Original | Odaily Planet Daily (@OdailyChina)

Binance Launches Second Round of Voting for Token Listing

Overview of Listed Tokens and Market Capitalization

According to official news, Binance has launched the second round of voting for token listing, which will last until April 10. Users can participate in the voting on Binance Square, and the winning projects will be listed for spot trading after review. The candidate tokens include: VIRTUAL, BIGTIME, UXLINK, MORPHO, GRASS, ATH, WAL, SAFE, ZETA, IP, ONDO, PLUME, totaling 12 popular crypto projects.

Unlike the first round where most candidate tokens were Meme projects and all were BNB Chain ecosystem tokens, this round includes candidates from various sectors such as AI, DeFi, infrastructure, and RWA. This may indicate that the voting mechanism for token listing will become one of Binance's regular methods for listing tokens. As of the time of writing, based on on-chain data, the unit price, circulating market capitalization, and fully diluted market capitalization of the second round candidate tokens are as follows:

Overview of Secondary Data for Second Round Candidate Tokens

It is not difficult to see that compared to the candidate tokens in the first round of voting, the market capitalization of this round's candidate tokens is generally higher. Among them, ONDO currently has a circulating market capitalization of up to $2.4 billion, ranking first among all candidate tokens; even the lowest market cap token, BIGTIME, has exceeded $100 million. This also indirectly indicates that Binance is more inclined to choose medium-sized projects with a certain market foundation and user consensus in this round of voting, in order to further enhance the attention and community competition of the listing activities.

How to Participate

As long as real users hold at least 0.01 BNB, the voting process is simple. First, find "Square" under the "News" section on Binance, then locate the Binance Square Official account and find "Voting" in the pinned content. Finally, choose your preferred project from the 12 candidates in the second round to vote. The specific operation process is shown in the image below.

Binance Voting Process Diagram

Review of Binance's First Voting for Token Listing

According to the information released by the official, in the first round of voting, BANANAS31 (19.4%) and WHY (18.8%) ranked first and second, respectively. However, unexpectedly, WHY did not appear on the final listing list, and instead, Binance listed four projects at once: MUBARAK, BROCCOLI 714, TUT, and BANANAS31, exceeding most users' expectations.

From the price trend, due to the overall market being currently sluggish, with insufficient liquidity and a lack of strong narrative support, the projects listed on Binance did not bring about a significant "wealth effect." Among them, the Meme project MUBARAK, which had the highest popularity during the voting phase, saw its price drop after listing instead of rising, continuing to weaken.

So, after the second round of voting for token listing on April 10, will Binance continue the practice of the first round and ultimately list four projects, or will it adjust based on this round's situation? This remains to be seen. Additionally, what will be the relationship between the listed tokens and the voting rankings? Odaily Planet Daily will continue to monitor and provide the latest reports.

Off-Market "Vote Buying" Heat Surpasses First Round

Although the short-term performance of the tokens listed in the first round was not satisfactory in the market, being listed for spot trading on Binance is still widely regarded as a strong endorsement and liquidity boost. Once the market warms up, the potential profit space is considerable. For this reason, even though the overall market sentiment is currently cold, the voting for token listing still attracts a lot of attention, and operations around "vote buying" continue unabated.

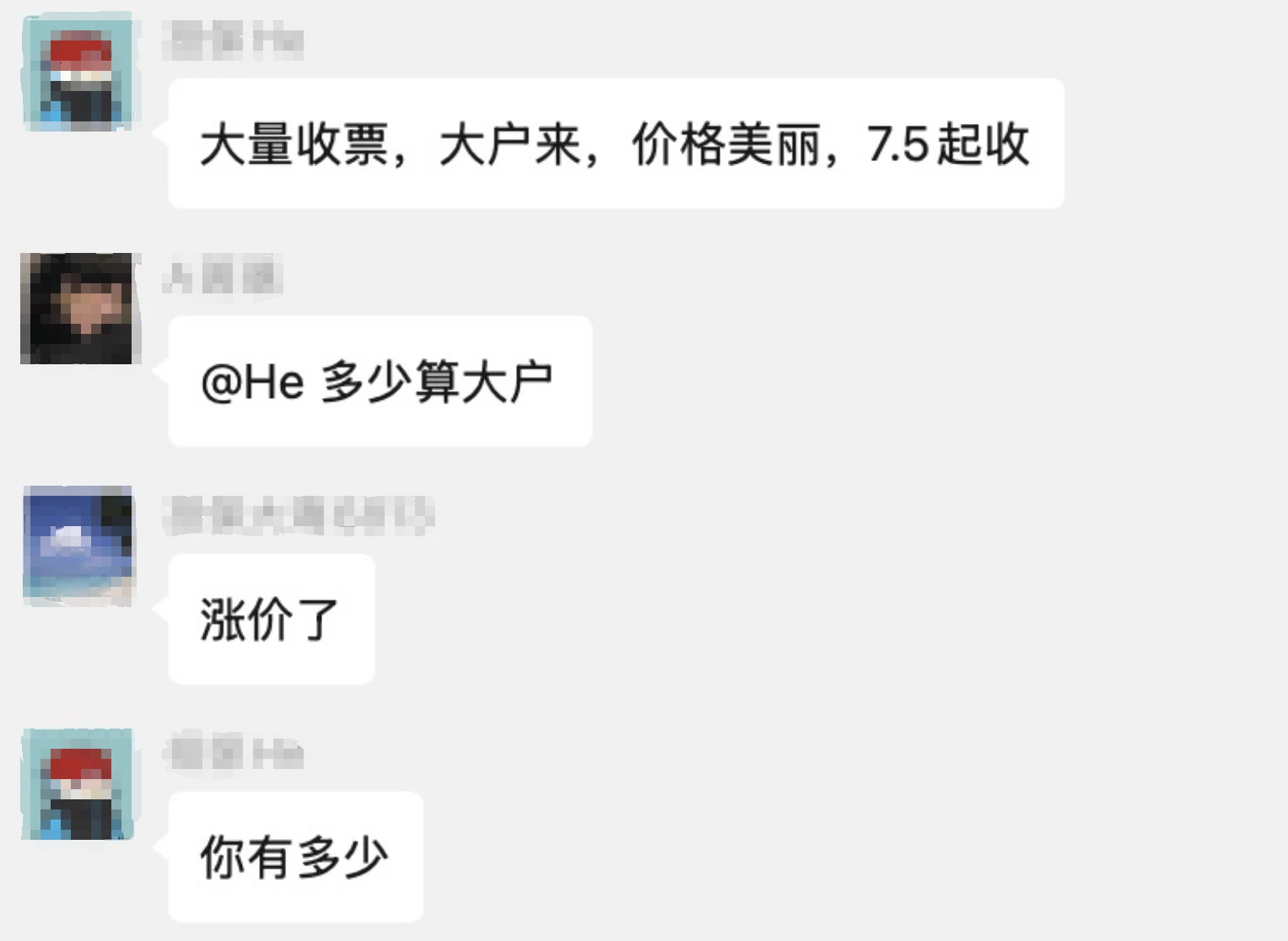

The enthusiasm for this round of voting even surpasses the first round. According to feedback from several off-market trading users, the demand for this round of voting has significantly increased, and the market price for "vote buying" has also surged—prices in the first round mostly hovered around $5, while this round has generally risen to $7. If "bulk selling" of votes occurs, prices could even reach $7.5 or higher.

Off-Market Vote Buying Situation

In addition, the three projects IP, ATH, and SAFE not only received considerable support from KOLs in community media but also saw exceptionally strong off-market "vote buying" demand.

The "Autonomous Experiment" of Voting for Token Listing is Still in the Exploration Stage

Finally, let us look forward to the future direction of Binance's voting for token listing mechanism, which may present three distinctly different scenarios.

The most ideal situation is that community members vote based on genuine consensus, promoting truly promising projects to stand out; at the same time, the anti-cheating mechanisms established by the platform work effectively to curb vote buying behavior, thereby creating a governance model that can be referenced for the industry.

However, in a more pessimistic scenario, large holders manipulate the voting results, sending inferior projects to the exchange stage; some speculators may even profit by shorting all candidate projects, leading to a large-scale decline in small and medium market cap tokens, disrupting market order.

What is more likely to occur is a complex and ambiguous intermediate state: although occasionally high-potential quality projects can be selected, vote buying and other fraudulent behaviors still occur from time to time, forcing Binance to continuously revise mechanisms and optimize rules to maintain the credibility and participation of the voting process.

Overall, this "autonomous experiment" of voting for token listing is still in the exploration stage, and its success or failure will directly impact Binance's openness in the token listing mechanism and community participation model.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。