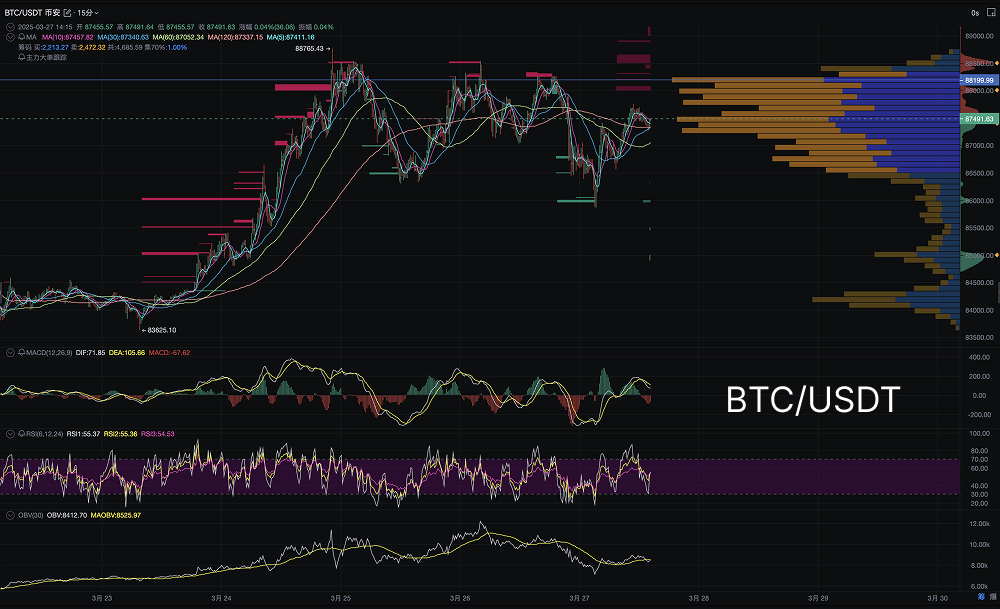

Candlestick Pattern Analysis

The current candlestick trend shows a pattern of consolidation with slight fluctuations, without any significant one-sided rise or fall. This pattern may indicate that the market is waiting for a new catalyst, and investor sentiment is relatively cautious. Some long upper shadows have appeared at high levels, indicating strong selling pressure, suggesting that bulls are facing significant selling resistance when attempting to break through.

Large Capital Movements

From the volume analysis in the chart, the OBV (On-Balance Volume) indicator is relatively stable, with no significant inflow or outflow of large capital. Although there have been price fluctuations recently, there has been no noticeable movement of large capital, indicating that the market remains relatively calm.

The market has not seen extreme buying or selling, which may suggest that the current market is not in an overheated state.

Technical Indicator Analysis

MACD: Currently, the DIF (fast line) is above the DEA (slow line), indicating that the market is still in a bullish trend, but the distance between the DIF line and the DEA line is beginning to narrow, which may signal that the momentum of the trend is starting to weaken, and the market is entering a consolidation phase.

RSI: The RSI indicator shows that it is currently around 55, neither in the overbought nor oversold zone, indicating that the buying and selling forces in the market are relatively balanced. However, the relative stability of the RSI also shows that the market does not have a clear directional signal and may continue to consolidate.

OBV: The OBV line shows stability, with no significant inflow or outflow of capital, indicating that the market does not have strong support or resistance from capital, and is more in a sideways consolidation state.

Volume Analysis

The trading volume shows a relatively dispersed trend, with the high volume area on the left (around 88,000) failing to break through significantly, indicating that the market may not have effectively broken through previous highs to form new upward momentum. The current price adjustment may be a process of the market digesting previous highs.

In-Depth Analysis

Price Range: The current price is around $87,400, overall within a volatile range of an upward trend. The market's support level is around $83,600, and the resistance level is around $88,200. The current price is close to the upper end of this range, which may face some selling pressure.

Horizontal Support and Resistance: From the distribution of points in the chart, the market has some important price accumulation areas (such as $87,400 and $89,000), which may form short-term support and resistance levels.

Short-Term Forecast

Today's Trend Prediction: Considering the current volatile market and the weakness of technical indicators, it is expected that Bitcoin may continue to fluctuate within the consolidation range, and may not break through the resistance level of $88,200 in the short term. If it fails to effectively break through this price level, the price may again pull back to the support level near $83,600.

Key Levels: The key support level to focus on is $83,600, and the resistance level is $88,200. If the price breaks through $88,200, it may usher in new upward momentum; conversely, it may enter a deeper adjustment.

Currently, Bitcoin is in a consolidation phase, market sentiment is relatively cautious, and capital flow is relatively stable. There are no strong buying or selling signals, and it is expected that Bitcoin will consolidate within the current range in the short term, waiting for further market breakthroughs or corrections.

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。