Source: Cointelegraph Original: "{title}"

Tokens

Unlock Value (USD)

This Unlock as Percentage of Circulation

Unlock Type

Unlock Date

Unlocking Party

OP

26.98 million

1.93%

Cliff

March 31

Retroactive Public Goods Funding, etc.

ZETA

16.44 million

6.19%

Cliff

April 1

Protocol Treasury, etc.

DYDX

5.85 million

1.09%

Cliff

April 1

Community Treasury and Rewards Treasury, etc.

SUI

171.4 million

2.03%

Cliff

April 1

Ecosystem Development, Project Development

IOTA

2.84 million

0.41%

Cliff

April 2

IOTA Holders, etc.

W

133.61 million

47.86%

Cliff

April 3

Ecosystem & Incubation, etc.

Core data overview of unlocks this week (March 29 to April 4). Source: Tokenmist

Note: Cliff Unlock: Tokens are released in a large amount at a specific point in time, resembling a "cliff," completely frozen during the lock-up period, and suddenly unlocked upon expiration.

Highlights of Key Unlock Projects Background

W (Wormhole) is an interoperability protocol that uses the Guardian network for transaction validation, enabling secure data and asset transfers across more than 30 blockchains.

Funding Situation: In November 2023, Wormhole completed its latest funding round, raising $225 million, with a project valuation of $2.5 billion. Investors include Brevan Howard, Coinbase Ventures, Multicoin Capital, Jump Trading, ParaFi, Dialectic, Borderless Capital, Arrington Capital, among others.

As of March 28, 3 PM, the price of W was $0.094 USDT, with a 24-hour decline of 9.2% and a 7-day increase of 12.1%.

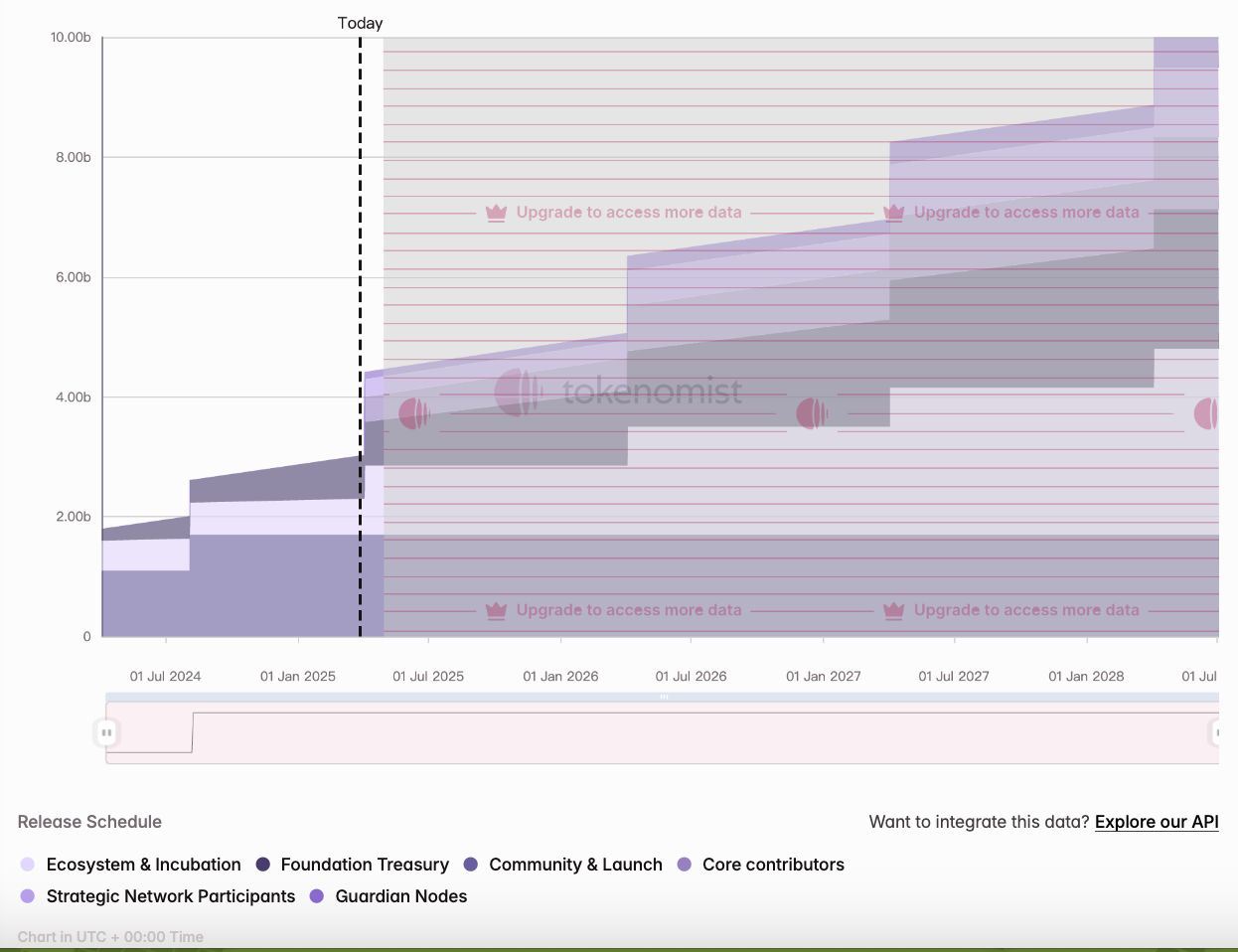

W tokens have been unlocked by 30.21%, with this unlock involving 1.39 billion tokens, out of a total supply of 10 billion tokens. The specific unlock curve is as follows:

W token unlock curve. Source: Tokenmist

SUI (Sui Network) was launched by Mysten Labs in 2023, and its innovative parallel transaction processing and Move programming language make Sui an important player in the Web3 ecosystem, achieving efficient, low-latency interactions to meet the growing demand for decentralized technology.

Funding Situation: The development team of Sui, Mysten Labs, raised $36 million in December 2021 with participation from a16z and other institutions, and completed a $300 million Series B funding round led by FTX Ventures in September 2022, with a valuation of $2 billion. Investment institutions include a16z, Binance Labs, FTX Ventures, Franklin Templeton, Coinbase Ventures, Bixin Ventures, among others.

As of March 28, 3 PM, the price of SUI was $2.64 USDT, with a 24-hour increase of 2.2% and a 7-day increase of 14.7%.

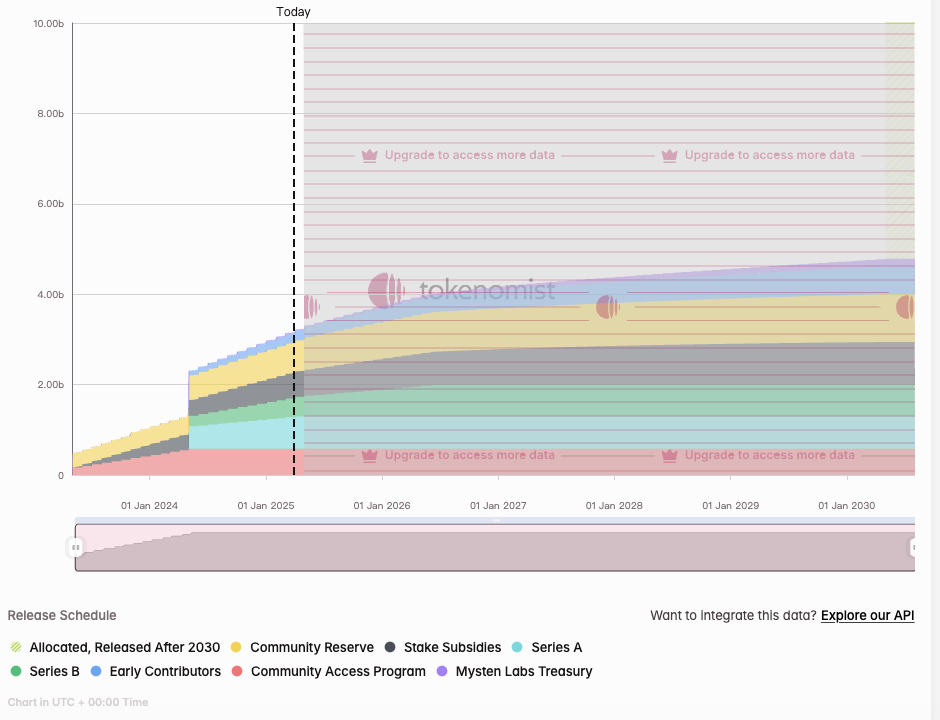

SUI tokens have been unlocked by 31.73%, with this unlock involving 64.19 million tokens, out of a total supply of 10 billion tokens. The specific unlock curve is as follows:

SUI token unlock curve. Source: Tokenmist

ZETA (ZetaChain) is a Layer 1 blockchain and interoperability platform established in 2021, aimed at achieving seamless cross-chain communication and full-chain smart contracts.

Funding Situation: In August 2023, ZetaChain completed a $27 million funding round, with participants including Blockchain.com, Human Capital, VY Capital, Sky9 Capital, Jane Street Capital, VistaLabs, CMT Digital, Foundation Capital, Lingfeng Capital, GSR, Kudasai, and Krust.

As of March 28, 3 PM, the price of W was $0.35 USDT, with a 24-hour decline of 6.8% and a 7-day increase of 62.2%.

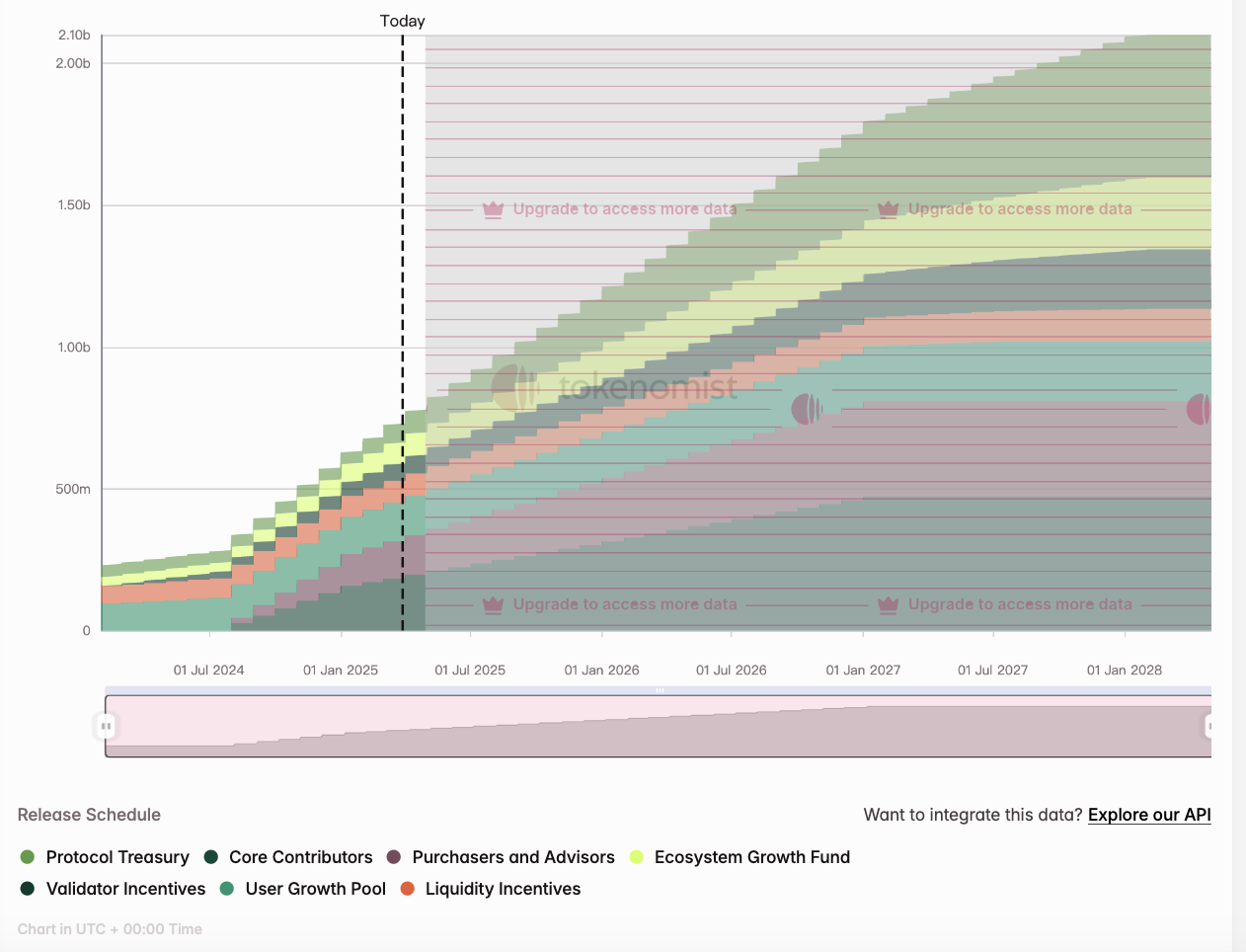

ZETA tokens have been unlocked by 34.76%, with this unlock involving 4.426 million tokens, out of a total supply of 2.1 billion tokens. The specific unlock curve is as follows:

ZETA token unlock curve. Source: Tokenmist

DYDX (dydx) is a decentralized derivatives exchange that provides users with key financial tools such as perpetual contracts, margin and spot trading, and lending. dYdX offers traders an off-chain order book with on-chain settlement, allowing them to short tokens, increase risk exposure through leveraged long positions, or earn interest on deposited tokens for profit.

Funding Situation: A total of $87 million was raised across four funding rounds, with notable investors including Paradigm, Polychain Capital, Andreessen Horowitz (A16Z), Three Arrows Capital, and one of the largest liquidity providers on dYdX, Wintermute.

As of March 28, 3 PM, the price of DYDX was $0.69 USDT, with a 24-hour decline of 7.5% and a 7-day increase of 5.8%.

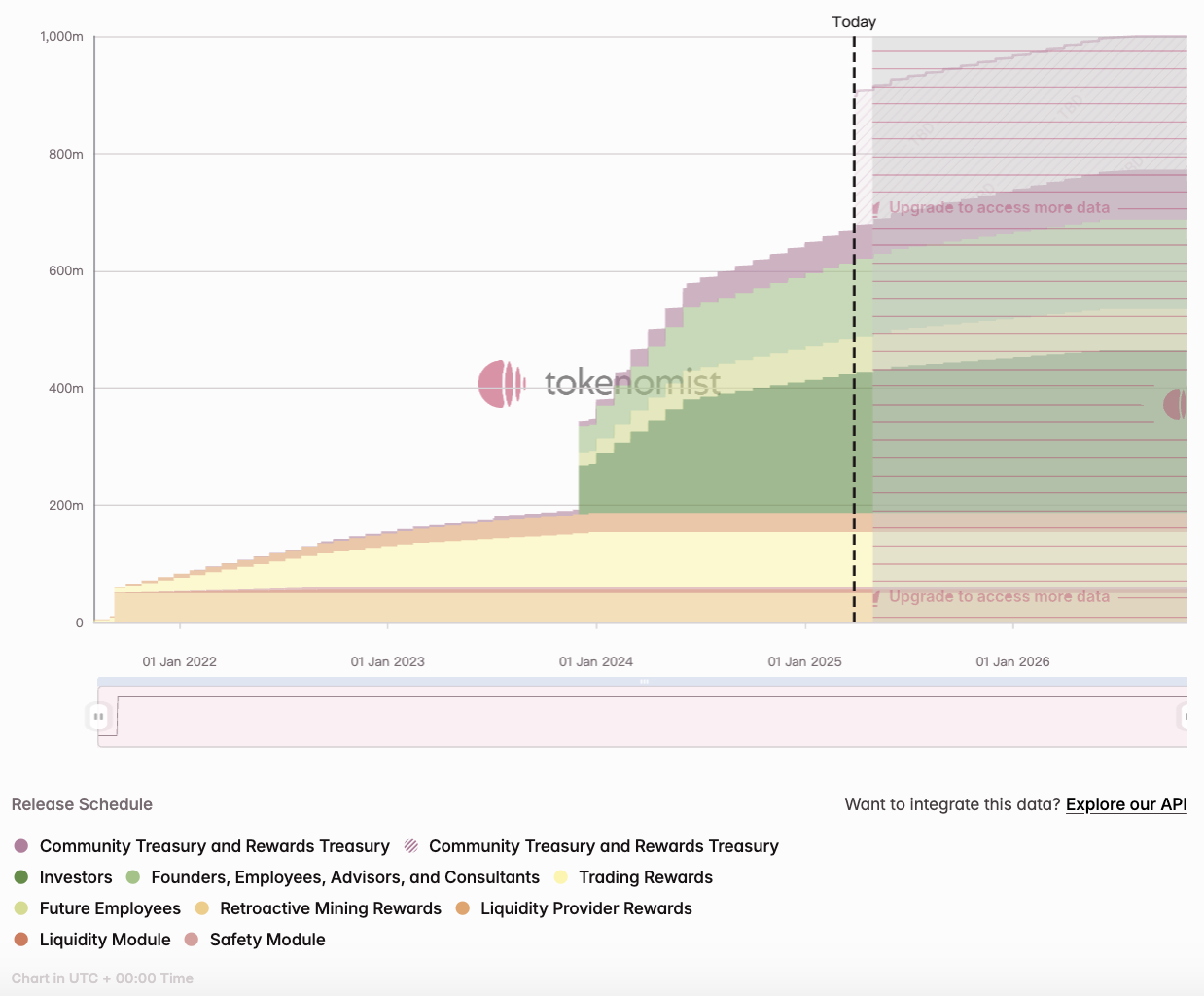

DYDX tokens have been unlocked by 67%, with this unlock involving 8.33 million tokens, out of a total supply of 1 billion tokens. The specific unlock curve is as follows:

DYDX token unlock curve. Source: Tokenmist

Token unlocks are an important factor in the cryptocurrency market. Before a token unlock, investors should closely monitor project dynamics and market sentiment, and position themselves in advance to mitigate potential risks.

Related: Pudgy Penguins submits ETF application: A tentative experiment or a turning point in the institutional NFT narrative?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。