Author: Nancy, PANews

As Trump wields the "tariff stick," global capital markets are caught in a whirlpool of intense turmoil. The combination of macroeconomic headwinds and a liquidity crisis has led to massive liquidations of whale positions, with panic selling occurring in waves, and bullish forces severely impacted and retreating… This storm triggered by policy once again puts the crypto market to a severe survival test.

Crypto Market Bloodied by Tariff Storm, Whales Liquidate Positions

"Black Monday" has struck the world again. Since Trump announced large-scale tariff increases, the financial market's reaction has continued to ferment, leading to a comprehensive sell-off of risk assets from traditional stock markets to the crypto market.

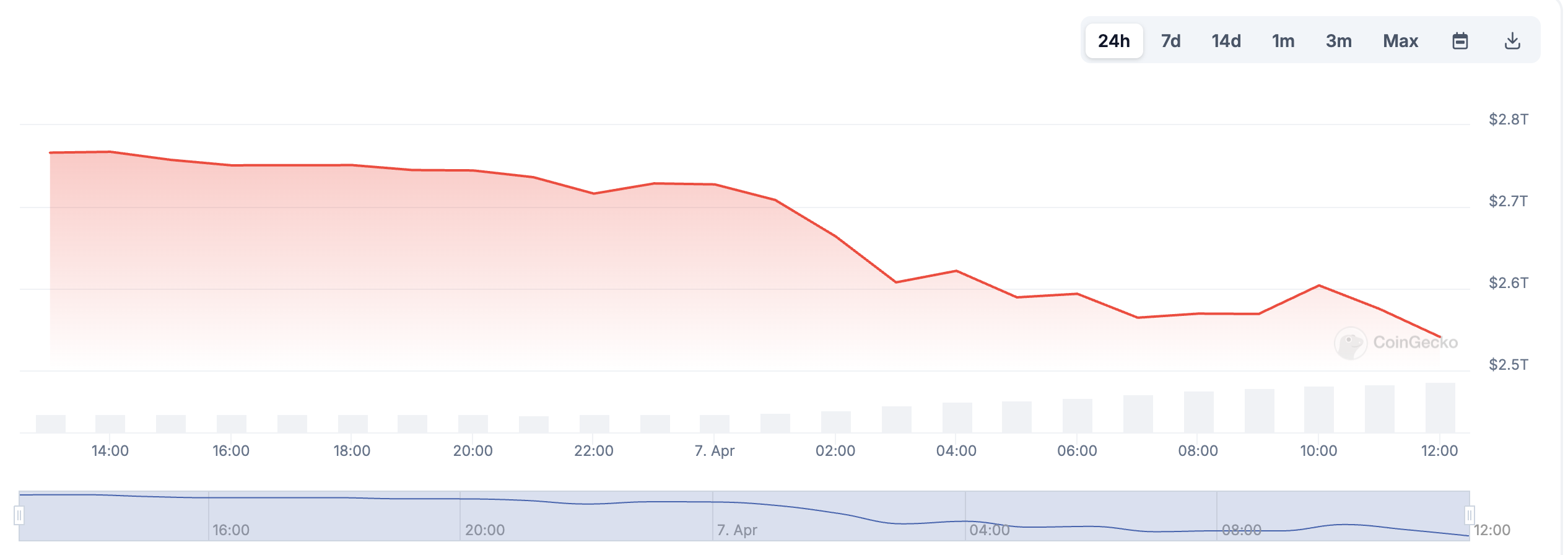

According to CoinGecko data, the total market capitalization of global cryptocurrencies fell by 9.7% in the past 24 hours, shrinking to $2.53 trillion. During this period, the price of BTC briefly fell below $77,000, and ETH dropped below $1,600.

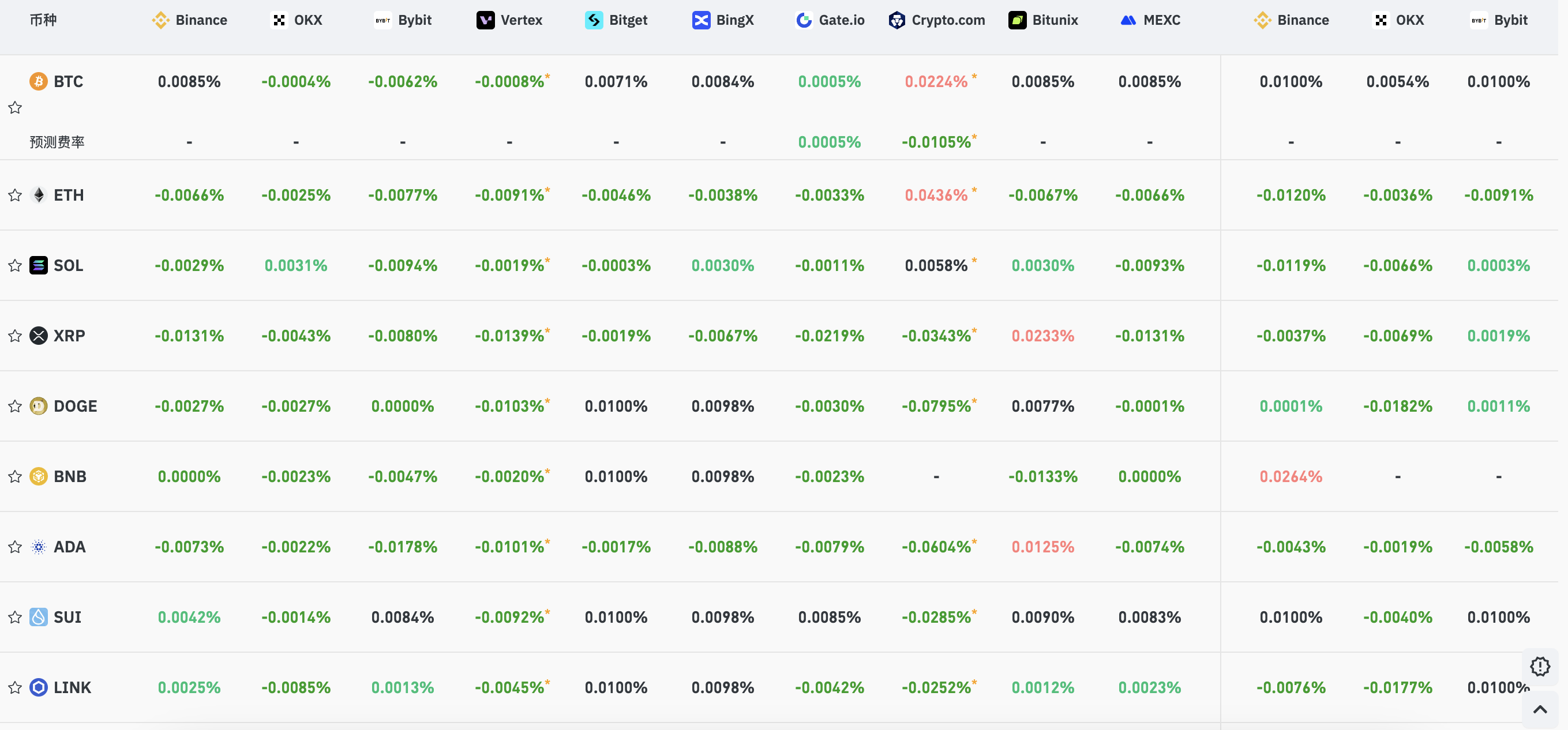

Amidst the market's violent fluctuations, bullish forces suffered heavy losses. Coinglass data shows that approximately $986 million was liquidated across the network in the past 24 hours, with long positions accounting for $850 million and short positions for $136 million. Among these, the liquidation amount for BTC reached $328 million, while ETH was about $293 million. From the funding rate situation of mainstream CEX and DEX, the current rates are generally below 0.005%, indicating that market participants are predominantly bearish, with short sentiment prevailing.

On-chain liquidation risks are also significantly escalating. For example, Onchain Lens monitored a whale facing liquidation, which provided 292.77 WBTC (approximately $23.05 million) and 964.39 COMP (approximately $38,000) to borrow USDT and DAI, with a liquidation price of $76,284. According to PeckShield monitoring, a whale was liquidated after collateralizing 9,370 WETH to borrow $12.8 million USDT when WETH fell below $1,700. The liquidator seized a total of 4,480 WETH, worth about $7.26 million.

According to on-chain analyst Yu Jin's monitoring, as the market declined, a whale address with a total of 67,500 ETH (approximately $10.5 million) was completely liquidated when ETH fell to around $1,650. This whale address had added 2,160 ETH as collateral at 1 AM on April 7 to lower the liquidation line but was ultimately forcibly liquidated around 6 AM, repaying its $74.4 million DAI loan. Meanwhile, a whale using leverage to invest in AAVE also faces liquidation risk. If the AAVE price drops another $7 (to $123), its position of 102,000 AAVE (worth $13.08 million) will be liquidated. This whale had a maximum unrealized profit of $21.33 million since purchasing until the end of last year but is now facing an unrealized loss of $3.58 million without having sold. Another whale holding 57,000 ETH currently has a liquidation price of $1,564, nearly liquidated at the same price as the previous 67,500 ETH position. It barely avoided liquidation by actively reducing its position in the past few days. Currently, its position remains on the edge of the liquidation line, and further reductions are expected to lower risk.

As market panic escalates rapidly, several whales have chosen to cut losses. For instance, Lookonchain monitored a whale address that panic-sold 14,014 ETH (approximately $2.21 million) in the past three hours; well-known trader Eugene stated that his BTC position, which he had built up last Friday, was automatically liquidated today after falling below the stop-loss price; before today's market crash, a whale address deposited the remaining 778.5 BTC (approximately $6.43 million) into Binance to cut losses, incurring a loss of $2.53 million. A whale unstaked 202,604 SOL two hours ago and deposited it into Binance, worth $24.3 million. This whale had withdrawn 201,755 SOL (worth $25 million) from Binance at a price of $124 on March 13 and is currently facing a loss of about $678,000. OnchainLens monitored that a whale/institution deposited 1,000 BTC (worth $77.58 million) into Binance and transferred 354.34 BTC (worth $27.49 million) to a new wallet address, facing a loss of $9.04 million.

Bear Market Signals Emerge? Investors May Face Severe Gaming Cycle

Due to the Trump administration's promotion of "reciprocal tariffs," global market turmoil has intensified, severely impacting investor confidence. According to a recent Forbes survey, support for Trump's economic policies among Wall Street elites has significantly declined, with market buying almost disappearing. Although distrust in current policies is rapidly spreading in the financial circle, Trump insists that "sometimes the market must 'take medicine'" and firmly believes that the tariff policy will bring "very good things" to the U.S. in the long run.

BitMEX co-founder Arthur Hayes pointed out that Trump's supporters are mostly from groups that do not hold significant financial assets, giving him more confidence in implementing tough tariff policies. Hayes reminds investors that if they want to predict when the Federal Reserve will restart easing, they should pay attention to the MOVE index, a volatility indicator in the bond market. When MOVE rises, traders financing the purchase of U.S. Treasuries or corporate bonds will face higher margin requirements and be forced to liquidate. If MOVE breaks 140, the Federal Reserve may intervene in the market.

Goldman Sachs has also adjusted its expectations for Federal Reserve rate cuts, stating that if a U.S. economic recession occurs, the risk of further easing by the Federal Reserve is higher. The bank expects the Federal Reserve to begin a series of rate cuts in June, earlier than the previously predicted July, as part of a preventive easing cycle. If the economy does indeed fall into recession, the Federal Reserve will respond with more aggressive policies, cutting rates by about 200 basis points next year. Considering the increasing likelihood of an economic recession, the institution's current weighted forecast shows a total rate cut of 130 basis points by 2025, higher than the previous 105 basis points.

As the "reciprocal tariffs" are set to officially take effect on April 9, further exacerbating global market volatility, investors will face an increasingly severe gaming cycle.

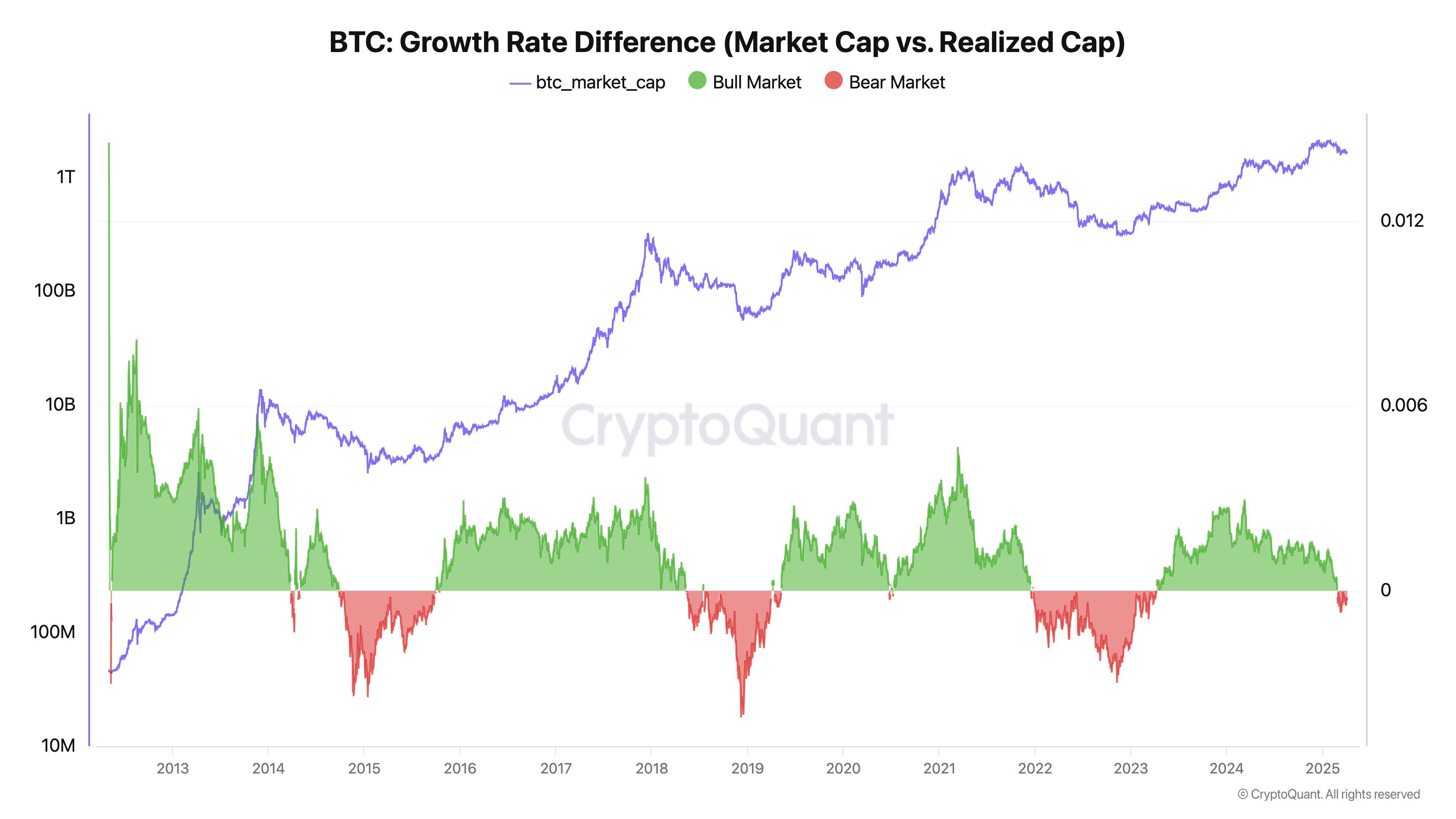

"The Bitcoin bull market cycle has ended, and the realized market cap in on-chain data shows that typical bear market signals have emerged: despite continuous capital inflows into the market, prices have not seen corresponding increases. He further explained that when small amounts of capital can drive prices up, it indicates a bull market; when large amounts of capital cannot push prices higher, it signifies the arrival of a bear market." CryptoQuant CEO Ki Young Ju bluntly stated that although selling pressure may ease at any time, based on historical experience, a true market reversal usually requires at least six months, and the likelihood of a rebound in the short term is low.

Mechanism Capital partner Andrew Kang also supports the bear market argument. He admitted that he has not closely followed cryptocurrencies in recent months, but the possibility of ETH returning to the $1,000-$1,500 range this year seems very high, considering that the speculative frenzy has clearly passed, and for an asset with negative growth/profit, a market cap of $215 billion is simply absurd.

Eugene stated that this decline is not only unprecedented in the crypto market but also in the entire stock market. He vaguely feels that as long as the response is appropriate, once this storm passes, it may create wealth sufficient to change one's fate. But for now, survival is key.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。