Source: Cointelegraph Original: "{title}"

An Ethereum investor holding a large position on the decentralized finance (DeFi) lending platform Sky was liquidated for over $100 million as the price of Ethereum (ETH) plummeted.

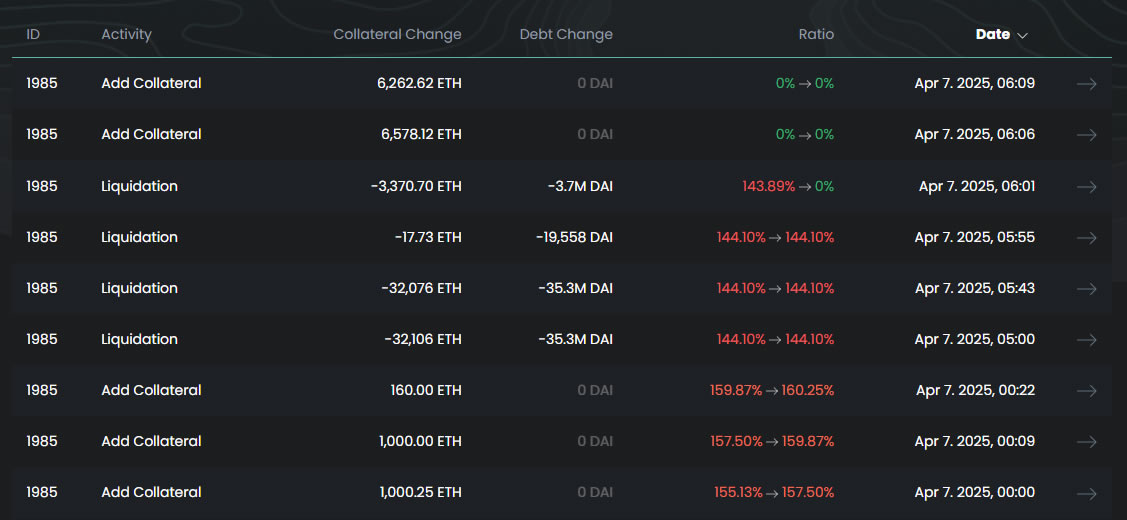

The Ethereum whale lost 67,570 ETH, worth approximately $106 million, when the asset dropped about 14% on April 6, leading to the liquidation of their collateralized debt position on Sky, as recorded by the Maker Vaults browser DeFi Explore and monitored by Lookonchain.

The Sky lending protocol (renamed from Maker in August) is used by DeFi participants to create collateralized debt positions by providing cryptocurrency (in this case, ETH) to borrow the platform's stablecoin DAI.

The system employs an over-collateralization ratio, typically 150% or higher, meaning users need to deposit at least $150 worth of ETH to borrow 100 DAI.

The protocol automatically monitors the value of ETH collateral relative to the borrowed DAI, and if the value of ETH drops and the collateralization ratio falls below the minimum requirement, the position faces liquidation risk.

When the ratio dropped to 144% due to the plummeting ETH price, the whale's position was liquidated.

ETH whale liquidation. Source: DeFi Explore

At the same time, Spot On Chain reported that another whale, who provided 56,995 wrapped ETH (worth approximately $91 million) to borrow DAI, is also facing liquidation risk.

In a liquidation event, Sky seizes the ETH collateral and repays the borrowed DAI and fees through an auction. After the debt is repaid, any remaining collateral is returned to the user.

In the past 24 hours, the price of ETH has dropped 14.5%, falling to $1,547 at the time of writing, as U.S. President Trump's tariff policies triggered a market sell-off, leading to a widespread decline in the cryptocurrency market.

The last time ETH fell to such a low point was in October 2023, when the cryptocurrency was still in a bear market, nearly a year after the collapse of the FTX exchange.

ETH is still down 68% from its all-time high in 2021, and if it continues to decline, more DeFi users will face liquidation unless they can provide additional collateral.

According to CoinGlass, 320,000 traders were liquidated in the past 24 hours, with losses nearing $1 billion. Data shows that most of the liquidations in the past 4 hours were ETH positions.

Related: Kalshi traders believe the probability of a U.S. economic recession in 2025 exceeds 61%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。