Recent signals from the Federal Reserve suggest that they may begin to ease monetary policy later this year, particularly in the government bond market.

Compiled by: Deep Tide TechFlow

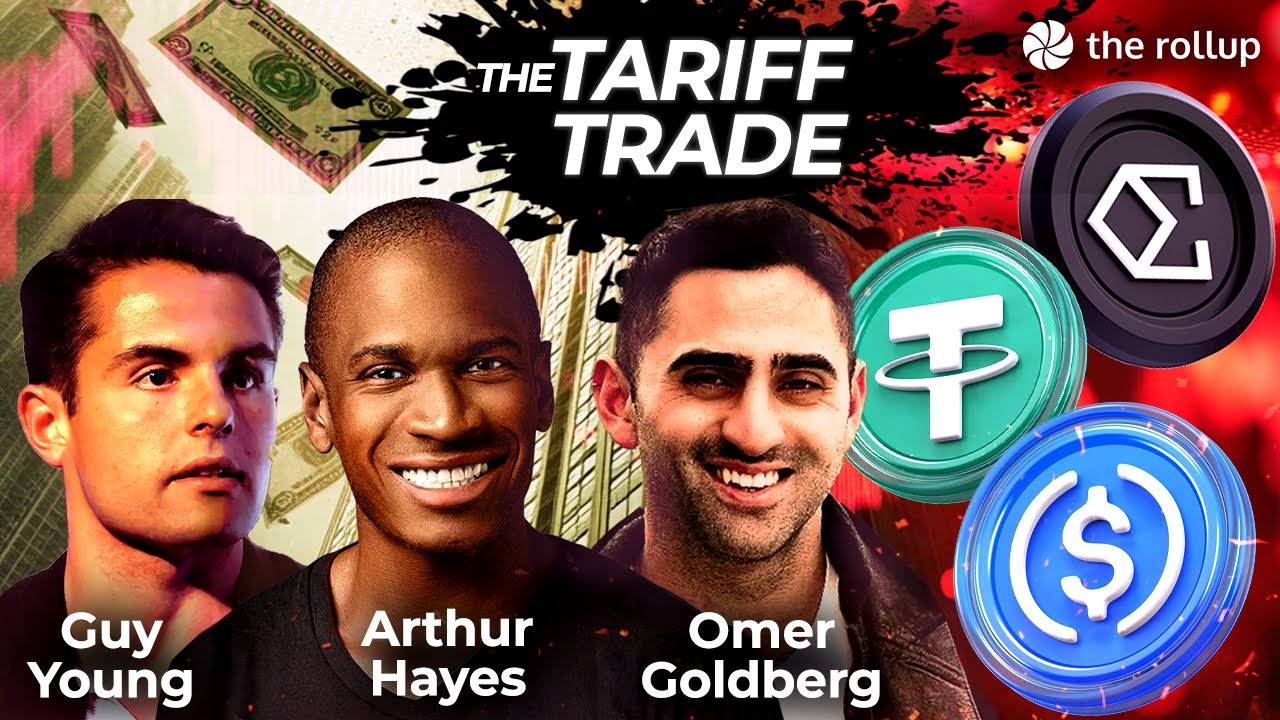

Guests: Guy Young, Founder of Ethena; Arthur Hayes, Chief Investment Officer (CIO) of Maelstorm; Omer Goldberg, Founder of Chaos Labs

Hosts: Robbie; Andy

Podcast Source: The Rollup

Original Title: How To Position For The Institutional Crypto Frenzy with Arthur Hayes, Guy Young, and Omer Goldberg

Broadcast Date: April 4, 2025

Key Takeaways

In today's episode, we invited Guy Young, Founder of Ethena, Arthur Hayes, Chief Investment Officer (CIO) of Maelstorm, and Omer Goldberg, Founder of Chaos Labs, to discuss the current competitive landscape of the crypto industry. We focused on the macroeconomic environment affected by tariffs and explored how Ethena's Converge announcement positions it at the intersection of decentralized finance (DeFi) and institutional finance.

Guy shared Ethena's journey from USD+ stablecoin to building a proprietary blockchain. He noted, "If your product doesn't consider how to leverage institutional capital flows, it's hard to carve out a space in the market." He also revealed plans to inject $500 million in seed funding for the upcoming iUSDE product.

Arthur Hayes candidly assessed the competitive landscape between Circle and Tether. He stated: "Circle's distribution capabilities are limited, primarily relying on Coinbase, and it lacks competitiveness in net interest yield; whereas Tether has a clear advantage." He also shared insights on the differences in trading practices between the East and West, and how these differences impact the development of institutional finance.

Additionally, we discussed changes in the macroeconomic environment, including Trump's tariff policies and the Federal Reserve's monetary policy. Arthur explained why he has reallocated assets into Bitcoin and believes that market liquidity is gradually recovering.

Highlights

Expectations of global monetary easing make me more optimistic about market prospects.

Stablecoins are not just for Americans; they exist for those who want a dollar bank account but cannot obtain one.

One of the biggest opportunities in the current cycle is how to bring institutional funds on-chain.

The advantage of cryptocurrencies and Bitcoin lies in their price movements, which can be explained by a very simple logic—we just need to focus on whether the supply of fiat currency is increasing globally, such as the dollar, euro, and pound.

Countries around the world will implement more fiscal and monetary stimulus to counteract the tariffs imposed by Trump on different nations.

If market conditions require, the Federal Reserve will not hesitate to intervene and adjust policies. If a similar crisis arises in the future, such as market volatility due to tariff issues leading to a 40% drop in certain stocks or major traders nearing bankruptcy, the Federal Reserve may act immediately without waiting for a formal meeting.

Central banks in every country will print money because they believe it is necessary to offset the negative impacts of these tariffs, whether due to inflation, poor performance of some American companies, or European companies unable to sell as many goods—these are merely excuses for central banks and treasuries to print money.

The main use cases in the crypto space can be summarized into two: one is speculation, such as trading meme coins; the other is dollar settlement and asset tokenization.

We need to find a balance between openness and pragmatism, maintaining a certain level of transparency and flexibility in the system while providing necessary safeguards in extreme situations.

Recent signals from the Federal Reserve indicate that they may begin to ease monetary policy later this year, particularly in the government bond market. Meanwhile, Europe may support military spending by printing euros; China is waiting for the U.S. to act, after which it may undertake larger-scale monetary easing; and the Bank of Japan is already in a predicament, and I expect they will re-engage when a crisis occurs in the Japanese government bond market.

Guy and Omer's Background

Andy:

Hello everyone, welcome back to The Rollup. Today is American Liberation Day, and I'm not sure if your portfolios feel liberated, after all, we have a very volatile president.

Before we dive in, could you please introduce yourselves briefly? Let's start with Guy, and talk about Ethena and the recent developments with Converge.

Guy Young:

Before joining Ethena, my professional background was primarily in traditional finance. I worked at a hedge fund focusing on analyzing financial companies, including banks, payment service providers, and lending institutions. In 2020, I started getting involved in cryptocurrencies, initially participating in market speculation as an ordinary investor. But soon, I decided to fully commit to this industry and began building my own project. The inspiration for this idea came from an article Arthur published in early 2023 titled "Dustin Crust." He mentioned that there are huge opportunities in this field and elaborated on why the market needs such assets. That article inspired me deeply, as if I had found my mission. So, I resigned from my previous job, assembled a team, and launched our first product about 13 months ago. Over the past year, our asset scale has grown from zero to over $6 billion, making us the fastest-growing dollar asset in the cryptocurrency space. That's the story of Ethena.

Andy:

Omer, could you briefly introduce the core business of Chaos Labs?

Omer Goldberg:

I founded Chaos Labs about four years ago. We are a platform focused on decentralized risk management. Our core technology is an engine that combines AI and simulation capabilities, currently supporting several well-known applications, including Aave, GMX, Jupiter, Ether, Pyth, Renzo, and others. We provide data services such as real-time financing rates, interest rates, liquidation thresholds, and liquidation balances. If you've used these applications, you may have indirectly interacted with our products. Additionally, I am honored to collaborate with Ethena to develop some new products, such as the reserve proof oracle, which is a new tool for verifying asset reserves.

Impact of Tariffs on the Cryptocurrency Market

Robbie:

Arthur, perhaps you can provide us with some background from a macroeconomic perspective. You have mentioned the Federal Reserve, the White House, and management's views on Powell and the Fed's fiscal dominance in your recent articles. You also noted that tariffs have a limited impact on the cryptocurrency market compared to the stock market. So, given today's market dynamics, has your viewpoint changed? Or how do you see the current macroeconomic backdrop?

Arthur Hayes:

My viewpoint hasn't changed much. Looking at the market data now, Bitcoin's price was at $89,000 and has now dropped to around $82,000, which is clearly a direct response to the tariff policies. I've spoken with some trading friends, and there isn't a clear number for expectations regarding these tariffs, but the measures introduced by the Trump administration seem worse than people imagined in the worst-case scenario. This has already been reflected in market prices.

However, I believe the advantage of cryptocurrencies and Bitcoin lies in their price movements, which can be explained by a very simple logic—we just need to focus on whether the global supply of fiat currency is increasing, such as the dollar, euro, and pound. If that is the case, then prices will rise, so I think this is just a short-term pain. We may retest Bitcoin's level of $76,500 to see what happens at that level. Even if the price drops below that, I will continue to buy. Therefore, I think now is a great buying opportunity.

Central banks in every country will print money because they believe it is necessary to offset the negative impacts of these tariffs, whether due to inflation, poor performance of some American companies, or European companies unable to sell as many goods—these are merely excuses for central banks and treasuries to print money. They have been telling us in less explicit ways, and Bloomberg and other relevant publications are also saying that these tariffs are very negative. Therefore, we need to provide some form of stimulus to the economy. So I expect countries around the world will implement more fiscal and monetary stimulus to counteract the tariffs imposed by Trump on different nations.

Andy:

Personally, I feel that the U.S. has basically reluctantly accepted tariffs over the past few decades as a form of soft power, with the dollar as an extension of the global reserve currency.

**Guy, from the perspective of stablecoins, especially in a low-interest-rate environment, how do you view the market in the next six to nine months? Goldman Sachs predicts there may be three rate cuts in the future. What impact do you think this will have on the stablecoin market, Ethena's **business model, and the entire crypto market?

Guy Young:

I think this will create interesting bidirectional effects. Generally, when interest rates decline, speculation in the crypto market increases, and demand for crypto bubbles also rises. In the last cycle, when interest rates dropped to zero, we increased the supply of stablecoins by about $100 billion. In fact, there is a counterbalancing factor here, with both sides having an impact. The difference between Ethena and Circle is that Ethena's product interest rates are usually negatively correlated with real-world actual interest rates, which may be Ethena's strongest feature. Because when interest rates decline, people will speculate more on cryptocurrencies and seek more leverage in the crypto market.

Ethena entered the market during a period of high interest rates, which indeed posed some challenges. However, when interest rates declined in the fourth quarter of last year, we found that market financing rates actually increased by an average of about 14%. This was the moment when Ethena's products demonstrated their competitiveness. In contrast, Circle's revenue significantly decreases with each rate cut. For example, for every 100 basis points (1%) drop in interest rates, Circle's revenue could decrease by about $400 million. Ethena's rates, on the other hand, rise with increased demand for stablecoins while benefiting from the overall decline in interest rates. Therefore, if there are indeed three rate cuts in the future, I would feel very optimistic about it.

Circle's Distribution Dilemma

Arthur Hayes:

You probably wouldn't consider investing in Circle's IPO, would you?

Andy:

I'm also pondering this question. Given these seemingly contradictory data, should we maintain an optimistic attitude or be cautious?

Guy Young:

To be honest, I am quite shocked by these numbers. There is a great chart that compares the supply and profitability of Tether and Circle side by side. Tether's profit this year is about $14 billion, while Circle's profit is just over a million. So even though their supply is similar, the gap in profitability is an order of magnitude different.

Arthur Hayes:

That's true. I believe Circle is facing a serious distribution dilemma. Circle's products are very "Americanized," and American users do not really need dollar stablecoins because they already have payment tools like Venmo and Cash App, making dollars readily available to them. In contrast, the users who truly need dollar bank accounts are in other parts of the world, such as China and emerging Asian markets, which are Tether's strongholds, while Tether's performance in the U.S. is relatively weak. Circle, as an American company, relies on Coinbase to distribute its products. To attract users, Coinbase has to offer yields to compete with Tether, while Tether itself relies on a stronger distribution network and does not need to attract users through yields.

Thus, Circle's strategy is to allocate a portion of its yields to Coinbase, which then passes these yields on to users holding Circle stablecoins. This model leads to Circle's strong dependence on its distribution network. I believe that in the future, Coinbase is likely to acquire Circle, but only when Circle's valuation is low enough. Therefore, I see significant issues with Circle's IPO. The lack of independent distribution capability forces Circle to rely solely on Coinbase, and in terms of net interest margins, they cannot compete with Tether. For American users who already have dollars, Circle's stablecoin is not a particularly attractive option. Therefore, if we are talking about dollar-backed stablecoins, Tether is clearly a superior product and will continue to lead over Circle in the future.

Andy:

Omer, do you have anything to add?

Omer Goldberg:

Overall, I believe the changes in the stablecoin market are reflected not only in supply but also in their actual applications and the various applications we collaborate with. The market landscape is evolving rapidly. What surprises me is that Ethena and Guy's project has only been established for 13 months, yet it already feels like it has been around for a long time. We can see that many stablecoins that were previously considered the "holy grail" are experiencing changes in market share regarding distribution, liquidity, and actual use at a pace far exceeding expectations.

Therefore, continuous innovation is particularly important. Companies need to constantly seek new application scenarios and explore how to more efficiently deliver these use cases to users. As for Circle's S1 filing (the IPO application), I think it also demonstrates their intention to push for innovation. Although there are many challenges, this is also an opportunity for them to explore new directions.

Follow-up Impact of Tariff Policies

Robbie:

I want to quickly follow up on the business model and explore the potential impact of tariff policies in conjunction with the macroeconomic background. It is well known that these tariffs could lead to severe inflation. If no rate cuts are implemented, the situation could worsen. Of course, rate cuts might be one way to address this issue. However, there is also a viewpoint that suggests more economic pain may be necessary, and long-term treasury yields could rise. So, Arthur, from your perspective, how likely is this situation to occur? If it does happen, Guy, how would you respond at Ethena to a significant rise in treasury yields?

Arthur Hayes:

Federal Reserve Chairman Jerome Powell has clearly stated that the Fed believes the impact of tariffs on inflation is only temporary. Therefore, even if inflation rates reach 4%, 5%, or even higher, they consider it a short-term phenomenon that is not sufficient to change their inclination towards loose monetary policy. This means that the Fed may not adjust its policy stance due to inflation caused by tariffs. However, if U.S. treasury prices fall and yields rise, the Fed may have to take action. For example, they might eliminate the supplementary leverage ratio requirements for banks and initiate quantitative easing for treasuries, as the U.S. government cannot bear a 4.5% or 5% yield on ten-year treasuries, especially with total debt already at $36 trillion and continuing to grow.

Guy Young:

From our perspective, even if interest rates rise by 75 basis points from the current level, our growth last year was still very strong. Therefore, I believe that even with a slight increase in interest rates, we can maintain growth, although the pace may slow down. If interest rates decline, our growth potential will be even greater.

In the past six months, we launched a new product called USTTB, which provides us with greater flexibility. This product is essentially a simple wrapper designed around Blackrock's Biddle fund. Today, Ethena is the largest holder of Biddle in the crypto space, with about 70% of our beta products included in our regular stablecoins. The advantage of this product is that it can provide flexibility based on changes in market cycles, allowing us to decide the proportion of these products filled with dollars. In the current low-interest-rate environment, financing costs have dropped to the lowest level in the past 18 months. We can choose some stablecoins backed by Biddle, which offer normal yields while meeting market demand. Therefore, as long as interest rates in the crypto market rise, the dollar will be better positioned to capture this growth opportunity.

Andy:

If interest rates decline, we will gain more speculative opportunities. Ethena seems to occupy a very advantageous position in the entire stablecoin market. Is this statement reasonable?

Guy Young:

This project indeed has certain reflexive characteristics because it has experienced significant market volatility, especially in the growth curve. If you observe the growth curve of USD, you will find it exhibits an unstable trend: it rapidly increased by $3 billion, then stabilized over a few months, and subsequently increased by another $1 billion as interest rates rose. This growth curve is not continuously stable but is filled with dramatic fluctuations and relatively gentle adjustments. However, I believe this is almost by design; it is one of the most reflexive assets in the crypto market.

Even in the growth of the last fourth quarter, we did not truly integrate in many places. At that time, we only had centralized exchange listings on ByBit, and since then we have added four centralized exchanges. We collaborated with OMA to launch the RB product, listing USD, where there is a very interesting leverage cycle strategy in large-scale situations. Unfortunately, OMA restricted us, limiting our ability to maintain safety. Therefore, I believe that market could have reached $3 billion to $5 billion, and we responsibly collaborated with OMA to elevate it to $1.5 billion. But the reason I provide this context is that as the market returns now, we should position ourselves well in multiple areas, and I believe we can grow further.

Omer Goldberg:

I believe we are now in a better position. In the past, industry participants like Aave still needed to manually update all protocols. However, today we have introduced risk oracles that can respond to market changes in real-time, with frequency and efficiency far exceeding previous capabilities. This allows us to quickly seize opportunities as they arise while slowing down when necessary to manage risks more safely. I believe this was a major limiting factor in the last market cycle, where we had to prepare for the worst-case scenario because any changes to the protocol would take at least a week.

Since launching Edge in collaboration with AAVE, I believe we will soon be able to achieve a more flexible PT market in the core Ethena market, while also making similar progress in the derivatives market. This will further enhance our competitiveness and market adaptability.

Strategies for Responding to Market Volatility

Robbie:

Omer, when the market experiences significant volatility, what kind of chain reactions will the risk oracle mechanism you mentioned produce? You also mentioned the application of AI in this context. What does the system's response look like in such volatile situations?

Omer Goldberg:

This question can be analyzed from several angles. First, I want to describe the role of AI in risk management. When we first started our business, risk models primarily relied on quantitative signals, such as market trading volume, price volatility, liquidity, and depth indicators. However, what truly drives market price fluctuations is often news events. When breaking news occurs, we are now able to respond faster than ever before.

For example, in the case of stablecoins, a typical example is the peg issue with USDC. We previously mentioned Circle's situation, which occurred during the collapse of Silicon Valley Bank (SVB). At that time, panic in the market led to a massive sell-off of USDC as users rushed to buy USDT. There was uncertainty in the market regarding the stability of USDC's peg and whether Circle had the capacity to reimburse users. Such black swan events (extremely rare but impactful occurrences) may have a low probability of happening, but as risk managers, we must always consider such scenarios because our primary responsibility is to protect users' funds while ensuring that the protocol operates normally.

Two years ago, we realized that governing each parameter individually was not the direction of the future. This is why we built the Edge oracle protocol. It truly plays a role during such times.

As Arthur mentioned earlier, the tariff policy announced by Trump today, the decline in interest rates, and the increase in speculative activities could trigger significant volatility in small and mid-cap tokens. Without secure real-time infrastructure support, many applications can only adopt conservative strategies or even suspend certain operations. The Edge oracle not only provides security for platforms like Abe, GMX, and Jupiter but also helps them capture market opportunities more flexibly, including traffic, trading volume, and fee income. In the past, these opportunities often went unrealized due to security issues, but the situation has changed significantly now.

Ethena's Collaboration Model with Institutions

Andy:

Guy, I think this has a significant impact on your risk strategy, especially when designing a product that is both resilient and sustainable. Recently, you announced the Converge project, which has garnered considerable attention, particularly with Trump's proposal for "World Free Finance" and the push from large institutions in New York and Washington.

Before diving into Converge, could you discuss Ethena's interactions with institutions and regulators in Washington and New York? What progress has been made in collaborating with these institutions and regulators on "World Free Finance," stablecoins, oracles, and DeFi projects?

Guy Young:

Our engagement with U.S. regulators has been relatively limited, focusing more on creditors and professional institutions. My view of the current macro environment is that there has been almost no new capital inflow in this market cycle, except for a slight increase in Bitcoin ETFs and Tether supply. If you look at the total value locked (TVL) in DeFi, you'll find that funds are merely shifting from one chain to another, such as from Ethereum to Solana and then from Solana to parallel chains. Overall, on-chain products have not attracted significant new capital.

We believe that Ethena's products are very attractive to institutions in the traditional finance (TradFi) sector. For instance, if you can offer a product with minimal volatility and an annualized return of 18%, the potential demand far exceeds $5 billion and could reach hundreds of billions. I think we have seen similar products in the last market cycle, although the outcomes were not ideal, we learned one thing: as long as a product can provide structurally higher returns, it can attract a wide range of investors, whether they are retail investors in Southeast Asia or Blackrock in New York.

Currently, many institutions are contemplating their next steps after ETFs. Many companies have formed teams of 30 to 50 people specifically to explore how to integrate on-chain financial products with traditional finance. We are also collaborating with these institutions to launch stablecoins and other on-chain solutions that meet their needs.

Guy Young:

However, I believe the bigger opportunity lies in how to export unique products from the crypto space to the traditional financial market, rather than simply adopting traditional financial products. To this end, we launched a product called IUSD. I mentioned it a few months ago in our roadmap. IUSD is essentially a tokenized dollar security that comes with basic identity verification (KYC) and permission management requirements. Through this design, we transform it into a format that can be widely accepted by traditional financial institutions. In the next 10 days, we will announce our first distribution partner, who plans to invest $500 million, which is clearly a very significant investment.

Guy Young:

This shows us the enormous potential that such a product can achieve under the right conditions. As long as the infrastructure is built properly, the scale can be further expanded. This is also a key focus for us right now. If your product does not adequately consider how to benefit from the inflow of institutional capital, you may fall behind in the market. If you are only focused on reallocating existing funds within DeFi, you are missing out on larger opportunities. We believe we are currently in a very favorable position to offer institutions highly attractive products.

I think this makes you realize how large this scale can become under the right conditions, as long as you build these infrastructures correctly. This is the theme we are focusing on. I believe that if you are sitting here now and your product has not considered how to benefit from the inflow of institutional capital into this space, you may be somewhat behind. If you are only focused on reshuffling the same funds within DeFi, we believe we are in a reasonable position to provide them with a very interesting product.

Andy:

Arthur, are you concerned that the entry of these institutions will take away your market share? As a participant that has performed well in the crypto market over the past few years, do you think the arrival of these institutions will make the market more efficient and mature, or will it increase the complexity of basic trading, thereby weakening your competitive advantage?

Arthur Hayes:

I think, ultimately, the primary task of any institution is to protect its own interests. For example, ByBit once experienced a significant loss of up to $1.5 billion. Fortunately, the founder Ben personally took on that loss. But if you are a hedge fund manager in the U.S. or Western Europe, you would feel very uneasy exposing yourself to the risks of an Asian exchange while engaging in basic trading. Because the worst-case scenario is that you convince your boss to allow you to participate in crypto trading, and then the exchange suddenly collapses, leading to massive losses.

Therefore, these institutions typically choose only a few trusted trading venues, such as CME or Coinbase. While this may compress the basic trading opportunities on these platforms, there is still a huge arbitrage space globally, especially between exchanges that are not strictly regulated in Western Europe and the U.S. This gap provides more opportunities for both ordinary investors and institutions. I believe this will make crypto trading more interesting, as there will be more liquidity supporting complex bilateral trades.

Guy Young:

I want to add to Arthur's point. I believe that different types of institutions have different risk appetites when entering the market. The gap between CME and Binance that Arthur mentioned is very typical. If you observe the basis spread between CME and Binance, there is about a 700 basis point difference. This indicates that many institutions are unwilling to take on credit risk. However, for some smaller hedge funds, they are more willing to take on these risks in exchange for higher returns.

As for whether more capital entering the market will reduce market inefficiencies and lower interest rates, I believe this is an inevitable process of market maturation. When faced with inefficiencies in the market, the correct approach is not to ignore them but to think about how to profit from them. This is precisely Ethena's goal. We believe that the current leverage costs in the crypto market are too high, and the annualized returns on cash and arbitrage should not be as high as 18%, but should be below 10%. In the future, a large amount of capital will flow into the market, trying to address these inefficiencies, and we hope to be a core force driving this change.

Omer Goldberg:

I want to add from another perspective. As Arthur and Guy mentioned, the autonomy and risk-taking ability of individual traders in the crypto market remain a significant advantage. However, a notable change in this market cycle is that, with the latest advancements in AI technology and the introduction of new trading tools, ordinary traders can now access information in real-time that was previously unavailable. While this information symmetry may not apply to every trade, it certainly exists in many cases. If you can effectively leverage this information, it comes back to the question of risk management: are you willing to take action? Therefore, I believe that even as the market matures, there will still be plenty of opportunities waiting to be explored.

Differences in Trading Approaches Between East and West

Robbie:

Arthur, I heard you recently received a pardon from Trump. However, you mentioned that you tend to adopt an Eastern Hemisphere mindset when trading. What are the significant differences in risk management between Eastern and Western traders?

Arthur Hayes:

The differences in trading approaches between East and West mainly lie in the degree of institutionalization. The U.S. is the core region for global capital formation, and Western Europe also has some participation. If you look back at modern financial history, you'll find that many of the most successful hedge funds were born in the U.S., such as Ren Tech, Millennium, and Point72. The operational models of these funds have become benchmarks for global emulation.

In the Western financial system, institutional investors, such as pension funds and endowments, typically pursue low volatility and stable returns, such as 7% to 12% annually. Hedge funds like Millennium, which manage hundreds of billions, only need to provide stable returns to be considered successful. This investment philosophy limits the range of choices for institutions, making them more inclined to participate in markets with deep liquidity and low risk, such as the financial markets in New York. In contrast, the high volatility of the cryptocurrency market deters many Western institutions because they cannot explain to their investors why they would incur massive losses in an unfamiliar market.

Guy's product is designed to address this issue. He simplifies the trading process and offers low-volatility investment options, such as an annualized return of 15%, while clearly outlining risks and providing detailed risk management solutions. This approach aligns better with the investment framework of traditional institutions. On the other hand, high-volatility trades, such as arbitrage between decentralized and centralized exchanges, may offer returns of 30%, 40%, or even 50%, but the risks are also very high. This trading model is unacceptable for large institutions.

The conservative attitude of Western institutions actually presents opportunities for individual investors and small to mid-sized funds in the crypto space. Due to reputational risks, large companies cannot enter certain markets, while individuals and small institutions can seek high-return investment opportunities globally, thereby creating significant alpha returns.

Andy:

By the way, did you meet with Trump? What procedures are involved in obtaining a pardon?

Arthur Hayes:

No, I did not meet with Trump. I cannot go into detail about the specific process, but it is a very standard procedure. We submitted the application, got lucky, and ultimately received the pardon. I am very grateful for the government's support for me, my partners, and the company, but there is nothing particularly special about it.

Andy:

We won't delve into other topics anymore. Guy, let's talk about Converge. I think it's a very interesting project, and you released a related announcement two weeks ago. The idea you proposed at Ethena for this has actually been promoted in the market for over a year. Many technologies do not fully operate in what you call the execution environment but have undergone various tests and practices on Ethereum.

We have a theory about dedicated chains, believing that designing a technical architecture for specific use cases is crucial. Whether it is an application chain or a single or multi-application chain, these choices are very specific. When running on general infrastructure, there are often some issues, such as the "noisy neighbor" phenomenon, high gas fees, and poor user experience. Additionally, technologies on general chains are difficult to customize deeply, while customization is a significant advantage of launching one's own chain.

Based on this theory, you decided to choose your own chain when building this project, and the logic behind it is simple: **the biggest opportunity lies in institutions entering the chain. We believe there are two major directions in the current market: one is speculation, such as 24/7 trading, *DeFi* investments, meme coins, and other on-chain activities; the other is infrastructure development for stablecoin settlement and payments.** Your collaboration with Security Tokens seems to be very active in this area and has had a significant impact. So, before delving into the technical details, could you share your decision-making process? Some Ethereum supporters might question, "Have they abandoned Ethereum? Is this a vampire attack?" Please discuss your thought framework over the past three to six months and why you chose this direction.

Guy Young:

Of course. From a macro perspective, the value you mentioned is precisely the starting point for us to launch this project. I agree with your point that the main use cases in the crypto space can be summarized into two: one is speculation, such as trading meme coins; the other is dollar settlement and asset tokenization. Ethereum has lost its advantage in the speculation space because most speculative activities have shifted to other chains, such as Solana. However, Ethereum still dominates the stablecoin space, which is also the starting point for Ethena and the preferred platform for institutions entering the chain.

However, I want to challenge one viewpoint: while institutions have indeed launched many projects on Ethereum, their assets may ultimately flow to other chains. For example, there have been recent reports of an institution moving assets to Solana. This is not determined by Ethereum itself but by stablecoin issuers and tokenized asset issuers. In other words, it is us who choose the destination of these assets.

The role of Security Tokens in the market is very interesting. They are clearly the preferred tokenization partners for Blackrock, aiming to bring not only government bonds but also various assets on Earth onto the chain and build financial infrastructure around them. We believe that the collaboration between Ethena and Security Tokens presents a unique opportunity to bring traditional financial (TradFi) assets onto the chain while leveraging the DeFi ecosystem to create new value.

Guy Young:

What’s more interesting is that Ethena is packaging crypto-native assets into a format that is more easily accepted by traditional finance, thereby attracting capital into the crypto market. At the same time, Security Tokens are working to bring traditional financial assets onto the chain and explore future development possibilities. This combination creates a very broad design space, such as the dedicated exchange created by Arthur. We believe it is unreasonable for ordinary users to trade single stock options on Robinhood; these markets will ultimately shift to more suitable chains.

Overall, we believe that one of the biggest opportunities in the current cycle is how to bring institutional capital onto the chain. We have a unique positioning in the stablecoin and tokenized asset space. If you believe in the long-term goals of crypto, you will trust that the proportion of speculative activities should gradually decrease, while stablecoins and tokenized assets will become the core of the future. Although the main use of the market currently remains speculation, we believe that as the market matures, these emerging assets will occupy a larger market share, and we are in a key position for this transformation.

Potential Development Directions for Institutional Chains

Andy:

Arthur, do you think there will be chains specifically designed for institutions in the future? Will this become a key entry point for institutions to enter the chain?

Arthur Hayes:

I hope so. If that’s the case, the assets I hold will also benefit from appreciation. But frankly, we cannot accurately predict which solution institutions will ultimately choose. I think it is unrealistic to try to predict this. However, what is certain is that asset management companies like Larry Fink want to optimize their products through tokenization, but they are not satisfied with the current distribution and trading methods. They prefer to control the entire trading process and bring the profits earned by exchanges back to their own platforms; for example, Blackrock might even completely bypass exchanges.

If Guy and others' vision can be successfully realized, then traditional financial exchanges may gradually be eliminated, and all trading will shift onto the chain. After all, in the internet age, everyone can connect to the global network through a computer; why rely on traditional paper-based processes? The infrastructure we are building aims to achieve decentralized trading on a global scale.

For asset management companies like Blackrock, while they currently rely on traditional financial frameworks, they also want to reduce intermediary costs, especially those institutions that act as gatekeepers for trading. They could easily establish their own decentralized exchanges, fully controlling the entire process from product design to trade execution. I believe this is the direction that large asset management companies like Blackrock are pursuing. I hope we can invest in technologies that drive this change and participate in building blockchain protocols that support disintermediation.

Guy Young:

I want to add that we sometimes overestimate the clarity of these institutions' decision-making. In reality, they are just focused on selling products. For example, when Blackrock launches a government bond product, they ask, "Who wants this?" If someone wants to buy it on Solana, they will provide it; if it needs to be issued on Avalanche, they will do that too. For them, these are just sales channels.

It is important to note that these products are essentially completely centralized. If a chain has issues, they can easily move to another chain to reissue. Therefore, decentralization is not their main focus. However, when it comes to their own funds and balance sheets, they will be more cautious. They need to ensure there are mechanisms to address potential risks, such as rolling back transactions or complying with regulatory requirements. This is completely different from the products they sell.

Currently, institutions' activities on the chain are mainly to promote new products rather than directly invest in on-chain assets. For example, Ethena decided to store the $1.5 billion in assets we manage on our own chain, which is entirely based on our considerations of asset security and efficiency; external opinions do not influence our decisions.

Omer Goldberg:

I think there is another important trend. Over the past decade, innovation in the fintech space has been relatively limited because it relies on inefficient traditional infrastructure. Many startups have focused more on user interfaces rather than underlying technology.

However, in the past three years, the infrastructure for stablecoins has made significant progress. Now, even in the U.S., users can easily connect stablecoins to bank accounts and freely circulate between different chains. This has opened the door for many new consumer applications, such as smarter savings accounts, which were difficult to achieve three years ago. Converge is a great example, but in reality, these features can be implemented on any chain, bringing tremendous flexibility to the market.

Therefore, we now have enough tools and conditions to develop products that truly attract ordinary users, not just loyal users from the crypto community. These users may not care about the ideology of decentralization, but they need a better product experience, and we are in the best position to meet this demand.

Robbie:

The market also seems to recognize this direction. Today, there was news that DTCC (Depository Trust & Clearing Corporation) announced the launch of a new application chain aimed at improving the liquidity and trading speed of collateral while facilitating the integration of traditional and digital assets. DTCC processes up to $30 trillion in transactions annually, and they are now exploring similar directions. What do you think about this? If this trend continues, will you face more competition? After all, the scale of this market is measured in trillions of dollars.

Guy Young:

The direction you mentioned is correct, but the actual implementation may differ. I believe the best technical architecture has not yet fully formed, but it may be a permissioned blockchain that allows anyone to enter and interact. Fundamentally, it cannot be completely closed; otherwise, our efforts here would lose their meaning. However, if you observe chains like Base, it is actually a highly permissioned blockchain because if Base's sequencer decides not to process certain transactions, those transactions cannot go through. This is a situation controlled by a single entity.

One scenario I envision is that if you have an environment similar to Base, but the validation process is completed by 10 to 20 participants. These participants could be the largest asset management companies or centralized exchanges globally, or other key stakeholders. This way, if a $1.5 billion hacking incident occurs and the victim is Blackrock's funds, you can roll back the transaction through the sequencer to avoid significant losses.

Of course, this mechanism may raise some controversies, especially those who adhere to decentralization principles may not accept it. However, the reality is that many on-chain systems already have similar centralized control mechanisms. I believe we need to find a balance between openness and pragmatism, allowing the system to maintain a certain level of transparency and flexibility while providing necessary protective measures in extreme situations. This design can not only attract more institutions to participate but also bring more stability and security to the entire ecosystem.

Andy:

I feel that the beauty of building a blockchain is that even if you have developed a very successful application, there is still room for further exploration around the infrastructure, providing you with a broad range of options. I think part of the reason for choosing to leave L1 (Layer 1 network) and launch your own chain is to better adapt to your specific use cases. At the same time, there are also other completely decentralized, censorship-resistant blockchain environments in the market, such as Bitcoin, which is a good example, right? But your goal is not to build another L1 like Bitcoin or Ethereum, but to create a chain tailored to specific ideas and technical needs. Therefore, I think you want to find a balance between "permissioned" and "permissionless" and design corresponding risk management and rollback mechanisms based on different situations.

Guy Young:

I completely agree with your view. Another question worth considering is whether we need to maintain an obsession with "decentralization" all the time. If we closely examine on-chain activities, most of them are actually centralized stablecoin trading and meme coin speculation. These scenarios do not require nation-level decentralization, right? I believe that for these use cases, 10 validator nodes' servers are already sufficient.

In fact, the market's pursuit of decentralization may be somewhat excessive. If we observe currently well-performing projects, such as Hyperliquid, their user experience and functionality are closer to centralized exchanges; for example, last week's Ethena, which has close cooperation with centralized exchanges and custodians; and Pump Fun, which is also a centralized exchange settled on-chain. These examples indicate that the market is willing to compromise on the degree of decentralization for a better product experience. Therefore, we should focus on building higher-quality products from the start rather than being overly attached to certain ideologies.

Robbie:

If you adopt an architecture with 10 validator nodes, it would actually be more decentralized than many popular L2s (Layer 2 networks) today.

Market Overall Trend Analysis

Andy:

I want to temporarily step away from the topic of Converge and return to the broader state of stablecoins, cryptocurrencies, and the speculative market. Arthur, two months ago, I participated in a podcast in Hong Kong with Akshatt. He mentioned that you were preparing for Trump's sell-off, and it turns out that was indeed the case. It seems you are also gradually reducing your positions in preparation for all of this.

In your recent article, you mentioned that you have started reallocating funds to the crypto space. What does this mean for the market? How do you see the overall market trend developing in the future? Is it the participation of institutions that reignited your interest, or did macroeconomic changes trigger your decision? What direction do you think the market will take next?

Arthur Hayes:

As I mentioned earlier, the key lies in liquidity. I was skeptical about future liquidity policies, especially during the period between Trump's election and his official inauguration.

The market currently generally believes that the Federal Reserve will not continue to print money, but I think the opposite is true. **Recent signals from the Federal Reserve suggest that they may begin to ease monetary policy later this year, especially in the treasury market. Meanwhile, Europe may support military spending by printing *euros*; China is waiting for the U.S. to act and may then undertake larger-scale monetary easing; and the *Bank of Japan* is already in a predicament, and I expect they will re-enter the Japanese government bond market when a crisis occurs.** Therefore, this expectation of a loosening of global monetary policy makes me more optimistic about the market outlook. The current market is also gradually increasing its allocation to crypto assets.

We are currently mainly focused on investing in Bitcoin. I believe Bitcoin's market dominance is gradually rising, while investors in the altcoin market are not yet ready to re-enter. I expect that when Bitcoin's price breaks through $110,000, market sentiment will significantly improve, and more investors will start to pay attention to other coins, and we will participate at that time.

My optimism mainly comes from Bitcoin's positive response to changes in fiat currency creation expectations, and I believe this trend will continue from now until the end of the year.

Robbie:

You mentioned that quantitative easing is an important factor. Recently, Federal Reserve Chairman Powell hinted at this in a meeting. We may need to wait another month to a month and a half for the next Federal Reserve meeting. He may announce a rate cut, or he may not. You also mentioned adjustments to the strategic leverage ratio; can he take action between meetings, or must he wait for a formal meeting to make decisions?

Arthur Hayes:

The Federal Reserve Chairman can absolutely take emergency action outside of meetings. For example, last year, they held an emergency meeting on a Sunday evening to announce the Bank Term Funding Program and stated they would print $4 trillion.

Therefore, if market conditions require it, the Federal Reserve will not hesitate to intervene and adjust policy. If a similar crisis arises in the future, such as tariff issues causing market volatility, certain stocks plummeting by 40%, or some large traders nearing bankruptcy, the Federal Reserve may take immediate action without waiting for a formal meeting. Thus, I believe there is no need to overly rely on the meeting schedule. However, at the next meeting in May, I expect they will further clarify how to reduce quantitative tightening policies, including how to handle the maturity of mortgage-backed securities and treasuries, as well as the potential impact of tariffs on inflation. If these tariffs are not lifted, the Federal Reserve may take corresponding policy adjustments.

Feasibility Discussion on Institutional Issuance of Stablecoins

Robbie:

I have a macro question I want to discuss, mainly revolving around the impact of liquidity injections. Typically, we ask whether such injections promote liquidity or reduce the overall liquidity of the system. Aside from the impacts of tariffs, Doge, and Elon, there is another pending question: the $10 trillion in treasury bonds planned for issuance at the end of Biden's term needs refinancing. So, when we refinance this $9 to $10 trillion in debt, will it have a positive or negative impact on overall liquidity?

Arthur Hayes:

Strictly speaking, it is neither positive nor negative, but rather a neutral impact. The government must do this; after all, the New York government will not default on its obligations, and the key lies in what interest rate they will refinance at. If the interest rate is too high, they may need support from the Federal Reserve or the banking system to lower rates by purchasing more treasuries to avoid higher financing costs. Currently, the average interest rate on U.S. treasuries is about 3.3%, while the yield on ten-year treasuries is around 4.1% to 4.2%. If the entire debt were refinanced at current rates today, interest expenses would significantly increase, which would be very unfavorable for the fiscal deficit. Similar to Trump's economic plan, the government needs to take certain measures, such as getting foreign investors to buy more treasuries or having the Federal Reserve print money, or having the banking system intervene. These are all possible solutions, but the key is how to get investors to be willing to buy these treasuries at negative real interest rates.

Robbie:

The current state of liquidity injections is that funds typically start generating from the top of the system and then flow downstream in layers, such as through loans for redistribution. Stablecoins are currently at the bottom of this structure; even if institutions like Blackrock issue stablecoins, they still occupy a lower tier. Is it possible to see stablecoins gradually rise in this tier, such as large institutions issuing stablecoins on-chain?

Arthur Hayes:

It's like banks issuing their own dollar stablecoins on the blockchain.

Robbie:

Yes, for example, some organizations or state governments, like Wyoming, could potentially issue their own stablecoins? Whether state or nationally supported, or even sponsored by the Federal Reserve, is such a stablecoin realistic?

Guy Young:

I think it is possible; I just have a pessimistic view on whether these traditional financial institutions can gain market share in the crypto space. I think PayPal is a good example; you could say that PayPal's existing products are essentially a private blockchain, as they are just moving PYUSD within their own accounting system.

Although they are doing well, their scale is still far less than even one percent of Tether. This indicates that entering the crypto ecosystem and gaining market share is very difficult, and the market structure is a key issue. For example, USDT (Tether) has become the primary pricing unit for centralized exchanges, with almost all trading pairs associated with USDT. No one will turn to other stablecoins for a 4% treasury yield because market participants value trading efficiency and liquidity more. **You either have to provide higher liquidity than Tether or pay a higher **yield, or else you will struggle to compete. This is also Ethena's strategy: we will not try to compete directly with Tether on liquidity or yield but will look for opportunities in other innovative areas.

I believe that if you are funding or launching a new stablecoin issuance, and that stablecoin is merely backed by treasuries, I think that is a waste of time, energy, and money.

Omer Goldberg:

Nevertheless, I think many institutions will still try this approach. For example, today I heard the CEO of Bank of America say they would issue stablecoins as long as it is legally permissible. From my discussions with large financial institutions, almost everyone is considering this issue. For them, it is indeed a cheaper and more efficient solution. Especially in the U.S., more and more users are starting to use payment tools like Venmo, which is impacting traditional banking.

Omer Goldberg:

So I think they will try, but as Guy said, whether they can succeed is another question. However, this attempt does have the potential to become a "holy grail," and if successful, it will have a huge market impact.

Arthur Hayes:

I think this situation mainly occurs in the U.S. For U.S. users, stablecoins can indeed provide a cheaper and more convenient way to transfer dollars. But this is not Tether's core business. Tether's main markets are in places like Shanghai, Hong Kong, and Buenos Aires, where JPMorgan and Bank of America can hardly enter. Therefore, stablecoins are indeed beneficial for U.S. users, but their impact on the global cryptocurrency market is limited.

Robbie:

Unless these stablecoins can break through closed systems, their impact on overall liquidity will not be positive either.

Arthur Hayes:

That's right. Unless stablecoin issuance involves loans and credit expansion, their impact is limited. If they only provide a new payment tool, like a substitute for Venmo, that has no substantive impact on the overall market.

Robbie:

Will the SLR (Strategic Leverage Ratio) exemption have an impact on the partial reserve mechanism of stablecoins?

Arthur Hayes:

The SLR exemption mainly allows banks to purchase treasuries without additional capital investment, which has no direct relation to stablecoins. Banks can use the SLR exemption to buy treasuries and create credit, thereby increasing profitability. If rising interest rates lead to falling bond prices, they can classify these bonds as "held to maturity" assets and ignore the losses. This is a common operational method.

Guy Young:

Last week, I saw a research report discussing what would happen if a large amount of bank deposits in the U.S. flowed into stablecoins. This is actually a very dangerous situation because the entire partial reserve system relies on deposits from commercial banks. If deposits shift to a one-to-one supported model like stablecoins, the lending capacity of banks would be severely affected, and the entire credit system could collapse.

Arthur Hayes:

This is also why the Federal Reserve opposes such a situation. If stablecoins become a banking model that does not engage in lending, merely accepting deposits and paying yields, this would be fatal for the partial reserve banking system.

Andy:

Yes, this is also an important part of the stablecoin legislation. I believe it will advance this month or by the end of May. Although this may be favorable for the stablecoin market, it may have a greater impact on USDC, while Tether seems less affected.

Arthur Hayes:

It doesn't matter. This is a U.S. issue; stablecoins do not exist for Americans; they exist for those who want a dollar bank account but cannot obtain one. The U.S. issue is about dollar bank accounts. The application of stablecoins merely makes transfers cheaper, perhaps saving you a few dollars in transfer fees each month. This is good for the voting demographic, but I think for crypto traders, whether it’s the "Genius Act" or some other legislation, I haven’t read any of them, it doesn’t matter, yield or no yield, who cares? It’s just a tool to allow Americans to transfer dollars within their system more cheaply, and it won’t affect you.

Robbie:

**The barbell effect that Andy mentioned, one side is speculation, the other is payments. Can stablecoins serve as a tool for extending credit, further *leveraging* the entire system?**

Arthur Hayes:

The question is who will bear the risk. The advantage of partial reserve banks is that when they encounter problems, the state will bail them out. But private stablecoin issuers do not have that guarantee. If they go bankrupt, no one will bail them out. In this case, stablecoins cannot extend credit like traditional banks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。