This round of the bull market is not friendly to altcoins, and the death list may continue to grow.

Written by: Dingdang

The crypto market seems to be experiencing a profound winter. Just six months ago, we were still immersed in the illusion that a bull market was about to arrive. Now, perhaps only Bitcoin can still be believed in, while altcoins have already been fundamentally hurt.

Recently, many altcoin projects have announced their closures due to funding shortages, user losses, and operational pressures. From the blockchain gaming ecosystem Treasure DAO to the Web3 social application Phaver, and the crypto shooting game Shrapnel, these projects were once seen as pioneers of innovation, but now they exit the stage quietly. Their failures not only expose the sharp deterioration of the market environment but also reveal the deep vulnerabilities of crypto projects in terms of technology and business models.

TreasureDAO: The Dimming of a Blockchain Gaming Star

Treasure DAO was once a shining star in the blockchain gaming field, with its NFT and MAGIC token ecosystem becoming popular from early 2023 to early 2024, regarded as the "Nintendo" narrative of the GameFi track, attracting keen attention from numerous users and investors. At that time, it was a formidable presence in the blockchain gaming market, rivaling the popularity of Axie Infinity.

However, on April 3, its chief contributor John announced that due to deteriorating financial conditions, the operation of the game and Treasure Chain would be terminated. The announcement indicated that Treasure DAO's current annual operating expenses are approximately $8.3 million, while the treasury only has $2.4 million left, with funds expected to last only until July 2025. If $785,000 in idle funds can be withdrawn from the market maker Flowdesk, the operating time may be extended to February 2026. Additionally, the ecosystem fund still holds 22.3 million MAGIC tokens, currently valued at about $2.3 million, but if MAGIC depreciates significantly, the DAO could face funding difficulties as early as December 2024 to February 2025.

The main issue for Treasure DAO lies in the break in its funding chain. High operating costs and a limited treasury create a huge gap, while the depreciation risk of the core asset MAGIC and the market's indifference to blockchain gaming leave the project with no way out.

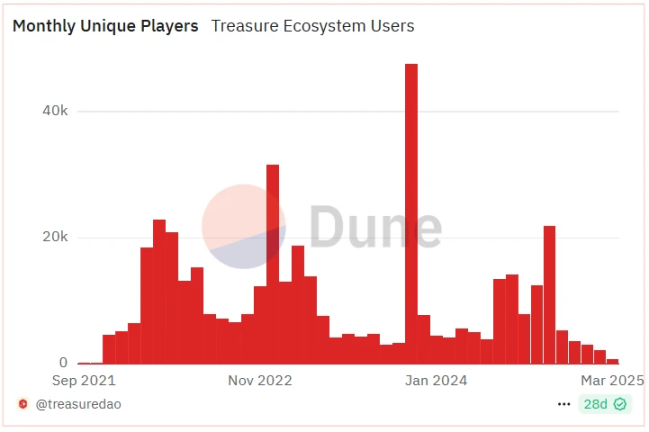

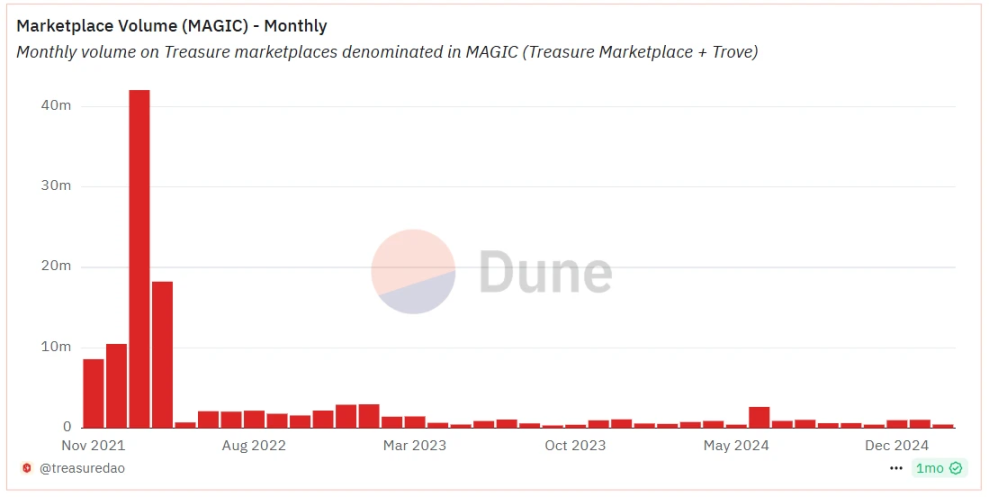

According to Dune data, the Treasure ecosystem had fewer than 1,000 monthly active users in March, only 1.5% of its peak period. The trading market has also seen long-term low trading volumes.

Shrapnel: The Financial Nightmare of a Shooting Game

Shrapnel, developed by Neon Machine, is a crypto shooting game that gained market attention in early 2024 due to the blockchain gaming boom. In terms of financing, Shrapnel performed quite well, raising a total of $37.5 million, with a luxurious lineup of investors including Polychain Capital, IOSG Ventures, and Dragonfly. Ironically, despite such successful financing, Shrapnel's token SHARP has never stepped foot on any major exchange, not even securing a "ticket."

On April 6, Blockworks reported that Neon Machine is facing severe financial difficulties. The company has consumed nearly $86.9 million in operating funds (excluding financing amounts). Although it expects $21.7 million in revenue in 2024, it faces a net loss of $11.4 million due to $33 million in operating costs. Currently, it is burning $2-3.5 million per month, cash has run dry, and it owes millions of dollars to external suppliers. After at least three rounds of layoffs, the staff has dwindled from nearly a hundred to just over ten, and the Seattle headquarters was closed at the end of March.

Reports indicate that Shrapnel's failure stems from massive losses and high operating costs, leading to an expanded net loss and depleted cash flow. A new round of financing planned for early 2025 has failed to materialize, and the tightening of market funds has completely extinguished this "shooting star."

Despite such dire financial conditions, Neon Machine still claims it will globally launch Shrapnel by the end of 2025. Meanwhile, Lingjing People's Game Lab and the main creative team of Shrapnel have reached a preliminary cooperation intention regarding the minting and distribution of game digital assets in the Chinese market. Hopefully, this is not just self-deceptive grandstanding.

Phaver: The Fleeting Moment of Web3 Social

Phaver was once the largest mobile social application on Lens, gaining some attention in the Web3 social space. It completed a $7 million seed round of financing in October 2023 and entered the market through TGE in September 2024. Unfortunately, after the token launch, it almost immediately fell below its initial value.

According to DeFi researcher Ignas, Phaver has ceased operations. The team admitted that the shutdown of Phaver was due to multiple issues: technical failures during TGE and airdrops prevented users from claiming tokens in a timely manner, leading to a crisis of trust. The low market sentiment has made Web3 social applications lose their appeal, and the high CEX listing fees (over $1 million) did not yield returns. Additionally, the team did not sell tokens during TGE, resulting in insufficient operating funds. Furthermore, as a Finnish company, Phaver must pay 1 to 2 months of severance for employees. Under multiple pressures, the project ultimately exhausted its funds and could not recover.

Currently, some former team members are developing SocialDAO, attempting to find new uses for Phaver's native token SOCIAL, but the prospects are uncertain.

Rollup.Finance: The Demise of Layer 2

Rollup.Finance was once an ambitious Layer 2 scaling solution. In December 2023, it announced the acquisition of the automated market-making protocol CherrySwap, attempting to expand its market footprint through resource integration. However, who would have thought that this gamble would end in dismal failure? In July 2024, the project team reluctantly announced the cessation of operations. Despite struggling for 16 months in a bear market and achieving growth in trading volume, the lack of support from the zkSync ecosystem and the mismatch between product and market rendered all efforts futile.

Users were given a final month to close positions and withdraw funds, and the platform completely shut down on September 21, 2024. Orders that remained open at expiration would be automatically liquidated, and affected users had an additional month to withdraw funds. After that, Rollup.Finance's email, official Twitter account, and Discord support channels were all disabled, leaving only silence where once there were grand ambitions.

Conic Finance: The Broken Chain of DeFi Ecosystem

Conic Finance is the Omnipools protocol within the Curve Finance ecosystem, which gained attention in the DeFi boom in early 2024. Financing information shows that it completed a $1 million raise in July 2023, with investors including Curve founder Michael Egorov.

In July 2023, Conic Finance suffered a flash loan attack, resulting in a loss of about $220,000. On March 9, 2025, Conic Finance ultimately announced the cessation of operations, requiring all liquidity providers (LPs) to withdraw funds from Omnipools, and the Conic treasury would return the remaining investment from Michael Egorov in July 2023. The project would also stop all Votium bribery and incentive measures for the CNC/ETH Curve pool.

The failure of Conic Finance stemmed from technical issues, team turmoil, and a deteriorating market environment. The core team had been working on a new version of Conic. However, despite collaborating with auditors, the team failed to propose sufficient fixes for several issues in the new version. Ultimately, this led to a lack of complete confidence in releasing a new audited version. During this period, some core members announced their departure, and the remaining team, after assessing that there was no continued value, ultimately decided to liquidate assets.

The current Conic deployment is operating normally and has not encountered any security-related issues. The Conic contracts will remain open source on GitHub, including the latest changes audited by ChainSecurity.

The failures of these projects are not isolated incidents but rather a microcosm of the market winter and the bursting of the industry bubble. From Treasure to Shrapnel, the collective downfall of altcoin projects, while lamentable, serves as a wake-up call for the industry. In this harsh winter, survival is the top priority.

Reducing operating costs, optimizing resource utilization, and ensuring the development of core functions are urgent tasks. Whether struggling on the brink of funding exhaustion or facing technological bottlenecks, altcoin projects must learn to find a way out in adversity: strengthen community support, embrace transparent governance, collaborate with mature ecosystems, and even bravely redefine their own value.

Though the winter is cold, it is also a furnace for tempering.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。