Author: Four Pillars

Translation: Bai Ding, Xian Rang

Note: Four Pillars is a South Korean investment and research institution. The team possesses deep insights into market and industry development trends and has invested in several star projects such as INJ, SUI, Ethena, Virtuals, and Hyperliquid based on its own assessments. This article serves as a research report explaining their investment logic and reasons for holding positions, where members of Four Pillars express their views on future market developments. We highly recommend reading it.

Whenever we talk about our involvement in blockchain research, there are always questions like, "What coins should I buy now?" "Which projects are worth investing in?" In fact, the role of a VC researcher is to analyze blockchain-related technologies and assess market trends, rather than provide investment advice, so we usually hesitate to answer such questions.

However, the uniqueness of the Four Pillars research team lies in the fact that we are both industry observers and deep participants in the crypto market. Therefore, instead of giving vague "investment advice," we prefer to openly share our portfolio structure and explain our investment logic.

You might be curious: what assets do these Four Pillars researchers, who are immersed in blockchain research around the clock, actually hold? What are the decision-making bases behind them? Before detailing each investment target, we will visually present the team's overall portfolio distribution in chart form:

From the chart above, we can easily see that the team's holdings exhibit a diversified distribution, covering multiple tracks and ecosystems. Next, we will analyze the investment logic of each researcher and their assessments of the future potential of these assets.

Steve: Declining Dominance of Ethereum, Focusing on Products with PMF in the Market

Portfolio: Sui, Injective, Jito, Ethena, Azuki, Rootlets, Kumo

Smart Contract Platforms No Longer Have a Winner-Takes-All Dynamic

Four Pillars was established in May 2023, at a time when several new public chains were seen as challengers to Ethereum. After the collapse of Terra and the FTX incident, they collectively failed, and Ethereum firmly held the market's dominant position. However, I was convinced at that time that in the next bull market, Ethereum's market share would inevitably drop to around 30%. The core logic is threefold:

First, the scale of new users entering the market will far exceed previous levels;

Second, the influx of new users will inevitably bring diverse value orientations;

Third, Ethereum cannot meet the demand preferences of all groups.

The Ethereum ecosystem places the "decentralization principle" as its highest priority, which draws my attention to its key contradiction— to achieve true "mass adoption," it must accommodate user groups that do not view decentralization as the ultimate value.

Of course, blockchain technology inherently requires "a certain degree of decentralization," but I believe not all scenarios need Ethereum-level decentralization. On the contrary, other value dimensions such as execution efficiency, compliance frameworks, and user experience may take precedence over decentralization. This diversity in value orientation will continue to drive market demand for other public chains beyond Ethereum.

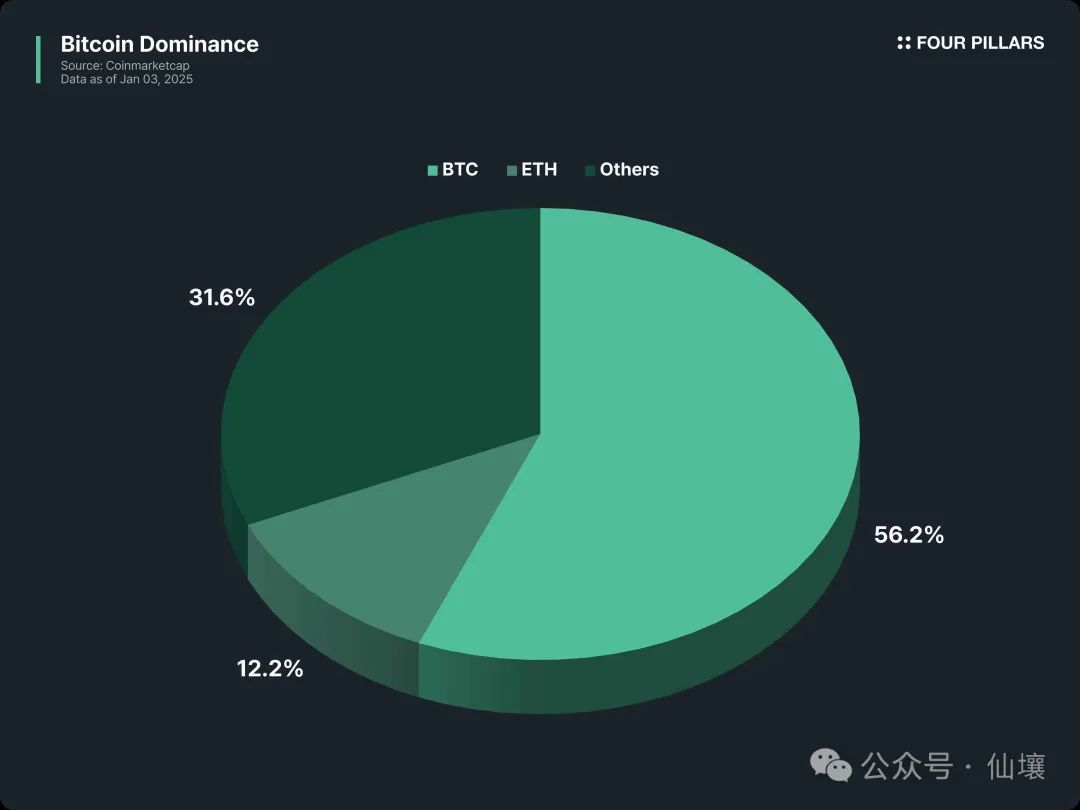

Subsequent market performance has validated my judgment: compared to 2023, Ethereum's current market share has stabilized in the range of 20-30%. As of January 9, 2025, Ethereum's market cap is $398.5 billion, while the total market cap of the crypto market is $1.35 trillion.

Moreover, I believe the biggest issue with the Ethereum ecosystem is not at the technical level, but rather its arrogant attitude of "everything will eventually return to Ethereum." To some extent, this contradicts the decentralization principle they advocate. The open world that blockchain seeks to build will never operate according to the will of any specific group. Therefore, I believe it is almost impossible for a winner-takes-all situation to form in the smart contract platform space in the future.

Because anyone can create a new public chain, innovation can emerge at any time. As time goes on, more and more people will become familiar with blockchain technology, and the barriers to using new public chains will continue to lower. The smart contract platform is likely to maintain a fiercely competitive landscape. Of course, this does not mean we will return to an era of indiscriminately launching chains. In the future, the number of major public chains participating in the competition may decrease, but new frameworks and platforms will continue to emerge, and existing leading public chains will continuously improve their infrastructure.

Based on this judgment, new blockchain frameworks and technologies have always been my focus. My interest in Sui will continue until 2025, as it is at the forefront of "new infrastructure technology." Additionally, I believe public chains like Solana and Injective, which build unique ecosystems based on their respective advantages, will ultimately gain greater market attention—Solana is known for its strong community foundation and scalability comparable to Sui, while Injective excels in rapid trading, flexible business expansion capabilities, and a unique token economic model.

Source: X (@leptokurtic_)

New Opportunities in Established Tracks

When asked, "Which areas of the blockchain industry have achieved PMF?" my answer has always been the three cornerstones: exchanges, stablecoins, and public chains. Before exploring unverified emerging market opportunities, deeply cultivating existing mature tracks and iterating on technology is also a highly valuable direction.

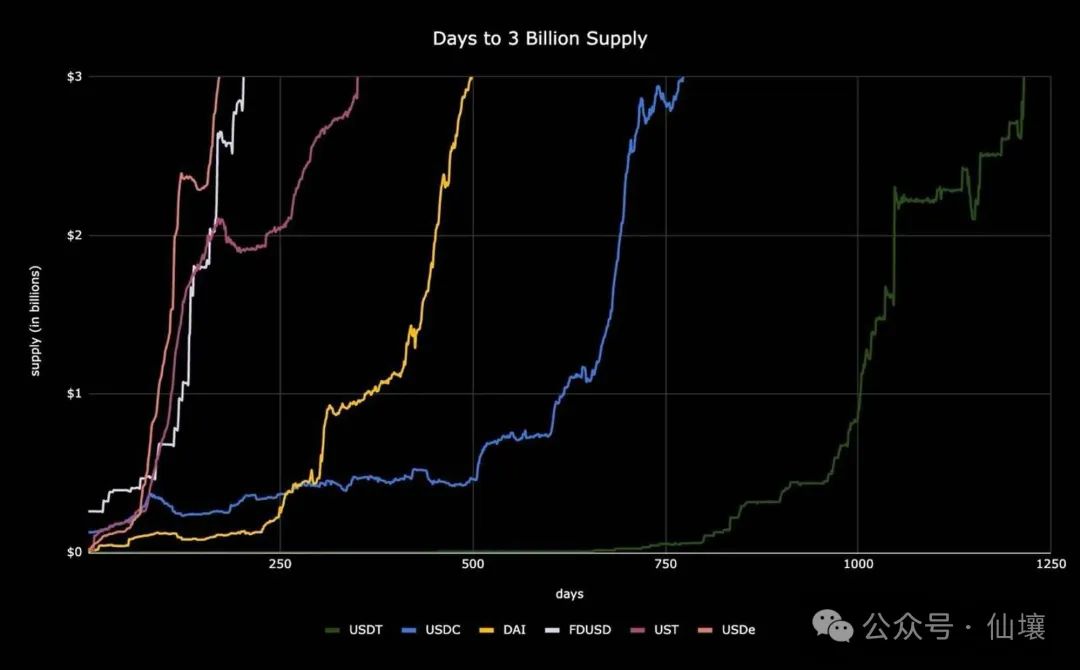

Take the stablecoin track as an example; its development space is far from reaching its peak. If we can build differentiated models while avoiding historical risks, such as the design flaws seen in Terra, it is entirely possible to generate new market demand. The rise and fall of Terra have proven that there is indeed a real demand in the market for Web3-native stablecoins beyond USDT and USDC.

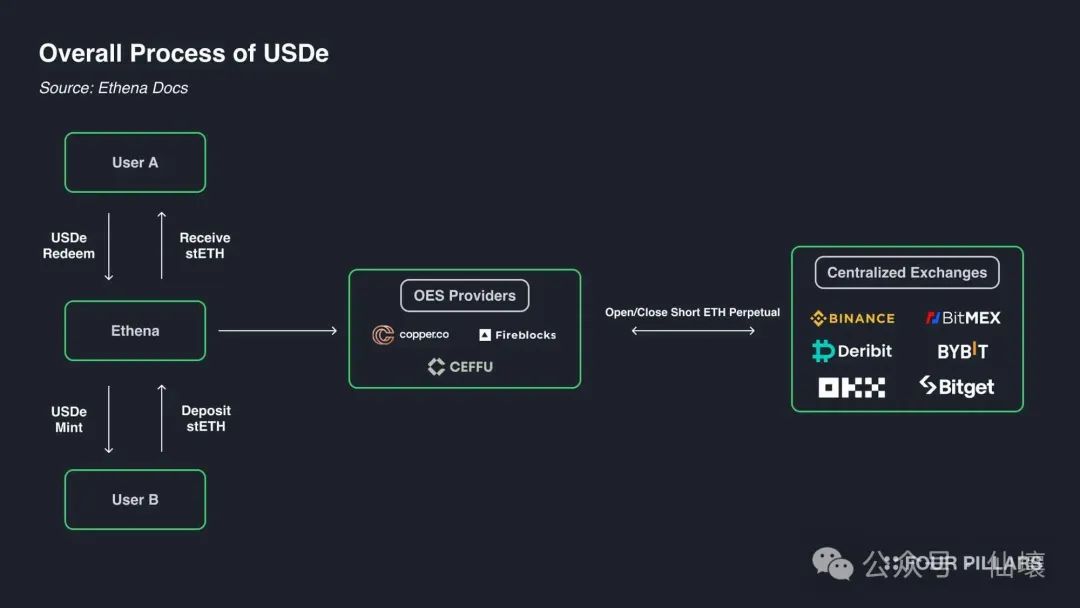

This is precisely the core logic behind my optimism for Ethena—it has constructed high yields through funding rates and has formed essential innovations in its underlying architecture compared to USDT and USDC. Ethena's breakthrough lies in its ability to continuously expand the application scenarios of USDe, such as its integration with Bybit, allowing it to be used as collateral for trading perpetual contracts.

Although the funding rate returns of Ethena may narrow during a bear market, the project team has already begun developing derivatives like USDtb to hedge against market volatility, demonstrating a mature risk management awareness.

For the reasons mentioned above, I maintain a high level of attention to innovative practices in the three market-validated tracks—exchanges, stablecoins, and public chains. For example, Hyperliquid (although I do not currently hold a position) is innovating in the derivatives trading experience through an order book model, showcasing a similar innovative gene to Ethena. Projects that "open up blue oceans in red sea tracks" are always my key observation targets.

What is a True Community?

"Community" may be one of the most abused terms in the Web3 space. Almost all projects claim to "serve the community," but in most cases, the community is merely their "liquidity outlet" or "listing threshold"—this hypocritical community narrative has now been seen through by most retail investors.

I am not denying the value of airdrops here. As a cold start tool, airdrops are indeed an effective means of building an initial community. However, airdrops are merely a means of initiation; only when users feel something beyond the price of the token can the community truly sustain itself. In some ways, blockchain is similar to a nation but lacks coercive power, making it closer to a religion.

Beyond economic incentives, what can truly bring people together is an engaging narrative, which is precisely why Ethereum and Solana have strong (even somewhat fanatical) communities—they have both experienced the DAO attack and the collapse of FTX but have risen from the ashes to form unique community narratives.

In the NFT space, Azuki is one of the few projects that has built such a "narrative." Despite a stunning start, the Azuki team and founder Zagabond have faced numerous challenges over the past three years. It is precisely because they have overcome these challenges that they have established a solid community foundation today. This shows that a true community cannot be built merely by throwing money; people need to gain a sense of belonging through "shared experiences in adversity" beyond economic incentives.

Based on this, I hold an optimistic view of projects that have established such communities, believing that projects with a solid community foundation will perform well in the industry. After all, code can be forked, but communities cannot be replicated.

Jay: Which Projects Will Truly Drive Adoption?

Portfolio: Solana, Sui, Jito, Ondo Finance, Ethena, Send, SOON Girl, MadLads, Kumo, SOON

Virtual Machines Beyond EVM

2024 is a critical turning point for the development of non-EVM ecosystems. Take Solana as an example; several DeFi projects and consumer applications under the SVM ecosystem, such as Pump.fun, Photon, and Daos.fun, have demonstrated performance that rivals or even surpasses leading projects in the Ethereum ecosystem. Especially in the stablecoin payment sector, Solana has successfully integrated with mainstream companies like Visa and Shopify, significantly enhancing market expectations for its mass adoption prospects.

In addition to Solana, Sui continues to grow its ecosystem with "Move on SUI" and achieves extremely low transaction latency through the introduction of groundbreaking technological innovations. Furthermore, the release of the SuiPlay0X1 handheld console, designed specifically for Sui, marks a potential explosive growth in its gaming ecosystem.

From a macro perspective, a clear trend is emerging: more and more ecosystems are gradually breaking free from the EVM framework, developing or integrating their own proprietary virtual machines to build customized ecosystems. Although Ethereum, as the first smart contract platform, has indeed led industry development and nurtured numerous innovative ideas, I am optimistic about non-EVM public chains surpassing the Ethereum ecosystem. The fundamental reason lies in the fact that EVM lacks a clear mission orientation and has many inherent flaws.

Currently, we are witnessing the rise of diverse virtual machines, and these innovations are breaking through the boundaries of the EVM ecosystem. Ultimately, the diversity and quality of applications will depend on the development level of virtual machines, with the key challenge being how to fully leverage the advantages of each VM to build full-stack applications optimized for specific scenarios. Looking ahead to 2025, non-EVM infrastructure and its combinatorial innovations may welcome broader development space to meet the evolving demands of the market.

Truly Understanding RWA Projects with Web2 and Web3 Synergies

What is the greatest value of blockchain? I believe it is its ability to tokenize assets. Tokenization can provide liquidity to any asset, bringing many advantages such as enhancing capital efficiency and accessibility, building quick infrastructure, automating smart contracts, and improving compliance and transparency. The long-standing challenge of mass adoption in the crypto industry fundamentally requires breakthroughs in the tokenization mechanism.

However, despite countless projects attempting to tokenize various assets over the years, we have seen few success stories. The root cause is that these projects have failed to establish a convincing value transfer system that demonstrates the advantages of tokenization. As traditional industries continue to show interest in the crypto space, the projects that can effectively implement tokenization will be the most closely watched in the future.

Source: How Ondo Finance Is Redefining Tokenization to Lead the RWA Market

Let’s take Ondo Finance, a leader in the RWA field, as an example. Ondo not only tokenizes U.S. Treasury products on-chain but also achieves two major goals by building partnerships across Web2 and Web3 ecosystems:

1) Ensuring that assets receive protection from institutional investors;

2) Maximizing their utility through interactions with various protocols.

This strategy can create value for both Web2 and Web3 investors. Projects that deeply understand the characteristics of off-chain and on-chain domains and achieve organic expansion and collaborative innovation between the two will gain increasing attention in the coming years.

Projects Creating Real Value for the Community

The launch of Hyperliquid can be described as revolutionary. Without external financing, the team relied entirely on internal resources to develop and grow alongside the community. Despite over 30% of tokens being circulated at TGE, the project surpassed a $10 billion FDV in just one week. Subsequently, the price of the HYPE token skyrocketed, generating a strong response. This was akin to a protest against traditional industry models, highlighting the importance of community-friendly projects.

So, what constitutes a truly community-friendly project? In short, it is a project that provides substantial value to the community. In my view, this value can be realized through two main avenues: economic benefits and cultural identity.

First, let’s look at the economic benefits. Given the sensitivity of the Web3 ecosystem to incentive mechanisms, project teams have long explored various ways to maintain the community of token holders and encourage ongoing participation. As I have discussed before, these economic incentives are traditionally realized in two ways: first, by directly sharing profits with token holders, and second, by indirectly enhancing the value of the native token through airdrops, buybacks, burns, or DAO treasuries.

However, recently, more refined and community-oriented strategies have emerged. For example, an increasing number of projects are opening investment opportunities to the public at low valuations in the early stages, establishing mutually beneficial value with the community. Projects like Legion and Echo are typical cases in this regard. Projects that carefully design community relationships using such strategies often gain significant attention right from the launch phase.

If economic incentives are an effective means of attracting users from the outside, then cultural identity aims to cultivate a sense of belonging among users, establishing and unifying community identity. This process is akin to the cohesion seen in religious groups under shared ideals and is a crucial driving force for maintaining momentum, fostering innovation, and pursuing grand plans.

To achieve this, project teams cannot merely fabricate slogans or share memes; they also need to host various large-scale, multi-regional events to promote deep interaction among members. Additionally, project teams should create an environment that allows community members to autonomously organize activities and strengthen their connections. This proactive approach to shaping the community will be more effective than organizing non-spontaneous activities solely for a one-time airdrop and will help build a more enduring and cohesive community.

Heechang: DeFi is in Long-Term Development

Portfolio: Ethena, LayerZero, Morpho, Ondo Finance, Uniswap

I am involved in the crypto space for long-term development, not to seek short-term profits in two or three years. I believe DeFi is the core of the crypto world; without DeFi, blockchain will always be limited to niche groups. Most people enter the crypto space to make money and achieve higher asset returns, which is where DeFi's potential lies, especially with diverse earning methods like self-custody.

All user behaviors in the crypto market stem from a tendency to participate in finance, which is why I focus on and hold tokens of those DeFi projects that are continuously developing.

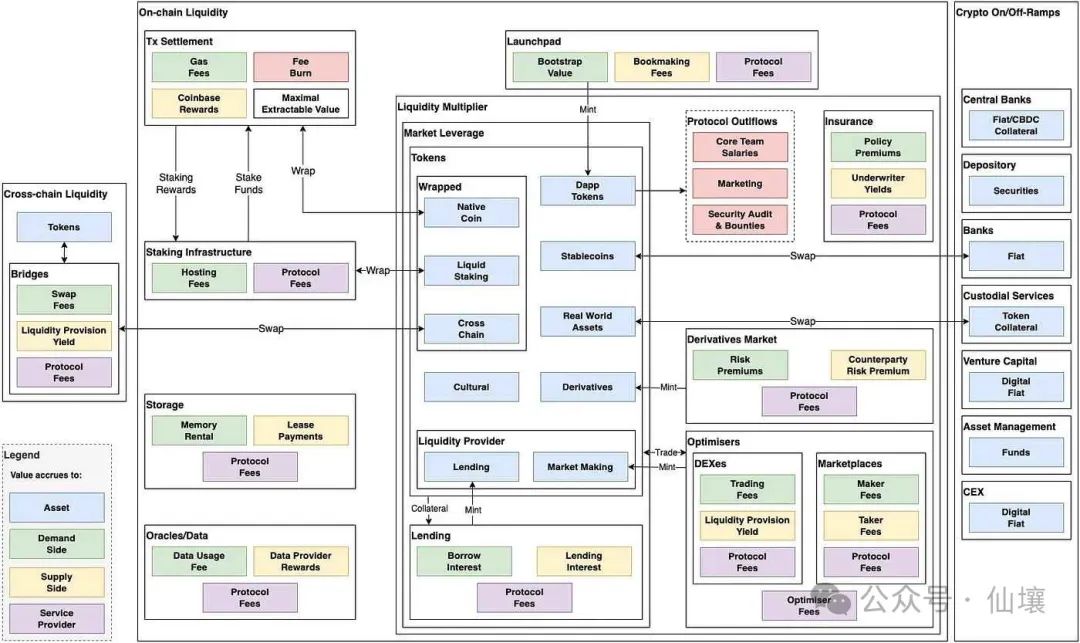

DeFi has a short but rapidly evolving history. Early AMMs gained momentum by enabling on-chain trading, followed by the emergence of other primitives like on-chain lending and perpetual contracts. Each primitive has undergone various mechanism tests, particularly in the on-chain trading space, where AMM and order book-based DEXs have explored different product directions.

Today, as spot DEXs, perpetual contract DEXs, and lending protocols achieve sustained and significant trading volumes, they are moving towards a further development stage and creating more value. This is why I pay attention to DeFi infrastructure.

The open and permissionless nature of the crypto space makes it natural for projects to expand their infrastructure to capture more value. DeFi applications were once merely smart contracts, but this perception is changing. These DeFi applications are expanding their infrastructure to address issues like MEV and high gas fees. With the emergence of new tools such as Rollup frameworks, Application-Specific Sorting (ASS), and interoperability frameworks, building new DeFi infrastructure is becoming increasingly easier.

Next, I will explore the evolution of the trend where DeFi expands from smart contracts to underlying infrastructure, as well as what I consider to be more innovative DeFi projects.

Source: Application Activity | Artemis Terminal

DeFi's "Money Legos" Are Growing Larger (Examples: Morpho, Ethena)

In the crypto space, "Money Legos" refers to the composability of DeFi, a term that describes how different DeFi protocols can combine to build more complex financial products. A typical example is the cross-chain trading aggregator LI.FI. LI.FI allows users to exchange tokens or perform cross-chain operations through more than 15 DEXs and over 20 cross-chain bridges within a single interface, exemplifying the openness of DeFi applications.

By mixing and matching different DeFi building blocks, DeFi protocols can create customized solutions to meet specific market needs, leveraging the strengths of multiple platforms to solve problems. This is fully reflected in the collaboration between Morpho (MORPHO), MakerDAO (MKR), Spark, and Ethena (ENA).

Morpho's infrastructure, Morpho Blue and MetaMorpho, serves as the underlying architecture, enabling Spark to allocate liquidity from MakerDAO to earn sUSDe yields in Ethena. This collaboration highlights the potential of DeFi composability to drive innovation in financial tools, something that is difficult to achieve in traditional finance.

As mature DeFi protocols establish good reputations and achieve more streamlined integration methods, the composability between protocols will accelerate. Protocols like Morpho, which provide customizable lending services, and Ethena, which offers high stablecoin yields, will lead the wave of DeFi integration across protocols and DAOs.

Source: DeFi Value Flows: Understanding DeFi Business Models and Revenues | by Aw Kai Shin

DeFi Infrastructure is Rapidly Developing (Examples: Uniswap, Ethena, LayerZero)

In 2022, Dan Elitzer published an article discussing the inevitability of "Unichain," arguing that this trend is due to inefficiencies and value loss in existing DEX systems. As stated in the article, Uniswap traders face three major costs: trading fees paid to liquidity providers, gas fees paid to Ethereum validators, and MEV costs.

In 2024, Uniswap announced the launch of its own Unichain, aimed at addressing issues related to execution quality, user experience, and liquidity fragmentation, allowing Unichain to capture more value from its user base and increase the application scenarios for the UNI token. Not only Uniswap, but other DeFi protocols are also announcing the launch of their own dedicated infrastructures—Frax Finance's Fraxtal, Swell Protocol's Swellchain, Worldcoin's Worldchain, Zerion's Zero Network, and more.

What makes these facilities unique is that no entity can control their "value flow"; every participant can contribute to building or expanding them to maximize value capture. In traditional business systems, how value is captured by others and how much value can be captured through expansion is often very vague, with little public information available. However, in the crypto space, the protocols have sovereignty, and the market is driven solely by supply and demand.

In this trend, I believe Ethena and LayerZero are the two protocols capturing the most value. Ethena's TVL grew from $0 to $6 billion within a year, making it the most successful DeFi project in this cycle. They are preparing to launch their own infrastructure to increase the application scenarios for the ENA token and build an ecosystem for their stablecoin USDe.

As Ethena's infrastructure is implemented through LayerZero's OFT (Omnichain Fungible Token) framework for token deployment in the future, the protocol's revenue will further increase. Additionally, DeFi protocols are expanding their infrastructure by building their own Rollups or deploying across multiple public chains, where cross-chain security is crucial. In this scenario, LayerZero (ZRO) can provide the best experience.

The Integration of DeFi and Traditional Finance is Deepening (Examples: Ondo, Ethena)

In the past, users in the crypto space were primarily limited to anti-government individuals and radical traders. However, as the advantages of DeFi in asset management become increasingly apparent, traditional finance (TradFi) is gradually entering the crypto realm. Currently, two major traditional finance groups are slowly integrating into the DeFi ecosystem.

The first group is fintech companies, which have been driving innovation in traditional finance within regulatory boundaries. The rise of fintech is relatively recent—before 2010, mainstream payment methods were limited to bank transfers and cash. The advent of mobile internet has propelled the development of fintech, with companies like Stripe, Robinhood, and Revolut emerging to provide better services for payments, trading, and asset management.

DeFi protocols also aim to improve the financial system, but they operate outside regulatory boundaries. The experimental spirit of fintech companies has led them to venture into the crypto space, with notable examples including PayPal's launch of the stablecoin PYUSD in the Solana ecosystem, which has reached a TVL of $500 million, and Stripe's acquisition of bridge.xyz for $1.1 billion. Additionally, Robinhood is preparing to launch a stablecoin, and Revolut is also participating in DeFi activities, indicating that the integration of DeFi and fintech is accelerating.

In addition to fintech companies, traditional financial institutions like BlackRock and JPMorgan are actively exploring the crypto ecosystem. Compared to Tether's $5.2 billion revenue in the first half of 2024, BlackRock's net profit during the same period was only $3.126 billion, prompting traditional institutions to seek a share of the crypto market.

Notably, BlackRock has launched a stablecoin, BUIDL, backed by U.S. Treasury bonds. Crypto-native protocols like Ondo Finance (ONDO) are closely collaborating with financial institutions within regulatory frameworks, while protocols like Ethena have integrated with BUIDL to provide on-chain users with broader access to Treasury yields. As regulatory thresholds lower and the stablecoin market continues to grow, the integration of DeFi and traditional finance will accelerate.

JW: Adoption of Consumer Applications and Application-Centric Ecosystem Transformation

Portfolio: Pengu, Abstract, MegaETH

The Rise of Speculation as a Product and Consumer Applications

2025 is expected to be a breakthrough year for consumer applications in the crypto space. Historically, the crypto field has followed a familiar evolutionary pattern: starting with early users represented by fund traders and gradually expanding to a broader audience. We have witnessed this pattern in the development of Bitcoin, stablecoins, and DeFi. Now, the consumer application track is gradually becoming active in the public eye.

To ensure that the crypto space is no longer just a battleground for experienced traders, it is necessary to expand its influence and attract new users and capital to drive ecosystem growth. This evolution is likely to be achieved through more streamlined applications that leverage some unique advantages of crypto technology, including meme, SocialFi, NFT, and GameFi. I predict that these areas will regain market attention, albeit in a more mature and complex manner compared to previous cycles.

Excitingly, the industry is shifting towards developing products that are easy for users to use. Whether through memes, NFTs, or AI-related applications, we are witnessing a new wave of applications that effectively utilize the unique advantages of crypto technology to create distinctive user experiences.

AI Agent and DeSci projects, which began gaining attention in 2024, can be seen as classic examples of speculation evolving into unique tracks and use cases. Users who initially entered the field for speculation often delve deeper into broader crypto use cases, such as DeFi, stablecoin payments, and prediction markets.

Current market conditions are particularly favorable for mainstream consumer applications in the crypto space, as user experience has significantly improved compared to before: wallets are more intuitive and seamless, mobile accessibility has greatly improved, and previous technical barriers surrounding scalability have largely been resolved. These improvements have brought the crypto market closer to the user experience of traditional financial services.

As overall market sentiment shifts positively, we may see continued growth in user adoption. Additionally, the Trump administration's shift towards more crypto-friendly regulations may create a more favorable regulatory environment for crypto in the U.S., catalyzing positive regulatory evolution in global markets.

The Rise and Fall of AI Agents

After the emergence of $GOAT at the end of 2024, AI Agents quickly became one of the hottest tracks in the crypto space, with the potential to reach new heights in 2025. As we have seen, new technologies excel at capturing public imagination and generating powerful memes. From the metaverse craze to modular blockchains, and now to AI Agents, each wave represents extreme optimism driven by technological innovation and speculative fervor. It is important to clarify that we are discussing AI Agents within the crypto space, not the traditional AI industry.

AI Agents have a key distinction from previous tracks. Fields like DeFi and modular blockchains successfully stabilized after their respective bubbles burst, entering a "enlightenment slope" phase based on actual utility and steadily gaining adoption. However, today's AI Agents are different; they resemble the hype cycles of the metaverse, facing similar issues: unclear use case definitions, ambiguous target users, and value propositions obscured by buzzwords.

Looking ahead, while AI Agents may continue to dominate market attention and experience rapid price increases driven by technological narratives, this field also faces significant risks. Without meaningful long-term growth drivers or specific use cases, AI Agents may face a sharp decline and struggle to recover. Whether investors in the AI Agent track can profit will depend solely on their ability to realize profits and exit before the bubble bursts.

Dynamic Changes Between Chains and Applications

In 2025, the crypto industry may undergo a fundamental shift in the traditional relationship between chains and applications. For a long time, public chains have been viewed as the focal point of ecosystems, but this notion is being challenged as the industry accelerates its transition to an application-driven paradigm. The traditional model in the crypto industry has been top-down, with blockchains serving as the foundation for ecosystem development. Although highly anticipated public chains like Monad, Bera, MegaETH, and Initia will enter the public eye in 2025, this may be the last generation of general-purpose blockchains that can successfully launch.

The future trend of blockchain development is shifting from general-purpose public chains to two distinctly different models: one is to expand mature applications into complete ecosystems, like HyperLiquid and Ethena, and the other is for successful protocols like Uniswap to launch their own blockchains.

The landscape of industry integration is also evolving with this shift. Community-centric token distribution is becoming increasingly important, with MegaETH successfully reviving the ICO model, while large-scale airdrops from HyperLiquid and Pudgy Penguins have also been successful. The focus of such projects has shifted from traditional VC financing to user adoption and community participation. Particularly, mature applications can leverage existing user bases to generate liquidity and network effects when launching their own tokens or chains, reducing reliance on traditional financing avenues.

Ingeun: The Blockchain Infrastructure Behind Bitcoin is Gearing Up

Portfolio: Ethereum, Solana, Ethena, Mantle, EigenLayer, Puffer Finance, Zircuit, EtherFi

In the 2024 bull market, Bitcoin's price surged more than 2.4 times from its previous low. While factors such as Bitcoin's four-year halving cycle and Trump's potential re-election as U.S. president have contributed positively, I believe these are not the main drivers of Bitcoin's growth. Instead, it is the gradual shift in public perception of cryptocurrencies, the further development of the blockchain industry, and the involvement of traditional financial forces in the crypto ecosystem.

As a bellwether for the blockchain industry, Bitcoin's price increase naturally drives up the prices of other cryptocurrencies. However, because Bitcoin holds a dominant position, capital is highly concentrated in Bitcoin, and the capital redistribution in other areas of the crypto industry has not yet fully occurred. In past bull markets, Bitcoin's price increases were often accompanied by a decline in its dominance as capital flowed into altcoins.

While many continue to focus on Bitcoin's sustained rise, capital is expected to be redistributed to other projects in 2025, such as Ethereum and other public chains, as well as L2s. These projects have been quietly preparing in the shadow of Bitcoin, and as capital flows in, they may shine this year. My portfolio aligns with this thinking, and I will elaborate on my views on some outstanding projects below.

Key Infrastructure Chains: Ethereum and Solana

Ethereum is facing significant challenges in this bull market. Although Ethereum holders have high expectations and ambitiously announced the Beam chain and its future roadmap at the 2024 Devcon conference, Ethereum's development has been overshadowed by the continuous progress of new public chains led by Solana. The comparison with Solana has made 2024 quite difficult for Ethereum, as reflected in its price performance.

From the ETH/BTC price trend, Ethereum has recently been on a downward trajectory. While it still maintains its position as the second-largest cryptocurrency, following Bitcoin, its momentum has clearly weakened. Nevertheless, I believe Ethereum is about to rebound. Although many public chains are vying for Ethereum's throne, Ethereum still holds a decisive advantage in scale. Among its competitors, Solana is the strongest contender; however, as of January 14, 2025, Ethereum's market cap is still more than four times that of Solana, and the assets locked in Ethereum's DeFi ecosystem exceed those of Solana by more than seven times.

Moreover, Ethereum is the first crypto asset to receive ETF approval after Bitcoin, making it easier for traditional financial institutions and institutional investors to participate. The funds flowing into Ethereum ETFs have been steadily increasing, with net inflows reaching a record $2.08 billion in December 2024, more than double the $1 billion in November. Notably, BlackRock's ETHA fund saw inflows of $1.4 billion in December, while Fidelity's FETH fund had inflows of $752 million.

From both internal and external perspectives, Ethereum is continuously strengthening its foundation. The previously unstable Layer 2 ecosystem has matured and is now functioning effectively, while Ethereum's focus on ZK has steadily grown with the support of numerous projects. At the same time, Ethereum's Restaking service, originating from its internal consensus system, has a unique positioning and is also making continuous progress.

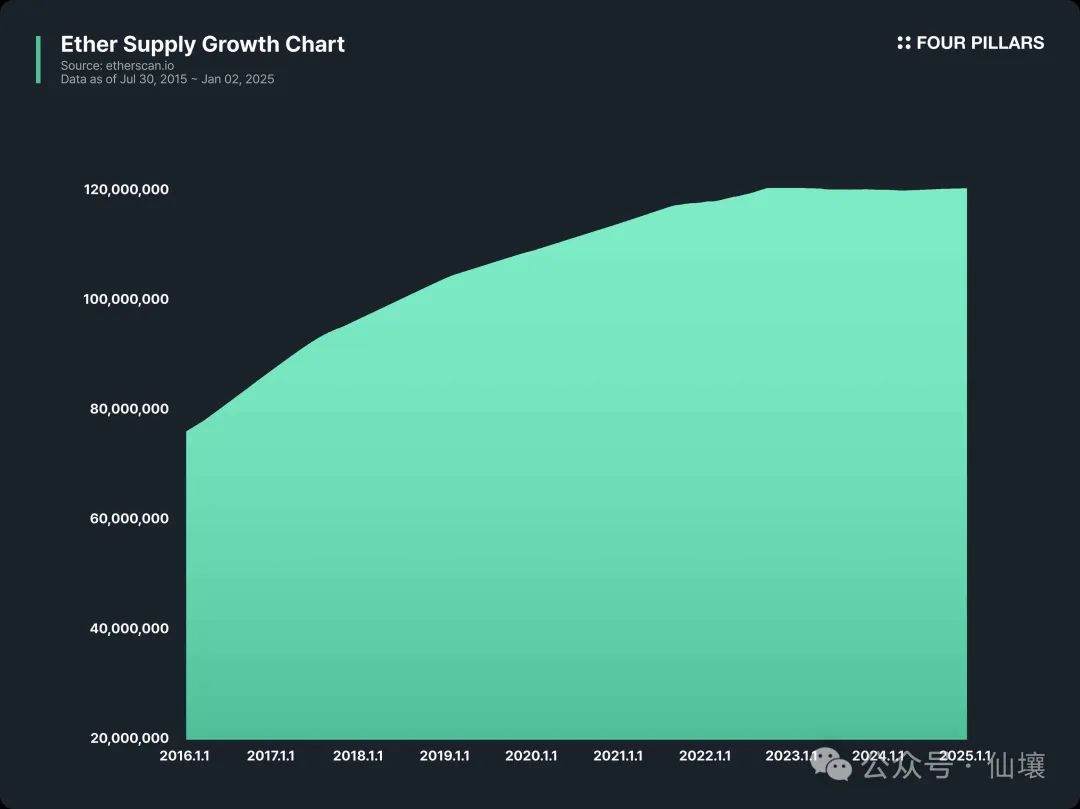

One of the biggest concerns for Ethereum investors is that there is no fixed upper limit on the supply of ETH; however, this issue has been largely alleviated. Since the London hard fork in August 2021, Ethereum's issuance has decreased, and its current circulating supply is partially in a deflationary state, which has helped stabilize ETH prices.

Is Ethereum in crisis at the beginning of 2025? My answer is yes. However, crises often come with the best opportunities. Ethereum has introduced the concept of a global computer that Bitcoin cannot achieve structurally and continues to improve itself. In 2025, Ethereum will overcome its crisis and prove its value as a leading public chain.

Ethereum's strongest competitor, Solana, is actively catching up in various areas of the blockchain ecosystem. Solana's ecosystem has developed to a considerable scale, being unparalleled among public chains outside of Ethereum, with a unique scale advantage.

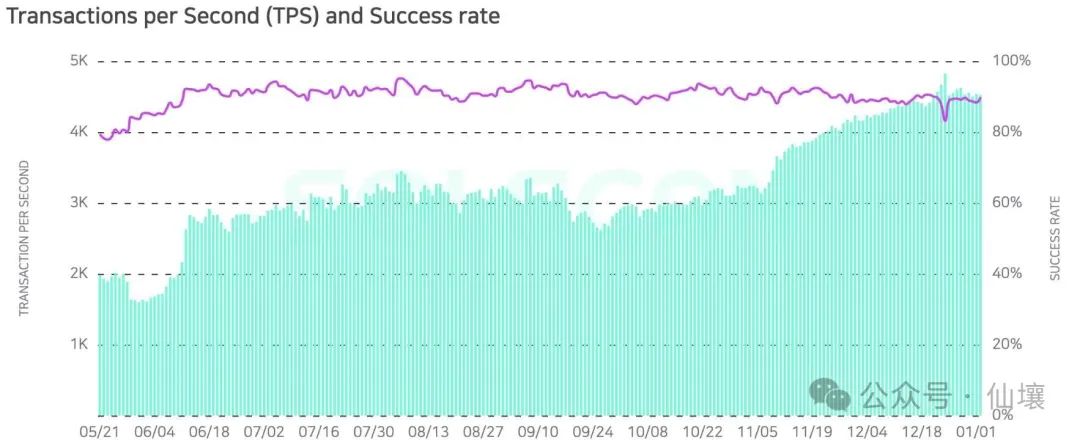

Source: Solscan

Solana prioritizes performance and user-friendliness rather than emphasizing decentralization like Ethereum. While this means Solana's operational structure is somewhat centralized, it can achieve thousands of transactions per second (TPS), providing Solana users with an almost seamless environment without unnecessary risks.

Additionally, Solana leverages its large developer and user community to maintain a leading position in technology and the market. In the early stages of this bull market, Solana led the meme coin trend, surpassing other chains through quicker cultural adoption. Recently, Solana has also kept pace with the AI trend by organizing AI hackathons and other activities, showcasing its ability to continuously lead new trends.

Unlike Ethereum's narrative development, Solana has been reshaping the crypto field's views on decentralization. It poses a fundamental question: if the high level of decentralization advocated by Ethereum ultimately has negative effects on users, should decentralization still be pursued at all costs?

With a powerful opponent like Ethereum above and challenges from various L1 chains below, Solana's next steps are crucial. As it continues to carve out its unique path, I will closely monitor how Solana develops in the crypto space.

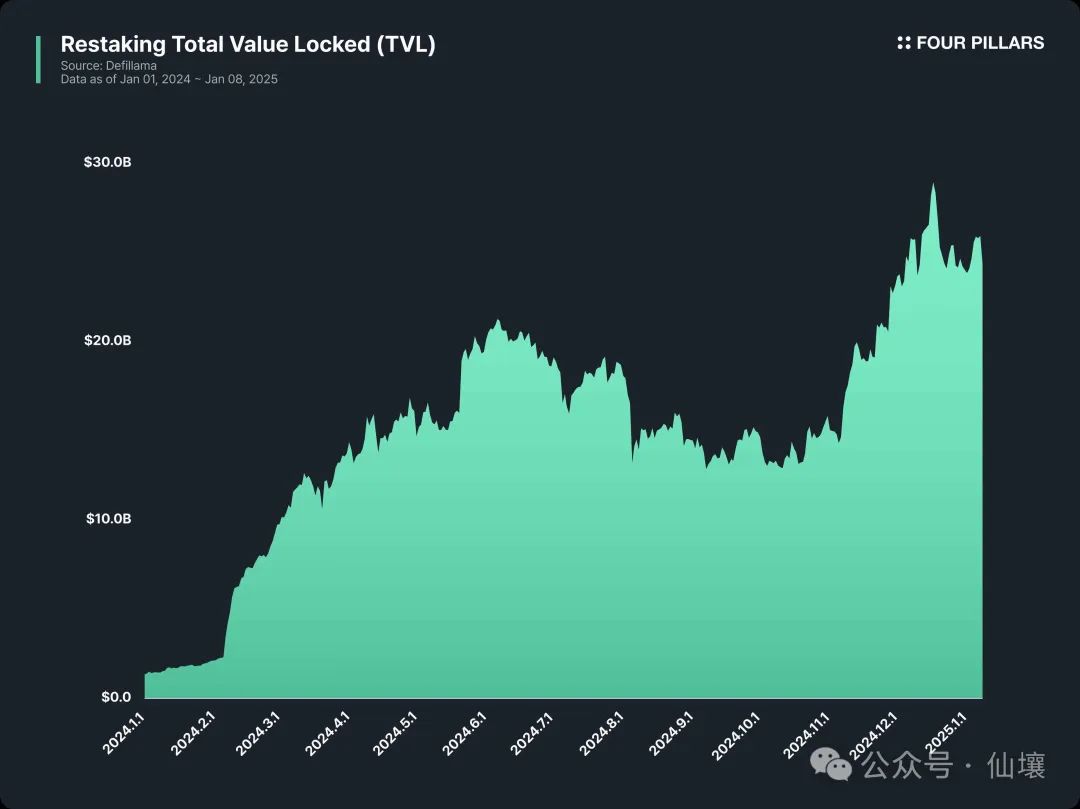

The Continued Growth of the Restaking Ecosystem

"Restaking allows users to reuse staked assets to provide additional economic security for multiple public chains or applications, enabling the recycling of staked assets, improving scalability and liquidity, while earning additional rewards."

As mentioned, Restaking is a finance-engineering-based solution. By reusing staked assets to enhance scalability and liquidity, it has achieved significant growth in 2024.

Notably, EigenLayer, as a Restaking ecosystem facility, along with platforms like EtherFi, PufferFi, and Zircuit, has attracted substantial funding, driving the expansion of the Restaking market.

If the keywords for Restaking in 2024 were "Restaking debut" and "focus on Ethereum," then the keywords for 2025 may be "more Restaking participants emerging" and "Restaking expanding to other L1 chains."

Ethereum can be said to be the birthplace of Restaking, and competition among infrastructure providers like EigenLayer, Symbiotic, and Karak is intensifying. Although Symbiotic and Karak are newcomers to EigenLayer, currently managing fewer staked assets than EigenLayer, they are actively carving out their niche markets.

For example, Symbiotic supports Restaking for various assets like Ethena (ENA) to attract more deposits, while Karak enhances its unique competitiveness by supporting cross-chain asset staking (including Arbitrum, Mantle, and BSC).

Therefore, in 2025, we may witness fierce competition among Restaking providers within the Ethereum ecosystem. At the same time, the Restaking narrative may expand beyond Ethereum to enter a new growth phase, with BTC and Solana being key ecosystems for the expansion of the Restaking narrative.

Bitcoin, with its unparalleled total asset scale, can utilize Restaking as a means to generate additional profitability on other blockchains. Babylon is a project that enhances the security of other PoS chains using Bitcoin staking and Restaking mechanisms. Notably, Babylon allows BTC to be staked directly on the Bitcoin network without bridging or mapping, providing higher availability and convenience.

Solana's high transaction speed and low fees have facilitated the development of numerous Restaking services, such as Jito and Solayer. Jito, a well-known staking provider within the Solana ecosystem, has expanded its expertise into the Restaking field, offering stable and reliable Restaking solutions based on its mature staking technology. Similarly, Solayer, inspired by EigenLayer, focuses on enhancing convenience while further promoting the development of the Solana ecosystem.

In 2025, competition in the Restaking track will intensify not only within Ethereum but also among other L1 chains like Bitcoin and Solana. Restaking will continue to evolve as a key innovation within the blockchain ecosystem.

Blockchain Projects to Watch in the New Year

Numerous new projects emerged in 2024. In 2025, there will be a competition between those projects that solidified their foundations in 2024 and the new projects that emerge this year. From this perspective, we can focus on Ethena and Mantle.

Ethena has stood out among dollar stablecoins, becoming one of the fastest-growing projects. It achieved significant growth in 2024 through its unique high-yield strategy, secure collateral management supported by BlackRock BUIDL, stability achieved through U.S. Treasury bonds, and comprehensive expansion plans for the Ethena network.

Source: The Verge of Crypto Dollar War and Strategy of Ethena (Feat. UStb, Network) | 4Pillars

Ethena's dollar stablecoin USDe stands out by providing clear returns through staking rewards, delta-neutral market strategies, and liquidity stablecoin yields. This has led to a significant influx of funds from other dollar stablecoins like USDT and USDC into USDe. As use cases continue to grow and fintech companies increasingly adopt stablecoins, its dominant position in the market is expected to persist. Based on this trend, the growth of Ethena and USDe should continue into 2025.

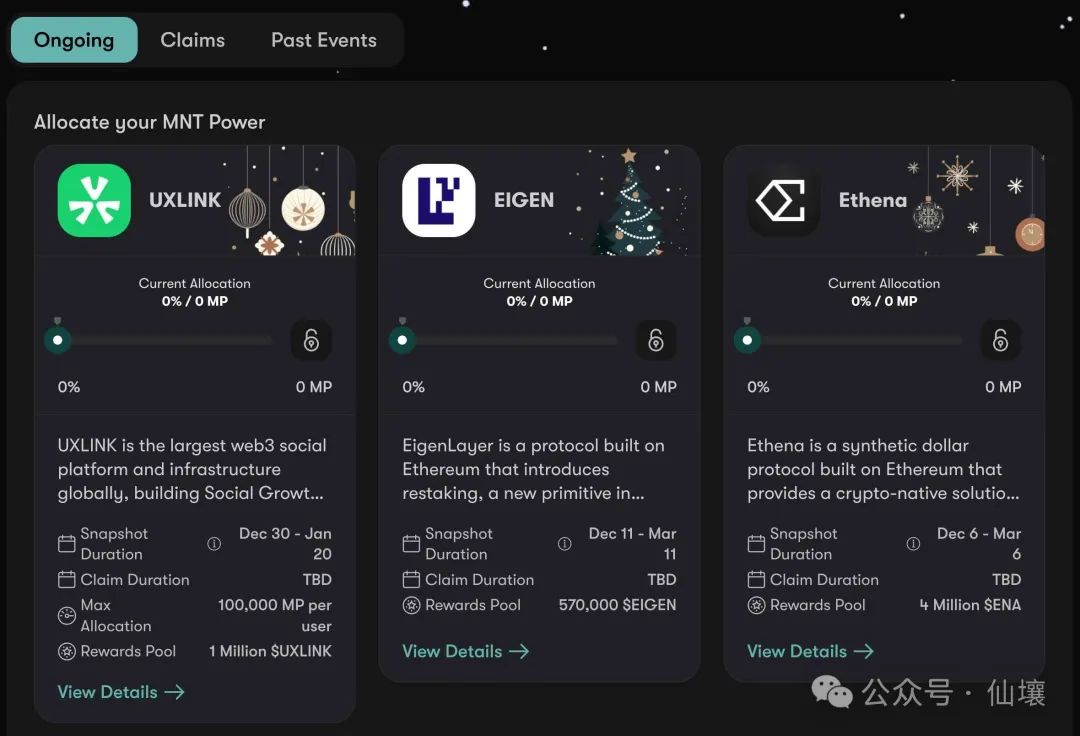

Mantle expanded its influence in 2024 by launching Mainnet V2, offering staking rewards, and distributing airdrops of other tokens. These efforts have allowed Mantle to broaden its user base and establish a strong presence. Technically, Mantle is collaborating with Succinct to explore transitioning from an Optimism rollup to a ZK rollup model. Additionally, Mantle is partnering with Chainlink to integrate Chainlink's cross-chain interoperability protocol CCIP, laying the groundwork for upgrading the Mantle ecosystem to a multi-chain ecosystem.

Source: Mantle Reward Station

From an ecosystem perspective, Mantle has solidified its partnership with Bybit, expanding Mantle's use cases and increasing its user base. Furthermore, Mantle's staking program allows users to earn MNT Power (MP) as rewards, which can be used to participate in other airdrops, thereby promoting active user participation. These initiatives have made Mantle's market promotion very effective, and I expect this momentum to continue into 2025.

Mantle has a close relationship with Bybit. Bybit is an exchange rapidly catching up to Binance, and the partnership between Mantle and Bybit lays a solid foundation for further growth. The increase in the number of Mantle holders may lead to more activity on the mainnet, creating a positive feedback loop beneficial to the entire Mantle ecosystem. Under this trend, 2025 is expected to be a year of significant expansion for the Mantle ecosystem.

Eren: The New Role of On-Chain Markets and the Development Direction Led by the AI Agent Craze

Portfolio: Virtuals Protocol, Axal, Tetsuo, Redacted Research and Development

Catalyst for Fragmented Capital Inflows: On-Chain Small-Cap Trading

The inflow of on-chain liquidity into mid- and small-cap assets is expected to accelerate further. Compared to launching large-cap assets on centralized exchanges, these assets will create more diversified opportunities and become a key driving force attracting retail investors into the crypto market due to their high expected returns. This model of on-chain asset issuance was already evident during last year's memecoin cycle. Excessive VC coin valuations led to the phenomenon of "high FDV," causing the return expectations of VC coins to decline, and many people shifted their attention from VC coins on CEX to on-chain memecoin trading.

In this context, perhaps the most impressive aspect last year was the significant price increase of memecoins, such as Chillguy and Moodeng. The Phantom wallet ranked high in app store downloads, indicating that even users without prior on-chain experience are now actively using on-chain wallets and tools like Moonshot to trade high-risk, high-return assets like memecoins.

This scenario marks an important turning point for crypto adoption. While we previously judged that attracting and accommodating on-chain users through infrastructure development and new applications is key, the unique speculative nature of the crypto market and its high expected returns can undoubtedly serve as a catalyst for driving crypto adoption.

Therefore, a more pronounced change in 2025 compared to previous years will be that trading of on-chain mid- and small-cap assets will no longer be limited to old users but will become a powerful catalyst for fragmented capital inflows, making the resulting trends worth paying attention to. For example, the proportion of DEX trading volume relative to CEX is expected to continue increasing, and new narratives suitable for creating mid- and small-cap assets may continuously emerge, similar to the AI Agent and DeSci tracks.

Additionally, projects like Daos.Fun integrating the financing process beyond the Pump.fun model are expected to become mainstream, while projects must ensure a fair launch.

In the AI Agent Wave, Which Will Survive and Which Will Perish

Last year, AI Agents captured over 70% of the market's attention, making it the most prominent narrative. Even today in 2025, the AI Agent cycle continues, and the combination of crypto and AI Agents will remain a key topic, as AI is considered a keyword across almost all industries. However, assuming the crypto market gradually fades and enters a long-term adjustment phase, we expect that once the interest driven by short-term speculative demand wanes, only a portion of AI Agent projects will survive, while another batch will perish.

In such market conditions, the projects that can survive are those that transcend technical imagination and possess novel ideas while also having practical value, with Virtuals Protocol being a typical example. Considering the long-term viability of combining crypto and AI Agents in creating sustainable use cases and businesses, Virtuals Protocol provides a development framework for AI Agents and a launch platform for AI Agent tokens, offering integrated services that will ensure its unique position as a foundational layer in the AI Agent market.

Notably, the $VIRTUAL token is paired with all AI Agent tokens and is consumed like a base currency when people use tools like launch pads. This token model of "accumulating value from interactions across all platforms" is a key foundation supporting the sustainable growth of Virtuals Protocol.

At the same time, from the perspective that the AI Agent ecosystem must generate actual profits, the combination of DeFi and AI Agents seems to be the most reasonable path. Transaction fees, lending spreads, and returns generated through structured products in DeFi protocols have already been clearly validated to have PMF space.

Therefore, rather than having AI Agents explore new businesses in areas like gaming or social networking, it is more effective to introduce them as solutions to the inefficiencies in DeFi, particularly as autonomous portfolio management tools, natural language-based user experience improvements, and automated trading tools. These AI Agents are expected to become key use cases leading the integration of AI Agents with crypto.

Ponyo: AI, DeFi, Hyperliquid

Portfolio: Pudgy Penguins, Ethena, FARM, MIZUKI

The three major trends in the crypto space this year are:

- The integration of crypto and AI

- A DeFi revival driven by fee switch models

- A resurgence of airdrops and ICOs propelled by Hyperliquid.

The first trend has already garnered widespread attention from leading AI research analysts, and this section will delve deeper into the latter two themes.

DeFi Revival: The Fee Switch Revolution

Today, most DeFi tokens serve merely as governance tools. While this aligns with the principles of decentralization, being only governance tools without empowerment limits the actual economic value provided to holders. Despite the strong operational performance of many DeFi protocols, their token prices remain undervalued, reflecting the limited utility of these assets.

In this context, the fee switch model—where a portion of protocol revenue is directly distributed to token holders—has long been seen as a potential catalyst for reassessing DeFi tokens and enhancing their appeal to investors.

However, the implementation of such mechanisms has repeatedly been hindered by regulation. The U.S. Securities and Exchange Commission (SEC) classifies revenue-sharing tokens as securities, imposing significant compliance burdens on protocols. Uniswap has attempted to activate the fee switch feature multiple times through three separate governance votes but has been blocked due to concerns over regulatory risks. Notably, influential stakeholders like a16z have opposed these proposals, highlighting the diverse risks within the DeFi space.

This situation underwent a dramatic shift after Donald Trump won the presidential election in 2024. With the Republican Party controlling the White House, Congress, and the Supreme Court, the outlook for crypto policy has significantly improved. The new government has expressed its intention to position the U.S. as the global "crypto capital," even exploring the inclusion of Bitcoin in its strategic reserves.

This policy shift is reflected in the appointments of many key positions. Paul Atkins as the new SEC chairman and David Sacks as the White House crypto policy advisor have introduced a more constructive approach. Initiatives such as the removal of "Chokepoint 2.0" and the establishment of a dedicated crypto advisory committee aim to address the pressing need for regulatory clarity. The departure of Gary Gensler and the subsequent shift in the SEC's stance have significantly alleviated compliance pressures for market participants.

Driven by this optimistic sentiment, several leading DeFi protocols are actively reconsidering the fee switch model. Well-known protocols like ENA, UNI, AAVE, and RAY, which have proven revenue streams, are participating in governance discussions to implement revenue-sharing mechanisms. As regulatory scope gradually clarifies, these protocols are expected to anchor their token economics on sustainable revenue distribution, thereby narrowing the gap between speculative value and fundamental financial metrics.

This evolution marks a new dawn for the DeFi revival. Unlike the explosive growth of DeFi Summer in 2020, driven by a surge in liquidity mining and innovative products, this revival prioritizes sustainable models, continuous revenue generation, and the revaluation of DeFi tokens. As these changes unfold, DeFi protocols have the opportunity to solidify their competitive advantages over traditional financial systems by providing decentralized solutions based on actual economic interests.

The Resurgence of Airdrops and ICOs Driven by Hyperliquid

One of the decisive moments in the 2024 market was the rise of Hyperliquid. After the TGE on November 29, the HYPE token surpassed a $34 billion FDV within a month, and as of January 14, 2025, its trading valuation was approximately $20 billion. However, Hyperliquid's influence extends far beyond its valuation; its steadfast commitment to the community-first philosophy sets a precedent for the development trajectory of Web3 projects in the coming years and may redefine industry standards.

Hyperliquid's decision to operate entirely through self-funding breaks traditional models. By ensuring equal opportunities for all participants and refusing to allocate tokens to private investors or market makers, the project directly challenges the common practice of inflating valuations through VC funding. The latter often leaves retail investors bearing the brunt of token sell-offs at high prices. Hyperliquid's model forces the industry to reevaluate token distribution standards, pushing it toward a more equitable and transparent direction.

As we enter 2025, a revival based on community funding models seems inevitable. While the ICO boom of 2018 was overshadowed by scams and regulatory ambiguity, clearer regulations under the Trump administration may restore an environment and structure of mutual trust in the market. Platforms like Echo and Legion are already capitalizing on this shift, marking a broad return to the decentralized ideals of Web3.

Hyperliquid has also reshaped perceptions of airdrops. Traditionally, airdrops have been criticized for failing to cultivate long-term community loyalty, often serving as short-term incentives with limited impact. Some project founders are skeptical, viewing them as cost-ineffective marketing activities that accelerate user churn rather than promote retention. This has indeed been the case, as many users participate in airdrops solely for one-time rewards and then quickly exit. The market generally views airdrops as an ineffective and unsustainable marketing tool.

However, Hyperliquid challenges the narrative of airdrops under traditional models by allocating 70% of the HYPE token supply to the community and demonstrating how to leverage airdrops to share rewards and jointly promote growth. By prioritizing the community, Hyperliquid showcases the potential of airdrops in building loyalty and long-term engagement. Inspired by this success, other projects are beginning to adopt similar strategies. For example, Azuki recently announced the allocation of 50.5 ANIME tokens to the community. Thus, the airdrop model is expected to revive and may become one of the defining themes of 2025.

Hyperliquid's success is attributed to its commitment to product quality. By achieving PMF before the token launch, Hyperliquid places practicality and community trust above speculative gains. This strategy not only solidifies its reputation but also provides a roadmap for projects aiming for long-term viability in Web3.

Hyperliquid's pioneering approach offers a blueprint for the future of Web3. While replicating its success may be challenging, its principles of fairness, transparency, and product-first growth will influence the next generation of projects. As these new models and ideas gain attention, 2025 may take significant steps toward realizing the foundational ideals of decentralized value creation and equitable participation in Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。