Original: Steven Ehrlich, Unchained

Translation: Yuliya, PANews

The global financial markets have recently experienced severe turbulence, and the cryptocurrency sector has not been spared. However, as the investment community often says, market reversals often create rare buying opportunities for visionary investors. In this turbulent environment, understanding the strategies of professional investors is particularly important.

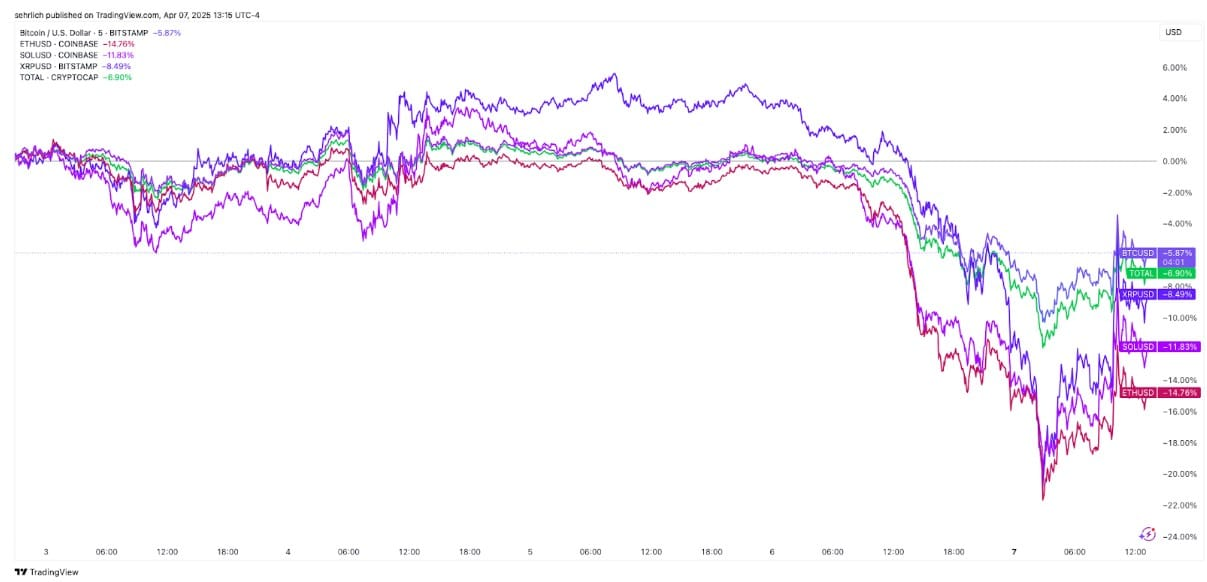

Following President Trump's announcement of large-scale and indiscriminate global sanctions last Wednesday, cryptocurrencies continued to decline alongside the overall market. As of the time of writing, Bitcoin has dropped 5.86% since then, even after a rebound from its first drop below $75,000 (the first time since the November 5 election). Other large-cap cryptocurrencies like ETH, Solana, and XRP have also performed poorly during this period, lagging behind the market leader.

In such a market environment, panic among investors is clearly rising. The Cboe VIX index, which measures expected stock market volatility, has reached 60 for the first time since the outbreak of the COVID-19 pandemic, while the Deribit Bitcoin Volatility Index (DVOL), the closest alternative to VIX in the cryptocurrency market, has risen nearly 30% in the past week.

In this situation, it is a natural reaction for investors to seek safe havens—such as purchasing U.S. Treasury bonds. However, there is a common saying in the investment world: "Be greedy when others are fearful, and fearful when others are greedy." This means that now is the time to buy blue-chip assets at a discount. To understand how professional funds are positioning themselves in the cryptocurrency market during this volatile period, two major venture capitalists, who requested anonymity, shared insights into their companies' strategies and provided key information on which categories and industries may perform best in the coming weeks and months.

Store of Value: Bitcoin and Ethereum

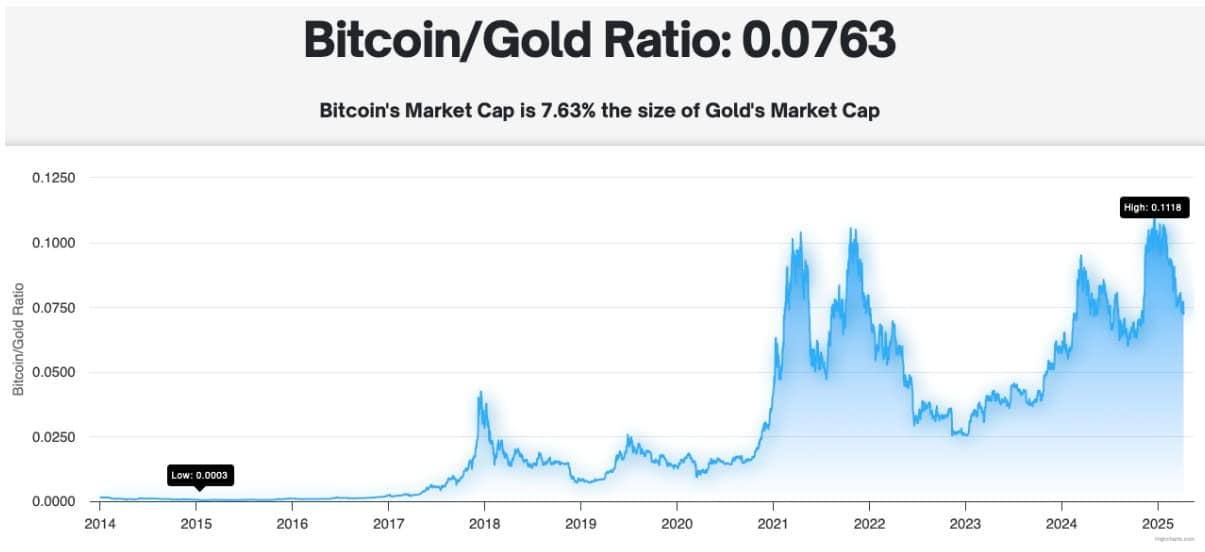

While it is not surprising, both interviewees believe that Bitcoin remains the top choice. Recently, gold has reached new highs and is widely regarded as a safe-haven asset. Meanwhile, Bitcoin is increasingly demonstrating its attributes as a "digital store of value." Despite recent volatility, the market capitalization comparison chart shows that there is still significant growth potential between Bitcoin and gold.

Currently, the market capitalization of gold is approximately $20.4 trillion, while Bitcoin's market capitalization is only $1.64 trillion. One investor pointed out: "To achieve a 1:1 market cap with gold, Bitcoin would need to rise at least 12 to 15 times. In the current environment, this is the easiest to understand and the most reliable opportunity."

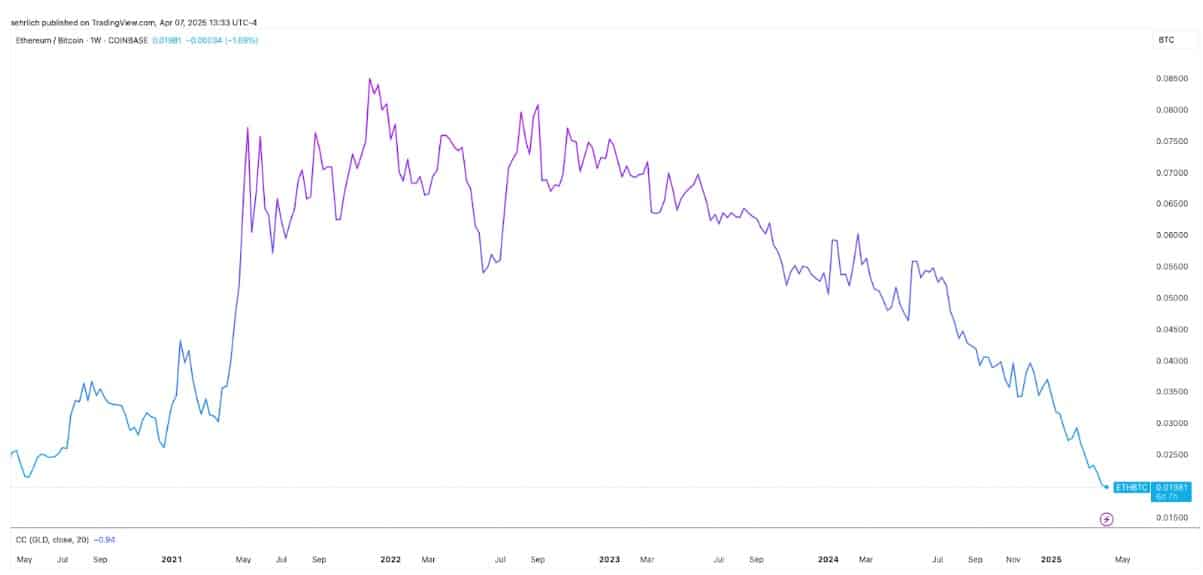

Ethereum is also considered an asset worth paying attention to, although it has significantly lagged behind Bitcoin in price performance in recent years, and its ratio to Bitcoin is at its lowest point since the early days of the pandemic.

One interviewee mentioned that after Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) in 2022, its monetary policy has become deflationary, allowing it to partially adopt Bitcoin's "store of value" narrative. Despite recent poor network usage and rising inflation, from a valuation perspective, the current price is at a historical low.

Another investor stated: "Ethereum is so low right now; it really is a good buying opportunity."

Solana and DeFi Opportunities

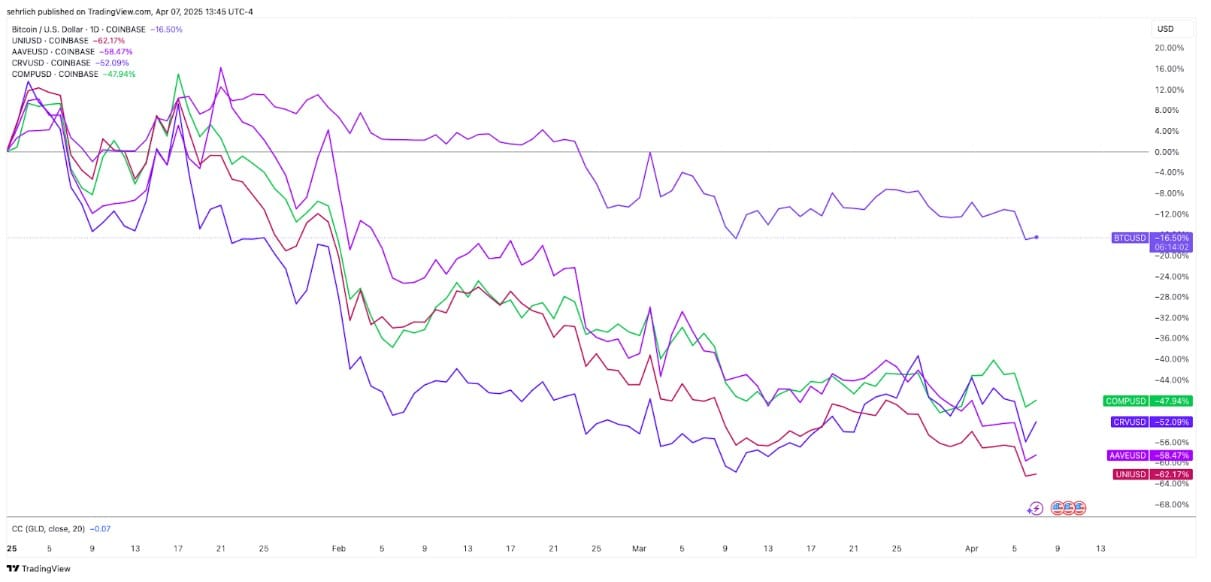

Decentralized finance (DeFi) tokens have generally suffered significant setbacks this year, with native tokens of exchanges and lending protocols like Uniswap, Aave, Curve, and Compound dropping nearly 50% since the beginning of the year. However, both investors believe that this sector is poised for a strong rebound in the current tightening macro environment.

One of them pointed out that in a period of low stablecoin yields, DeFi may actually see a return of funds. Because in on-chain lending portfolio operations, there are still ways to achieve relatively high yields. "This is very similar to the situation in 2021," he added.

Two projects to watch closely are Raydium and Hyperliquid. The former is a traditional automated market-making exchange built on Solana, similar to Uniswap; the latter focuses on perpetual contracts, a type of cash-settled derivative.

If one is unwilling to pick a single token, they can also pay attention to Solana itself. "Solana is somewhat like an index fund for DeFi. There are many very interesting DeFi projects developing on it."

EigenLayer and Near: Next Round of Infrastructure Opportunities

Both investors believe that the "AI + blockchain" concept that was hot last year is mostly overhyped. One bluntly stated, "Basically, it's all air projects." But he also pointed out that this situation is not uncommon in early-stage tracks, as seen during the ICO boom in 2017. "The first wave is usually air projects, but there will also be a little bit of real substance, which is what will be worth paying attention to in the following years."

They believe the next phase of the AI narrative is more likely to focus on "AI agents," such as travel robots that automatically book tickets. The question is how to ensure that the funds deposited with such agent programs are not misappropriated. One method is to have their security guaranteed by the security of Ethereum itself.

However, Ethereum is not suitable for all projects, mainly due to high transaction costs and the need for some applications to operate cross-chain. EigenLayer was born in this context, providing a "shared trust layer" for applications, allowing projects to leverage Ethereum's security without needing to be fully deployed on its mainnet.

"Once your application runs on EigenLayer, its fund security is guaranteed by Ethereum," one investor stated. He also specifically mentioned that Near could also benefit from this trend.

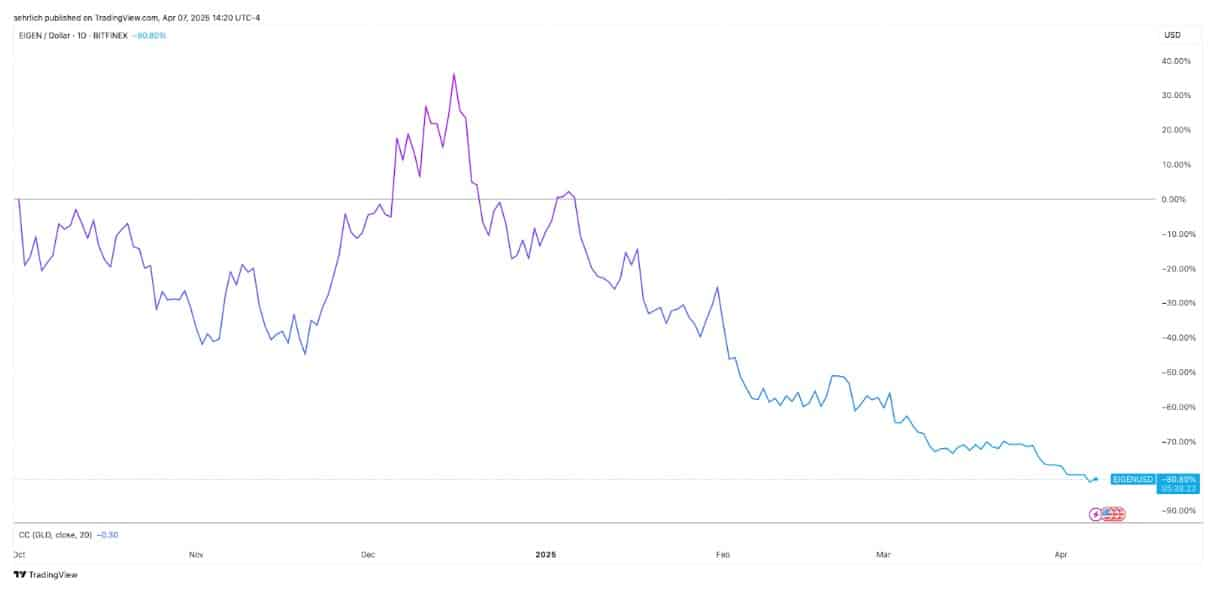

EigenLayer was once one of the most anticipated projects in the market, but its token launched in October last year, just as the bull market was nearing its peak, and subsequently plummeted over 80%. However, if the current narrative holds, this actually means investors can buy in at a significant discount. One investor added: "EigenLayer's market cap is now less than $1 billion; this is the time to buy and hold."

Overall, although the cryptocurrency market is still digesting macro and policy uncertainties in the short term, for institutional investors, this is a critical time to reallocate assets and position for a new upward cycle. From store of value assets to infrastructure and DeFi platforms, to emerging AI interaction applications, the direction of capital bets is gradually becoming clear.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。