Dragging the global economy into chaos, his role as a driving force is indisputable, but whether the cost of this war is worth it remains unknown.

Written by: Deep Tide TechFlow

The global financial market is being swept by a sudden cold wave.

After Trump announced his extreme policy of imposing "reciprocal tariffs" on almost all trading partners, panic in the global capital markets reached its peak:

On April 7, as of 10 PM Eastern Time, S&P 500 futures fell by 5.98%, Nasdaq 100 futures dropped by 6.2%, and Dow Jones futures decreased by 5.5%.

The Asian market was even more filled with risk-averse sentiment, with the Nikkei index plunging by 8.9% in the morning session. The Taiwan Weighted Index plummeted nearly 10% after a two-day holiday, with major stocks like TSMC and Foxconn experiencing trading halts.

The cryptocurrency market was also not spared.

Investors watched helplessly as their assets shrank, with the red lines on crypto trading screens serving as alarms, signaling a larger turmoil ahead.

Data from CoinGlass shows that the liquidation amount in cryptocurrencies has surged to about $892 million, including over $300 million in long and short positions in Bitcoin.

BTC has dropped to around $77,000, while ETH has fallen to $1,500.

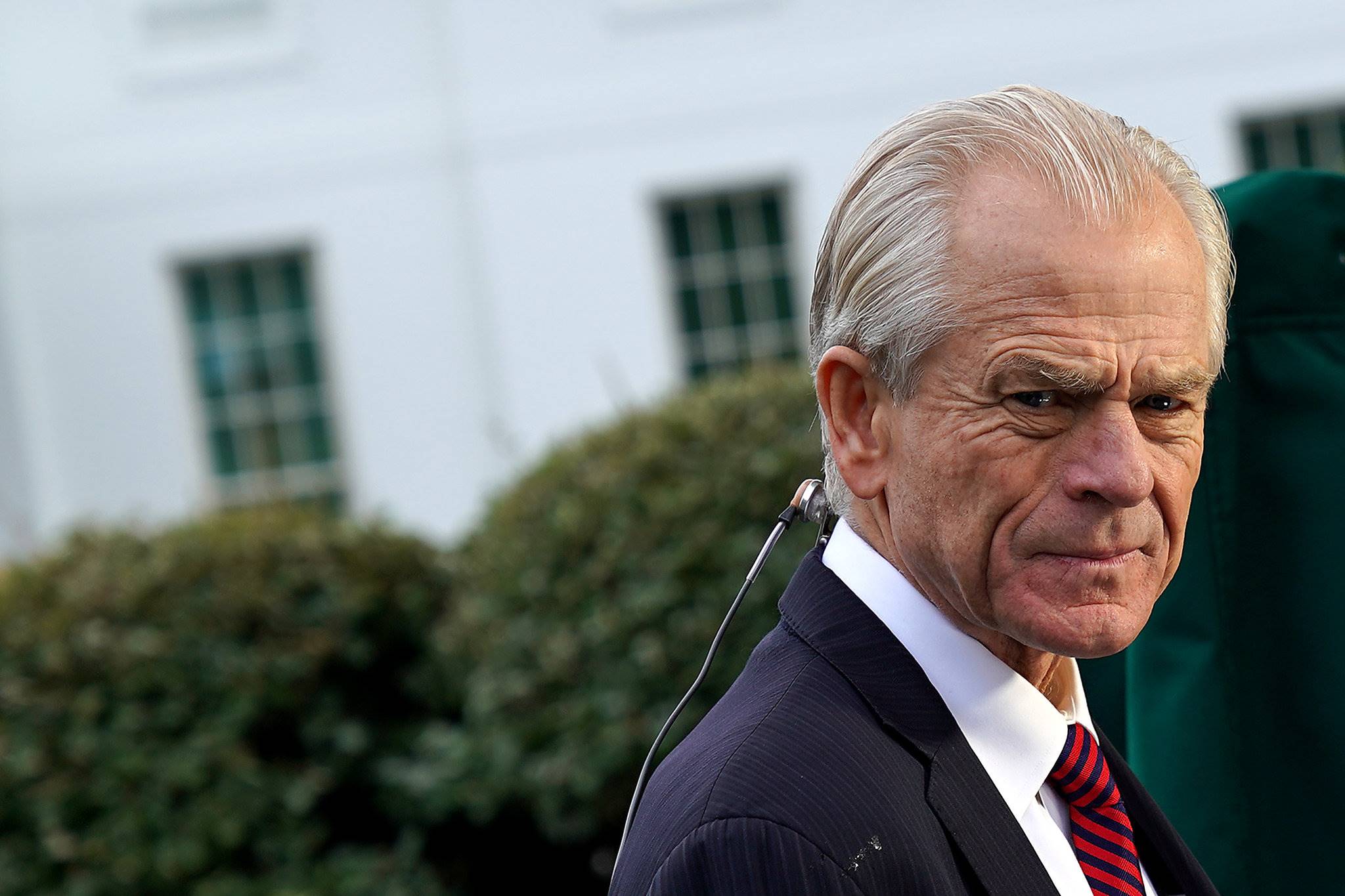

The trumpet of trade war has sounded again, and at the center of it all is Trump’s senior trade advisor, Peter Navarro.

On April 6, Navarro appeared in an interview on Fox News.

He attempted to soothe investor sentiment, playing a laughable game of linguistic art during the interview:

"The primary principle, especially for small investors, is this — unless you sell your stocks now, you won't lose money. The wise strategy is not to panic and hold on."

Unrealized losses are not losses; not selling means no loss.

It’s hard to imagine that such ineffective consolation, reminiscent of a psychological victory, could come from a seasoned presidential trade advisor and university economics professor.

This statement clearly failed to calm the market's anxiety, instead drawing attention to him — this Harvard PhD, mockingly referred to as a "non-mainstream economist," seems not only to be a spokesperson for policy but also an undeniable driving force behind extreme trade protectionism.

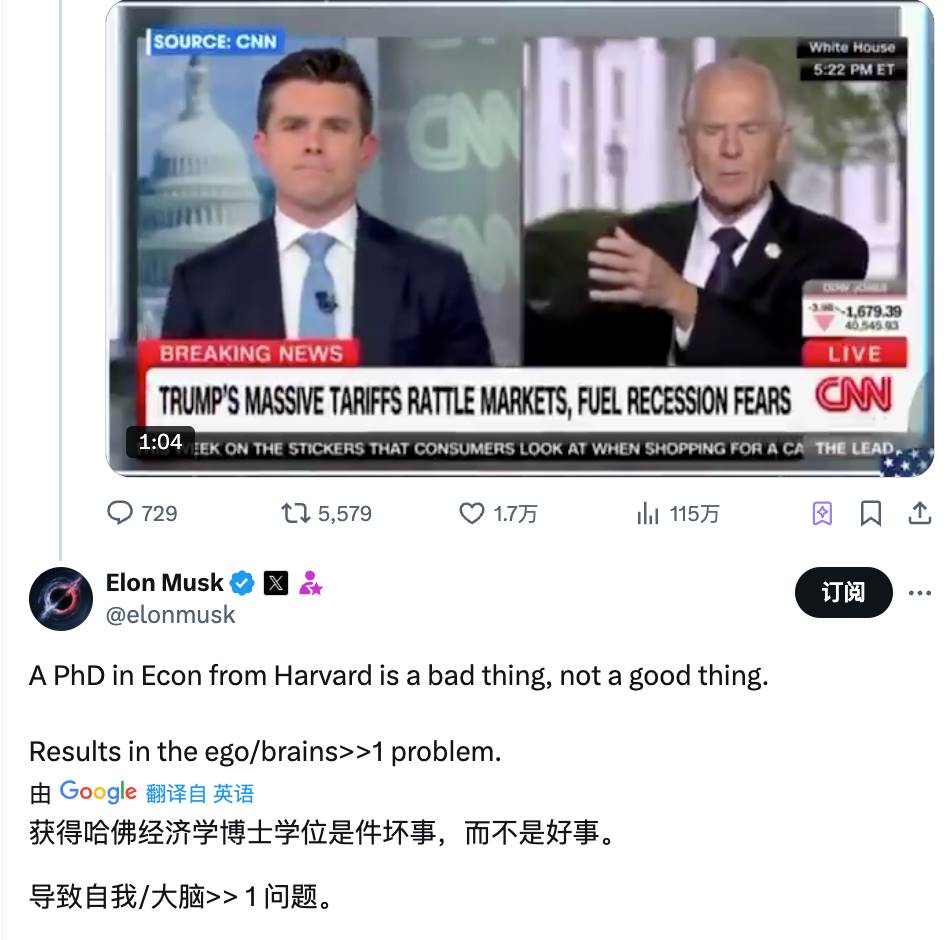

Even Elon Musk, who has a close relationship with President Trump, publicly criticized and mocked this presidential advisor on social media a few days ago, bluntly stating, "Getting a PhD in economics from Harvard is not a good thing; it may lead to decision-making errors due to excessive arrogance"; and questioned Navarro's lack of any substantial achievements.

Who is this economist standing behind Trump? How did he drive the tariff policy storm sweeping the globe?

From the fringes of academia to the core of decision-making in the White House, Navarro's life intersects with Trump's protectionist ideology, perhaps jointly brewing this crisis.

From an outsider in academia to a political figure

Peter Navarro's story began on July 15, 1959, in an ordinary family in Cambridge, Massachusetts.

His father, Albert "Al" Navarro, was a saxophonist and clarinetist, while his mother, Evelyn Littlejohn, was a secretary on Sax Fifth Avenue.

However, this family time was short-lived and tumultuous, as his parents divorced when he was 9 or 10, leaving Navarro and his mother to move between Palm Beach, Florida, and Bethesda, Maryland.

Growing up in a single-parent family may have planted a desire for stability and independence in his heart, which quietly sprouted when he completed his education at Bethesda-Chevy Chase High School in Maryland.

In 1972, with an academic scholarship, Navarro entered Tufts University, earning a bachelor's degree. That same year, he joined the Peace Corps and served in Thailand for three years. This experience gave him his first exposure to the complexities of international society, possibly laying the groundwork for his later focus on global trade imbalances.

In 1979, he obtained a Master of Public Administration from Harvard University, and later earned his PhD in 1986 under the guidance of economics luminary Richard E. Caves. With his degree in hand, he chose to stay in academia, serving as a professor of economics and public policy at the University of California, Irvine, for decades, eventually becoming a professor emeritus.

However, Navarro was not content to remain an academic; he made five attempts to enter politics, trying to put his ideas into practice.

In 1992, he ran for mayor of San Diego, leading the primary with 38.2% of the vote but narrowly losing in the general election with 48%;

After that, he ran for city council, county supervisor, and congressional seats, all of which ended in failure — he garnered 41.9% of the vote in the 1996 congressional election and only 7.85% in a special city council election in 2001. These failures did not deter him; instead, they highlighted his persistence and marginalized nature.

He repeatedly emphasized economic protectionism and job prioritization in his campaigns, echoing Trump's later "America First" slogan, yet failed to win over voters at the time.

From a boy in a single-parent family to a Harvard PhD in economics, and then to a repeatedly defeated political outsider, Navarro's trajectory is filled with contradictions.

He appears to be both a rigorous scholar and a radical activist; he has left his mark in academia while facing setbacks in politics.

In his transitions between academia and politics, attitudes toward trade protection and a hardline stance on China seem to have already taken root.

The China Threat Theory has long been traceable

From the moment Peter Navarro received his PhD in economics from Harvard, he was destined not to be satisfied with the tranquility of the ivory tower.

His subsequent trajectory shows that this newly minted PhD had developed a keen interest in the global economic landscape.

When he joined the University of California, Irvine in 1989, he began to transform his academic passion into sharp criticism. His target was an increasingly rising power — China.

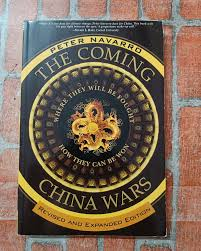

What truly drew attention to him was a series of works promoting the China threat theory.

In 2006, he published "The Coming China Wars," warning in a near-prophetic tone that China's economic expansion was not just commercial competition but a threat to the survival of American manufacturing.

The book reveals a stubbornness that borders on prejudice, such as the assertion that "China's development is a threat to humanity and will bring more conflict and instability to the world."

At the time, reader reviews on Amazon often suggested that the book had a tendency to sensationalize and provoke.

Although this book did not resonate widely in mainstream economics, it stirred ripples in certain conservative circles.

Five years later, in 2011, "Death by China" pushed Navarro's critique to a climax. This book was not only an academic analysis but also a kind of indictment.

He aggressively accused China of systematically destroying the foundation of the American economy through illegal export subsidies, production subsidies, currency manipulation, and intellectual property theft…

However, Navarro's views were not without controversy.

Mainstream economists, such as Simon Johnson from MIT, publicly criticized his analysis as "too one-sided, ignoring the complexities of global supply chains"; and Navarro's strong rhetoric in the book sharply contrasted with the generally perceived refined academic image, leading him to be labeled as an "outlier" in the economics community.

Nevertheless, Navarro built a theory of trade confrontation against China over more than a decade of academic accumulation, arguing that the U.S. must use tough measures to reverse trade deficits and protect domestic industries. This theory also laid the groundwork for his later entry into Trump's decision-making circle.

His pen had long pointed toward China, and fate would open a larger door for him in 2016.

With the help of Trump's son-in-law, he entered the core circle

"Death by China" did not create a stir in mainstream economics but unexpectedly opened the door to Trump's campaign team.

Reports indicate that during Trump's campaign for his first term in 2016, his son-in-law Jared Kushner stumbled upon the book on Amazon and was drawn to its sharp criticism of China's trade practices, subsequently recommending it to Donald Trump.

Trump read it and praised it, stating, "This guy understands my thinking."

Navarro later recalled that his role from the beginning was "to provide analytical support for Trump's trade instincts." As a businessman, Trump was well-versed in trade, and their thoughts may have aligned at a fundamental level, igniting their connection.

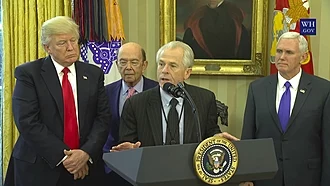

On January 20, 2017, the same day Trump was inaugurated, Navarro officially entered the White House as the newly established Director of the National Trade Council.

His first task was unsurprisingly focused on China. He quickly pushed for a proposal to impose a 43% tariff on Chinese goods and led the policy to impose a 25% additional tax on steel and aluminum imports.

When the U.S.-China trade war fully erupted in 2018, Navarro was everywhere. He declared at a White House briefing, "China must pay the price for its unfair trade."

That year, he also helped draft Trump's tariff order on global steel and aluminum imports, directly leading to trade frictions with the EU and Canada. Navarro's hardline stance not only aligned with Trump's "America First" but also solidified his position in the White House.

However, Navarro's time in the core circle was not without challenges.

In 2020, he published a report accusing election fraud and participated in the "Green Bay Sweep" plan on January 6, 2021, ultimately leading to a four-month prison sentence for contempt of Congress in 2023. Despite this, Trump's trust in him did not wane; he even referred to him as a "loyal warrior" while in prison.

On January 20, 2025, when Trump returned to the White House, Navarro also returned as a senior trade and manufacturing advisor. This time, his goals were even more radical.

In February, he co-led tariff economic discussions with Stephen Miller regarding Canada, China, and Mexico, pushing for a trade policy memorandum signed by Trump on his first day.

The "reciprocal tariff" plan led by Navarro — calculating additional tax rates based on trade deficits, such as 46% for Vietnam and 20% for the EU — became the cornerstone of the new policy. In an interview with CNBC, he defended, "These are not negotiation chips but necessities of a national emergency."

This position is consistent with his academic assertions from over a decade ago.

From a book in 2016 to the brain behind the trade war in 2025, Navarro's connection with Trump is not coincidental.

His protectionist ideology aligns closely with Trump's aversion to trade deficits; his hardline character perfectly matches Trump's policy style.

Despite being embroiled in controversy and even serving time in prison, Navarro has always been the soul of Trump's trade strategy. His journey from the fringes of academia to the center of power relied not only on luck but also on his obsession with trade confrontation.

The best strategy is to outsmart the enemy, not to attack the city

The intersection of Trump and Navarro's efforts is about to face the most severe test in the global market in 2025.

Returning to what Navarro said at the beginning, "You won't lose money if you don't sell stocks," does this non-mainstream economist truly understand the pulse of economic operation?

Navarro may be well-versed in tariff data, but he seems to have missed the essence of military strategy.

As Sun Tzu's Art of War states: "The best strategy is to outsmart the enemy; the next is to attack alliances; the next is to engage in battle; the least effective is to attack cities." Winning without fighting is the ultimate goal.

The wisdom of our ancestors is to win through strategy and diplomacy, not through direct conflict.

However, Navarro and Trump's tariff declaration is precisely the opposite — choosing direct confrontation, trading high economic costs for so-called "fairness."

This hard-hitting approach not only failed to weaken the opponent but also put American businesses and consumers at the forefront. Economists estimate that 60% of tariffs on China will raise the prices of imported goods, ultimately borne by the American public.

Reality is far from mere theory.

Dragging the global economy into chaos. His role as a driving force is indisputable, but whether the cost of this war is worth it remains unknown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。