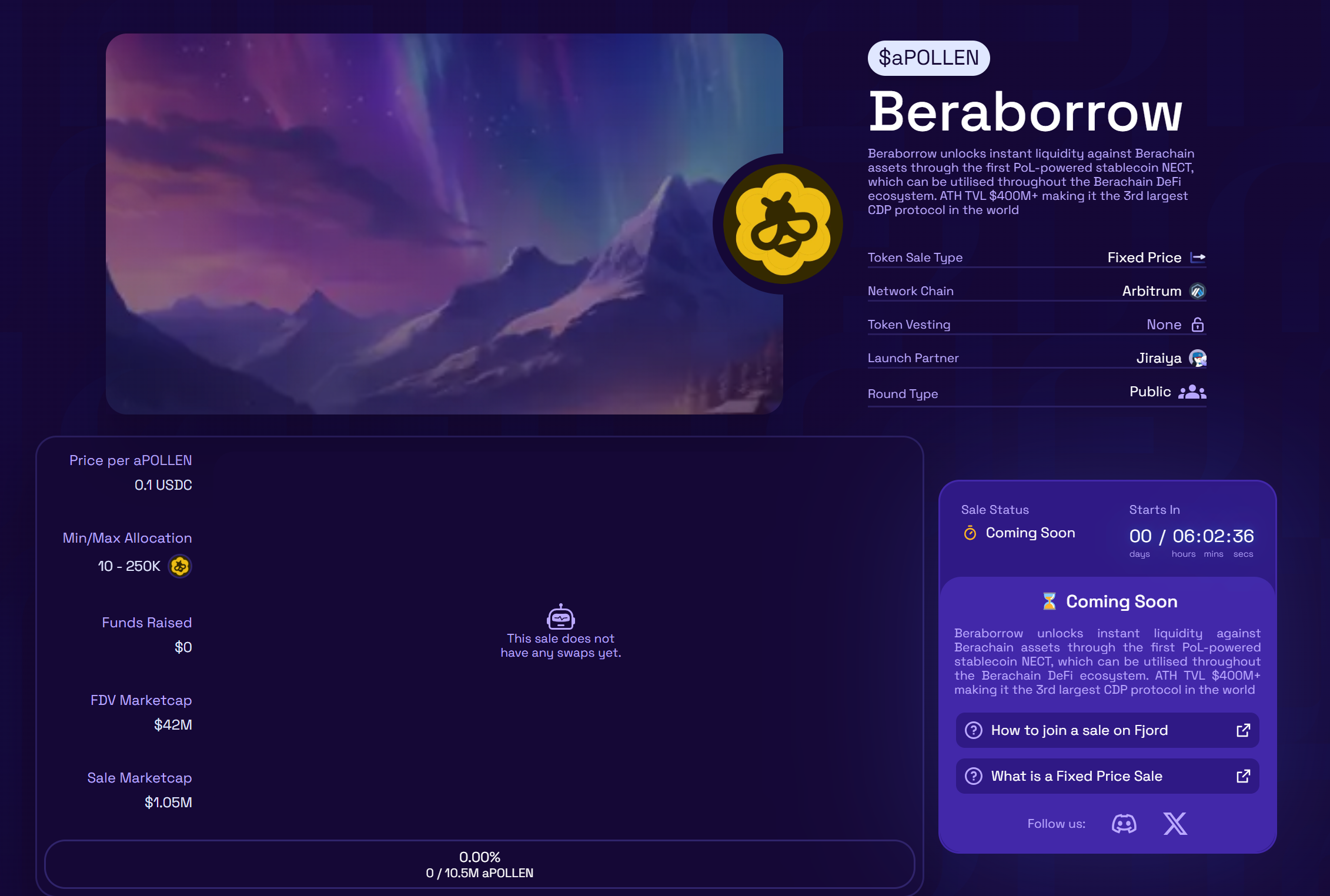

2.5% of the total supply of the protocol's native token POLLEN will be publicly offered through Fjord Foundry at a $42 million FDV.

Written by: 1912212.eth, Foresight News

On March 25, BeraChain officially launched its Proof of Liquidity (POL), with its token price rising from around $5 to the current $8.6, standing out in a generally declining mainstream cryptocurrency market. After entering the governance phase, the ecological opportunities of the public chain have begun to attract the attention of keen investors. Beraborrow officially launched its public offering today, with 2.5% of the total supply of the token POLLEN being offered through Fjord Foundry at a $42 million FDV, and Beraborrow plans to raise $1 million. Users can enter the Fjord Foundry related page and follow the prompts to participate.

As a decentralized lending protocol based on the BeraChain public chain, Beraborrow has become one of the most notable DeFi projects on BeraChain since early 2025, thanks to its unique interest-free loan model and innovative Proof of Liquidity (PoL) mechanism.

What is Beraborrow?

Beraborrow is a DeFi lending protocol on the BeraChain network, designed to provide users with efficient and flexible asset liquidity solutions. BeraChain itself is known for its unique PoL consensus mechanism, which rewards users who provide liquidity rather than relying on traditional Proof of Work (PoW) or Proof of Stake (PoS), creating a blockchain network centered on ecological prosperity.

Beraborrow releases instant liquidity for BeraChain assets through the stablecoin Nectar (NECT), supported by the Proof of Liquidity (PoL) mechanism. With a focus on simplicity and flexibility, Beraborrow aims to maximize opportunities for users without sacrificing yield.

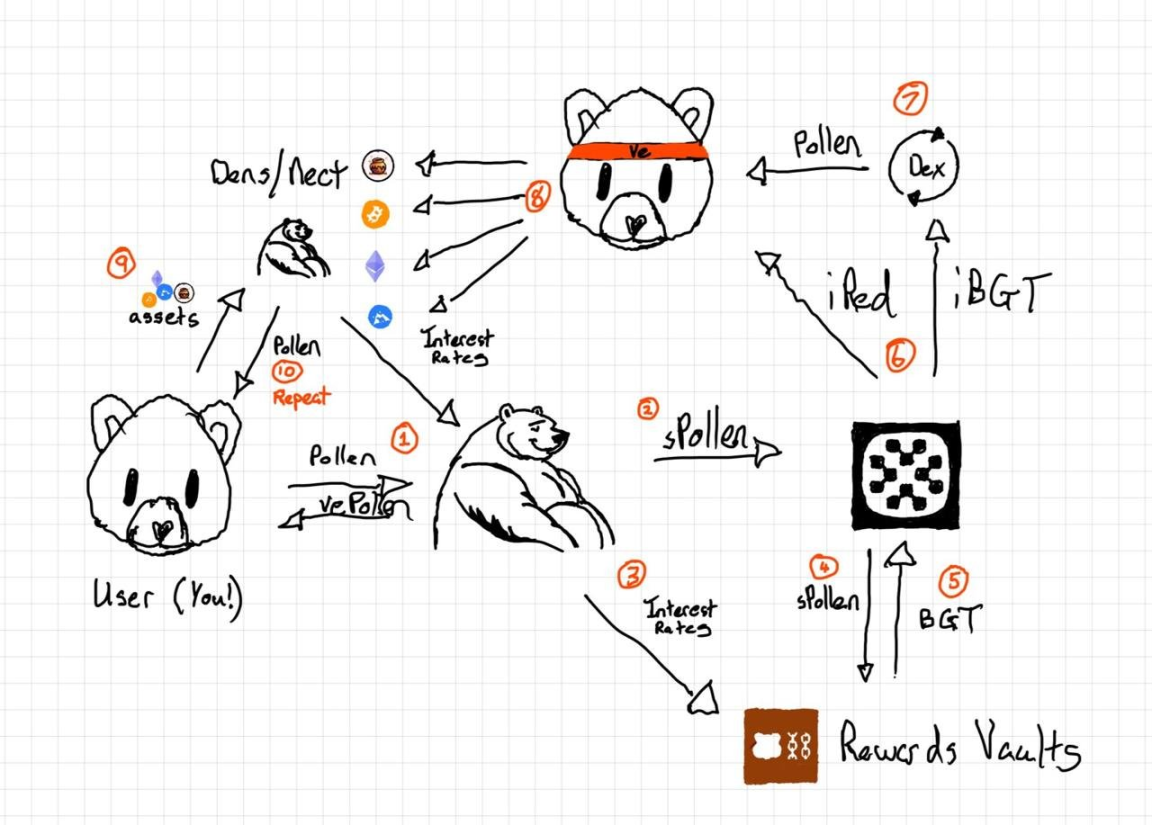

The protocol allows users to deposit collateral into Dens to mint over-collateralized stablecoin NECT. NECT can be used within the BeraChain DeFi ecosystem to unlock more opportunities while still maintaining exposure to the original assets. Initially, Beraborrow was primarily built around iBGT, but it has now evolved into a multi-collateral asset platform, supporting BeraChain native tokens, liquid staking derivatives (LSD), and LP positions as collateral to mint NECT.

Key Highlights

Instant Liquidity

Unlock liquidity without selling BeraChain assets. Users can deposit collateral into Dens to mint Beraborrow's over-collateralized stablecoin NECT while still holding the original assets. After borrowing, NECT can be seamlessly used to participate in various DeFi protocols.

Automatic Leverage

With flash loans, Beraborrow provides users with seamless on-chain leverage. Simply adjust the slider to expand exposure or maximize yield, and the system will automatically manage the complexity of synthetic leverage through recursive borrowing.

Earn Yield Through Liquidation

Participate in the Liquid Stability Pool to fully leverage the potential of NECT assets. Staking NECT can earn liquidation rewards and generate fees from other users' operations on Beraborrow.

Auto-Compounding Dens

Dens now support auto-compounding, where users' earnings will be automatically reinvested into iBGT, increasing the collateralization rate over time and creating a self-reinforcing yield mechanism to maximize returns on deposited assets.

Tokenized Dens

Beraborrow unlocks new governance and incentive mechanisms through the tokenization of Dens. These tokenized assets can be deposited into the Infrared treasury, with the generated yields automatically reinvested, providing users with continuous rewards and optimizing collateral positions.

LP Positions as Collateral

Beraborrow allows users to use Bex and Berps LP positions as collateral, enabling them to earn liquidity rewards while borrowing funds. This dual-revenue model allows liquidity providers to balance liquidity and yield, creating more value.

Arbitrage Strategies

Beraborrow's Liquid Stability Pool provides users with arbitrage opportunities. Users can utilize sNECT to arbitrage between the liquidation asset pool and decentralized exchanges, maximizing returns while enhancing the protocol's capital stability.

Token Economics

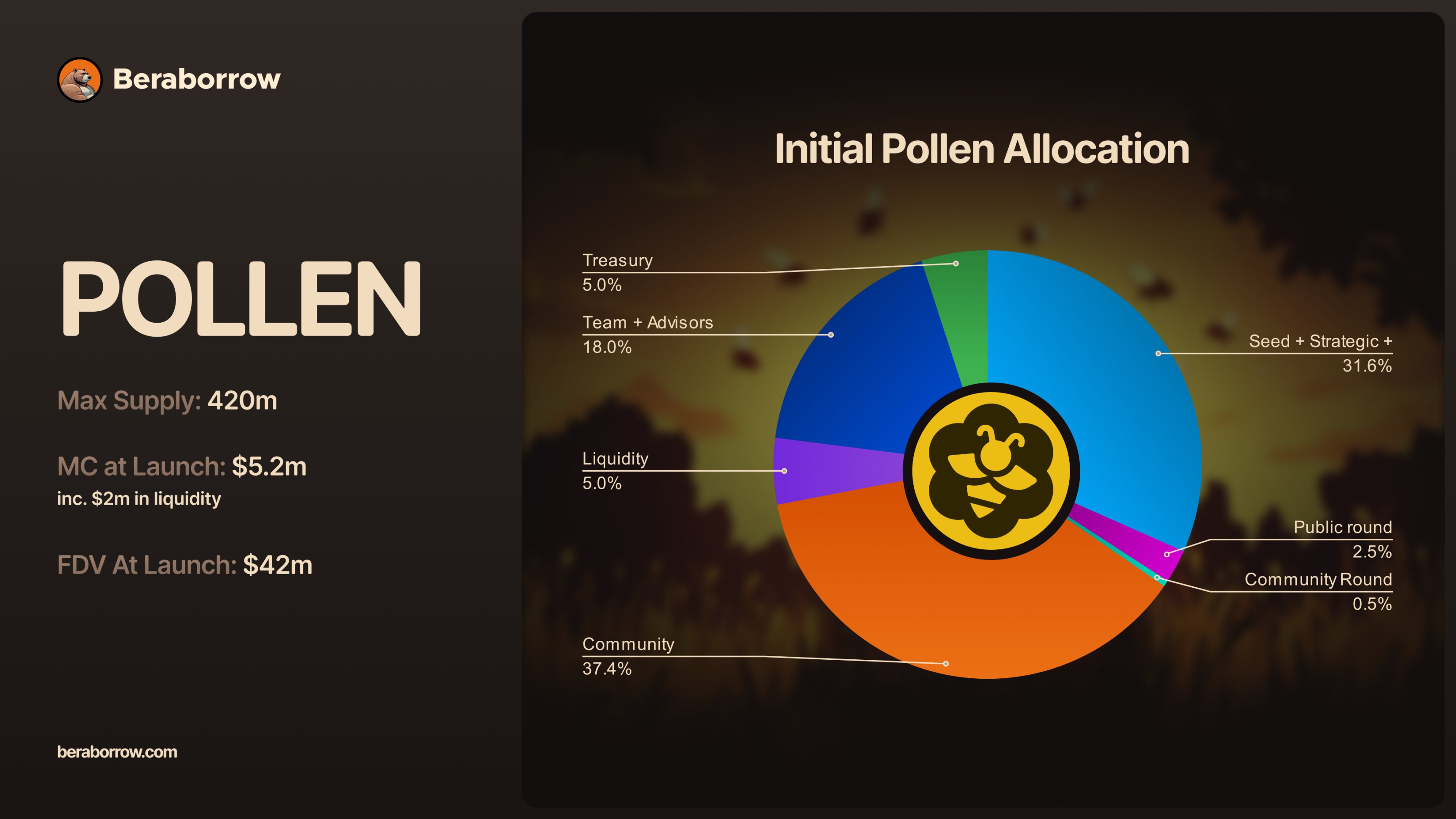

On March 25, Beraborrow's private sale raised $170,000, and today the public offering will officially launch on Fjord Foundry. Beraborrow's governance token POLLEN has a total supply of 420 million tokens, and POLLEN holders can participate in key decisions of the protocol, such as adjusting collateral types and protocol parameters. Currently, users can accumulate POLLEN points by participating in ecological activities using NECT (such as providing liquidity on Kodiak Finance or holding NECT), which will be exchanged for POLLEN tokens in the future. According to official data, since its launch, Beraborrow's TVL has exceeded $390 million, with NECT minted exceeding $100 million.

This allows the protocol to capture value from the "Proof of Liquidity" without needing to create new reward vaults for each NECT (our stablecoin) use case.

More application scenarios for NECT encourage more users to leverage Beraborrow, thereby increasing overall interest rates and fees, with these earnings flowing into the sPOLLEN BeraChain reward vault, which is then used to incentivize liquidity and further drive ecological growth. This cycle repeats, creating a "flywheel effect."

37.4% of the total token supply is allocated to the community, 31.6% to seed and strategic round investors, 18% to the team and advisors, 5% to the treasury, 5% to the liquidity pool, 2.5% to the public offering round, and 0.5% to the community round.

It is worth mentioning that the officials have stated that after the voting is completed, 60% of the protocol fees will be allocated to governance plans determined by vePOLLEN holders.

Conclusion

For a popular public chain, the development of its ecological infrastructure, such as DEX and lending protocols, is extremely important. If representative projects can emerge and be listed on major exchanges, it will have a positive effect on both its ecosystem and the public chain itself. Investors need to comprehensively consider the overall market conditions and the project's fundamentals when participating in ecological opportunities, while also paying attention to risk control.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。