Source: Cointelegraph Original: "{title}"

In the 2025 cryptocurrency market, the frenzy of memecoins has evolved from a mere community cultural symbol into a battleground of intergenerational cognition. The Ghibli craze has spawned related themed memecoins (Ghiblification, GhibliCZ), and MUBARAK has quickly gained popularity due to its community-driven nature and social media hype. The explosion of MUBARAK is particularly representative: this project transformed a widely used Arabic blessing into a token symbol, achieving a 6000% increase in just 16 hours after launch, with a market cap exceeding $6 million, driven by a community primarily composed of Middle Eastern users. Its success logic lies in precisely capturing the "cultural void market"—previously, there had been no phenomenal memecoins in the Arabic-speaking region, while the number of cryptocurrency users in that area has reached 42 million.

Currently, MUBARAK has been listed on top exchanges such as Binance and Gate.io.

However, at the same time, long-term value projects like Bitcoin (BTC) and Ethereum (ETH) emphasize technological innovation and practical applications, attempting to bring stability and sustainable growth to the market. The conflict between this short-term speculative frenzy and the long-term value narrative forms what is known as the "intergenerational cognitive divide," reflecting the divergence in investment preferences among different groups.

The Rise of Memecoins: Cultural Phenomenon and Market Impact

The rise of memecoins originates from internet culture, with their value primarily driven by community enthusiasm and social media trends. The earliest breakout memecoins, DOGE and SHIB, saw their prices soar due to support from celebrities like Elon Musk, attracting a large number of new users. Their low entry barriers and entertainment value have made them the preferred choice for young investors, especially on platforms like X and Reddit, where community interaction drives price fluctuations.

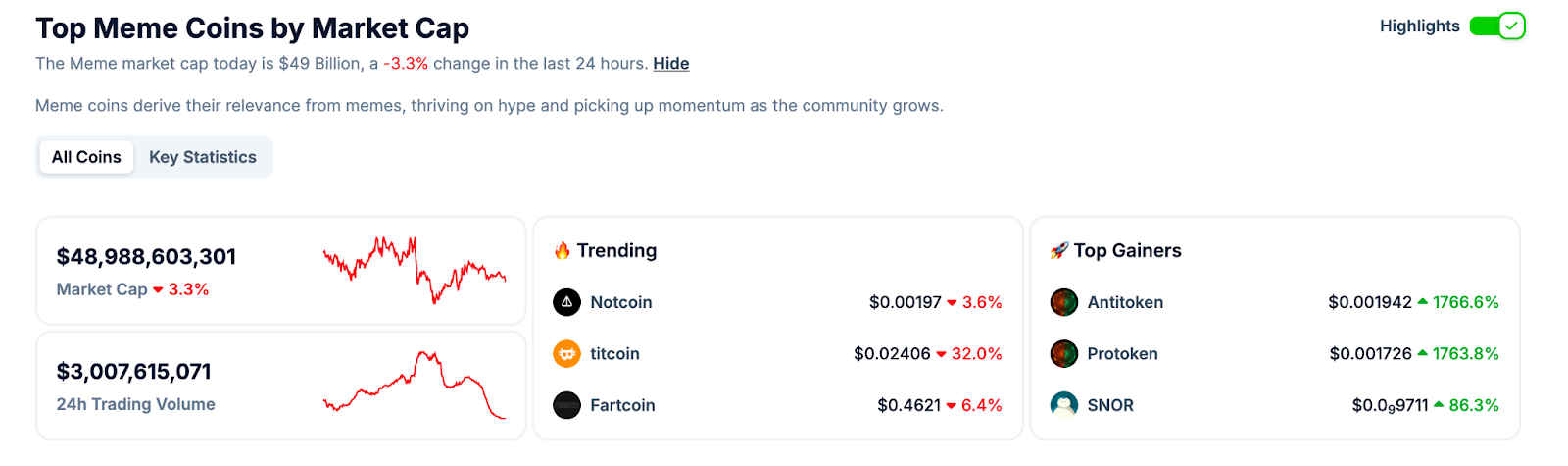

Market capitalization of memecoins. Source: CoinGecko

The Core of Long-Term Value Projects: Stability and Sustainability

Long-term value projects like BTC and ETH focus on their technological foundations and practical applications, aiming to solve real-world problems such as DeFi, attracting investors seeking long-term returns. Their stability relies on clear roadmaps and strong development teams, with market capitalization typically higher and volatility relatively lower.

Conflict Analysis: The Opposition of Short-Term Speculation and Long-Termism

The high speculation and volatility of memecoins may pose a threat to long-term value projects. According to the U.S. Securities and Exchange Commission (SEC), memecoins often lack utility, with their value primarily driven by market demand and speculation, similar to collectibles. This could undermine the overall credibility of the cryptocurrency market, especially in the eyes of institutional investors.

Coexistence and Mutual Benefit: Possible Bridges

Despite the conflicts, memecoins may also bring indirect benefits to long-term value projects. Research indicates that memecoins can serve as entry tools for new users, attracting them into the cryptocurrency market through community enthusiasm, and these new users may subsequently invest in more robust projects.

On the regulatory front, there is increasing attention from regulators towards memecoins, which may impact their development. According to guidance issued by the SEC's Division of Corporation Finance in February regarding memecoins, it states that memecoins do not fall under the category of securities but are similar to collectibles. The division believes that the trading of memecoins described in the guidance does not involve the issuance and sale of securities as defined by federal securities laws. Therefore, individuals participating in the issuance and sale of memecoins are not required to register their transactions with the Commission under the Securities Act of 1933, nor do they need to comply with the registration exemption provisions in the Securities Act. Consequently, buyers or holders of memecoins are not protected by federal securities laws. Global regulatory frameworks, such as the EU's MiCA rules, may further regulate the market, balancing innovation and stability.

The frenzy of memecoins is a cultural phenomenon in the cryptocurrency market and a challenge to traditional financial values. It makes the market more interesting and vibrant but also brings more risks and uncertainties.

The coexistence of long-termism and memecoins requires joint efforts from both sides. Long-term projects need to be more open and inclusive, embracing the innovation and creativity of memecoins. Meanwhile, investors in memecoins need to be more rational and mature, recognizing the risks of speculative behavior.

The transition from division to integration is an inevitable trend in the development of the cryptocurrency market. Only through coexistence and cooperation can the cryptocurrency market achieve more stable and sustainable development. This requires not only self-regulation of the market but also guidance and support from regulatory agencies. Through joint efforts, the cryptocurrency market can become a healthier and more prosperous ecosystem, creating more value and opportunities for global investors and users.

Related: TRUMP, DOGE, BONK ETF may be approved, but Cathie Wood won't invest: Redefining finance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。