Source: Cointelegraph Original: "{title}"

Stablecoins are "creating their own bull market," despite smart contract platforms—including Ethereum and Solana—struggling amid market turmoil, according to asset management firm VanEck in its monthly report last Thursday (April 3).

The decrease in activity on smart contract platforms reflects a cooling of cryptocurrency and its external market sentiment, as traders brace for the impact of U.S. President Donald Trump's massive tariff policies and the impending trade war.

However, the adoption of stablecoins—a key indicator of the overall health of Web3—continues to progress steadily. VanEck's research director Matthew Sigel stated in a post on X (formerly Twitter) last Friday that this is partly due to ongoing macroeconomic uncertainty "potentially accelerating the strategic case for cryptocurrencies."

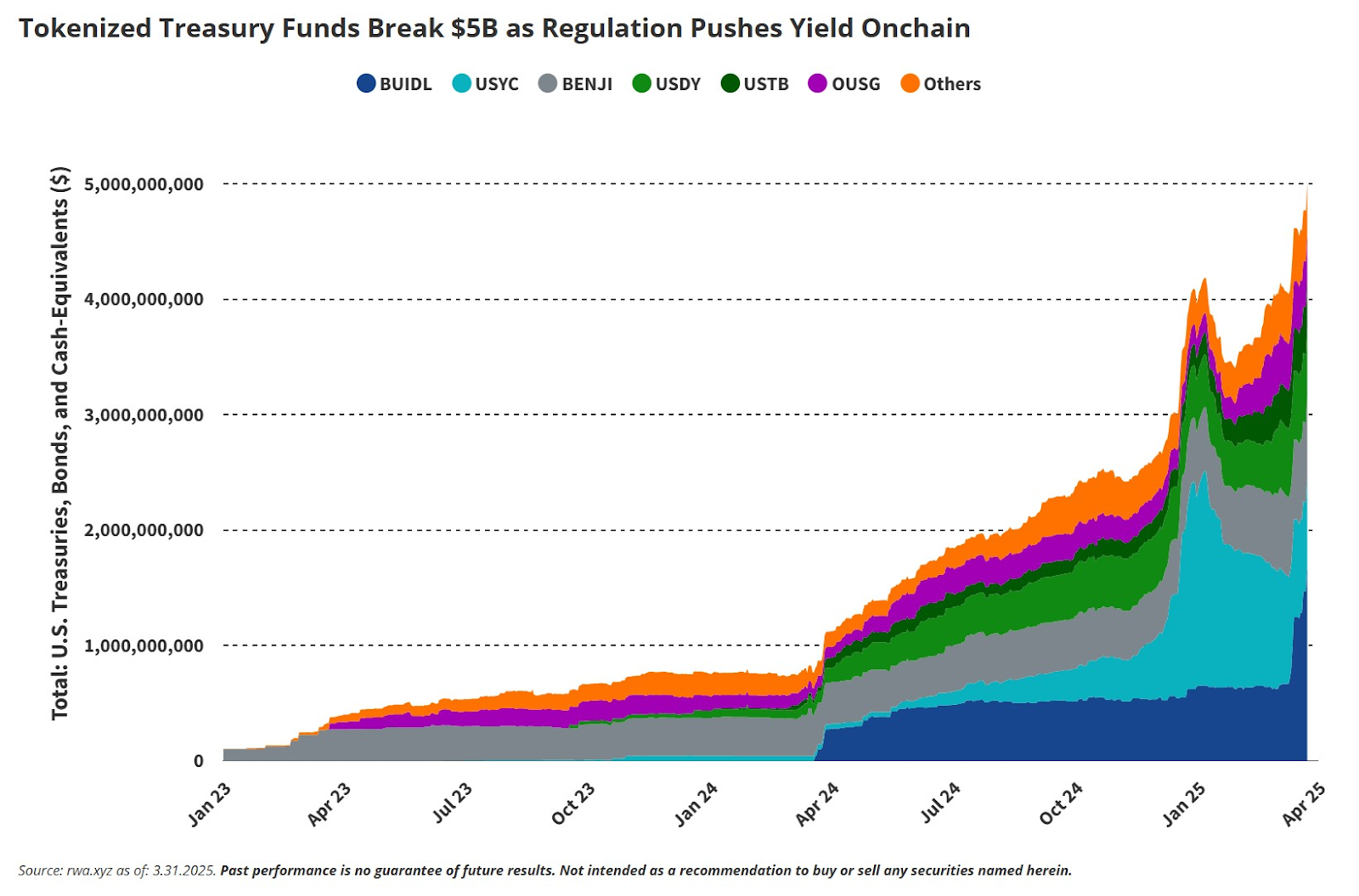

Tokenized treasury bills help support the adoption of stablecoins Source: VanEck

Stablecoins poised for growth

VanEck reported that stablecoins added nearly $10 billion in total market capitalization in March, as several issuers, including VanEck, prepare to launch branded stablecoin products.

Despite a significant drop in average yields for stablecoins, inflows continue, the asset management firm noted.

Currently, the yield on stablecoins is around 3% to 5%—close to or slightly below treasury bills—down from as high as 10% at the beginning of the year, the report stated.

Nevertheless, the issuance of tokenized treasury bills—the main source of institutional stablecoin yields—grew by 26% from February to March, with total issuance surpassing $5 billion, according to the report.

Ethereum, Solana slow down

Meanwhile, activity on smart contract platforms has generally declined, with the report noting that their revenue and trading volume fell by 36% and 40%, respectively.

Solana, in particular, has suffered a more severe blow. VanEck reported that Solana's daily fee revenue and decentralized exchange (DEX) trading volume dropped by 66% and 53% in March, respectively.

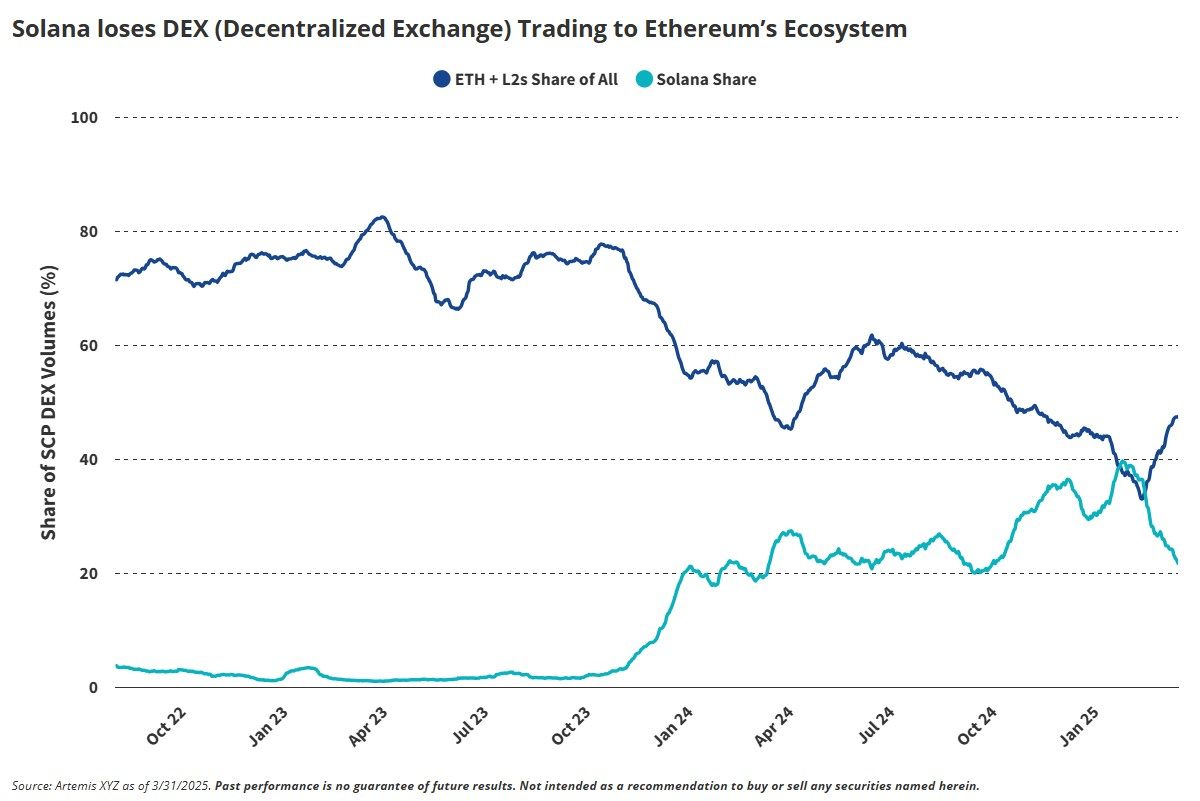

In fact, Solana's share of DEX trading volume has once again fallen below that of Ethereum and its layer 2 scaling solutions (L2s), after briefly surpassing them in February.

Solana loses its lead over Ethereum in DEX trading volume Source: VanEck

This relative decline partly reflects a slowdown in memecoin trading, which still dominates DEX activity on Solana.

Since February, the memecoin sector has been hit hard due to a series of scandals related to memecoins that have worsened retail trader sentiment.

On February 14, the memecoin Libra, seemingly endorsed by Argentine President Javier Milei, erased about $4.4 billion in market capitalization within hours of its launch.

In March, trading volume on Ethereum's layer 2 also saw a decline—falling about 18% from February—but performed better than Solana, VanEck stated.

In the last week of March, Etherscan data showed that the "blob fees" earned by the Ethereum network through layer 2 fell to the lowest weekly revenue level of the year.

Related articles: TRUMP, DOGE, BONK ETF may be approved, but Cathie Wood won't invest: Finance redefined

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。