Source: Cointelegraph Original: "{title}"

The Hong Kong Securities and Futures Commission (SFC) has released new guidelines for cryptocurrency exchanges offering staking services.

In an announcement on Monday (April 7), the SFC announced new guidelines for cryptocurrency exchanges providing staking services and local recognized funds participating in staking digital assets. This announcement followed a recent speech by Christina Choi, Executive Director of the SFC's Investment Products Division, at the Hong Kong Web3 Carnival, where she stated:

"The SFC is committed to supporting the development of Web3 in Hong Kong."

In the announcement, the regulator stated that it "recognizes the potential benefits of staking in enhancing the security of blockchain networks and the possibility of generating returns for investors." Therefore, the latest guidelines allow cryptocurrency exchanges to offer staking services.

Chen Wu, co-founder and CEO of Hong Kong licensed cryptocurrency exchange Ex.io, told Cointelegraph that the company appreciates the regulator "allowing licensed platforms to provide staking services under clear and responsible guidelines." She said:

"The SFC's announcement indicates that more doors are opening—not just for staking services, but also to allow a broader range of Web3 products to take shape within a regulated and trustworthy framework."

Chen added, "Hong Kong is positioning itself not just as a compliant market, but as a true hub for Web3 applications, protecting user interests while not hindering the development process."

New Regulations for Staking Services The regulator conveyed the new regulations in its latest circular sent to cryptocurrency exchanges under its jurisdiction. The SFC requires cryptocurrency exchanges to obtain written approval before offering staking services, retain control over the staked virtual assets, and not delegate custody to third parties.

Cryptocurrency exchanges engaged in staking must disclose all relevant risks and fees, minimum lock-up periods, unstaking processes, interruption processes, and custody arrangements to customers. Finally, service providers must report their staking activities to the SFC.

A similar circular was also sent to cryptocurrency fund operators regulated by the SFC, with the new rules applicable to funds that invest directly or indirectly in digital assets with a net asset value of over 10%. Funds can only purchase virtual assets that are directly available to the local public and must rely on SFC-authorized platforms. Leverage exposure is prohibited.

If aligned with the fund's objectives, funds can participate in staking, while providing clear disclosures and strong control measures. If the implementation of staking leads to significant changes in strategy or risk conditions, investor notification or even shareholder approval may be required.

Hong Kong Bets on Web3 In a recent speech, Choi acknowledged that the Web3 space is still evolving, "its full benefits will unfold over time and are likely to experience ups and downs." She cited the speculative industry of non-fungible tokens (NFTs) as an example, demonstrating the need for caution in current regulatory approaches:

"Therefore, rather than chasing every new spark, we believe in a pragmatic approach—strengthening the foundation and nurturing a supportive ecosystem that allows Web3 to thrive sustainably."

These officials' comments came after recent reports that cryptocurrency exchange Bybit announced the closure of its NFT marketplace due to the market losing momentum. This decision closely followed a similar announcement by major NFT marketplace X2Y2 at the end of March.

The non-fungible token market is experiencing a significant decline. Before Bybit's announcement, daily NFT trading volume exceeded $18 million, while at the time of the decision to close the platform, it was only $5.34 million—a drop of 70%.

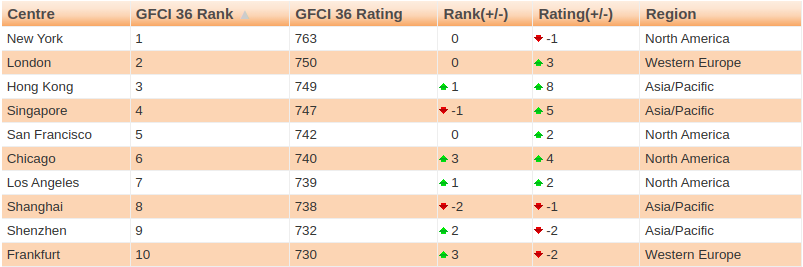

When arguing why Web3 companies should choose Hong Kong as their headquarters, Choi pointed out that Hong Kong ranks third in the Global Financial Centers Index. Additionally, local regulators have established clear guidelines for cryptocurrency industry companies, and Hong Kong offers convenient access to Asian markets.

Top Ten Global Financial Centers Index Source: LongFinance

In conclusion, Choi stated, "Today we stand at the crossroads of traditional finance and the digital economy, which will bring promising outcomes for our financial markets." She added:

"The breakthrough from zero to one has been achieved, and future success largely depends on how we nurture this integration, that is, how we move from one to a hundred."

Her statement echoes the 250% growth of Hong Kong's fintech industry since 2022. The SFC recently launched a new roadmap positioning Hong Kong as a global cryptocurrency hub.

The "ASPIRe" roadmap aims to prepare the local virtual asset ecosystem for the future. It includes 12 initiatives spread across five major categories, including providing market access, optimizing compliance and frameworks, and enhancing blockchain efficiency.

Related Articles: Decentralized AI and AI Agents Drive Web3 2025 Super Cycle - 0G Labs CEO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。