Source: Cointelegraph Original: "{title}"

The EU insurance regulator has proposed implementing a comprehensive rule requiring insurance companies to hold capital equivalent to their cryptocurrency holdings as a measure to mitigate risks for policyholders.

This new proposal—put forward by the European Insurance and Occupational Pensions Authority (EIOPA) in a technical advice report submitted to the European Commission on March 27—will set stricter standards than other asset classes (such as stocks and real estate), which do not even require half the capital support.

"EIOPA believes that, given the inherent risks and high volatility of these assets, applying a 100% discount in the standard formula is prudent and appropriate," the agency stated in a separate announcement.

EIOPA indicated that this measure would fill the regulatory gap between the Capital Requirements Regulation and the Markets in Crypto-Assets Regulation (MiCA), noting that the current regulatory framework for insurance companies in the EU lacks specific provisions regarding crypto assets.

Circle argued in January that applying a 100% pressure on crypto assets does not take into account the lower risks associated with stablecoins. Source: Circle

EIOPA outlined four options for the European Commission to consider—1: make no changes; 2: apply an 80% pressure level on crypto assets; 3: apply a 100% pressure level on crypto assets.

The percentage of the pressure level determines how much capital a company needs to hold to maintain solvency.

The fourth option calls for the European Commission to consider the risks of tokenized assets more broadly.

EIOPA stated that option three would be the most appropriate choice.

"Implementing an 80% pressure on crypto asset exposure seems insufficiently prudent, while a 100% pressure is more appropriate and aligns with one of the transitional treatment approaches for crypto assets under the Capital Requirements Regulation," EIOPA stated.

A 100% pressure assumes that the price of crypto assets could drop by 100%, and diversification—spreading risk across different assets—would not alleviate this pressure. EIOPA noted that Bitcoin and Ethereum have previously dropped by 82% and 91%, respectively.

According to the solvency capital requirements set out in the Commission Delegated Regulation (EU) 2015/35, applying a 100% capital requirement on crypto assets would reflect a stricter approach, in contrast to the capital requirements for stocks, which range from 39% to 49%, and 25% for real estate.

EIOPA stated that implementing a 100% capital requirement for crypto asset-related (re)insurance companies would not be "overly burdensome" and would not impose substantial costs on policyholders.

"The capital requirement will fully capture the risks of crypto assets, and if significant exposure arises in the future, it will have a positive impact on the protection of policyholders."

EIOPA acknowledged that the share of crypto asset (re)insurance companies is only €655 million, accounting for 0.0068% of all business in Europe—calling it "negligible."

"At the same time, crypto assets are high-risk investments that can lead to total loss of value," EIOPA explained its recommendation for option three.

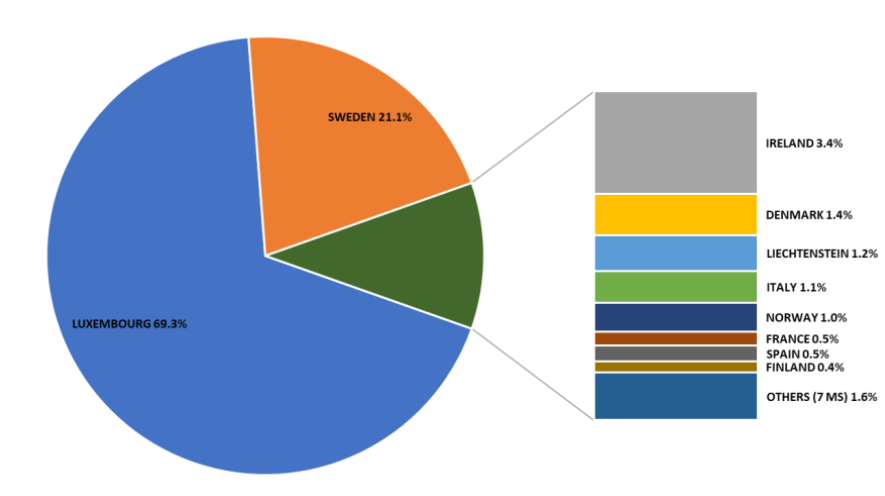

According to a report cited by EIOPA for the fourth quarter of 2023, insurance companies in Luxembourg and Sweden may be most affected, with these two countries accounting for 69% and 21% of all crypto asset-related exposures of (re)insurance companies, respectively.

Ireland, Denmark, and Liechtenstein account for 3.4%, 1.4%, and 1.2%, respectively.

EIOPA noted that these companies are mostly structured within funds, such as exchange-traded funds, and represent unit-linked policyholders.

Distribution of crypto asset exposure among European countries in the fourth quarter of 2023. Source: EIOPA

However, EIOPA acknowledged that the broader adoption of crypto assets in the future may require a more "differentiated approach."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。