Highlights of This Issue

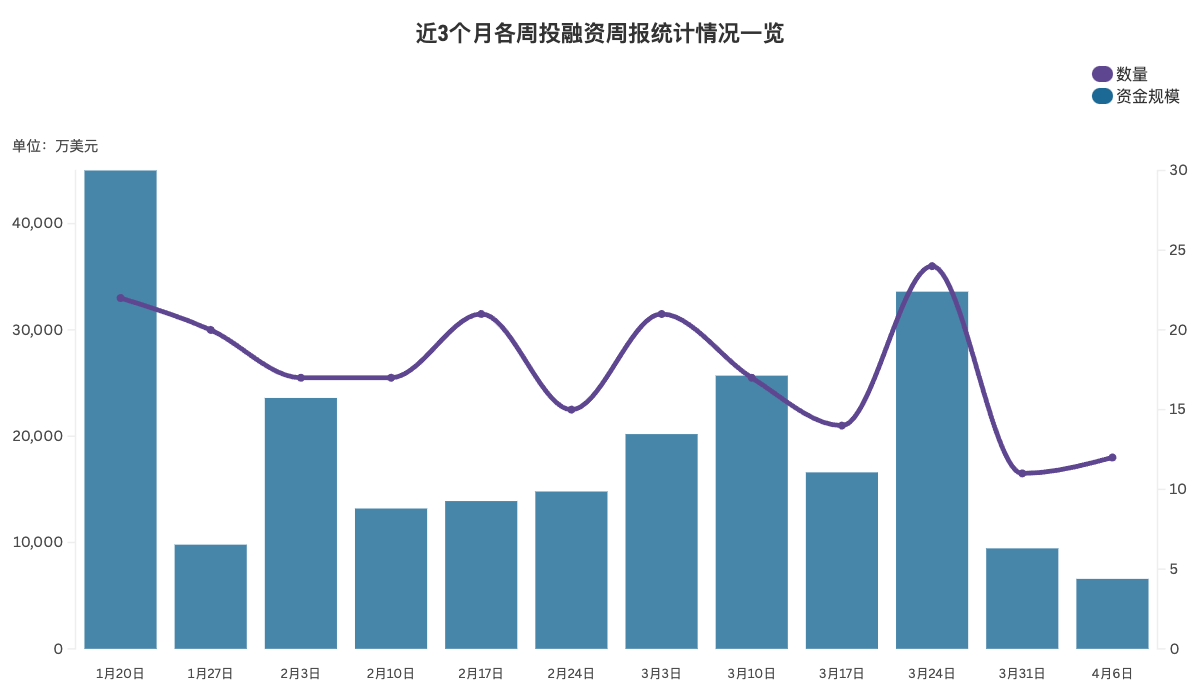

According to incomplete statistics from PANews, there were 12 investment and financing events in the global blockchain sector last week (3.31-4.6), with a total funding scale exceeding $6.58 million. The inflow of funds continues to decrease, as summarized below:

- DeFi reported 1 investment and financing event, with P2P.me completing a $2 million seed round financing, with participation from Multicoin and Coinbase Ventures;

- NFT reported 1 investment and financing event, where the developer of the blockchain game Immortal Rising 2, Planetarium Labs, completed $3 million in financing;

- Web3 Gaming reported 2 investment and financing events, with the blockchain game platform Ultra completing $12 million in financing, led by NOIA Capital;

- Web3+AI reported 4 investment and financing events, including AI infrastructure protocol Cambrian Network completing $5.9 million in seed round financing, led by a16z CSX with participation from BB Fund;

- Infrastructure & Tools reported 3 investment and financing events, with Ambient completing $7.2 million in seed round financing, with participation from a16z, Delphi Digital, and Amber Group;

- Centralized Finance reported 1 investment and financing event, with the startup Codex completing $15.8 million in seed round financing, led by Dragonfly.

DeFi

P2P.me Completes $2 Million Seed Round Financing, with Participation from Multicoin and Coinbase Ventures

The cryptocurrency to fiat payment application P2P.me announced the completion of a $2 million seed round financing, with investors including Multicoin and Coinbase Ventures. P2P.me enables users to pay merchants that only accept fiat currency using stablecoins through a network of intermediaries, with the transaction process taking about 90 seconds. The platform uses zero-knowledge proof technology to verify user identity, ensuring privacy and security.

NFT

Luxury fragmented investment platform Collecto completed €2.8 million (approximately $3.05 million) in seed round financing, with participation from LinkedIn Italy CEO Marcello Albergoni, Accenture Interactive Managing Director Alessandro Zanotti, McKinsey Senior Partner Andrea Travasoni and Guido Frisiani, Wind Tre Italy Co-CEO Gianluca Corti, BCG Senior Advisor and former ING Italy CEO Marco Bragadin, Jakala Civitas CEO Giacomo Lorusso, BizPal CEO Fabio Peloso, and several seed round investors. The financing structure includes €2.3 million in equity financing and €500,000 from the Italian Ministry of Economic Development's "Smart&Start Italia" startup support program.

Collecto is described as a platform that democratizes luxury collection by providing fractional ownership of exclusive items, including modern art, luxury watches, and investment-grade wine.

Web3 Gaming

Ultra Completes $12 Million Financing, Led by NOIA Capital

The blockchain game platform Ultra announced the successful completion of $12 million in financing, led by Luxembourg-based multi-family office NOIA Capital through its NOIA Digital Assets fund. Additionally, Ultra appointed Maxime van Steenberghe as Chief Operating Officer to further its goal of becoming Europe's leading gaming platform. Ultra plans to use this financing to accelerate the realization of its 2025 roadmap and inject transformative power into the gaming industry.

NASDAQ-listed internet company The9 Limited announced a directed issuance agreement with cryptocurrency investment funds Elune Capital, Fine Vision Fund, and Bripheno Pte. Ltd. According to the agreement, the investors will inject $8 million into The9. The9 will issue Class A common stock to investors at the average closing price of the 30 trading days prior to the agreement, with the issued shares subject to statutory lock-up periods. The9 will establish a new company to operate its global GameFi platform. The company plans to collaborate with third-party international cryptocurrency foundations to use the GameFi tokens issued by the foundation as the platform's official cryptocurrency, while also partnering with cryptocurrency exchanges to drive platform users into The9's GameFi ecosystem.

The9 will issue 302,263,200 warrants to investors, valid for two years. Some warrants have an exercise price of $60 per ADS, while the remaining warrants are divided into two batches: the first batch can be exercised after the investor or its business partner signs a strategic cooperation agreement with The9, and the second batch can be exercised after the official launch of The9's GameFi platform, with the exercise price being the same as the ADS issuance price in this agreement.

AI

Cambrian Network Completes $5.9 Million Seed Round Financing, Led by a16z CSX

AI infrastructure protocol Cambrian Network announced the completion of $5.9 million in seed round financing, led by a16z Crypto Startup Accelerator (CSX) with participation from BB Fund. Cambrian aims to build intelligent infrastructure for AI financial agents, empowering AI agents to make smarter market predictions and financial decisions by integrating on-chain and off-chain data. The project was founded by former members of The Graph and Semiotic Labs and has now launched private testing with plans to release a testnet.

AI+Crypto Project Mahojin Completes $5 Million Seed Round Financing, Led by a16z CSX and Others

AI+Crypto project Mahojin announced the completion of $5 million in seed round financing, co-led by a16z CSX and Maelstrom. Mahojin is described as a GitHub for AI model creators and datasets, capable of tracking IP and compensating model creators and dataset owners.

The Ethereum Layer 2 network Capx AI, aimed at AI agents, completed $3.14 million in seed round financing, co-led by Manifold and Luganodes, with follow-on investments from Echo, P2 Ventures (Polygon Ventures), Gate Labs, Stix, MH Ventures, Blue7, Cogitent Ventures, Autonomy Capital, Next Web Capital, Blockarm Capital, Mythos Venture Partners (MVP), Arcanum Capital, and notable individual investors including Sandeep Nailwal, Richard Ma, and Amrit Kumar.

Capx AI is described as an Ethereum Layer 2 network designed to enable users to build, monetize, and trade AI agents. It provides a comprehensive ecosystem consisting of Capx Chain, Capx Super App, and Capx Cloud to facilitate the creation, deployment, and exchange of AI-driven applications.

On-chain AI Agent Fund bAI Fund Receives $1 Million Investment

The on-chain AI agent fund bAI Fund received a $1 million investment from Morph and Foresight Ventures. bAI Fund is described as an on-chain agent fund operating in a trusted execution environment (TEE), integrating quantitative trading, investment, and marketing to create a diversified AI agent ecosystem. The fund helps creators independently issue AI agent tokens and promotes decentralized governance.

Infrastructure & Tools

The crypto-AI project Ambient completed $7.2 million in seed round financing, with participation from a16z's crypto accelerator program, Delphi Digital, and Amber Group. Ambient aims to combine artificial intelligence technology to provide fast, low-cost, and open intelligent services. The project employs a proof-of-work mechanism similar to Bitcoin and operates in a manner similar to the Solana network.

Singapore Digital Asset Startup BetterX Completes Approximately $1.7 Million Pre-Series A Financing

Singapore-based digital asset infrastructure provider BetterX announced the completion of S$2.3 million (approximately $1.7 million) in Pre-Series A financing to support its expansion in Asia, the Middle East, and the United States. This round of financing attracted new investors, including Grand Prix Capital, Aument Capital, as well as angel investors such as Sabrina Tachdjian from the HBAR Foundation and Riaz Mehta from Crypto Knights. Existing supporters, including Aura Group and Tibra co-founder Kinsey Cotton, also participated in this round of financing. Previous investors Scalare Partners, Wholesale Investor, B7 Capital, and the founders of Audacy Ventures also took part in this round.

BetterX was established in Singapore to provide institutional-grade infrastructure for the tokenization, trading, and portfolio management of digital assets. The company aims to offer compliant and scalable solutions for financial institutions, including wealth managers and licensed intermediaries. Its platform supports the issuance and management of tokenized financial products, digital asset trading infrastructure, and custody solutions.

Bloctopus Completes $1 Million Financing to Advance dApp Development Tools

Formerly LZero, now rebranded as Bloctopus, has completed a $1 million pre-seed round of financing led by Hivemind Capital, with participation from Techstars, IronKey Capital, and several blockchain founders. Bloctopus is dedicated to building an on-chain "Firebase" and has partnered with the Ethereum Foundation and Kurtosis to launch on-demand deployable developer tools, aiming to reduce DevOps costs by 90% and increase development efficiency by 20 times. Its v1 version has been launched, supporting cross-chain environment simulation.

Centralized Finance

Startup Codex Completes $15.8 Million Seed Round Financing, Led by Dragonfly

Startup Codex raised $15.8 million in seed round financing led by Dragonfly Capital. Codex is building a blockchain specifically designed for stablecoins. Other investors include the venture capital arms of Coinbase and Circle. Cryptocurrency market makers such as Cumberland, Wintermute, and Selini Capital also contributed. Dragonfly's general partner Rob Hadick stated that the firm invested approximately $14 million in this round.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。