Cryptocurrency mining machine manufacturers can study and utilize the "American component" rule to produce mining machines that qualify for tariff exemptions and turn their attention to the second-hand mining machine trading market.

Written by: FinTax

1. Trump's New Tariff Policy: Content and Motivation

1.1 Policy Content

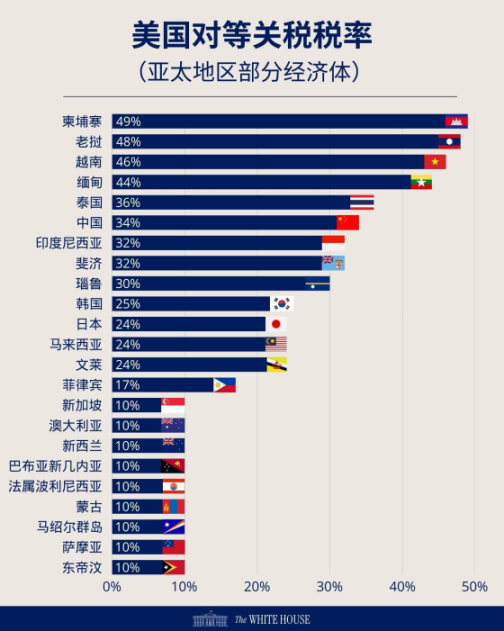

On April 2, 2025, U.S. President Trump signed two executive orders at the White House, announcing that the U.S. would establish a 10% "minimum baseline tariff" on trade partners and impose higher tariffs on certain countries. The displayed tariff rate chart shows that the U.S. has set reciprocal tariff rates ranging from 10% to 50% for countries worldwide, with the UK, Australia, and Singapore at 10%, the Philippines at 17%, the EU at 20%, Japan at 24%, South Korea at 25%, China at 34%, Vietnam at 46%, and Cambodia at 49%… Trump claimed that the new tariff measures aim to promote U.S. manufacturing and "make America wealthy again." The "baseline tariff" rate will take effect on April 5, and the "reciprocal tariff" will take effect on April 9.

The core of this new tariff policy is the so-called "reciprocal tariff." However, the "reciprocal tariff" does not apply in certain cases, including but not limited to: (1) items subject to 50 USC 1702(b); (2) steel and aluminum products, automobiles, and auto parts already subject to Section 232 tariffs; (3) copper, pharmaceuticals, semiconductors, and wood products, certain critical minerals, and energy and energy products listed in the executive order's Annex 2; (4) goods subject to the tariff rates specified in Column 2 of the U.S. Harmonized Tariff Schedule (HTSUS); (5) all goods that may be subject to future Section 232 tariffs; (6) goods from Canada and Mexico that meet USMCA origin rules; (7) the value of American components in goods (American components refer to the value attributable to components produced entirely in the U.S. or based on substantial transformation), provided that the American component is not less than 20% of the value of the goods.

1.2 Motivation Analysis

The White House claims that the new tariff orders aim to address the long-standing trade deficit issue in the U.S. by significantly adjusting tariff policies, creating a fair competitive environment for American businesses and workers. In fact, Trump has aggressively increased tariffs since the beginning of his current term, with economic factors being just one of the motivations:

First, economic factors. The U.S. has long been in a trade deficit position in international trade. According to White House statements, this "has led to the hollowing out of America's manufacturing base, suppressed the ability of the U.S. to expand advanced domestic manufacturing capacity, disrupted critical supply chains, and made the U.S. defense industrial base dependent on foreign adversaries." From an official standpoint, reducing the deficit and revitalizing American manufacturing are the biggest economic factors driving the upgrade of the current U.S. government's tariff policy.

Second, political factors. Trump's voter base primarily consists of blue-collar workers and conservatives, who are also the main victims of the loss of American manufacturing jobs. The Trump administration's use of tariffs to achieve its "Make America Great Again" political slogan is one of its important strategies to cater to voters, fulfill campaign promises, and solidify its electoral base. At the same time, raising tariffs and trade barriers is essentially a means to maintain America's core position in the global political and economic system, using economic measures to achieve political goals.

Third, leadership factors. From a certain perspective, the new tariff policy is related to Trump's business background. Compared to long-term economic planning, Trump prefers to achieve short-term benefits for the U.S. during his term, shaping a "America First" political image, and is therefore willing to use tariffs as "bargaining chips" in international negotiations.

2. How Tariffs Affect the Cryptocurrency Mining Industry

The release of this tariff policy immediately triggered a strong market reaction. On April 2, U.S. stock futures collectively plummeted, and during the collapse of the U.S. stock market, the cryptocurrency market was also not spared. Recently, Bitcoin fell from $88,500 to $82,000, a drop of 3%, while mainstream altcoins like BNB, SOL, and XRP experienced even steeper declines. Aside from the overall impact on traditional financial markets and the cryptocurrency market, the impact of the new tariff policy on the cryptocurrency mining industry deserves special attention.

2.1 Impact of the New Tariff Policy on the Cryptocurrency Mining Industry

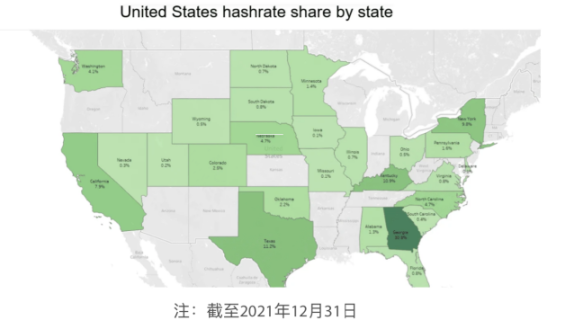

Due to its abundant cheap energy, strong infrastructure, and robust financial strength, the U.S. has become the most important cryptocurrency mining market globally. According to statistics from December 2024, the U.S. accounted for about 36% of the global hash rate, leading by a wide margin, alongside countries like Russia (16%), China (14%), and the UAE (3.75%), shaping the basic structure of the global cryptocurrency mining market. By early 2025, the U.S. share of computing power may have exceeded 40%, even approaching 50%.

The high computing power in the U.S. represents a high demand for cryptocurrency mining machines, while the U.S. is not the main production area for these machines but mainly acquires them through imports. Therefore, in the cryptocurrency mining ecosystem, the main entities directly affected by the tariff policy are the upstream and midstream manufacturers, namely the raw material supply, assembly, and sales of mining machines. The raw material supply involves chips, materials, and other components. As the main component of mining machines, chips mainly come from South Korea's Samsung and Taiwan's TSMC, while related materials are mainly supplied by manufacturers in China and Southeast Asia. Regarding the assembly of mining machines, due to labor costs and other factors, China and Southeast Asia have undertaken the vast majority of assembly work due to their cheap and abundant labor. However, these countries and regions are all included in the reciprocal tariff collection areas, with tariffs in Cambodia, Laos, and Vietnam even approaching 50%. This enormous tariff will create a lose-lose situation for U.S. cryptocurrency miners and mining machine manufacturers: on one hand, tariffs will directly raise the import prices of mining machines, compressing the U.S. market for machine manufacturers and weakening their profitability in the primary market. For an already slowing mining machine manufacturing industry, this is akin to another heavy and lasting blow. On the other hand, this portion of tariff costs will also be passed on to U.S. cryptocurrency miners, significantly increasing their operational pressure. Especially considering that since Bitcoin's price has been continuously declining from its peak of $100,000, various cryptocurrencies have also been on a downward trend, and the profit margins for various cryptocurrency miners have already been significantly reduced. If mining machine prices rise, some miners may face a situation where expenses exceed income, forcing them to shut down their mining operations. Furthermore, if the number of miners, as blockchain nodes, decreases too much, the processing efficiency and security of the blockchain will also be threatened, fundamentally negatively impacting the entire cryptocurrency industry.

2.2 Exemptions and Uncertainties

The reciprocal tariff policy has several exemption scenarios, particularly including exemptions for certain semiconductors and U.S.-made products, but these scenarios are difficult to apply to the cryptocurrency mining machine manufacturing industry. First, the Trump administration has coordinated the tariff schedule (HTS) system, assigning different customs codes to different products to specify the applicable tariffs for specific products, and the annex it announced that is not subject to the new tariffs only lists a small portion of HTS codes in the semiconductor field, while the chip models required for mainstream mining machines do not belong to this list. Second, according to the so-called American component rule, if the components manufactured in the U.S. account for more than 20% of the total value of the product, it can theoretically constitute an "American component" and be exempt from reciprocal tariffs. However, the U.S. has never been a major production area for cryptocurrency mining machines; whether it is chips, other components, or assembly, all are completed in regions subject to tariffs, making it difficult for mining machine manufacturers to obtain exemptions through this rule.

In addition, the uncertainty of the tariff policy is also worth noting. Currently, many countries have indicated that they will respond to the U.S. tariff policy with retaliatory tariffs and other countermeasures, such as China, Australia, and Canada. For example, the Tariff Commission of the State Council of China announced that starting April 10, 2025, it would impose a 34% tariff on all imported goods originating from the U.S., taking actual countermeasures. At the same time, some countries have taken a conciliatory attitude; facing the high tariffs from the U.S., Vietnam proposed to reduce tariffs on U.S. goods to 0%, and Cambodia proposed to reduce them to 5%, with both sides agreeing to continue negotiating on bilateral agreements related to tariffs. After a series of political negotiations, the implementation of the tariff policy may change. According to the logic of reciprocal tariffs, if relevant countries (especially in Southeast Asia) lower their tax rates on the U.S., they may secure certain tax exemptions, thereby reducing the overall impact of the tariff policy on the cryptocurrency mining industry, which may be a glimmer of hope in a bleak outlook.

3. Breaking the Deadlock: How the Cryptocurrency Mining Industry Can Respond

3.1 Ineffectiveness of Traditional Response Strategies

In terms of responding to tariff barriers, the effectiveness of traditional trade diversion strategies may be significantly diminished. After the start of the China-U.S. trade war in 2018, Chinese companies had previously used transshipment trade through Southeast Asian countries like Vietnam and Thailand or shifted production capacity to mitigate the adverse effects of tariffs, and the mining machine manufacturing industry was no exception. However, the scope of this "reciprocal tariff" policy is unprecedented, essentially a global tax increase, and the Asia-Pacific region, as an important production capacity transfer area, has almost "fallen completely," making it particularly difficult to reroute to other regions unaffected by tariffs. As for the practice of directly underreporting mining machine prices during customs declaration to reduce tariff expenditures, it carries significant compliance risks; if discovered, it could lead to hefty fines or even criminal risks.

As the world's largest mining market, the U.S. has numerous cryptocurrency miners and corresponding demand for mining equipment. Since Trump's new tariff policy has increased production costs for U.S. cryptocurrency miners, could not purchasing mining machines and mining outside the U.S. become a viable survival strategy? After all, before China's mining ban in 2021, more than two-thirds of global cryptocurrency mining activities were concentrated in China, and the migration of miners from China to the U.S. has already shown that the cryptocurrency mining industry does not have absolute path dependence. In fact, choosing to deploy mining operations in other countries or regions has its pros and cons. The most direct benefit is to avoid the risks of Trump's tariff policy. On the downside, first, companies need to bear the additional uncertainties of relocating and rebuilding mining sites; second, since the U.S. has abundant electricity resources, mining outside the U.S. while using expensive electricity or adopting computing power leasing and other production models will cause miners to lose their economic cost advantage; third, and most importantly, the U.S. has a friendly regulatory attitude, a good rule of law environment, and a prosperous cryptocurrency market, which can greatly ensure the stability and sustainability of the cryptocurrency mining industry, reducing the black swan risks brought by policy uncertainties.

3.2 Some Exploratory Response Measures

In addition to hoping for Trump to "change his mind" and adjust the tariff policy for specific regions, cryptocurrency miners and mining machine manufacturers may also seek response measures from the following two aspects:

First, cryptocurrency miners can turn their attention to the second-hand mining machine trading market. Tariffs involve import and export issues, and conducting second-hand mining machine transactions within the U.S. does not require paying tariffs. Miners can quickly deploy mining sites and meet current computing power growth needs by purchasing second-hand mining machines. However, the prices of second-hand mining machines fluctuate significantly, are highly non-standard, and their performance may be outdated, which may not meet mining needs.

Second, cryptocurrency mining machine manufacturers can study and utilize the "American component" rule to produce mining machines that qualify for tariff exemptions. As mentioned earlier, considering that Trump's current term has just begun and the political objectives of tariffs, the U.S. tariff trade barriers may continue for several years. At this time, short-term avoidance measures may be ineffective, and long-term compliance measures need to be considered. Unlike traditional origin rules, the 20% "American component" threshold set by this tariff aims to lower the barriers for manufacturing to return to the U.S. and encourage foreign companies to transfer high-value-added segments (such as R&D and core component production) to the U.S. Under this rule, without considering other factors and risks, cryptocurrency mining machine manufacturers can seek domestic alternatives for high-tariff components like chips or separate IP companies from manufacturing companies to increase the American component of mining machines. For example, foreign cryptocurrency mining machine manufacturers can collaborate with U.S. semiconductor manufacturers to develop mining machine chips or procure chip modules tested in the U.S. (such as TSMC's Arizona factory), thereby counting the chip costs towards the U.S. origin value, increasing the proportion of American components in mining machines, and thus avoiding tariffs. Additionally, they could consider establishing a technology holding company in the U.S. to hold core patents for mining machine chips, algorithms, etc., and then authorize foreign cryptocurrency mining machine manufacturers to produce chips and machines, but this plan carries certain tax risks and needs further evaluation in specific applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。