Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market _ (Odaily Note: Systematic risk can never be completely eliminated) _, to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

The rhythm of the financial management market changes more slowly compared to the trading market. In previous issues, we have basically covered mainstream yield markets such as Pendle and Fluid, as well as "dual mining" opportunities like Sonic, Ethreal, Level, Meteora, Vest, Perena, BackPack, and Echelon.

To avoid redundancy, starting from this issue, we will focus on the latest developments in the financial management market over the past week.

Previous Records

New Opportunities

Berachain Flywheel Launch

Last Monday, Berachain officially launched its Proof of Liquidity (PoL) mechanism, meaning this Layer 1 with a built-in Ponzi mechanism is officially in motion.

- Odaily Note: For specific details about PoL, refer to “Detailed Explanation of Berachain PoL Mechanism: A More Aggressive Bribery Model than Curve”.

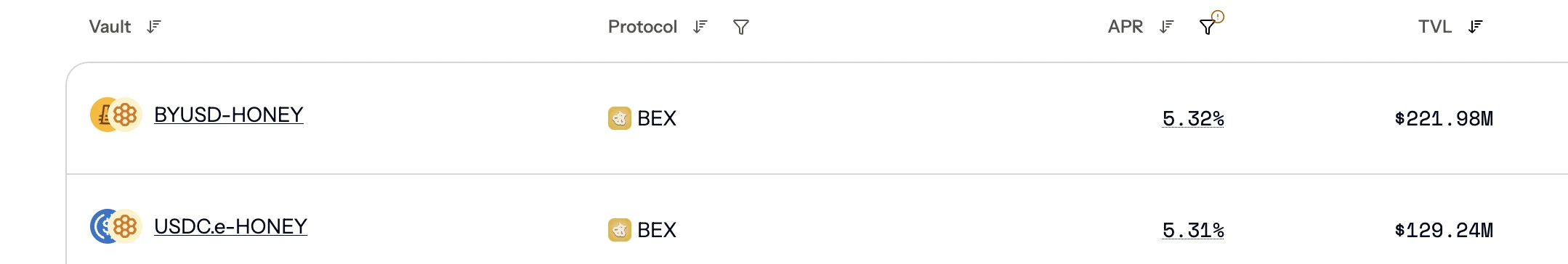

In the early stages of PoL, the APR of the two main stablecoin pools, BYUSD/HONEY and USDC.e/HONEY, once exceeded 20%. However, as the pool size expanded and BERA followed the market downturn, the APR has now significantly shrunk to around 4%.

However, with the help of Berachain's PoL liquidity staking protocol Infrared, this APR data can rise to around 5.3% (because iBGT has a certain premium over BERA), while maintaining long-term interaction with Infrared — Although the APR figure is not very ideal, I personally still recommend mining this, as Infrared is likely to be the project with the highest market cap imagination in the entire Berachain ecosystem, with significant potential airdrop expectations.

- Odaily Note: For more details, refer to “Raised over $18.75 million, How to Maximize Berachain's Only Leading Project Infrared”.

Additionally, since the LP APY of iBGT and iBERA on Pendle is relatively high (base 132%, 299%, and up to 322%, 543% with sufficient PENDLE staked), a "spot mining, contract shorting" hedging strategy can also be adopted. Currently, the annualized cost of shorting BERA on Binance is around 50%, and the yield is sufficient to cover the fee costs, while also maintaining interaction with Infrared — iBGT has a premium, which is relatively uncontrollable, so it is more advisable to operate with iBERA.

In addition to these relatively mainstream pools, there are also many small pools on Berachain with annualized rates exceeding 100% or even 1000% (such as the newly launched stable project USDbr), which will not be listed here (can be viewed on Infrared's homepage). Everyone can participate based on their risk preferences.

Reslov's Blueprint

Last Tuesday, IvanKo, the founder of the stablecoin project Reslov, published a lengthy article outlining the two biggest problems facing the currently popular "yield-bearing stablecoins" — scalability and risk.

Scalability refers to the fact that the on-chain yield space will be rapidly compressed as the asset scale expands, even the actual capacity under the BTC + ETH + SOL hedging strategy, which Ethena (USDe) relies on for growth, is only about $20 billion, so it is necessary to explore all yield paths, including but not limited to futures arbitrage, MEV, high-frequency trading (HFT), etc.

Risk refers to the fact that with more yield paths, potential risk points will also increase, so risk isolation is necessary — Resolv's current solution is to walk on two legs with USR and RLP, where RLP acts as insurance for unexpected situations with USR, earning higher yields while bearing risks.

Including Ethena, Level, and Reslov, yield-bearing stablecoins are increasingly seen by the market as the biggest opportunity to disrupt the stablecoin sector (refer to “Four Yield-bearing Stablecoin Protocols About to TGE, Who Can Define the New Paradigm of DeFi?”), but few people mention the upper limit of on-chain yield space. However, for projects within the track, it is indeed better to realize this as early as possible. Overall, Resolv's thinking is quite clear, I personally tend to raise expectations for this project's airdrop.

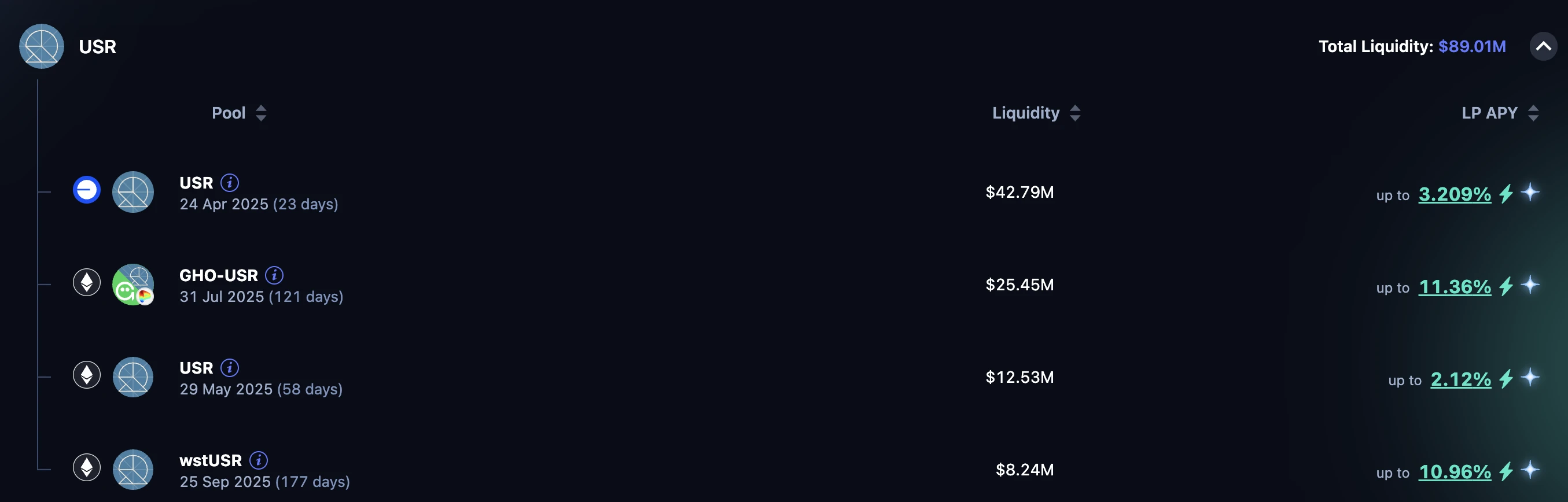

Resolv's points program has been open for quite some time, but there are still many paths to accelerate scoring, which can be supplemented before TGE. For example, the four pools of Pendle shown in the image below can provide a minimum of 25 times and a maximum of 45 times the scoring rate bonus.

AC's Algorithmic Stability

The algorithmic stablecoin of veteran DeFi expert and Sonic co-founder Andre Cronje (AC) is also receiving significant market attention.

- Odaily Note: Refer to “APR Exceeds 200%? 'Old King of DeFi' AC Enters Algorithmic Stablecoin”.

Currently, the known information is that this stablecoin is expected to be released in 4-5 weeks. Although the excessively high APR seems daunting, the consistent logic of algorithmic stability is "early entrants eat meat, later entrants pay the bill." Interested users are advised to set a reminder to act in a timely manner.

Vest Annualized Surge

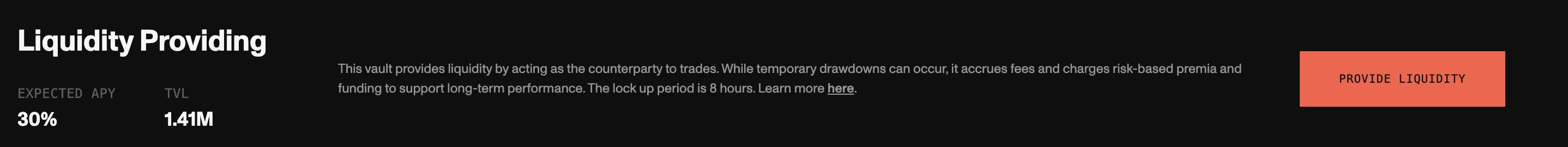

Lastly, a note: the LP APY yield rate of Vest, recommended in the March 17 issue, has increased to 30%. The six-month points program has just opened for two weeks, and there is still a long time to participate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。