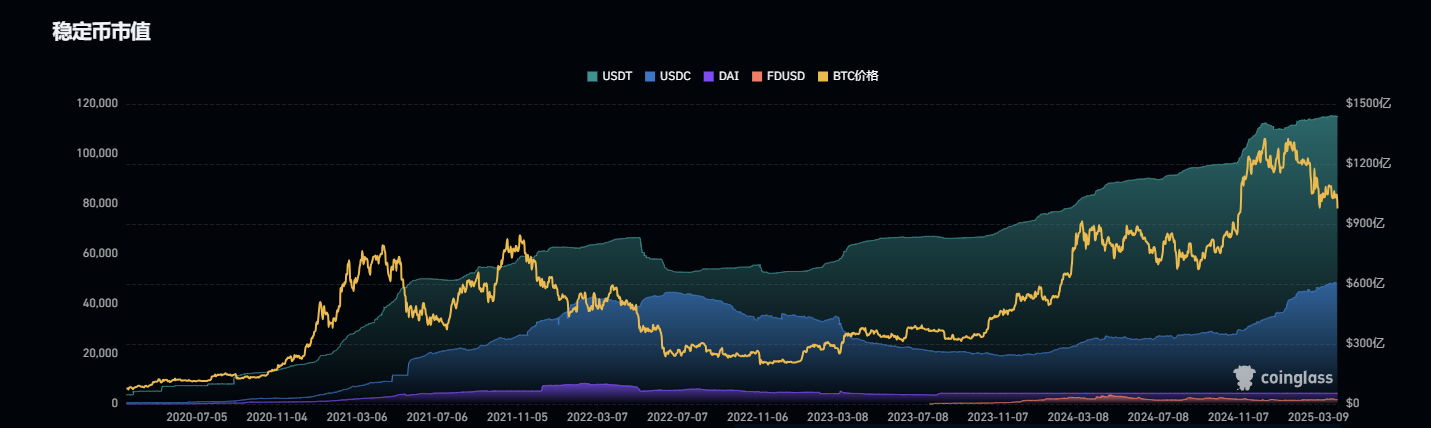

As speculative fervor wanes, projects with real applications and revenues will become the backbone of the altcoin market. The DeFi sector remains core, with projects like Uniswap and Aave continuously attracting users and funds due to stable trading volumes and fee revenues; RWA (real-world asset) tokens are opening the connection between blockchain and traditional finance by putting assets like real estate and bonds on-chain, with projects like Ondo Finance already gaining traction. The stablecoin sector has immense potential, with the payment demand for USDT and USDC continuing to grow, and the stablecoin legislation that may pass in 2025 (requiring full collateralization with dollars or U.S. Treasuries) will further solidify the dollar's dominance and promote the expansion of the stablecoin ecosystem. Projects like Circle (the issuer of USDC) may become new hotspots due to favorable policies. These sectors, due to their real demand and revenue sources, are expected to grow steadily in the next cycle.

3. Strong Whales or Ground Promotion Projects: Community-Driven Traffic Engines

Projects with strong community power and ground promotion capabilities often maintain high market values during market downturns. XRP has accumulated a large user base through extensive ground promotion in places like South Korea, keeping its market cap consistently high; Pi Network attracted tens of millions of users to participate in mining through a social viral model, forming a strong community consensus; Cardano (ADA) has built broad grassroots support through educational projects in Africa. Although these projects may not have outstanding technical value, their strong community drive and traffic engines have the opportunity to attract funding attention in the next cycle, becoming highlights of local trends.

Operation Guide for the Next Cycle

The glory of the altcoin season has become a fleeting memory, but the next cycle is not without opportunities.

Source: @CryptoPainter_X

Even though the market value of altcoins against BTC is still in a bearish trend, with only 23% space left to the lower boundary of the range, the next quarter may be a critical window for bottoming out. Experienced traders have summarized a set of strategies to capture the glimmers of altcoins through long-term observation, which investors might consider trying:

Step 1: Assess the Overall Trend and Gauge the Macro Environment

The rebound of altcoins is closely tied to the macro environment. The primary task is to observe global liquidity and the movement of the dollar: if the dollar enters a weak cycle and global liquidity loosens, risk assets may experience a rebound, providing local opportunities for altcoins; conversely, if the dollar remains strong and liquidity tightens, the pressure on altcoins will further increase. In 2025, the global economy is still affected by high interest rates and geopolitical risks, so investors need to closely monitor the Federal Reserve's policy direction.

Step 2: Select Carefully and Identify Potential New Stars

In the altcoin market, selecting quality projects is key. Focus on new projects that have been established for about a year and have begun to stabilize, avoiding newly launched high-risk tokens. Do not be misled by the dollar price of tokens; instead, pay attention to their performance against BTC. In the current end phase of the decline in altcoin market value, filter out those that are resilient or stable in performance, as these projects often exhibit greater resilience and may become dark horses in the next cycle.

Step 3: Deep Dive into Sectors and Seek Star Fields

The selected projects are not the end; the next step is to analyze the potential of the sectors behind them. The explosion of altcoins often relies on sector narratives, such as AI, RWA, and stablecoins. Identify the fields where multiple projects intersect the most and assess whether they have the potential to become star sectors in the next bull market. The key lies in the liquidity sensitivity and actual demand of the sector: AI tokens may rise due to technological breakthroughs, RWA tokens may stabilize due to real assets being tokenized, and stablecoins may become the focus due to favorable policies (such as the stablecoin legislation in 2025).

Step 4: Steady and Patient Accumulation

After selecting the sector, adopt a phased accumulation strategy. Gradually build a spot position in the target sector over six months, occupying 60% of the total capital. You can choose to invest fixed amounts at regular intervals or buy in batches when prices fall below key support levels, such as investing 10% of the position each time. Given the high volatility of altcoins, patience is crucial; after accumulating positions, one can wait for the market to warm up.

Step 5: Dynamic Optimization and Rolling Strategy Adjustments

The altcoin market is ever-changing, requiring a reassessment of sector and project performance each quarter. Continuously filter new projects, analyze sector trends, and adjust position allocations until the spot position reaches the target ratio. Rolling adjustments can help investors seize market changes and avoid missing new opportunities.

Step 6: Wait for the Bloom and Lock in Profits

The cyclical fluctuations of altcoins require time, and investors need to learn to befriend time. When the market value of altcoins against BTC returns to a high range, it may signal the emergence of a bull market. At this point, gradually liquidate positions over a quarter to lock in profits. Although the altcoin season may not return, the glimmers of local trends are still worth capturing.

Conclusion: The Survival Rules of Altcoins

The glory of the altcoin season has become a thing of the past, with exhausted narratives, collapsed values, and liquidity crises making a comprehensive bull market a luxury. Bitcoin's market share may soar to 70%, dominating the stock game market. Investors should prioritize positioning in leading public chain tokens like Ethereum and Solana, focus on the stablecoin sector, and cautiously participate in narrative projects like AI and meme coins. Avoid bottom fishing in illiquid altcoins; a 90% drop may just be the beginning. In the next cycle, the glimmers of altcoins lie in practical applications and strong narrative sectors; only through rational operations can one find opportunities in the winter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。