Candlestick Pattern Analysis

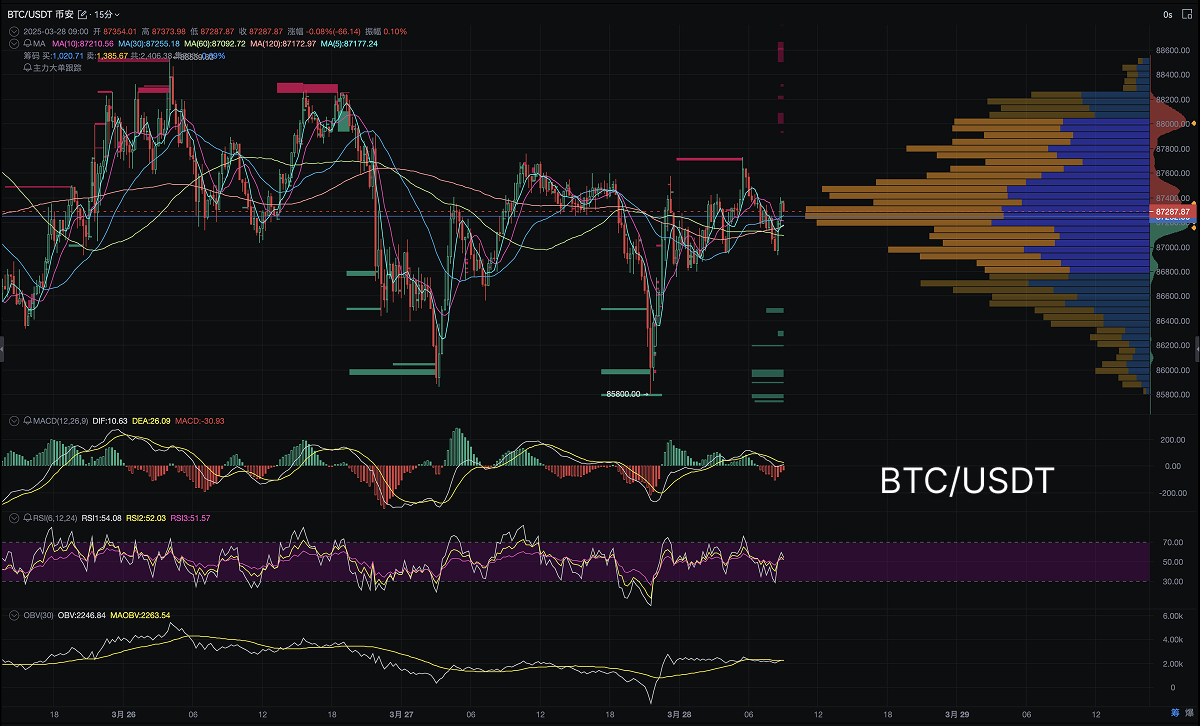

From the candlestick patterns in the AiCoin data chart, Bitcoin has experienced several fluctuations and corrections in the past few days. Particularly, a certain top structure formed as the price approached 88,000, indicating strong selling pressure in this price area. Sell orders are concentrated above the top area, while the price gradually declines, showing some signs of a pullback. Currently, the price fluctuates around 87,000, without forming strong breakout or rebound signals.

Additionally, from the price range in the chart, Bitcoin is currently in a consolidation phase, with a fluctuation range between 86,000 and 88,000. If the price breaks through this range, it may trigger a new trend change.

Large Capital Movements

By observing the Volume Profile in the chart, we can see strong selling pressure around 87,400, while the support area below 86,000 has concentrated buying, especially below 86,000, forming strong buying support. The movements of large capital in these ranges indicate that market participants are highly attentive to the short-term support and resistance in this price range.

Technical Indicator Analysis

MACD (Moving Average Convergence Divergence): The MACD line (blue) is currently close to the 0 axis, and the DEMA (orange) shows signs of divergence, indicating a weakening of market momentum. Although MACD has not yet given a clear bearish signal, the market is still in a correction phase, suggesting that the market is currently in a consolidation state and has not yet decided on a new direction.

RSI (Relative Strength Index): The RSI is currently at 54.08, close to the overbought area (70), but has not yet entered an overbought state. Its relatively stable trend indicates that market sentiment is neutral, with no strong buy or sell signals at the moment. However, if the RSI begins to approach the area below 50, it may signal a pullback.

OBV (On-Balance Volume): The OBV line has shown a stable trend for a long time, without indicating strong buying or selling trends. This suggests that the current market lacks clear capital flow signals and may be in a tug-of-war situation between bulls and bears.

Market Sentiment and Capital Flow

The capital flow indicators suggest that the current market's capital movement is cautious, with no significant inflow or outflow of capital in the short term, which may reflect investors waiting for further confirmation signals from the market. From the OBV and MACD perspectives, the market does not show strong trends and may enter a correction period or continue to fluctuate.

Today's Trend Prediction

Based on the current technical analysis, it is expected that Bitcoin's trend today may continue to fluctuate and consolidate. If it breaks through the current resistance level of 87,400, it may test the pressure area of 88,000; however, if it fails to break through this area, it may continue to pull back to the support level around 86,000.

Short-term target range: If it breaks through 87,400, the upper target is at 88,000-88,500; if it pulls back to 86,000, it may seek support before rebounding again.

Risk point: If the price falls below the support level of 86,000, it may form a deeper pullback, testing lower support levels (e.g., 85,000).

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。