"The first black card for young people," behind it is the ambition of crypto giants to change the financial system.

Written by: Bright, Foresight News

ETH NFT has attracted young people.

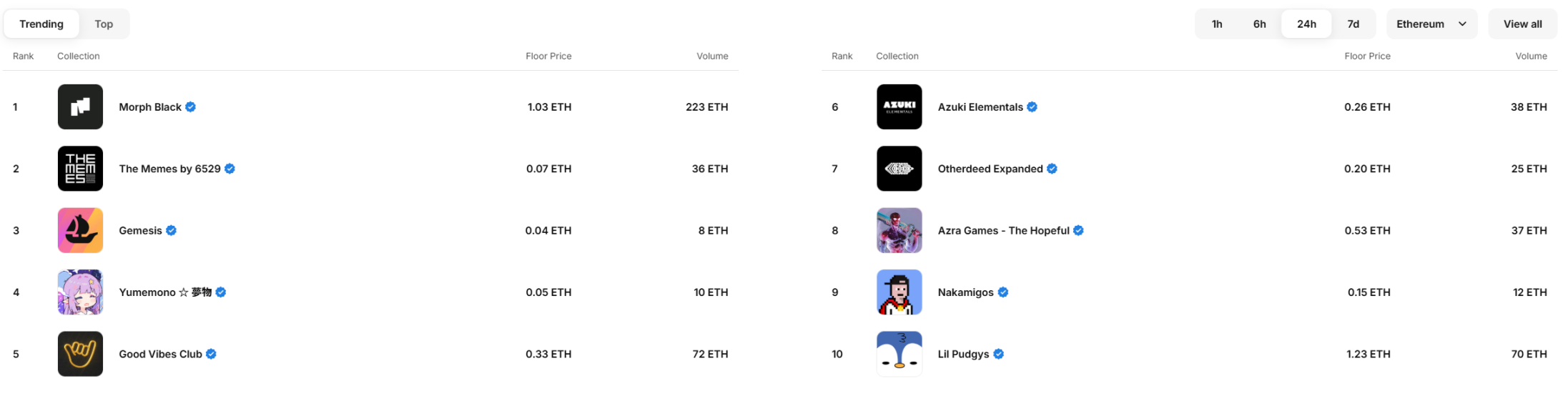

On March 28, this Morph black card, claiming to be "the first black card for young people," strongly broke through the floor price of 1 ETH today, becoming a hot new player in ETH NFTs. As of the time of writing, according to Opensea market data, since the mint opened at 8 PM on March 27, the Morph black card series NFTs have completed 274 transactions in the secondary market, with a trading volume of up to 223 ETH within 24 hours, surpassing a series of established blue-chip NFTs like Pudgy Penguins, CryptoPunks, and BAYC. During this period, some community members even mistakenly purchased counterfeit Morph black card NFT collections due to FOMO, resulting in losses of up to 0.5 ETH.

What exactly is the Morph black card that has made so many heroes bow down?

NFT + Utility + RWA, the three-pronged Payfi killer

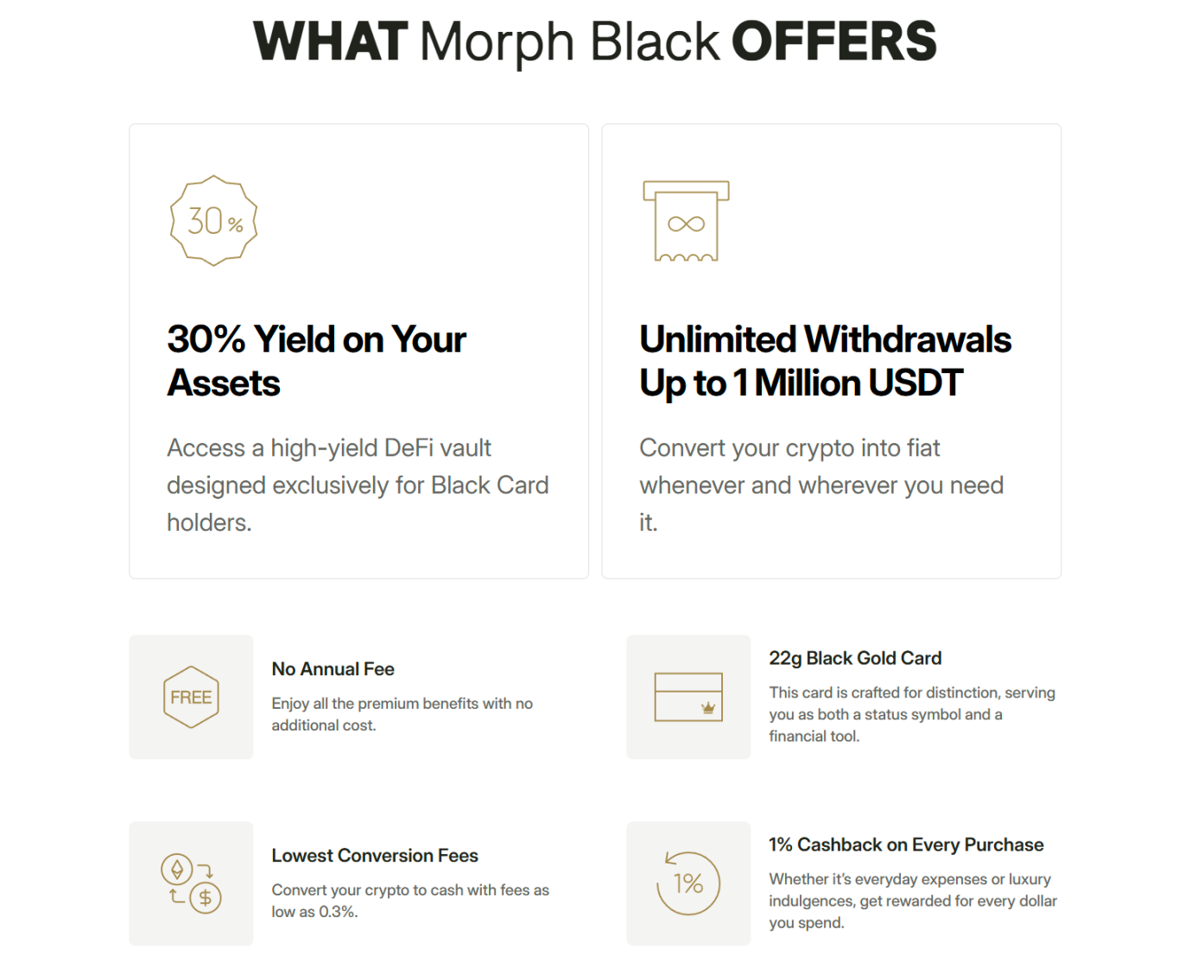

On February 25, Morph, a global consumer-grade public chain backed by Bitget, officially launched Morph Pay, a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 DeFi (decentralized finance) yield capabilities. The Morph black card is essentially Morph Pay Premium. According to the Morph Black official website, holders of the Morph black card can enjoy the following benefits without an annual fee:

Ⅰ Up to 30% annualized yield.

Ⅱ Support for single withdrawals of up to 1 million USDT without review.

Ⅲ Cryptocurrency to fiat exchange rates as low as 0.3%.

Ⅳ 1% cash back on any spending.

In addition, the Morph black card has a high potential to receive airdrops from Morph and its ecological partners (such as BulbaSwap, Momodrome, etc.).

In this cycle, stablecoins have become the fastest-growing sector in the cryptocurrency industry, with total amounts continuously reaching new highs. The emerging industry trend is the Payfi market, which transcends crypto and introduces competition from real-world political and economic giants. The Payfi concept sector, led by Ripple, has significantly outperformed the market in this cycle, breaking free from SEC lawsuits and various regulatory shackles.

However, the Payfi market has many sub-sectors, and aside from institutional-level payments, personal consumption scenarios urgently need updates and iterations of Payfi products. The Morph black card meticulously addresses the core "consumption" needs of cardholders in terms of deposit yields, large cash outs, daily spending, etc., even including global hotel and travel Aspire VIP concierge services, perfectly embodying the consumer-centric principle consistently advocated by the Morph public chain.

Thus, the Morph black card NFT is not just a symbol of PFP but is genuinely tailored to create a killer personal Payfi product for crypto holders, serving as the most direct financial link and rights certificate between reality and the blockchain.

It is reported that the Morph public chain may conduct its TGE in Q2 2025, with the corresponding Morph black card possibly undergoing KYC certification in Q3. At that time, Morph black card NFTs will be issued as physical cards, converting the original NFTs into SBT forms.

Payfi, the value anchor in the post-Meme era

The crypto industry has always been labeled with high risk and high returns, but under the trend of compliance in the crypto industry, the market has become difficult to grow wildly like during the ICO era. Although the Meme market has fluctuated for a year, there has indeed been growth in terms of price and trading volume. However, the Meme, which raises cultural flags, has not gained more incremental value; instead, after a peak, it has dragged the entire crypto industry into a zero-sum game of continuous PVP, leading to the "bad money driving out good" scenario. This has not only made outsiders and observing institutions disgusted with the speculative bubble-filled "Web3.0," but has even forced some builders to waver—should they continue to "BUIDL" in such a market?

Currently, there are about 37 million tokens in the crypto market, of which 99.9% belong to worthless "air projects." Crypto analyst Miles Deutscher believes that fewer than 100 projects meet the following criteria: having an experienced team, maintaining a long-term bullish attitude towards their own tokens (net buying exceeds net selling), possessing a clear business model and a roadmap for sustainable profits, finding a real product-market fit or a clear path, being able to deliver continuously regardless of market conditions, having real competitive barriers, and aligning with macro trends (such as AI, RWA, stablecoins, etc.).

Looking back at Morph, it is the Payfi solid infrastructure driven by stablecoins. Morph is actually leveraging the most everyday consumption scenarios, backed by the leading global exchange Bitget and Singapore's top issuing institution DCS, to attract traditional savings funds onto the blockchain, truly integrating "banking, securities, and currency," thereby potentially transforming the world financial system that could disrupt SWIFT and achieve Crypto Mass Adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。