Market sentiment has reached one of the most pessimistic levels in history.

Author: The Kobeissi Letter

Translation: Deep Tide TechFlow

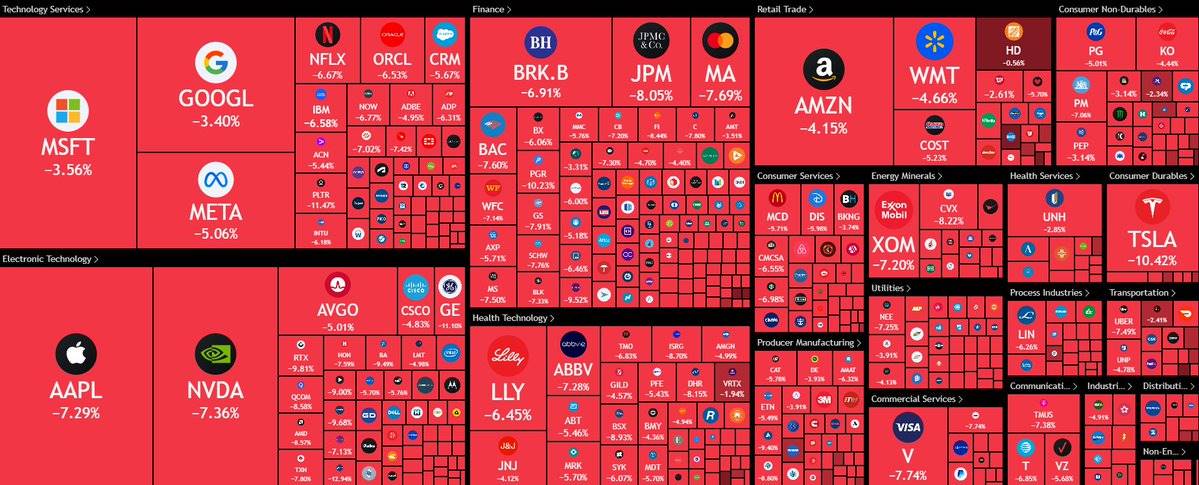

Today, U.S. stock market futures fell again, with S&P 500 futures down by -22%, officially entering bear market territory.

Over the past 32 trading days, the U.S. stock market has averaged a daily evaporation of $400 billion in market value.

Is it time to "buy the dip" in stocks?

Just 32 trading days ago, the S&P 500 index hit an all-time high of 6147 points.

In the timeline below, we will explain how the S&P 500 has evaporated over 1300 points in 32 trading days.

This is a crash similar to March 2020, with market sentiment reaching one of the most pessimistic levels in history.

Key Time Points:

12:00 PM Eastern Time: The crypto market began to decline.

5:00 PM: The decline accelerated sharply, with about $200 billion in market value evaporated. We see this as a clear signal that risk-averse trading is intensifying again.

6:00 PM: U.S. futures markets opened down 6%.

So, what has changed since Friday?

More accurately, what has "not" changed since Friday—President Trump doubled down on his trade war stance.

Before Friday's close, investors were hopeful for signs of a trade agreement over the weekend.

However, the result was complete silence, and the market reacted with extreme dissatisfaction.

Just now, President Trump responded to the stock market crash:

The S&P 500 index is expected to drop 15% in three days, one of the largest three-day declines in modern history.

His response was: "Sometimes you have to take your medicine."

In other words, short-term pain for long-term gain.

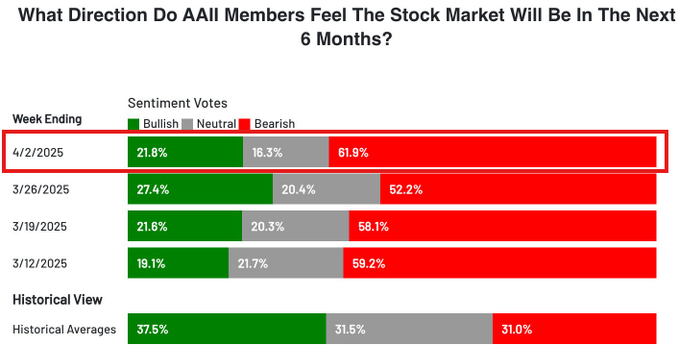

The latest market sentiment survey (AAII Sentiment Survey) further reveals the pessimism:

Only 21.8% of investors are optimistic.

61.9% of investors are pessimistic, the third-highest reading in history.

Only March 2009 and October 1990 had higher levels of pessimism.

It is worth noting that these survey results were mostly collected before April 2.

Today's market observation: Panic sentiment surges, market enters extreme state

Today, the volatility index futures ($VIX) soared to above the peak of August 2024.

We have been shorting the S&P 500 index for weeks and referred to the previous S&P 500 decline as an "orderly correction."

But now, this decline no longer appears orderly, and panic sentiment has reached extreme levels.

The market may be on the verge of a bottom rebound.

A significant bottoming signal?

Even safe-haven assets like gold have seen sharp sell-offs.

Before Friday, gold had surged due to tariff uncertainties.

But today, gold prices have fallen back below $3000 per ounce, indicating that investors are rapidly exiting the market.

Panic sentiment is intensifying again.

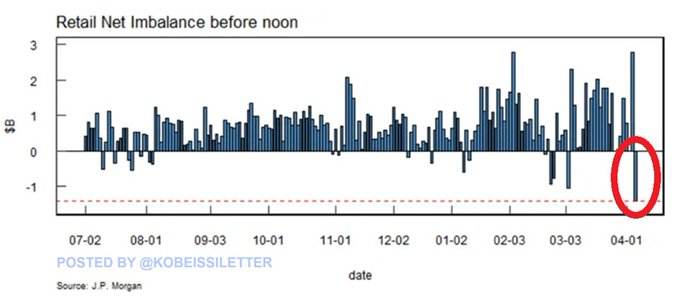

On Friday, between 9:30 AM and 12:00 PM Eastern Time, retail investors sold $1.5 billion in stocks.

This is the largest sell-off recorded in a 2.5-hour period in history.

Since 2022, retail investors have been steadfastly buying the dips, but this trend seems to be rapidly reversing.

The massive withdrawal of institutional capital combined with a large amount of cash moving off the market has further exacerbated the sharp decline.

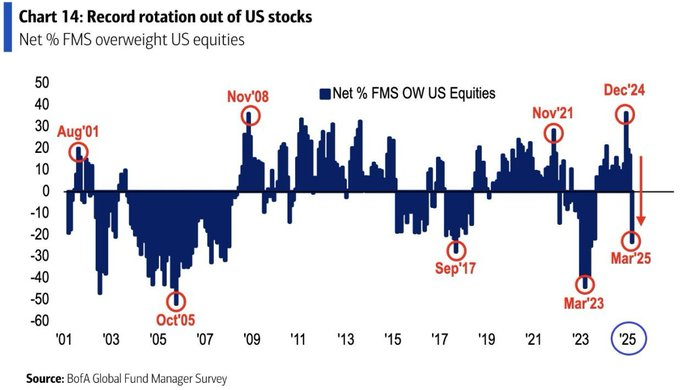

March 2025 marks the most severe rotation of institutional capital out of U.S. stocks in recent years.

Now, retail investors have also joined the selling wave, accelerating the market's decline.

The market has now digested a large amount of negative news

During the recent 15% decline of the S&P 500 index, we have not seen any "breathing rebound."

Any short-term news about reaching a trade agreement with major trading partners or delaying tariffs could trigger a 5%+ rebound.

The balance of risk and reward is shifting.

Summary of the current market situation:

The S&P 500 index has dropped sharply over 32 trading days;

The crypto market has also joined the sell-off after a stable week;

Gold has fallen sharply due to investors fleeing the market;

The volatility index ($VIX) has surpassed the August 2024 peak;

Both retail and institutional capital are withdrawing;

The market has priced in a large amount of negative news.

While this is not a prediction of a long-term bottom, we emphasize that the market needs a breathing rebound.

Even in the most severe bear markets, there will be a rebound of 5% or more.

A "healthy" bear market requires breathing rebounds to sustain market momentum.

We have been shorting the market for several weeks, but this has now become an overcrowded trading strategy.

Current market sentiment is polarized, with panic levels nearing those of March 2020, indicating that more volatility is likely ahead.

Our subscribers are capitalizing on these fluctuations for profit.

Ultimately, it all comes down to one core question: Will Trump's tariff policy persist in the long term?

If the answer is yes, then the U.S. will inevitably face a severe economic recession.

If the answer is no, then the current market will represent a historic buying opportunity.

Follow us @KobeissiLetter for real-time analysis and updates!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。