Source: Cointelegraph Original: "{title}"

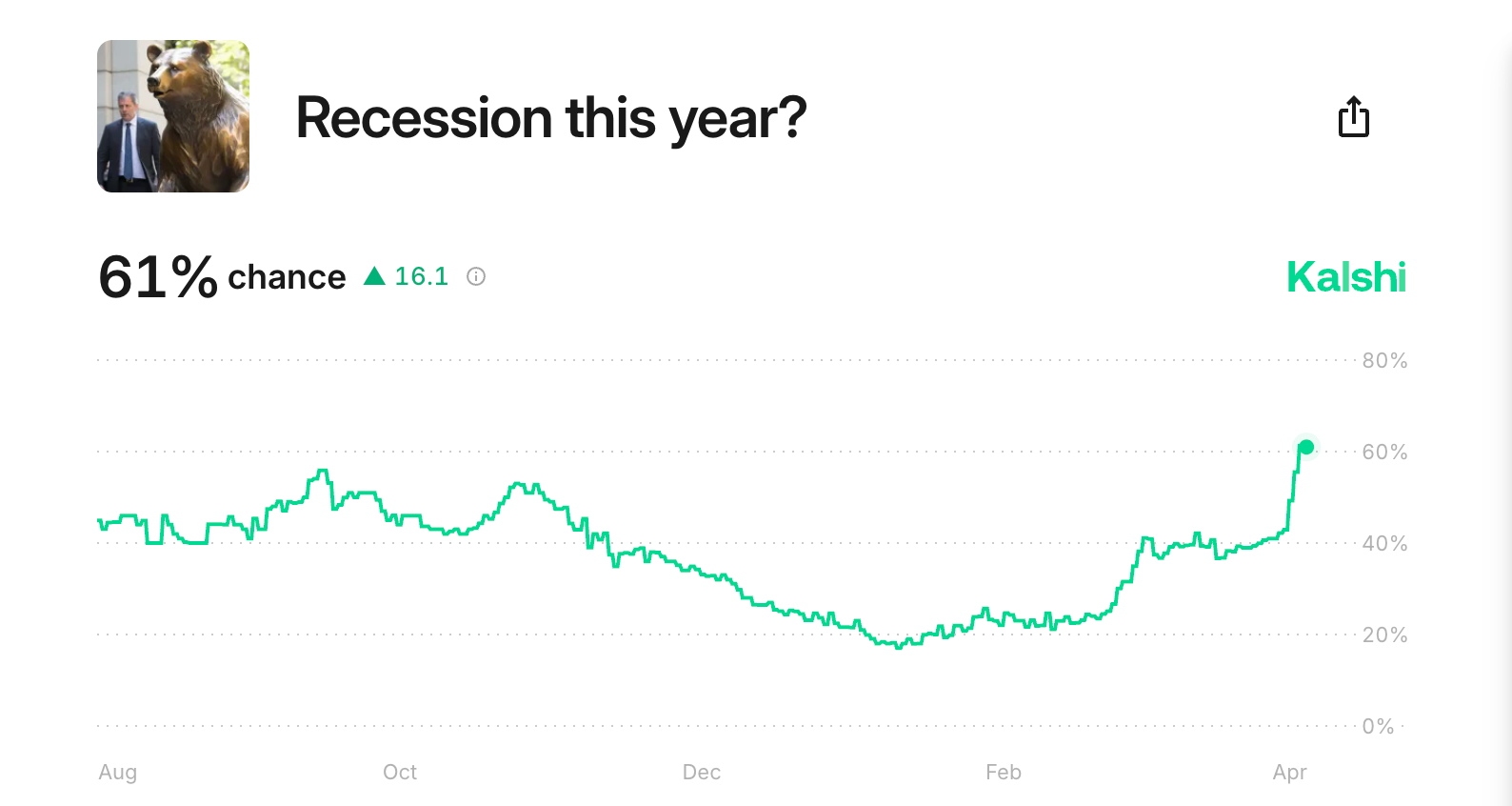

On April 2, after President Trump signed a comprehensive tariff order, traders in the Kalshi prediction market set the probability of a U.S. recession in 2025 at 61%.

Kalshi adopts the standard definition of a recession, which is two consecutive quarters of negative Gross Domestic Product (GDP) growth as reported by the U.S. Department of Commerce.

Since March 20, the probability of a U.S. recession on the prediction platform has nearly doubled, aligning with the current trader prediction of a 60% chance of a U.S. recession in 2025 on the Polymarket platform.

Following President Donald Trump's comprehensive tariff order and the subsequent sell-off in capital markets, the macroeconomic outlook for 2025 has rapidly deteriorated, raising concerns about a prolonged bear market.

The Kalshi prediction market shows a probability of over 60% for a U.S. recession in 2025. Source: Kalshi

The presidential executive order sets a baseline tariff rate of 10% for all countries and establishes different reciprocal tariff rates for trading partners that impose tariffs on U.S. imports.

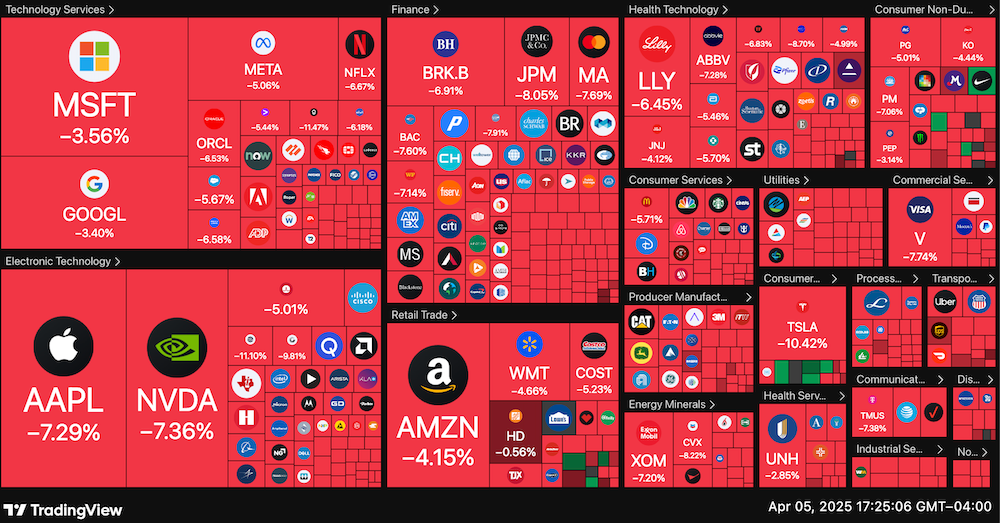

Trump's announcement immediately triggered a stock market sell-off, evaporating over $5 trillion in shareholder value within days.

As market analysts warn that a potential prolonged trade war could negatively impact global markets and suppress the prices of risk assets, including cryptocurrencies, concerns about a recession continue to grow.

Meanwhile, President Trump expressed confidence that the tariffs would strengthen the U.S. economy in the long run and correct any trade imbalances.

"The market will thrive," Trump stated on April 3, calling the current market sell-off a part of the expected process.

As trillions in stock market value evaporate, the sell-off continues. Source: TradingView

Asset manager Anthony Pompliano recently speculated that President Trump is intentionally causing a market crash to lower interest rates.

Pompliano cited the decline in the 10-year U.S. Treasury yield as evidence that the president's strategy of forcing an economic recession to influence interest rates is working.

The yield on the 10-year U.S. Treasury bond fell from about 4.66% in January 2025 to just 4.00% on April 5. President Trump is also pressuring Federal Reserve Chairman Jerome Powell to lower short-term interest rates.

In a Truth Social post on April 4, Trump wrote, "This will be the best time for Federal Reserve Chairman Jerome Powell to cut interest rates."

Related: Trump's Liberation Day: The "Peak of Uncertainty" Before the Cryptocurrency Market Recovery

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。