"I didn't mean to crash the stock market, but sometimes you have to take medicine to cure the disease."

Written by: Natalia Wu, BlockTempo

Due to tariff policies causing turmoil in the U.S. stock market and global markets, a wave of anti-Trump protests erupted across the U.S. last week, with 500,000 people taking to the streets. However, Trump remains steadfast in his stance on tariffs. On Monday, Trump responded: "I didn't mean to crash the stock market, but sometimes you have to take medicine to cure the disease."

After U.S. President Trump announced last week that he would implement "reciprocal tariffs" on multiple countries and regions, global financial markets experienced severe turbulence. U.S. stock futures plummeted this morning, with the Dow futures dropping as much as 1,822 points, a decline of 4.7%. The S&P 500 and Nasdaq 100 futures also fell over 5%, and the VIX, a measure of market volatility, surged past 45, marking the third-highest level since the 2008 financial crisis and the 2020 COVID-19 pandemic.

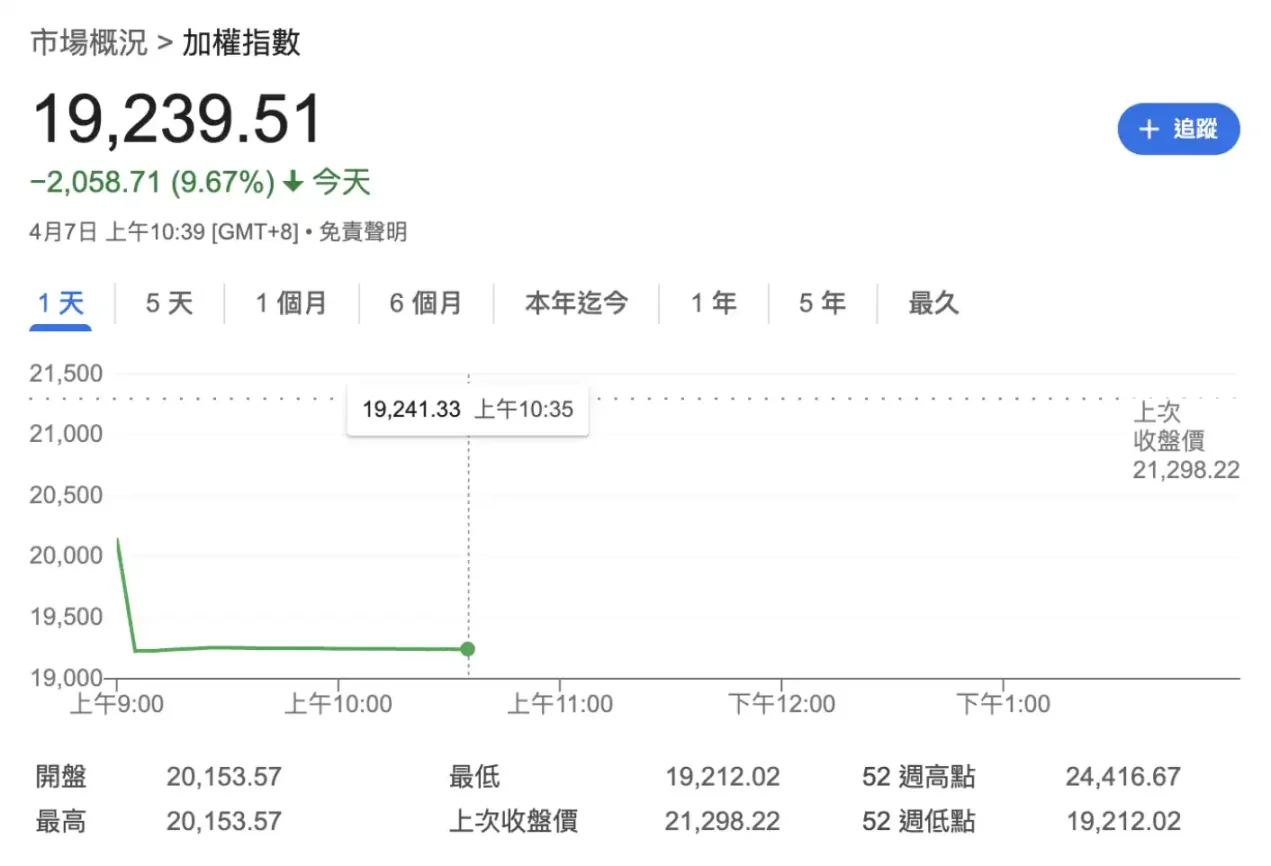

The Taiwanese stock market, which narrowly escaped a disaster last week due to a holiday, also opened with a sharp decline today, dropping as much as 2,085 points to a low of 19,212 points (or 9.8%), setting a record for the largest intraday drop in history. Other Asian stock markets, including Japan, A-shares, and South Korea, also faced significant losses this morning, triggering circuit breakers.

Current trend of the Taiwanese stock market

In the cryptocurrency market, Bitcoin plummeted to $77,000 this morning, with over $890 million in liquidations across the cryptocurrency market in the past 24 hours, affecting more than 299,000 people. Meanwhile, gold, as a safe-haven asset, also suffered, with spot gold briefly falling below $3,000 this morning.

Investor risk aversion drove the Japanese yen and Swiss franc, two major safe-haven currencies, higher. The yen surged 2.27% to 146.584 yen per dollar over the past five days, while the Swiss franc rose over 3% during the same period.

Trump: I didn't mean to crash the stock market…

Due to tariff policies causing turmoil in the U.S. stock market and global markets, a wave of anti-Trump protests has erupted across the U.S., with over 500,000 people participating in 1,200 protests last week, chanting for Trump to "Hands Off."

However, Trump remains firm in his stance on tariffs. This morning, he posted on his social media platform Truth Social, emphasizing that "tariffs are a very good thing," claiming they are bringing hundreds of billions of dollars in revenue to the U.S. His goal is to address the massive trade deficits with China, the European Union, and many other countries, insisting that tariffs are the only solution to the trade deficit.

According to Bloomberg's report on Monday, Trump told reporters aboard Air Force One:

"I didn't mean to crash the stock market, but sometimes you have to take medicine to cure the disease."

Trump also mentioned that he has spoken with several unnamed national leaders. He reiterated that the purpose of imposing tariffs is to completely eliminate the U.S. trade deficit.

"They are eager to reach an agreement, and I said, 'We will not have a trade deficit with your country.' We will not do that because, for me, a trade deficit is a loss. We will achieve a surplus, or, at worst, we will achieve a balance."

We must address our trade deficit, especially with China. Unless an agreement can reduce the U.S. trade deficit with China, I will not reach an agreement. I hope this issue can be resolved. He stated, "China is now suffering a huge blow because everyone knows we are right."

Trump also pointed his finger at Europe, even stating that he not only wants trade balance but also compensation:

"We impose high tariffs on Europe. They come to the negotiating table, they want to negotiate, but negotiations will not proceed unless they pay us a large amount of money every year."

When asked about public concerns that tariffs would lead to a rebound in inflation, Trump simply responded, "I don't think inflation will be a big problem."

Trump vows to reverse trade deficits with tariffs

White House economic officials revealed that more than 50 countries have called the White House seeking negotiations to mitigate the impact, but Commerce Secretary Ross emphasized on CBS's "Face the Nation" that Trump "is not joking." Trump's tariff strategy will take effect on April 9 and will not be delayed, "it will absolutely continue for days or even weeks."

Ross optimistically believes that tariffs will stimulate the return of manufacturing. In an interview with CNBC on the 3rd, he revealed that semiconductors are not currently included in the tariffs, but Trump plans to move their manufacturing from Taiwan back to the U.S., and may impose targeted tariffs in the future.

More than 50 countries around the world are racing against time, trying to persuade Trump to "spare them," but Trump remains firm, stating, "No negotiations unless the trade deficit disappears." Experts warn that this tariff war could trigger a chain reaction, dragging down global growth, with little relief in sight in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。