Source: Cointelegraph Original: "{title}"

With the Trump administration cutting back on bureaucratic agencies, the future of this federal regulatory body is now in question. According to Ethan Ostroff, a partner at Troutman Pepper Locke, the role of the Consumer Financial Protection Bureau (CFPB) in cryptocurrency regulation may diminish, while other federal agencies like the Securities and Exchange Commission (SEC) and state-level regulators will play a larger role in cryptocurrency policy.

Ostroff stated in an interview with Cointelegraph, "Under the current administration, my sense is that we are likely to see a significant retreat of the CFPB in the context of activities by other regulatory agencies."

The attorney noted that under the Consumer Financial Protection Act (CFPA), state regulators also have the authority to take on some of the CFPB's regulatory responsibilities, but he added that certain regulatory functions will continue to fall under the jurisdiction of the CFPB according to established law. Ostroff mentioned the New York Department of Financial Services (NYDFS) and the California Department of Financial Protection and Innovation (DFPI) as regulatory bodies to watch, as they may become leaders in cryptocurrency regulation at the state level.

However, the attorney clarified that while the CFPB may play a smaller role during the Trump administration, the agency will not be completely dismantled during the current regime due to statutory obligations and requirements that can only be changed through congressional action.

The Trump administration has positioned the CFPB as part of a broader effort to cut government spending and reduce federal debt through the Department of Government Efficiency (DOGE).

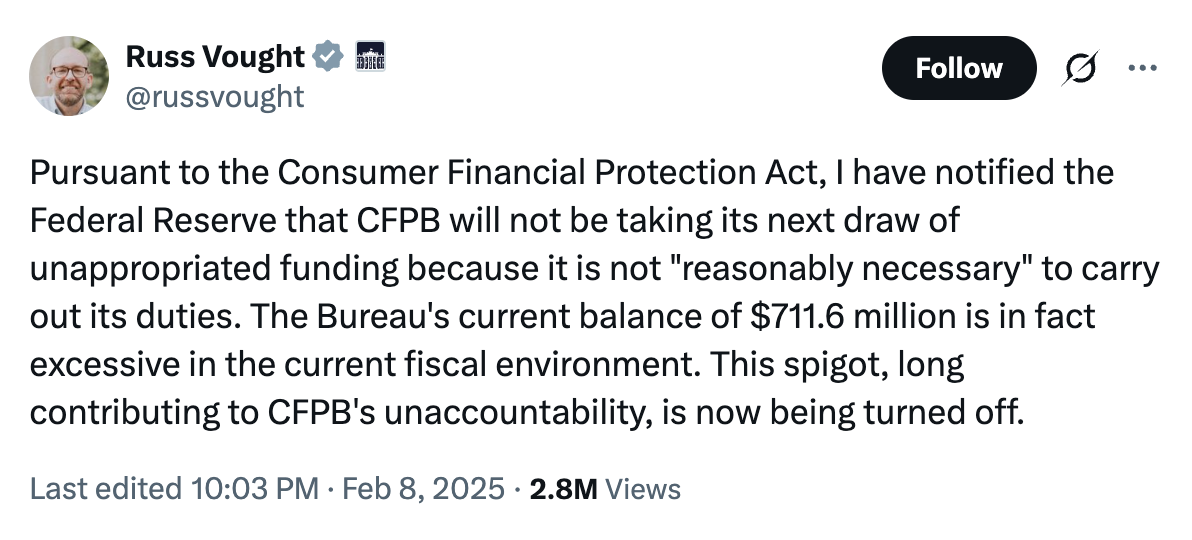

New CFPB head Russell Vought announced significant funding cuts and business reductions within days of taking office in February 2025.

Source: Russell Vought

Massachusetts Senator Elizabeth Warren criticized Elon Musk for dismantling the CFPB, which she co-founded in 2007.

Warren likened Musk to a bank robber and claimed that the Trump administration's dismantling of the CFPB was aimed at eliminating consumer protection rules and tightening control over the financial system.

In an interview with Mother Jones on February 12, the senator emphasized that the executive branch does not have the statutory authority to completely dismantle the CFPB, which can only be achieved through congressional approval.

Related: U.S. lawmakers pressure SEC for information related to cryptocurrency companies supported by the Trump family

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。