Highlights of This Issue

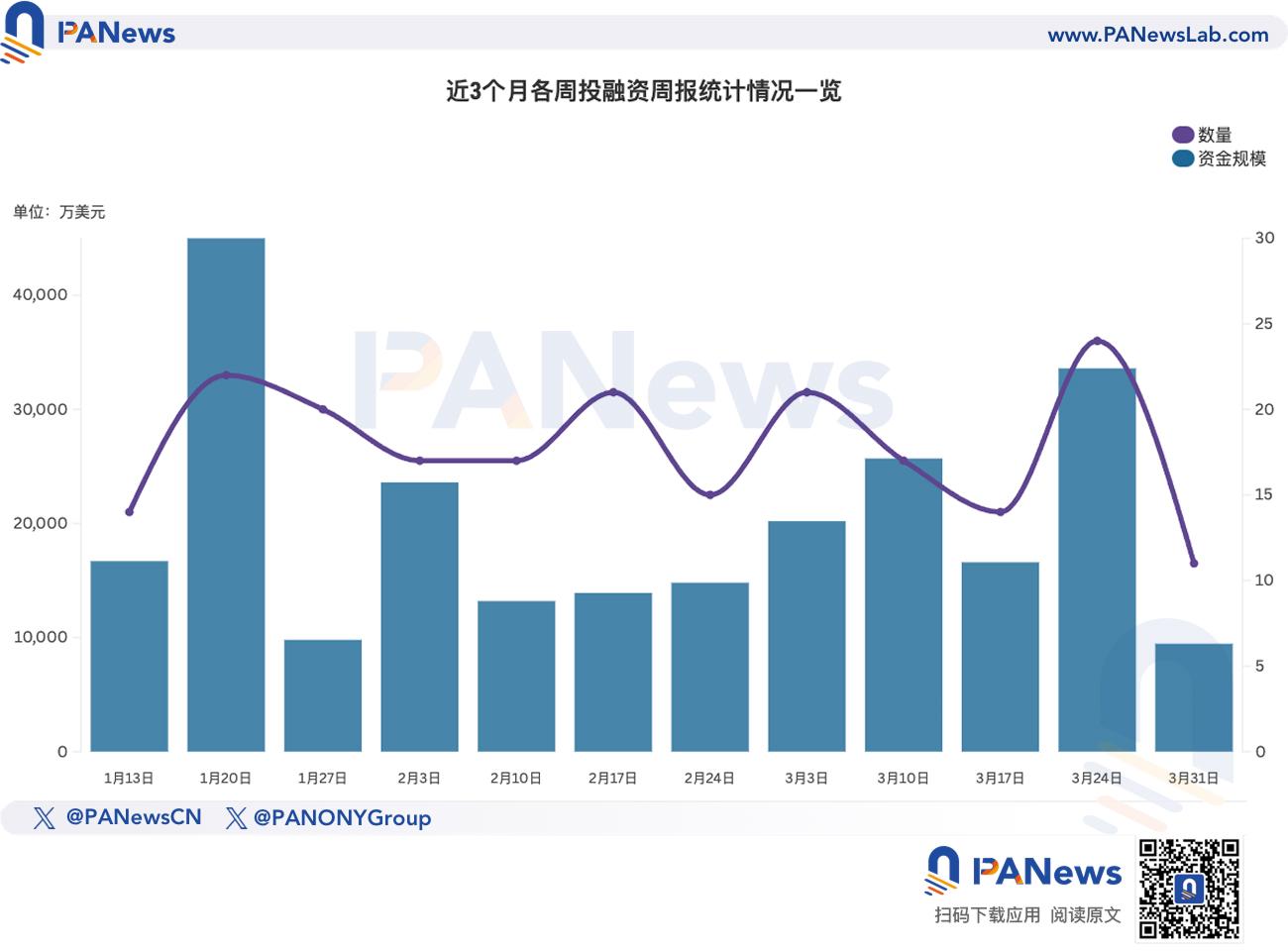

According to incomplete statistics from PANews, there were 11 financing events in the global blockchain sector last week (3.24-3.30), with a total funding scale of approximately $9.45 million, a significant decrease compared to the previous week. The overview is as follows:

- DeFi reported 2 financing events, including on-chain order processing company Warlock Labs, which completed $8 million in funding, led by Polychain Capital;

- Web3 Games reported 2 financing events, including the chain game Immortal Rising 2 developer Planetarium Labs, which completed $3 million in funding;

- Web3+AI reported 1 financing event, with AI agent public chain Hibit completing $5 million in funding, with participation from Waterdrop Capital and others;

- Infrastructure & Tools reported 2 financing events, including Ethereum on-chain oracle service Chronicle, which completed $12 million in seed round funding, led by Strobe;

- Other categories reported 1 financing event, with memecoin incubation platform Coresky completing $15 million in Series A funding, led by Tido Capital;

- Centralized Finance reported 2 financing events, including debit card issuer Rain, which allows stablecoin settlements, completing $24.5 million in funding, led by Norwest Venture Partners.

DeFi

On-chain order processing company Warlock Labs has completed $8 million in funding. Polychain Capital led the round, with participation from Greenfield Capital, Reciprocal Ventures, Symbolic Capital, Ambush Capital, and TRGC. The company aims to prove that submitted order flows have not been tampered with to ensure fair trading.

Solana ecosystem re-staking protocol Fragmetric completes $5 million in funding, led by RockawayX

Solana ecosystem re-staking protocol Fragmetric has completed $5 million in funding, led by RockawayX, with participation from Robot Ventures, Amber Group, Hypersphere, and BitGo. Currently, Fragmetric has raised a total of $12 million. Previous news reported that the Solana re-staking protocol Fragmetric completed $7 million in seed round funding, co-led by Finality Capital Partners and Hashed.

Web3 Games

Anime IP ecosystem Tarta Labs announced the completion of $4.5 million in funding, with participation from BITKRAFT Ventures, The Spartan Group, Infinity Ventures Crypto, HashKey Capital, and Gam3Girl Ventures. It is reported that Tarta Labs' first game, Spot Zero, will enter CBT1 (Closed Beta Test 1) this April.

Chain game Immortal Rising 2 developer Planetarium Labs completes $3 million in funding

Planetarium Labs, the developer of the dark fantasy chain game "Immortal Rising 2," successfully completed $3 million in funding led by Solarium Labs before the TGE (March 27) and successfully concluded its NFT sale. Investors in this round also include Spartan Group, Immutable, MARBLEX, Comma3 Ventures, Sovrun, 32-Bit Ventures, Notch Ventures, Cristian Manea, Niels de Ruiter, and other Web3 institutions and angel investors. The new funds will be used to expand the ecosystem and enhance gameplay. Planetarium Labs is a community-driven Web3 gaming company that previously completed $32 million in Series A funding led by Animoca Brands.

AI

AI agent public chain Hibit completes $5 million in funding, with participation from Waterdrop Capital and others

AI agent public chain Hibit announced the completion of $5 million in funding, with participation from Bochsler Finance, Nvidia, distributed Shenbo, Waterdrop Capital, Web3 Venture, Betterverse DAO, Hitters, and several traditional entrepreneurs. The funds will be used to advance Layer 2 infrastructure, Hibit DEX, cross-chain interoperability technology, and the ecological construction of the AI Agent economy. Hibit is an independent Layer 2 that has covered multiple public chains such as TON, Kaspa, Solana, ETH, BTC, BNB, and ICP, focusing on secure cross-chain solutions without cross-chain bridges. Its core product, Hibit DEX, supports millions of TPS, permissionless token listing, and integrates features of both CEX and DEX, serving AI agent and meme community scenarios.

DePIN

Decentralized charging project DeCharge based on Solana completes $2.5 million in seed round funding

Decentralized charging project DeCharge based on Solana announced the completion of $2.5 million in seed round funding, led by Lemniscap, with participation from Colosseum, Daedalus, Escape Velocity, and Levitate Labs. DeCharge is a community-driven electric vehicle charging network built on Solana. It enables decentralized ownership and monetization of electric vehicle charging through modular charging stations, allowing anyone to host and operate charging infrastructure.

Infrastructure & Tools

Ethereum on-chain oracle service Chronicle has completed $12 million in seed round funding, led by Strobe (formerly Blocktower Venture Capital), with participation from Brevan Howard, 6th Man Ventures, and others. The new funds are intended to support its data infrastructure services for tokenized assets.

Parallel privacy computing network Arcium completes $1 million in angel round funding

Parallel privacy computing project Arcium (formerly known as Elusiv) announced the completion of $1 million in angel round funding, with investors including Jordi Alexander, Joe McCann, WereMeow, Fedor Holz, and RunnerXBT. Arcium claims this round of funding brings its total financing to $11 million. Arcium is a decentralized confidential computing network that ensures data integrity and confidentiality by processing encrypted data across multiple nodes without exposing the complete dataset, utilizing distributed architecture and multi-party computation (MPC).

Other

Meme:

Memecoin incubation platform Coresky completes $15 million in Series A funding, led by Tido Capital

Memecoin incubation platform Coresky announced the completion of $15 million in Series A funding, led by Tido Capital, with participation from WAGMI Ventures, CoPilot Ventures, Web3 Vision Fund, and Parallel Ventures, bringing the total funding to $21 million. The Coresky platform promotes community-driven fair launches of memecoin projects through user voting.

Centralized Finance

Debit card and credit card issuer Rain has completed $24.5 million in funding, led by Norwest Venture Partners, with participation from Galaxy Ventures, Goldcrest, Thayer, and Hard Yaka. The valuation of Rain in this round of financing has not been disclosed. Rain is a company that issues debit and credit cards, allowing customers to settle payments using stablecoins. Rain will use the funds raised in this round to expand its team, develop new technologies, and apply for additional regulatory licenses.

Remittance app Abound completes $14 million in funding, led by NEAR Foundation

The remittance application Abound, spun off from Times Internet in 2023, has raised $14 million in its first round of external financing. This seed round financing is entirely equity financing, led by NEAR Foundation, with participation from Circle Ventures, Times Internet, and other investors. The company plans to use the new funds to expand its business scope, increase product variety, and improve its technological infrastructure. Abound, originally named Times Club, allows users to remit money to India, earn rewards, and receive cash back on services such as sports live streaming, grocery shopping, and OTT subscriptions. The company plans to explore ways for users to earn high-yield savings, India-centric investments, and cross-border credit solutions. Abound currently has 40 employees, primarily working in India. The company plans to increase its workforce and establish a management team in the United States.

Venture Capital Firms

Crypto venture capital Maven 11 completes fundraising for its third fund, raising $107 million

European crypto venture capital firm Maven 11 has completed fundraising for its third fund, raising $107 million, slightly above the initial target of $100 million. This financing concluded approximately nine months later than originally anticipated. The fund received support from Theta Capital Management and new institutional backers from Europe and Asia. Maven 11 did not disclose the names of all LPs but noted that London-based investment firm Karatage is one of the participants. The size of the third fund is still smaller than Maven 11's second fund, which closed at $120 million in May 2023.

Maven 11's Chief Information Officer and Executive Partner Balder Bomans stated that the fund has supported several startups over the past year, including decentralized trading platform GTE, on-chain competition platform JokeRace, on-chain brokerage firm August, and Ethereum scaling startup Spire Labs, deploying approximately 15% of its funds, with the remaining funds planned for deployment over the next 3-4 years. The third fund will support equity and token rounds of financing, ranging from $500,000 to $5 million. Its investment focus covers emerging areas such as consumer applications, infrastructure, and the intersection of artificial intelligence and cryptocurrency.

French state-owned bank Bpifrance establishes a €25 million fund to invest in cryptocurrencies

French state investment bank Bpifrance plans to invest up to €25 million (approximately $26.95 million) to purchase niche cryptocurrencies to support cryptocurrency projects in France. This is the first time Bpifrance has specifically established a fund to directly purchase cryptocurrencies; previously, the bank had invested €150 million in blockchain projects, but only involved "a small amount" of cryptocurrency investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。