In March 2025, the cryptocurrency and Web3 sectors witnessed a series of remarkable events. From U.S. President Donald Trump's high-profile statements at the White House and the Digital Assets Summit, to the explosive rise of the meme coin Mubarak fueled by Binance founder Zhao Changpeng (CZ), and Ethereum's historic slump in the first quarter, as well as the Trump family's support for World Liberty Financial (WLFI) launching the USD1 stablecoin plan, the events of this month not only ignited market enthusiasm but also had far-reaching impacts on the global financial landscape.

Bitcoin's March Performance Review

In March 2025, Bitcoin experienced a process of volatility, consolidation, and recovery. At the beginning of the month, there was a noticeable decline, dropping to around 76,606 at its lowest point. Subsequently, this may have been influenced by market corrections or external factors. From March 7 to March 17, the price fluctuated significantly, with moving average crossovers indicating that the market was testing support and resistance levels, and investor sentiment was relatively uncertain. From March 17 to March 25, Bitcoin's price gradually recovered, forming a resistance range around 87,420. From March 25 to March 28, the price gained upward momentum, approaching this resistance level, showing significant buying and selling pressure, which could lead to further volatility. Overall, Bitcoin showed a trend of recovery from decline in March, with the 88,000 resistance level potentially being key to short-term trends.

Trump's Dual Summit Statements: A Barometer for Cryptocurrency Policy

March 7: The First White House Cryptocurrency Summit

On March 7, 2025, U.S. President Donald Trump hosted the first White House cryptocurrency summit in the State Dining Room, a historic event that quickly became a global focal point. According to Cointelegraph, Trump explicitly expressed support for including Bitcoin (BTC) as part of the U.S. strategic reserve assets and invited heavyweight figures from the crypto space, including Binance founder Zhao Changpeng (CZ), Ripple executives, and representatives from Coinbase. X user @DtDt666 revealed that the tokens discussed at the summit included BTC, Solana (SOL), XRP, and Cardano (ADA), suggesting that these assets might be included in the reserve plan.

Although no specific policies were announced at the summit, Trump's remarks were seen as a strong endorsement of the crypto industry. CNBC analysis pointed out that this move echoed Executive Order 14178 issued after Trump took office, aimed at enhancing the U.S. competitiveness in the global crypto market through regulatory easing and establishing a "digital reserve." Bloomberg commented that this summit marked a shift in the U.S. government's attitude towards cryptocurrencies from passive observation to active embrace.

March 20: Continued Discussions at the Digital Assets Summit

On March 20, Trump delivered a video speech at the 2025 Digital Assets Summit held in New York. Although it lasted only about two minutes, it sparked widespread discussion. According to Cointelegraph, he reiterated his support for Bitcoin as a strategic reserve and specifically mentioned the necessity of stablecoin legislation, urging Congress to establish "simple and sensible" rules to solidify the dollar's dominance and promote industry development. FXStreet cited expert opinions suggesting that Trump's statements could pave the way for the U.S. stablecoin bill set to advance in the House Committee on April 2.

While no specific new policies were proposed, Trump's words were interpreted by the market as a signal of regulatory easing. X user @Amy14913 summarized his core points: support for BTC reserves, promotion of regulatory relaxation, and acceleration of stablecoin development. CoinDesk noted that this speech further solidified Trump's image as the "crypto president."

February CPI Data Release: Data Below Expectations, Inflation Easing Boosts Market Sentiment

On March 12, the U.S. Bureau of Labor Statistics released the Consumer Price Index (CPI) data for February, showing a year-on-year increase of 2.8%, below the market expectation of 2.9% and the previous value of 3.0%. According to Reuters, this sign of easing inflation quickly affected global financial markets, particularly impacting the cryptocurrency sector. CoinDesk analyzed that the reduction in inflationary pressures lowered expectations for Federal Reserve interest rate hikes, boosting investor confidence in risk assets.

On that day, Bitcoin's price rebounded, and the BNB Chain ecosystem rose by 1.2% due to the Mubarak craze (FXStreet). Analysts believe that the CPI data provided support for a short-term rebound in the crypto market, but the long-term trend still needs to focus on the upcoming PCE data to be released on March 28 and the Federal Reserve's subsequent policy direction.

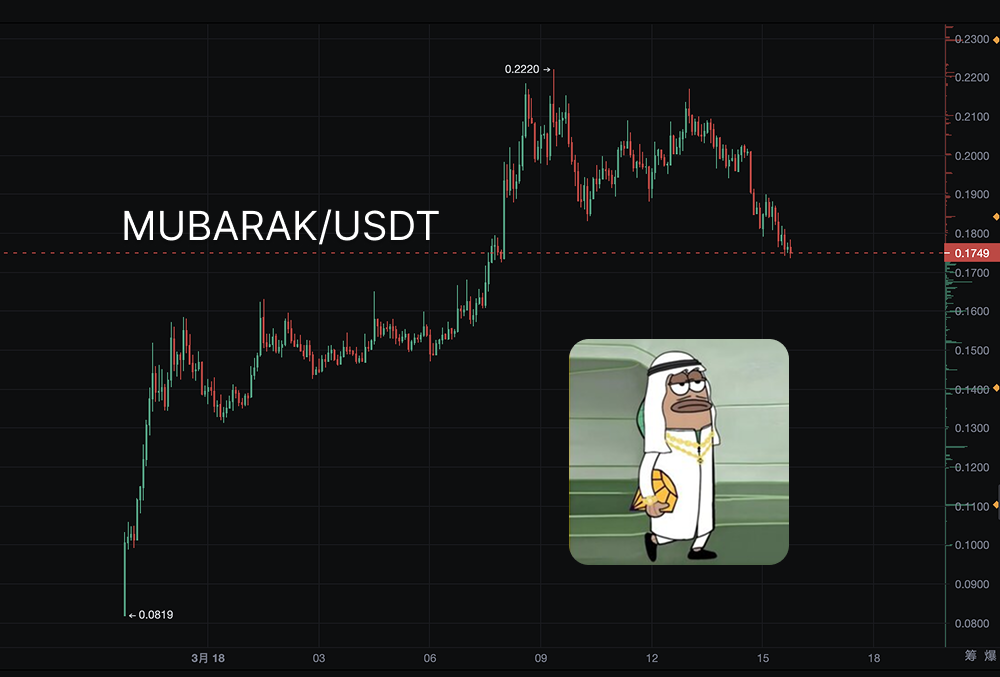

Mubarak Meme Coin Craze: CZ Ignites the BSC Ecosystem

The meme coin Mubarak became the brightest star in the crypto space in March, with its explosive rise attributed to an unexpected boost from Binance founder Zhao Changpeng (CZ). Initially, the Binance Chinese official account posted a tweet with a Middle Eastern flair, which CZ casually retweeted with the caption "mubarak" (Arabic for "blessing"), igniting market enthusiasm. On March 15, CZ posted on Binance Square, "Going to meet a friend this weekend," along with a Mubarak meme image, directly driving the price of $Mubarak within the BSC ecosystem to soar by 150%, with its market cap skyrocketing from $5 million to $20 million (X user @beidouxingshequ).

Cointelegraph reported that CZ purchased Mubarak for 1 BNB (approximately $600) and changed his X avatar to show support, resulting in a 325% increase in just 48 hours, with its market cap briefly surpassing $148 million. On March 20, Binance included it in the "Voting for Listing" list, further boosting its popularity. On-chain data showed that a trader purchased it for $232, making over $1.1 million in profit, highlighting the speculative nature of meme coins.

The rise of Mubarak is not just a speculative frenzy but also reflects the power driven by the Web3 community. Its name, rooted in Middle Eastern culture, combined with decentralized trading characteristics, has made it a representative of the BNB Chain meme ecosystem. Lookonchain data indicated that BSC's trading volume surpassed Solana, intensifying competition among public chains.

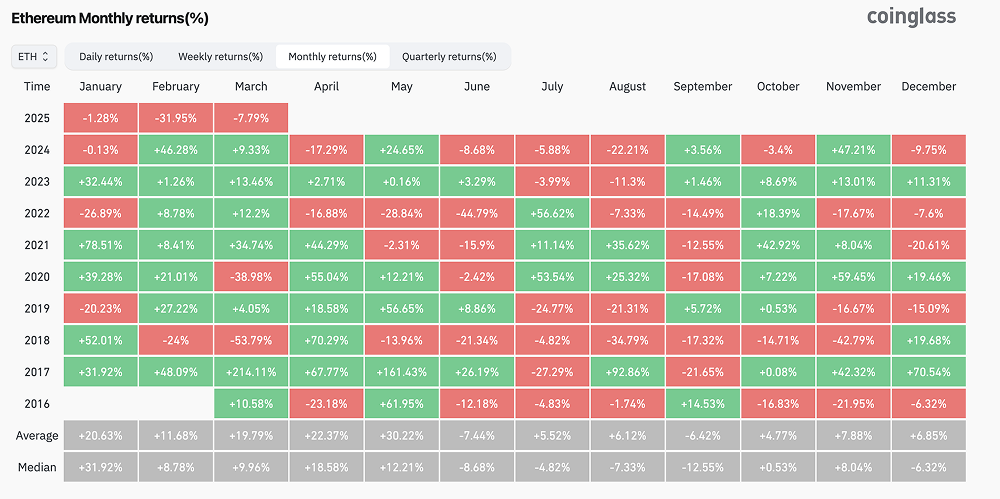

Ethereum's Q1 Slump: A Historic Negative Return Start

On March 24, Coinglass released data showing that Ethereum (ETH) performed poorly in the first quarter of 2025 (Q1), marking the first time since 2017 that it experienced three consecutive months of negative returns at the start of the year. Cointelegraph analyzed that ETH's price had dropped about 15% since the beginning of the year, influenced by multiple factors: delays in mainnet upgrades (such as Pectra), the Holesky testnet set to end support in September (Web3Caff), and the market's greater focus on BTC over ETH.

FXStreet pointed out that although Ethereum remains at the core of Web3 and DeFi, its ecosystem's vitality has not diminished, but investor confidence has been significantly undermined. On March 25, WLFI announced that the USD1 stablecoin would be issued on Ethereum, which might provide some boost to ETH, but it is unlikely to reverse the downturn in the short term.

World Liberty Financial Launches USD1: A New Player in the Stablecoin Market

On March 25, World Liberty Financial (WLFI), supported by the Trump family, announced the launch of the USD1 stablecoin. This coin is pegged 1:1 to the U.S. dollar and is 100% backed by short-term U.S. Treasury bonds, dollar deposits, and other cash equivalents, initially issued on Ethereum and BNB Chain, with BitGo serving as the custodian. According to CryptoNews, WLFI positions USD1 as a "safe and transparent cross-border transaction tool," targeting institutional and sovereign investors, and plans to expand the lending market through smart contracts.

CNBC noted that the launch of USD1 comes at a time when the stablecoin market is in an expansion phase (with a market cap exceeding $200 billion in January), clearly intending to compete with Tether (USDT) and USDC. The Trump family's deep involvement (with Eric and Donald Jr. as Web3 ambassadors and Barron as a DeFi visionary) has sparked controversy, with Cointelegraph warning of potential "foreign influence" risks on Trump policies.

FXStreet data showed that BNB Chain rose by 1.2% due to the news of USD1's deployment, indicating market recognition of its potential. Bloomberg predicted that if the stablecoin bill is signed in June, USD1 could become a new player in the institutional-grade stablecoin market. However, WLFI did not disclose its auditing firm, and transparency issues could pose risks.

Conclusion

In March 2025, the crypto space advanced amid intertwined policy benefits, meme frenzies, and technical challenges. Trump's endorsement ignited enthusiasm, the explosive rise of Mubarak showcased Web3 vitality, while Ethereum's slump and the launch of USD1 reflected the industry's complexity. As the stablecoin bill approaches in April, the market may face greater volatility, and investors need to cautiously seize opportunities and risks.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。