Author: Tulip King, Messari Analyst

Compiled by: Luffy, Foresight News

Alpha First:

- Maximize your human capital: Find a high-paying job and work hard. Today, your career is the best defense against inflation.

- Shift assets from traditional finance to unrelated alternative assets. The stock market may remain flat or decline for decades.

- Accumulate gold for stability and hold Bitcoin for appreciation. In an era of de-globalization and financial repression, both will outperform the market.

The Legendary Bull Market Has Ended

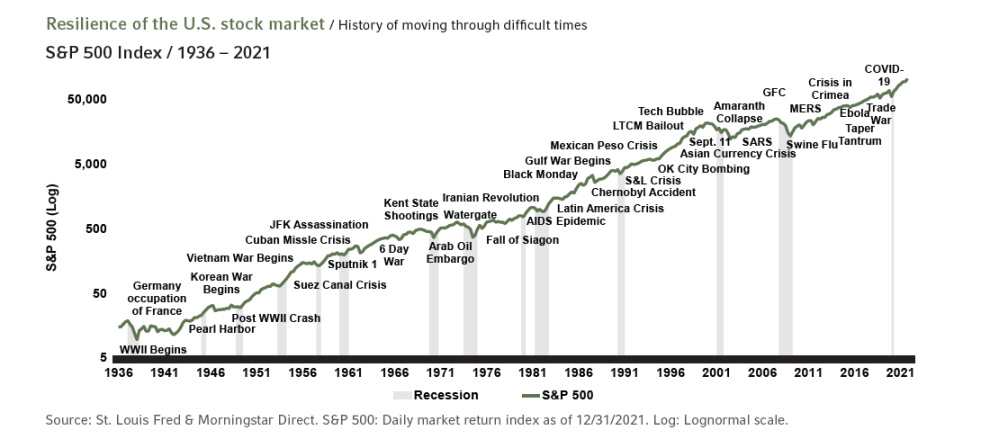

We have just experienced the longest bull market in history, rising from the ruins of World War II to Donald Trump's victory in 2024. This epic bull market has made generations of passive investors accustomed to believing that "nothing will happen" and "the market will only go up." Unfortunately, the good times are over, and many are about to suffer heavy losses. The structural tailwinds that have driven this decades-long prosperity are not only stagnating but are sharply reversing. The populist revolution has arrived, and it will sacrifice capital to make labor great again.

Populists Take Control

The globalist neoconservative political agenda led by the presidencies of Clinton → Bush → Obama → Biden has officially come to an end. Trump has stifled it, and its remnants will not be revived.

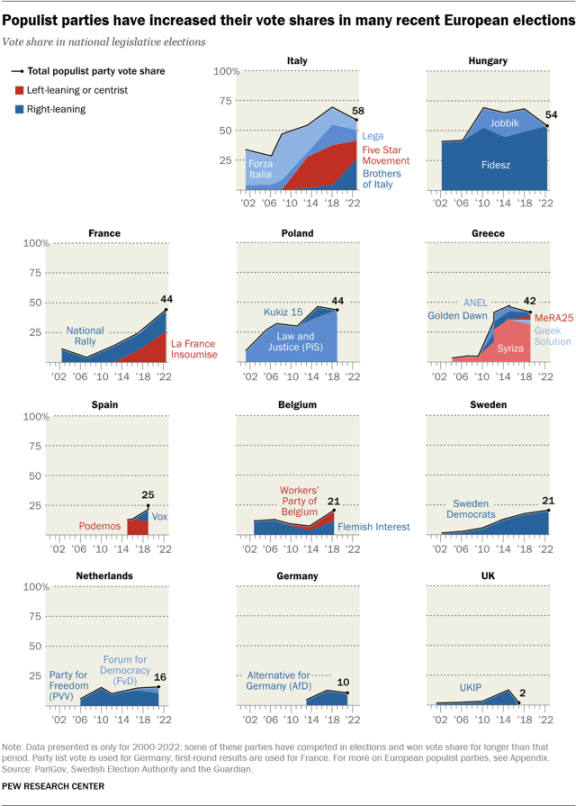

By the way, the shift towards populism is not only happening in the United States.

A brand new populist political agenda has emerged in the U.S. Today, Trump has completely taken control of the Republican Party in a way that was not possible in 2016. Meanwhile, the Democratic Party is experiencing the kind of internal strife that the Republican Party has just ended, and you can expect that the populist faction will ultimately defeat the globalist faction.

Populist politics fundamentally differs from globalist politics. You need to update your view of the goals of the two parties. There will still be differences between the Republican and Democratic parties, but they will increasingly converge on a core populist agenda:

- Reverence for blue-collar jobs. Both sides are now competing over who loves factory workers more. The era of "learn to code" is over.

- Re-industrialization. Everyone wants factories, supply chains, and key industries to return to the U.S.

- Tariffs. The next president, whether from the Republican or Democratic Party, is expected to continue a tariff-centric foreign policy.

- Free trade has become politically toxic.

- Nationalism. The distinction between "citizens and non-citizens" is making a stronger comeback. Both parties will continue to restrict immigration and deport illegal immigrants. The difference will only be in scope and speed, not direction.

The elite consensus that drove policy from Reagan to Obama promised prosperity through free trade, open capital flows, and globalization under U.S. leadership. This brought astonishing results for financiers and tech moguls. But for large swathes of America, especially the industrial heartland, it resulted in community hollowing, wage stagnation, and a fentanyl crisis. Populism is not an accidental phenomenon; it is a foreseeable one.

The Value of Labor

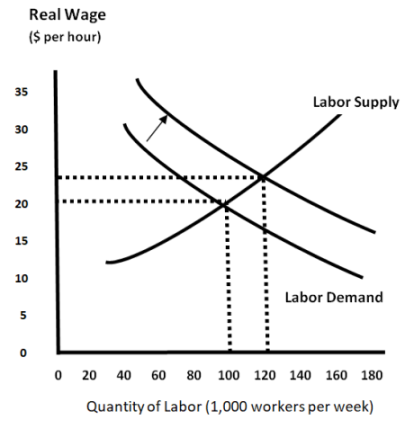

Two powerful forces are converging to drive wages significantly higher:

Re-industrialization is causing a surge in demand for labor. Even with automation, the return of factories and supply chains to the U.S. will create a huge demand for workers. Every new semiconductor factory or electric vehicle battery plant needs engineers, technicians, construction workers, and logistics personnel. The CHIPS Act and the Inflation Reduction Act alone have injected hundreds of billions of dollars into domestic manufacturing opportunities.

Immigration restrictions are simultaneously reducing labor supply. Whether through border control, deportation, or reduced visa approvals, the influx of new workers has been limited. Republicans want to deport all illegal immigrants; Democrats are at least conceding to deport those with criminal records. Regardless, the trend is clear: fewer workers are entering the job market.

Let’s revisit the supply and demand curve from basic economics.

This is a fundamental economic principle: when labor demand increases and supply contracts, wages must rise. This is not a temporary phenomenon but a structural shift that could last for decades. For the first time in many years, you will see wage increases outpace inflation and financial asset returns.

Even in an inflationary environment, this holds true. I expect that over the next decade, due to de-globalization, tariffs, and labor shortages, inflation will range between 3% and 9%. But if your wages grow 5% faster than inflation each year, rising prices won’t keep you up at night. While asset owners watch their portfolios stagnate, your real wealth will be increasing.

This means: it’s time to focus all your efforts on your career. Work hard, learn valuable skills, especially those related to domestic production and physical infrastructure. Your human capital (your ability to earn) is appreciating. This is a generational opportunity to accumulate wealth through income rather than asset appreciation.

Wall Street's Influence is Waning

During the period of globalist political agendas in the U.S., Wall Street was the most important interest group. Their interests were seen as synonymous with national interests. Free capital flows, deregulation, and bailouts when necessary were all privileges enjoyed by Wall Street. It seemed that every Secretary of the Treasury came directly from Goldman Sachs.

Now, as the process of de-globalization advances, Wall Street is rapidly losing favor in political and public spheres. Financial elites have not yet realized this, but they no longer have the allies and power they had 5 to 10 years ago. They are like dinosaurs looking up at a strange light in the sky, not understanding that their time is about to end.

The idea that the Fed will inevitably shift to rate cuts is incorrect; the Fed will not pivot.

Because Wall Street has not yet recognized its declining status, they still expect the Fed to come to their rescue when they are in trouble. They assume the famous "Fed put" (the central bank's implied promise to cut rates to save the market) is still in effect. But that is not the case.

Since 2021, every politician has learned a key lesson: if you are an elected leader and there is inflation domestically, you will lose your re-election campaign. It’s that simple. This has completely reversed the political motivations surrounding monetary policy. Astute politicians are now pressuring the Fed to maintain high interest rates, as rate cuts could reignite inflation, which would cost them their jobs.

Even if the market crashes, the current political considerations prioritize fighting inflation over saving asset prices. Wall Street can cry all they want, but in a populist environment, their tears won’t translate into votes. In fact, many voters will cheer for Wall Street's setbacks. This reality has yet to be reflected in market prices.

The Decline of Financial Assets

It’s time to stop pretending that the stock market and the real economy are the same thing. While financial assets and the stock market decline, your wages and quality of life can absolutely improve. For those under 30, this is actually an ideal situation; you finally have the opportunity to buy homes and stocks at reasonable prices with rising wages.

You may never see Apple’s stock price reach a new all-time high again.

Take Apple as an example. In Q4 2024, Apple’s price-to-earnings ratio is about 40, with a gross margin of about 46%. This means that if Apple generates about $100 in revenue per share, with a profit of about $46 per share, the stock price would be around $1960.

Now assume they must bring production and labor back to the U.S. Due to lower domestic production efficiency, their profit margins will be compressed. The gross margin drops to 20%, and in a high-interest-rate environment, the market will no longer accept such an aggressive P/E ratio, so it drops to 25 (still above historical averages). Assume that over the next decade, because Apple remains an excellent company, they manage to double their revenue. By 2035, their revenue per share would be about $200, but their profit per share would only be $40, leading to a stock price of $1000.

This is how financial assets can enter a long-term bear market (over 10 years) while companies continue to be profitable and give employees raises. Even with business activity growth and rising wages, stock prices could actually fall by 50%.

This is not just theoretical; it is what happened in Japan after 1989. That year, the Nikkei index peaked at nearly 40,000 points and then crashed. Today, 36 years later, it has still not fully recovered. If you bought Japanese stocks at the peak and held them for a generation, you would still be at a loss in real terms. This happens when a financialized economy built on loose monetary policy and globalization has to adapt to a new reality.

U.S. financial assets could easily fall into a "lost decade" (or even two decades). The passive investment strategies that worked for the baby boomer generation may yield dismal returns for the next generation. For index fund believers, this will be a nightmare.

So, Who Are the Losers?

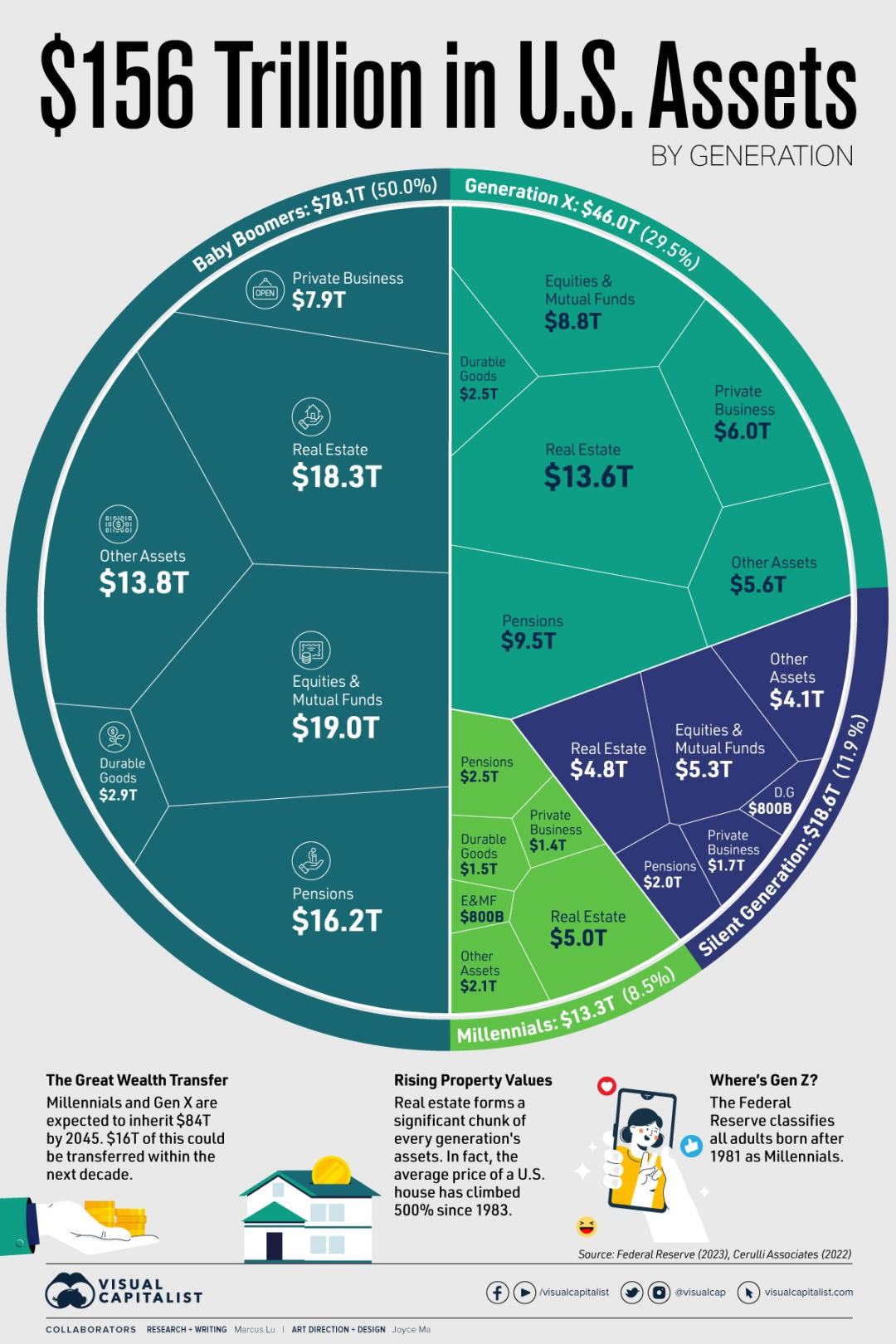

This is a useful reference regarding how much the baby boomer generation has profited from the globalist political agenda.

At this point, you may be wondering who will be the unfortunate ones in the new political and economic landscape, primarily two groups:

- Large companies with high profit margins. Those companies that have enjoyed the benefits of globalization (outsourcing production, optimizing global supply chains, paying extremely low wages) face painful adjustments. The return of production means rising costs, labor scarcity means rising wages, and tariffs mean higher input costs. All of this compresses their previously high profit margins. They will still be profitable, but profits will decrease, and investors will assign lower valuations to these reduced profits.

- Baby boomers who are too old to benefit from wage growth. The real victims are retirees and those nearing retirement, who have substantial assets but meager incomes. After decades of policies catering to their interests, the advantages of the baby boomer generation have come to an end. They have exited the labor market, so rising wages do not help them. Their retirement accounts are heavily invested in stocks and bonds, which may stagnate or decline for years. Meanwhile, inflation erodes their fixed incomes. This is a triple whammy: asset declines, rising costs, and an inability to earn more income.

This is not just an economic issue; it is a matter of intergenerational fairness. The baby boomer generation enjoyed the fruits of post-World War II prosperity, purchasing properties at low prices and watching their stocks rise by 10% annually for decades, only to pull up the ladder behind them. Now, as they attempt to cash in on these gains, they find that buyers are dwindling. The massive intergenerational wealth transfer that many anticipated may not be as bountiful as imagined.

So, Who Are the Winners?

In this new paradigm, the winners are clear:

- Labor, especially blue-collar workers. Electricians, plumbers, welders, mechanics, construction workers—anyone who manufactures or repairs physical goods stands to gain significantly. These jobs cannot be outsourced, are crucial for re-industrialization, and face decreasing competition for labor. The era of stagnant wages for these workers is over. They will earn high salaries and regain social status.

- Young people entering the workforce. If you are just in your twenties, this shift is beneficial for you. Throughout your career, you will earn higher wages. After asset prices decline, you will ultimately purchase assets (housing, stocks) at more reasonable valuations. You have decades to benefit from a pro-labor environment. This is much better than the situation in 2010 when wages were stagnant but assets were already expensive.

- Those holding unrelated assets like Bitcoin and gold. As financial repression intensifies and traditional assets struggle, alternative assets outside the system become increasingly attractive. For thousands of years, gold has been a classic hedge against inflation and a safe haven. Central banks around the world have been accumulating gold at a record pace. Bitcoin, as digital gold, offers a similar function with greater upside potential. Both can thrive in environments of financial instability, currency devaluation, and geopolitical tension.

Central banks are buying gold in large quantities.

Regarding Bitcoin, one thing must be clear: it was created precisely for moments like this, when trust in traditional financial institutions is shaken, and governments take increasingly desperate measures to manage debt. When everything else is depreciating, Bitcoin's fixed supply is highly attractive. I expect Bitcoin to eventually reach $1 million, but you need to be patient. This is not a get-rich-quick scheme.

New Economic Order

We are witnessing a historic turning point: the end of the neoliberal globalist order and the rise of populist nationalism. This is not a minor policy adjustment; it is a fundamental reshuffling of economic winners and losers.

For decades, capital has dominated labor, financial assets have outperformed wages, and Wall Street has called the shots in Washington. That era is over, and we are entering a period where labor regains influence, wage growth outpaces asset returns, and economic policies prioritize workers over investors.

This transition will not be smooth; markets will experience severe downturns, and inflation will persist longer than most expect. As countries prioritize their own interests over global cooperation, geopolitical tensions will escalate.

But within this turmoil lies opportunity. Focus on learning high-paying skills in the new economy, shifting from overvalued financial assets to unrelated alternative assets. Prepare for a world where wage checks, rather than investment portfolios, serve as the primary means of wealth accumulation.

The populist revolution not only changes politics; it rewrites the economic rules. Those who recognize this shift early and position themselves accordingly will reap the rewards. Those clinging to old strategies will struggle. This is not the end of prosperity; it is a redistribution of prosperity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。