In the context of the ongoing decline in the cryptocurrency market, investors are facing pressure from asset depreciation, but passive selling is not the only option. By reasonably allocating mainstream assets for financial management, especially by choosing high-yield, low-risk platform products, it has become an effective strategy to combat market volatility.

As a leading global exchange, Gate.io has launched financial tools such as Launchpool and HODL&Earn, which have become the focus of the market due to their high return support for mainstream cryptocurrencies (such as BTC and ETH).

I. Asset Allocation Logic During Market Downturns

During market downturns, investors holding mainstream coins often face "holding anxiety"—selling may miss out on rebound opportunities, while idling means opportunity cost. At this time, using financial management tools to achieve "holding coins for interest" becomes a compromise solution.

Stability of Mainstream Coins: BTC and ETH, as the top two cryptocurrencies by market capitalization, have strong liquidity and high market consensus, maintaining resilience even in bear markets, making them quality underlying assets for financial management.

Yield to Hedge Risks: Financial management returns can partially offset losses from price declines; for example, the annualized yield from BTC staking in Gate.io's Launchpool can reach over 5%, far exceeding traditional financial products.

Flexibility and Security: Gate.io allows for the redemption of staked assets at any time, avoiding lock-up risks, while the platform employs multiple security mechanisms, such as 100% reserve proof, to ensure the safety of user assets.

Current cryptocurrency financial management has transcended simple interest accumulation, evolving into a comprehensive solution that includes risk management, opportunity capture, and cost optimization. Taking Gate.io as an example, its "holding coins for interest+" ecosystem integrates financial management returns, participation in Launchpool projects, VIP rights upgrades, and other diverse values, enabling investors to achieve:

Risk Exposure Compression: Reducing actual holding costs through returns covering losses.

Opportunity Cost Transformation: Converting idle assets into project resource acquisition channels.

Safety Margin Construction: A multi-layered protection system ensures the safety of asset custody.

This multi-dimensional financial management strategy is becoming an important tool for navigating cycles.

II. Core Advantages of Gate.io Launchpool

(1) Launchpool: The "Dual Engine" Model for High-Yield Mining of Mainstream Coins

Gate.io Launchpool allows users to stake mainstream coins in exchange for rewards in emerging project tokens, forming a "dual yield" model.

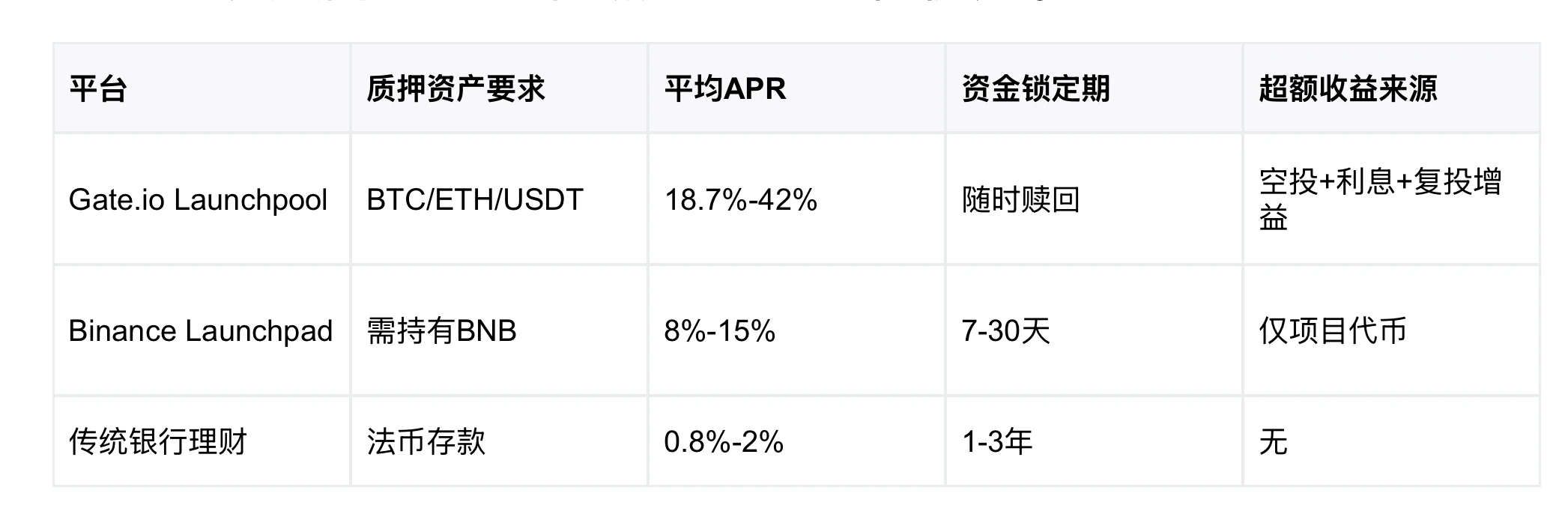

- Yield Comparison: Compared to Binance Launchpool (which typically requires staking platform token BNB) or traditional savings (annualized around 1-3%), Gate.io offers a differentiated advantage by allowing direct participation with mainstream coins and higher APR.

(2) HODL&Earn: Flexible Earnings with No Lock-Up

Gate.io's HODL&Earn product further lowers the participation threshold:

No Lock-Up Required: Holding BTC, ETH, or USDT allows users to earn floating interest daily, with funds available for trading or withdrawal at any time, suitable for short-term volatile markets.

Compound Yield Model: Users can participate in both Launchpool and HODL&Earn simultaneously, for example, staking BTC in Launchpool to earn new coins, then transferring the new coins to HODL&Earn for secondary interest accumulation, achieving yield stacking.

III. Horizontal Comparison: Why is "the Yield So High on Gate.io"?

Compared to other platforms, Gate.io's core competitiveness lies in:

Compatibility with Mainstream Coins: Most platforms (such as Bybit Launchpool) only support staking platform tokens, while Gate.io allows direct participation with BTC, ETH, etc., reducing exchange losses.

Real-Time Settlement Mechanism: Rewards are distributed hourly, making the compounding effect more significant compared to platforms that settle daily or weekly.

Low Fee Structure: Gate.io's spot trading fee is only 0.1%, lower than the industry average, further amplifying net returns.

Conclusion

In the face of increasing uncertainty in the cryptocurrency market, Gate.io provides holders with a dual solution of "anti-decline + interest accumulation" through products like Launchpool and HODL&Earn. Its high-yield design centered on mainstream coins not only meets investors' demand for security but also adapts to market changes through flexible mechanisms. It is recommended that investors allocate BTC, ETH, and other assets to different financial pools based on their risk preferences, maximizing capital efficiency while preparing for the next bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。