Once, the ETH mainnet was a golden mine for airdrops, but by 2025, the route of the big players had quietly shifted—Base, BNB, Sui, and Berachain had become synonymous with the new frontier.

Author: Biteye

Once, the ETH mainnet was a golden mine for airdrops, but by 2025, the route of the big players had quietly shifted—Base, BNB, Sui, and Berachain had become synonymous with the new frontier.

We have dissected the logic behind this trend and attempted to answer a question:

Where should airdrop players go?

Overview of the article:

The decline of ETH airdrops, the end of the big player myth

Base/Sui/Bera take over, becoming the new battleground

Emerging chain projects: aggressive financing, familiar gameplay

Selected project recommendations + low-threshold gameplay

Airdrops ≠ hard work, but rather direction

Understand the logic behind the migration and see where the next explosion point lies.

1/5 "The higher the gas, the more expensive the fish!"

Jason is a newcomer who entered the space in 2022 and once interacted with Opensea while paying over a thousand in GAS. A basic set of Approve and Send operations cost him $120, equivalent to half a week's salary. "Opensea has a high valuation, significant financing, and a strong investment background, so it must be a big player! The GAS burned now will be insignificant when it comes to airdrops in the future."

However, by 2025, Jason had been away from the crypto space for almost a year. "I didn't make any money at all; my accounts on Zksync and LayerZero were all deemed as 'witches.' I spent money on fingerprint browsers and independent IPs, but in the end, I had no idea what went wrong and had to return to work in shame."

In February 2025, Opensea suddenly announced, "We are launching a token," and after work, Jason casually opened the official website, greeted by familiar tactics: points, blind boxes, and experience points (XP).

2/5 How long has it been since you heard about airdrops from Ethereum ecosystem projects?

Let’s not even mention that the "myths" of getting rich through airdrops have vanished from platform X; even the once-dominant airdrop KOLs have all transitioned. In 2025, well-known airdrop blogger Ice Frog @Ice_Frog666666 even defended multiple projects like Kiloex and Corn, successfully carving out a new "defender persona."

Taking the airdrop projects from January 2025, when the market was relatively good, as an example, among the 14 projects launched, the proportion of native projects from the ETH ecosystem was almost zero. Most public chain projects chose to directly launch their mainnet and airdrop tokens, while others opted for new chains like @base or @BNBCHAIN, which had lower gas costs and more support from exchanges.

Comparing to the glory days of ETH in 2021, the current ETH ecosystem is worlds apart. As ETH's gas fees gradually dropped from tens of dollars to just a few dollars, even falling below $1, the number of projects announcing their launch on the ETH mainnet has not increased but rather decreased. The reasons may include @solana becoming a paradise for new players or BNB Chain serving as a ticket for projects to land on Binance, but more importantly, the once-proud innovation and development activity of the Ethereum ecosystem have gradually declined, and the community's grievances against the Ethereum Foundation have become increasingly evident.

3/5 True "big players" never ask about the source; they just want to give you money.

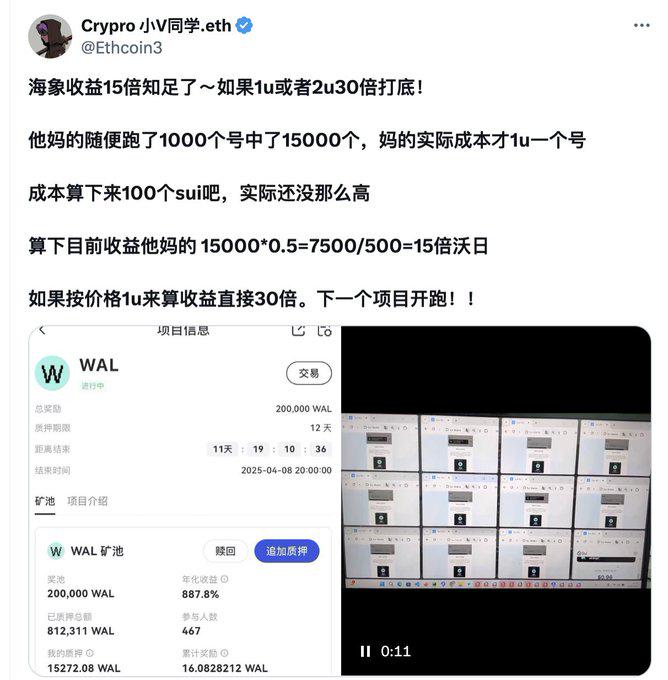

@WalrusProtocol is an airdrop project officially confirmed by Sui Network. After Binance announced the launch of contracts on March 28, it undoubtedly became the most dazzling airdrop star of the first quarter. The airdrop criteria for Walrus are very simple; even with just the most basic "low-income account," depositing a minimum of 0.1 Sui can yield about 15 times the return.

At first glance, Walrus is indeed extraordinary: it has raised $140 million, with a valuation of $2 billion, and its investors include top institutions like Standard Crypto, a16z crypto fund, Electric Capital, and Franklin Templeton's digital assets division.

In the past, such backgrounds typically appeared only within the Ethereum ecosystem, but now, more and more star projects with similar backgrounds are beginning to take root in emerging public chains like Sui and Berachain.

These projects share several obvious commonalities: practical teams, steadily rising token prices, and attempts to break historical highs.

4/5 Migrating from Ethereum to the new frontier for airdrops.

In the business world, a blue ocean signifies a market full of opportunities and unsaturated competition, while a red ocean symbolizes an intensely competitive or even cutthroat market. In the past, Ethereum was always the "noble chain" of the airdrop circle, with new players flocking to Ethereum L2 for opportunities, while experienced players calmly enjoyed generous airdrops on the ETH mainnet. However, times have changed; the market has gradually cooled, and the airdrop track has become fully saturated, with Ethereum now resembling a red ocean. To continue obtaining decent airdrop returns, one must board the new "Mayflower" and venture to new territories.

Where is the new frontier for airdrop players? Currently, @SuiNetwork and @berachain seem to provide the answer. By carefully observing the ecosystems of these two emerging public chains, it is not difficult to find that they share the following common characteristics:

High project valuations and large financing scales;

Native tokens of public chains have already landed on mainstream exchanges;

The public chains themselves provide ecological incentives and have strong financial support;

Projects within the ecosystem have generally completed quality financing;

They follow the traditional airdrop model of "low threshold, high return," focusing on zero-cost participation, testnets, and simple staking activities.

Following the trend, we can pay attention to these popular projects on these chains:

• Core protocols in the Berachain ecosystem: @KodiakFi, @InfraredFinance, @beraborrow, @GummiFi, etc.;

• Popular protocols on Sui: @HaedalProtocol, @AftermathFi, etc.

5/5 Choice is greater than effort; be a friend of the cycle.

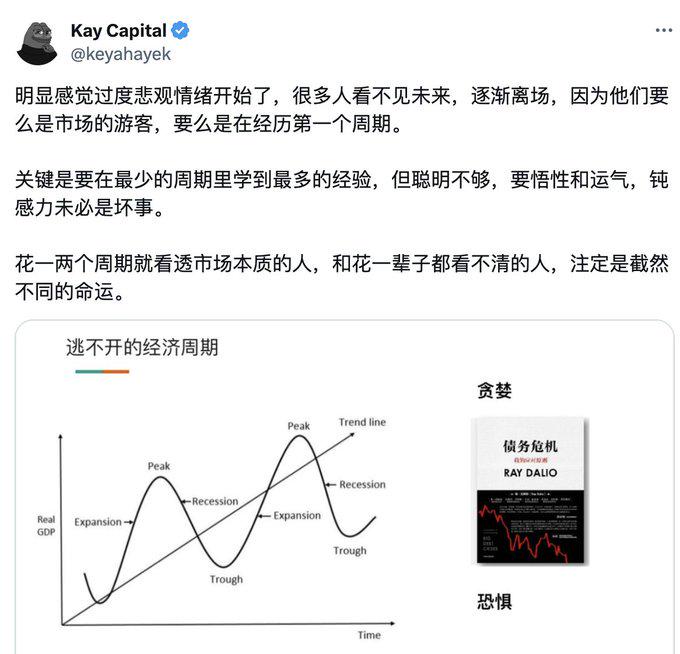

Well-known crypto blogger @keyahayek commented on the power of cycles: "Those who can see through the essence of the market in one or two cycles are destined to have a completely different fate from those who can never see it clearly in a lifetime."

In the cyclical rhythm of the crypto market, both project parties and players experience ups and downs, hoping to gain wealth during the upward cycles, but often stepping on the wrong beat in the rapidly changing market rhythm. However, projects that truly transcend cycles often perform a perfect "deep V" in token prices, providing stable returns to supporters in ecological construction. As an airdrop player, what you need to do from start to finish is actually the same thing:

Patiently wait and enjoy the game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。