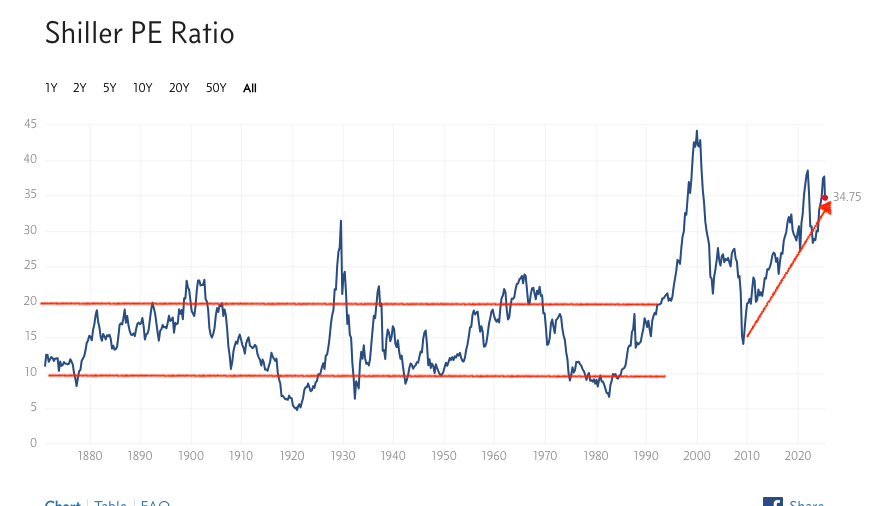

During the period from 1880 to 1990, the Shiller PE of the S&P 500 generally ranged between 10 and 20, rarely exceeding this range.

From the 1990s to 2000, it broke out of this range, then fell back, and has been climbing ever since… Currently, it stands at 34.75, far above the historical average and range.

Is this normal?

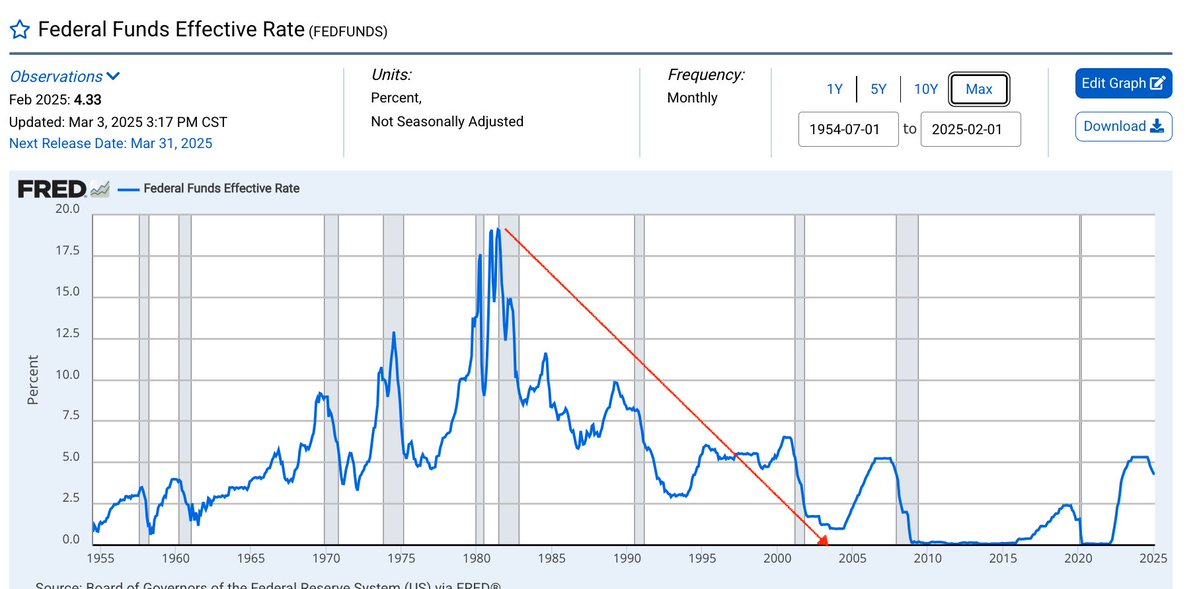

It's merely the effect of dollar interest rate cuts and QE.

To put it bluntly, how is this different from China's real estate bubble?

The problem with the real estate bubble is that houses are too expensive, leading to fewer buyers, and prices must drop to clear the market.

What about stocks? You can keep playing indefinitely, but the problem is that it turns into a game of hot potato, completely detached from fundamentals.

In other words, the U.S. stock market is just a larger version of the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。