Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the articles and videos from the King. Every day, I bring you different news from the crypto world and precise market analysis.

**Click the link to watch the video: **https://www.bilibili.com/video/BV1Ceo9YBENw/

Bitcoin and Ethereum Market Strategy Report for March 28

I. Macroeconomic Environment and Market Sentiment

Federal Reserve Policy Suppresses Liquidity

The Federal Reserve's dot plot for March shows a very low probability of interest rate cuts this year, with the benchmark rate maintained in the 4.25%-4.50% range. The high-interest-rate environment continues to suppress liquidity in risk assets, and the strengthening dollar has led to capital outflow from high-risk areas like cryptocurrencies. The PCE price index remains above target, and St. Louis Fed President Bullard emphasizes "anti-inflation priority," with a policy shift waiting for clearer signals of economic recession.

Trump's Tariff Policy Intensifies Market Volatility

The Trump administration recently announced a 25% tariff on goods from Mexico and Canada, causing significant declines in the three major U.S. stock indices, which in turn pressured the crypto market. Historical data shows an increased correlation between Trump's tariff policy and the crypto market: for example, at the end of February, Bitcoin briefly rebounded to 95 due to news about "strategic reserve tokens," but quickly fell back to 83 after the tariffs were implemented. The market needs to be cautious of short-term volatility caused by policy "pullbacks."

Institutional Fund-Dominated "Divergent Bull Market"

Since the approval of the Bitcoin spot ETF, institutional funds have continued to flow in (BlackRock's IBET holdings have increased significantly), pushing BTC from 30 to 70. However, retail funds are constrained by economic disorder (such as a wave of project bankruptcies) and inflation tightening, making it difficult to form a collective force, leading to the depletion of altcoin liquidity. The current market shows an institutional characteristic of "Bitcoin sucking blood, altcoins stagnating."

II. Bitcoin Technical Analysis and Trading Strategy

Key Levels and Pattern Analysis

Support/Resistance: First support at 86.8 (coinciding with the 120-day moving average), second support at 86.3 (yesterday's low); resistance above at 87.6 (upper edge of the triangle convergence), 88.3 (previous high).

Pattern Signal: A 1-hour triangle convergence pattern (86.8-87.3), with the breakout direction determining the short-term trend. Historical statistics show that the probability of an upward breakout from a triangle convergence in an uptrend is about 65%, but the current MACD shows a bearish crossover, and the RSI has dropped to 45 (oversold edge), so caution is needed for false breakout risks.

Trading Suggestions

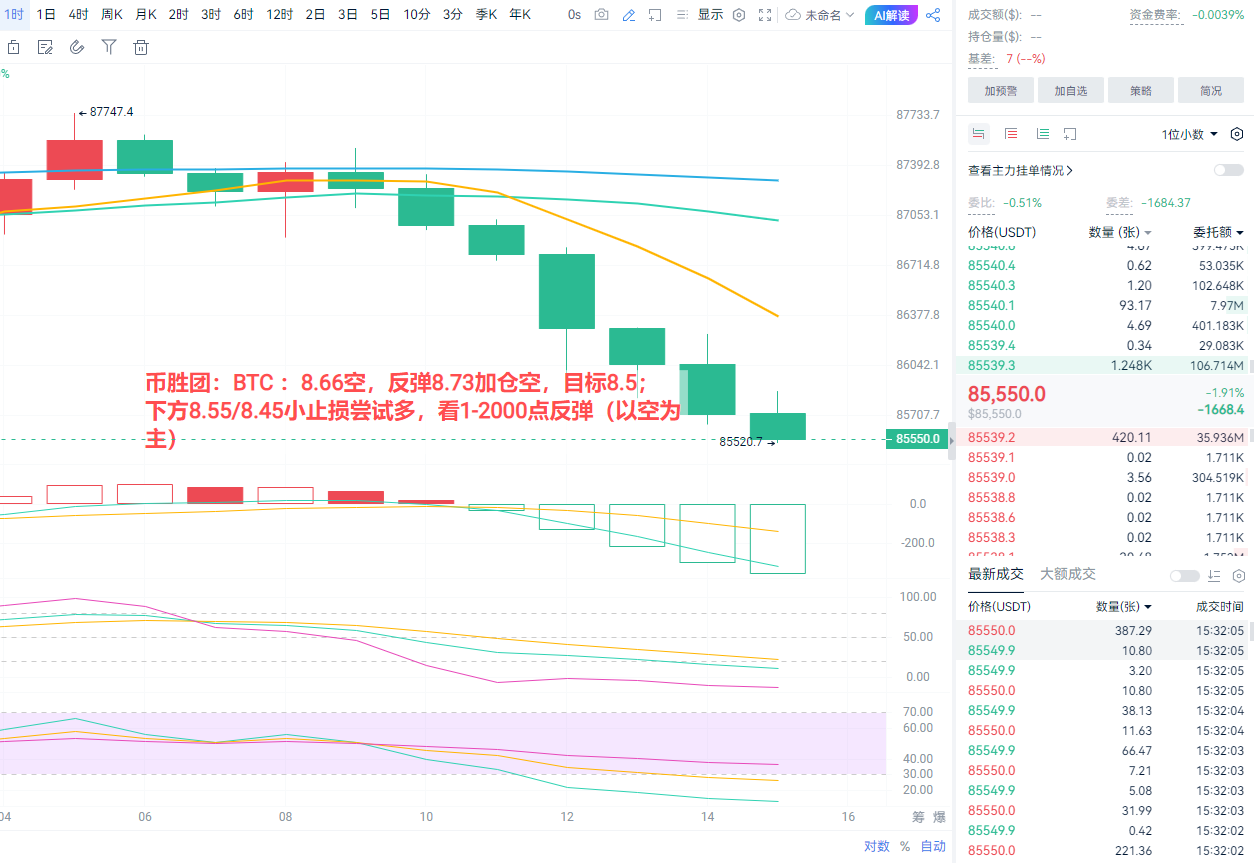

Short Position Strategy: Light short in the 87600-88300 range, stop loss at 89000, target 86800-86300. If it breaks below 86.3K, additional shorts can be added to 84.5 (weekly MA30 support).

Long Position Strategy: Do not actively build positions for now; if the price forms a long lower shadow at 85.5 with increased volume, a small position can be tried for a long, targeting 87.5.

Breakout Response: If it breaks above 88.3 with volume, stop loss on shorts and observe, with key resistance above at 89.3 (previous high area).

III. Ethereum Technical Analysis and Trading Strategy

Key Levels and Trend Judgment

Moving Average Pressure: The daily MA5/MA10/MA30 has formed a death cross in the 2050-2000 range, and the price has fallen below all short-term moving averages, indicating a bearish technical outlook.

Support/Resistance: First support at 1940 (previous low platform), second support at 1850 (psychological level), strong support at 1800 (2024 cycle low); resistance above at 2050 (moving average convergence area).

On-chain Data: The number of active addresses has decreased by 5%, reflecting a decline in retail participation and a lack of rebound momentum in the short term.

Trading Suggestions

Short Position Strategy: Light short at 1940, add to position at 1980, stop loss at 2000, target 1850-1800. If it breaks below 1800, it may test 1750 (February 2025 low).

Avoiding Long Positions: Do not counter-trend buy before clear bottom signals appear; pay attention to the effectiveness of the 1800 support. If the weekly close is above 1850 and RSI shows a bottom divergence, consider left-side positioning.

IV. Controversial Focus: Is the Halving Cycle Rule Invalid?

Opposing Viewpoint

Outlier Ventures research indicates that BTC performance is weak after the 2024 halving (down 8% from the halving day), with ETF fund inflows (299,000 BTC) replacing halving as the main driving force. The miner selling pressure ratio has dropped to 9.2%, weakening the supply-side impact of the halving, and psychological expectations are overshadowed by macro policies.

Supporting Viewpoint

The Coin Victory Group believes the cyclical rule has not failed:

Delayed Effect of Institutionalization: The ETF makes the supply-demand imbalance after the halving more pronounced, and a "delayed bull market" may occur in Q2-Q3 of 2025.

Historical Comparison: The 6.6-fold increase after the 2016 halving was mainly driven by QE; the current high-interest-rate environment suppresses short-term explosions, but the cycle span may be extended.

On-chain Signals: USDT activity has reached a two-month high, and ETF holdings growth provides long-term support. If the price stabilizes above 85K, the halving logic may reassert dominance.

V. Capital Flow and Market Structure

Institutional vs. Retail Behavior Divergence

Bitcoin: Institutions continue to accumulate through ETFs (BlackRock's holdings increased by 12% month-on-month), while retail holdings have dropped below 40%.

Ethereum: Institutional interest has decreased, with the liquidation volume in the lending market reaching a 12-month high in February, and funds shifting to BTC for safety.

Altcoins: The top 10 tokens account for 64% of liquidity, with meme coins (like DOGE) and AI concepts being the few active sectors, while most projects have daily trading volumes below one million dollars.

Liquidity Trap Warning

The depth of the altcoin market has decreased by 37% since early 2024, with project selling pressure (average unlocking volume increased by 15%) creating a negative feedback loop with retail exits. It is only recommended to focus on L1/L2 tokens with strong correlation to BTC/ETH (like SOL, ADA).

VI. Summary and Risk Warning

Short-term: Before the implementation of Trump's tariff policy, the market will maintain a range of 86-88, with a breakout requiring macro catalysts (such as non-farm payroll data, SEC policy easing).

Mid-term: If BTC stabilizes above 90, the halving cycle logic may restart, targeting 95 (historical high); if it breaks below 84, it may retest 80 (institutional cost area).

Risks: Divergence in volume and price (Bitcoin's daily trading volume has decreased by 23%), high leverage in derivatives (ETH perpetual contract funding rate turning negative), and policy black swans (SEC's classification of ETH's security attributes).

In terms of operations, it is recommended to focus on intraday swings, strictly control positions (leverage ≤ 3x), and pay attention to volume changes during 14:00-16:00 (Asian main trading hours) and 20:00-22:00 (European and American main trading hours).

This article is independently written by the Coin Victory Group. Friends who need current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been mainly characterized by fluctuations, accompanied by intermittent spikes. Therefore, when making trades, please remember to control your take-profit and stop-loss levels. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Friends who wish to watch can find the Coin Victory Group online and contact me for the link. The focus is on spot, contracts, BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT. Expertise includes: mobile locking strategy around high and low support and resistance for short-term swings, mid to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, and monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。