Source: Cointelegraph Original: "{title}"

Indian cryptocurrency exchange WazirX has received over 90% support from voting creditors for its restructuring plan following a hack.

According to an announcement on Monday (April 7), 93.1% of the creditors who participated in the vote cast their votes in favor, holding 94.6% of the debt value. All creditors holding crypto assets on the platform voted through Kroll Issuer Services from March 19 to 28.

Nischal Shetty, co-founder and CEO of WazirX, told Cointelegraph that with the approval of the plan, recovering the stolen assets has become a "top priority," but he also noted that profit sharing will be another important measure to compensate users.

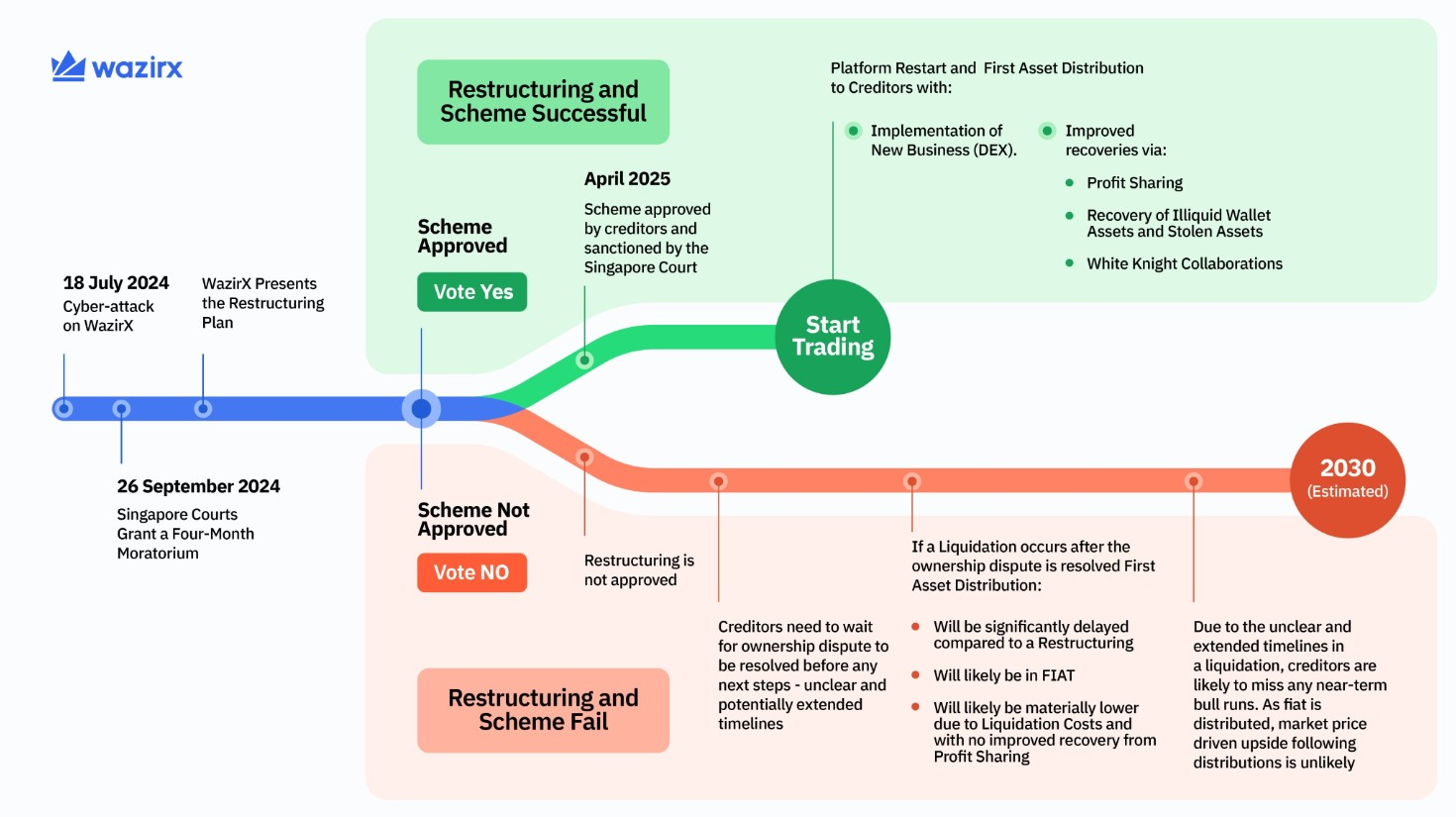

In early February this year, reports revealed that WazirX had warned creditors at the time: if the restructuring plan was not approved, compensation for the $235 million hack incident could be delayed until 2030. The platform clearly stated that if the plan was rejected, creditors might face a "vague timeline and significantly extended repayment period."

WazirX stated that if creditors vote against the restructuring plan, they may face repayment delays. Source: WazirX

Shetty later celebrated the voting results on the X platform, writing:

"The people's will. We will do our utmost to rebuild the platform and create value for all users."

Describing the creditor repayment plan as an "important milestone in the recovery process," Shetty stated that it "reflects the shared belief in the proposed restructuring plan." The plan was developed under the supervision of the Singapore legal system and announced in January, requiring WazirX to hold $566.4 million in USDT liquid assets, while the total claims amount to $546.5 million USDT.

The exchange also issued recovery tokens to settle unpaid debts, allowing creditors to benefit from the platform's future operations and asset recoveries. WazirX promised to return funds through token distribution, with repayment amounts reaching 75% to 80% of the value in user accounts at the time of the cyber attack.

The remaining portion will be represented by recovery tokens, which will be regularly repurchased using profits generated from platform operations and the proposed decentralized exchange (DEX). This DEX is planned to be announced in November 2024, and Shetty stated at the time that it would help prevent future losses from hacks:

"Ideally, you will be able to self-custody your assets here—your assets will be completely under your control—you can trade or dispose of your assets as you wish." Shetty also told Cointelegraph that the goal of this DEX is to make the interaction experience much simpler than common decentralized trading platforms. He stated, "Our goal is to make it comparable to our centralized exchange (CEX) in terms of operational convenience."

In a hacking incident related to North Korea, WazirX lost $234.9 million in digital assets in mid-July 2024 due to a vulnerability in the Safe Multisig wallet. This attack was attributed to a North Korean state-sponsored hacking group, whose speed and precision in the attack were shocking, leading many to speculate on the potential impact on India's broader cryptocurrency industry.

Shetty told Cointelegraph that to prevent future hacks, WazirX has turned to BitGo and Zodia for cryptocurrency custody services, promising "enhanced fund protection." Reports indicate that these partnerships also include insurance coverage.

Hacking remains a significant issue facing the cryptocurrency industry. According to the latest reports, in just the first quarter of 2025, the cryptocurrency industry suffered losses exceeding $2 billion due to hacks, with nearly $1.63 billion of those losses stemming solely from access control vulnerabilities.

This marks the third consecutive quarter where the top attack incident, very similar to WazirX's case, has been related to multi-signature issues. Hacken shared important insights on this:

"Protecting digital assets requires more than just secure on-chain code—the entire infrastructure, from the front-end interface to internal processes, must be equally robust, as a single weak link is enough to compromise the entire system."

Related articles: WazirX approved for hack repayments, Tornado Cash sanctions overturned: Legal interpretation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。