Recently, Ki Young Ju, the founder and CEO of the crypto data analysis platform CryptoQuant, published a striking analysis on the X platform, bluntly stating that "the Bitcoin bull market cycle has ended." This statement quickly sparked heated discussions within the crypto community. By comparing the dynamic changes between "realized market cap" and "market cap," he revealed the current weak characteristics of the Bitcoin market and warned investors to be cautious of downward risks. What exactly did this article say? Has the Bitcoin market really entered a bear market? Let’s delve deeper.

The Secret of Realized Market Cap vs. Market Cap: Why Hasn't Capital Inflow Boosted Prices?

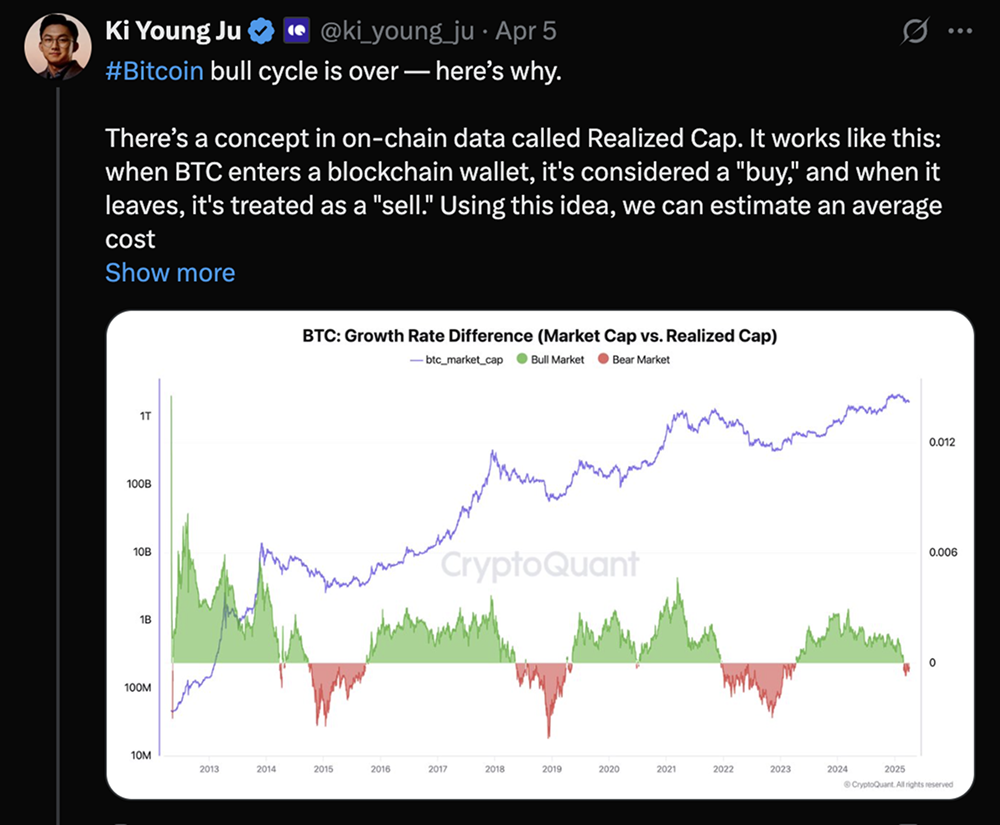

Ki Young Ju's core argument revolves around a key on-chain data metric—“realized market cap.” Simply put, realized market cap estimates the total capital invested in the market by tracking the actual flow of Bitcoin on the blockchain. When Bitcoin enters a wallet, this action is considered a "buy," with its cost basis calculated at the time of the transaction; conversely, when Bitcoin leaves a wallet, it is considered a "sell." By calculating the average cost basis of each wallet and combining it with the amount of Bitcoin held, one can derive the realized market cap for the entire market. This metric is regarded as a "true ledger" reflecting actual capital inflow into the Bitcoin ecosystem.

In contrast, the commonly referred to "market cap" is the result of multiplying Bitcoin's current price by its total circulating supply, which more reflects market sentiment and price volatility. Ki Young Ju pointed out that the relationship between the two serves as a barometer for market operations: when realized market cap grows while market cap simultaneously surges, it indicates that new capital inflow effectively drives up prices, which is a typical bull market signal; conversely, if realized market cap increases while market cap stagnates or even declines, it suggests that capital inflow has failed to boost prices, often signaling the onset of a bear market.

Current data shows that although on-chain activity indicates continued capital inflow into the Bitcoin market, prices have not risen accordingly. Ki Young Ju cited an example where, when Bitcoin's price approached $100,000, market trading volume was exceptionally high, yet prices remained almost unchanged. This state of "high selling pressure, low response" is a key basis for his judgment that the bull market has ended.

Small Capital Lifts vs. Large Capital's Inability: The Bull-Bear Divide

To help ordinary investors better understand this phenomenon, Ki Young Ju made an analogy: in a bull market, even "small capital" can easily push prices higher. For instance, some institutions raise funds by issuing convertible bonds to purchase Bitcoin, and their book value often grows far beyond the actual capital invested. This "small bets for big gains" strategy has repeatedly succeeded in low selling pressure environments, driving multiple price increases in Bitcoin over the past few years. However, when the market enters a high selling pressure phase, the situation changes completely. Even large purchases struggle to influence price trends.

"When small capital drives prices up, it's a bull market; when even large capital cannot push prices up, it's a bear market," Ki Young Ju succinctly summarized. Current data clearly points to the latter: although on-chain capital inflow has not ceased, the price weakness indicates that the market has entered a state of "indigestion." This phenomenon is not unprecedented; historically, similar cyclical reversals have often been accompanied by months of stagnation.

Historical Patterns: Patience Required for Bear Market Reversals

If Bitcoin has indeed entered a bear market, how long can investors expect a rebound? Ki Young Ju sought answers from historical data. He noted that in past cycles of Bitcoin's bull-bear transitions, it typically takes over six months from the peak of the cycle to a true trend reversal. This means that even if selling pressure eases in the short term, a rapid price recovery remains unrealistic.

Looking back at Bitcoin's historical trends, this pattern seems to hold true. For example, after Bitcoin broke through $20,000 at the end of 2017, the market underwent a year-long adjustment period in 2018, stabilizing only in early 2019. Similarly, after the bull market peak in 2021, prices fell into a trough in 2022, only to regain momentum in 2023. Ki Young Ju's warnings are not unfounded but are based on a profound insight into market cycles.

Conclusion: Bear Market or Adjustment, Time Will Tell

Whether the Bitcoin bull market has truly come to an end may only be answered by time. Ki Young Ju's analysis, grounded in rigorous logic and solid data, provides us with a new perspective on observing the market. Whether you are a steadfast "holder" or a cautious "newbie," the current market signals remind us that maintaining patience and rationality is more important than ever.

As we stand at the point of April 2025, the story of Bitcoin is far from over. Under the extreme tariff policies of Trump, the shadow of a bear market may be looming, but as proven by its journey over the past decade, this "digital gold" path has never lacked thrills and hope. How will the market unfold in the next six months? Let’s wait and see.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。